Why Latin America?

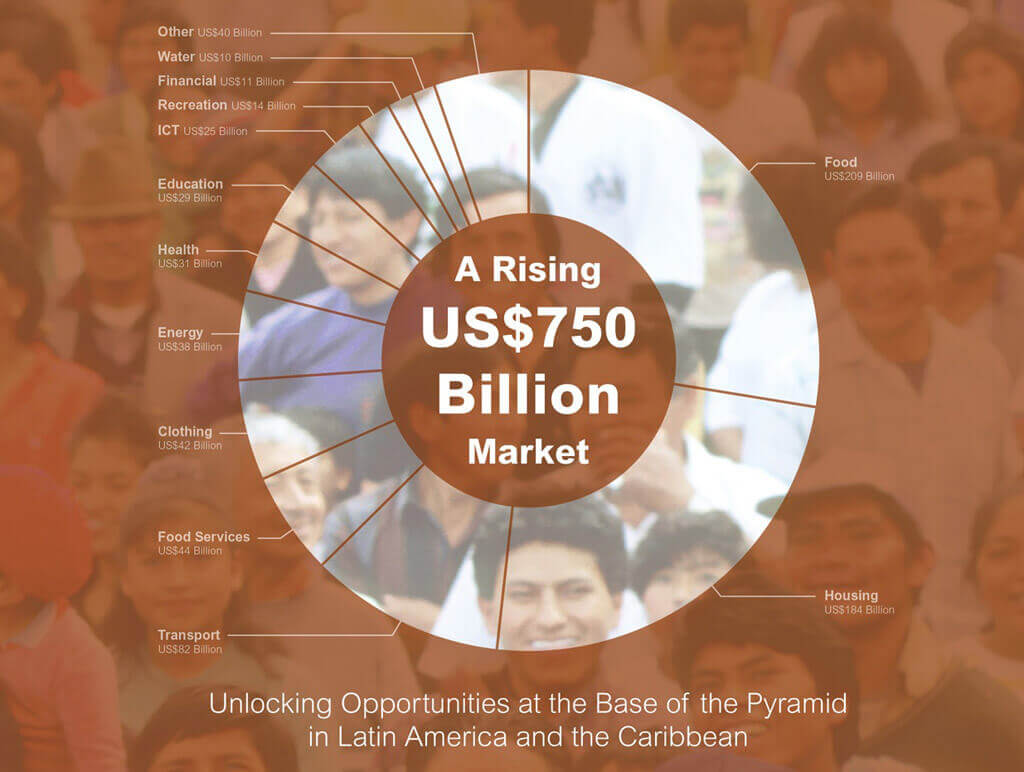

The expectations and opportunities for foreign investment are growing and turning Latin America into an exciting place to start a business. Some of the best business opportunities are now in Latin America (LATAM); with lots to offer, attractive incentives for new companies to invest, an abundance of natural resources and good human talent. For these reasons and more, LATAM is a good business option.

The Opportunities

According to the LATIA (Latin American Investment Association), over the next decade, Latin America will be an important area of global influence, both economically, in terms of tourism, and also in the expansion of the resource sectors, such as mining, oil and gas, forestry and finance. Latin America has become attractive to new investors as a place to diversify internationally within various industries. The growth of businesses in the region, coupled with good investment management, has allowed several Latin American companies to gain international recognition.

Table of Contents

Key Opportunities by Region

The following country analysis, given by our professional Biz Latin Hub Country Managers, explain why you should consider investment within the region of Latin America; particularly Peru, Colombia, Chile and Mexico.

Peru

Peru is fast becoming a mining powerhouse, with the mining sector experiencing the fastest growth in modern history; accounting for over 50% of foreign currency, 20% of tax revenue and 11% of gross domestic product. The country is an attractive market for establishing a legal entity, allowing 100% foreign ownership and minimal capital controls, and a relatively attractive company tax rate.

“According to the data published by the agency of “Promoción de la Inversión Privada en el Perú” (Pro-inversión), there are four (4) points to explain why it is a good decision to invest in Peru:

- Macroeconomic Soundness; since in recent years GDP has grown rapidly (by 1.3% from 2015 to date), 4.0% in June 2016 and with a total growth estimated at 4.3% to 2017.

- Favorable Investment Climate; Peru is one of the Latin American countries with the greater macroeconomic stability, registering one of the lowest inflation rates at regional level (3%), compared to Chile (3.7%), Mexico (3.9%), Colombia (4.2%) and Brazil (5.9%). Also during the past 10 years, Peru has maintained a stable exchange rate and a country risk level below the regional average, consequently reducing the loss risk of the capital invested in the country.

- Policy Trade Integration; Peru offers a favorable legal framework for foreign investment, in which the emphasis is on non-discriminatory treatment, free movement of capital, free competition and freedom to access internal and external credit.

- Potential Sectors for Good Investment; particularly the mining sector; ranking as the third largest worldwide producer of copper, silver, tin and zinc, the largest producer in Latin America of gold, zinc, tin and lead, and the second largest producer of copper, silver, mercury, diatomite, rock phosphate and molybdenum. Moreover, Peru is one of the few countries in the world with non-metallic minerals of diatomite, bentonite, limestone and phosphates, among others.

Many consider that the election of Pedro Pablo Kuczynski (PPK) as the new President of Peru, will have a very positive effect on the Peruvian economy and foreign investment will be highly supported. PPK was sworn in as President on 28 July, 2016, and with his background as a former World Bank Official and Wall Street banker, he has lifted investor’s hopes with a plan for infrastructure investment, small business assistance and job programs. PPK is said to be looking to increase foreign investment and grow the country’s all important mining and banking sectors. “This President is going to be very good for Peru,” said Epiphany’s Mr. Creixell, who holds positions in Credicorp, Southern Copper, Buenaventura as well as Peru’s iShares ETF. “He’s going to be good for the markets …and good for the international community.”

Finally, like other countries across Latin America, Peru is becoming more and more welcoming to outside investors and this can be clearly seen from the country’s company incorporation requirements. A Peruvian company can be 100% owned by foreign shareholders and there are minimal (token) capital requirements for incorporation. The same goes for the opening of standard company bank accounts with local Peruvian banking institutions; the opening deposit requirements are minimal, i.e. USD$100 or PEN500 at present. All of which make business in Peru for foreigners to be more accessible and attractive”. – Cheryl Harvey, PBS Country Manager.

Colombia

“A strong democracy where it is worth investing”. The slow-down of the global commerce and the financial uncertainty following the UK ‘Brexit’, is prompting a wave of investment in Latin America coming from different countries around the world.

Colombia is the largest economy within the Andean region, with a national GDP of USD$378Bn (2013), and is the only country in South America with coastlines on both the Pacific Ocean and the Caribbean Sea. The country is an attractive market for establishing a legal entity, allowing 100% foreign ownership, limited capital controls, cheap operating costs and a relatively attractive company tax rate.

Colombia is considered as one of the rising stars of Latin America in terms of growth. Expected to grow its GDP by 2.7% in 2016, the country is consolidating its position as an obvious choice when looking for a friendly country in which to do business within the LATAM region. The United States with 32%, UK with 20%, Spain with 11% and Chile with 6%, represent nearly 70% of the current total foreign investment in Colombia.

Highly qualified workers and relatively low salaries compared to other Latin American countries, are other key advantages of investing in Colombia.

The Colombian Government is preparing to invest USD 12.2 Billion in the country’s infrastructure over the next 4 years. The main projects involve motorways, ports, airports and social housing. This will have a positive repercussion, both for the country’s competitiveness and the quality of life for its people.

Colombia has demonstrated that as a growing economy, it is willing to learn from the past and to receive the future with open arms, offering friendly and secure business conditions for foreigners willing to invest in the region.” – Fernando Merchán Ramos, CBS Country Manager & General Counsel.

Chile

“Although international markets have slowed and the impacts of this recession are still being felt, Chile is still a very good option for investors”.

Rating agencies have increased or maintained high growth rates for the country, due to its low public debt, a healthy financial system and reliable institutions. According to the Business Environment Ranking of the Economist Intelligence Units 2014-2016, Chile took 13th place out of 82 economies.

In the latest report by the UNCTAD (United Nations Conference on Trade and Development), Chile was positioned at number 17 of the nations with the largest foreign direct investment in 2015, with an inflow of USD 20.2 billion. With this, Chile takes third place in Latin America after Brazil and Mexico. Chile is also known for its transparency; according to the Transparency International’s 2015 Corruption Perceptions Index, Chile is ranked at number 23 out of 168 countries.

Chilean business links are well established with the international community and the country remains an attractive market for foreign investment, due to its stable economy, good infrastructure and large resources sector. As one of the most advanced economies within the region, the country has few barriers for establishing and operating a business, however the operating costs tend to be higher than other Latin American countries due to the higher input costs such as salaries, fuel, transport and other consumables.

With that in mind, the resources sector, which the country remains very dependent upon is facing a number of challenges associated with low commodity prices, elevated input costs and a scarcity of water and energy. Nevertheless, these challenges also present an opportunity for foreign companies and/or investors that can bring to market higher energy efficient systems, water management systems, energy efficient desalination technology, low water-use mineral processing technologies and training and practices linked to improved productivity and systems that reduce operating costs.

Combining the opportunities above with the abundance of local human capital, Chile remains a land of opportunity. Supporting this is the high level of education provided from local institution’s, whereby Chile has two of the top ten universities in Latin America, according to the Academic Ranking of World Universities (ARWU). Chile is also positioned in 25th place among 100 economies in the Global Talent Index 2015 of The Economist Intelligence Unit (EIU).

Finally, Chile has a variety of landscapes and a special Mediterranean climate for tourism. Security, the political environment and its modernity, make Chile one of the countries with the best quality of life in Latin America. Chile’s capital, Santiago, is cataloged as one of the best cities to live in Latin America. The country was evaluated in place 29 of 162 countries within the Global Peace Index study of 2015. – Ivette Avaria, CIB Country Manager.

Mexico

“Mexico is tipped to be one of the world’s top 5 economies by 2050. This can be explained in part by the rapidly growing automotive and finance sectors, as well as the bold reforms pushed through by President Peña Nieto’s administration in the energy sector.

Mexico’s is Latin America’s second largest economy, with a strong extractive sector and a population of over one hundred and twenty million people. And recently rated by the World Bank as the best jurisdiction in the Region to do business.

Mexico’s alignment with the Western culture and its proximity to the US has helped persuade international companies to favour the country as a reliable location for production and manufacturing activities. Companies and individuals looking at foreign direct investment in Mexico are drawn by the fact that the nation has a large pool of human talent covering a wide range of services and industries at all levels of skill set. Foreign investors are attracted by reduced manufacturing costs, high quality work and a lower payroll burden relative to Europe or even China.

Recent changes to the Mexican Foreign Investment Law mean that the process is very transparent, and as a result, many foreign entrepreneurs have followed the lead of large multi-nationals by identifying business opportunities and setting up innovative start-ups across the country, and often thanks to the help of organizations such as the Mexican Association of Venture Capital and Private Equity (MEXCAP) and the National Institute of Entrepreneurship (INADEM).” – Alex Mahoney, MBS Country Manager.

Biz Latin Hub can assist you doing business in Latin America & the Caribbean

At Biz Latin Hub, we provide integrated market entry and back office support to investors throughout Latin America and the Caribbean, with offices in more than a dozen countries around the region and trusted partners in many more.

That unrivaled reach means we are ideally places to support multi-jurisdiction market entries and cross-border operations.

Our portfolio of services includes company formation, accounting & taxation, legal services, bank account opening, and hiring & PEO.

Contact us today to find out more about how we can support you.

If you found this article on nearshoring in Latin America of interest, check out the rest of our coverage from across the region. Or read about our team and expert authors.