Jamaica’s vibrant economy and strategic location in the Caribbean make it an attractive destination for companies seeking to expand their operations. With a growing talent pool and evolving labor regulations, understanding the nuances of recruitment and hiring in Jamaica is essential for success. This guide explores key hiring trends, legal frameworks, and strategic methods to help businesses navigate employment landscape after initial company formation in Jamaica.

Key takeaways on hiring in Jamaica

| Do I need a local entity to hire in Jamaica? | No. You can hire through an Employer of Record (EOR), which handles legal employment and compliance. |

| What are the top hiring sectors in Jamaica? | Tourism, business process outsourcing (BPO), software development, renewable energy, and financial services lead the market in 2025. |

| What are the main employer obligations? | Employers must register for PAYE, NIS, NHT, and HEART contributions, and provide written contracts. |

| Can I hire freelancers in Jamaica? | Yes, but proper classification is essential to avoid misclassification risks and penalties. |

Top Hiring Sectors & Workforce Trends in Jamaica

In 2025, Jamaica’s labor market is driven by several key industries. Tourism remains a cornerstone of the economy, supported by a robust hospitality sector and international investment. The business process outsourcing (BPO) industry continues to thrive, with Jamaica recognized as a leading destination for customer service and tech support operations.

Additionally, sectors such as renewable energy, financial services, agribusiness, and software development are experiencing notable growth. These trends reflect Jamaica’s commitment to diversifying its economy and investing in workforce development.

Understanding Jamaica’s Recruitment Landscape

Recruitment in Jamaica typically involves a mix of digital platforms and traditional methods. Online job portals such as CaribbeanJobs.com and JobInJamaica.com are widely used by both employers and job seekers. Local recruitment agencies also play a significant role, offering specialized services across various industries.

Many companies collaborate with universities and technical institutions to access emerging talent. Regardless of the method, employers must ensure compliance with Jamaican labor laws, including the provision of formal employment contracts and registration with relevant government bodies.

How an Employer of Record (EOR) Simplifies Hiring in Jamaica

For foreign companies without a legal entity in Jamaica, partnering with an Employer of Record (EOR) offers a streamlined solution. An EOR acts as the legal employer on behalf of the client company, managing all aspects of employment including payroll, tax compliance, and onboarding. This arrangement allows businesses to hire in Jamaica without the administrative burden of establishing a local subsidiary. It also ensures full compliance with Jamaican labor regulations, reducing the risk of penalties and accelerating market entry

Best Practices for Recruiting Talent in Jamaica

To attract and retain top talent in Jamaica, companies should focus on offering competitive compensation packages that reflect current market standards. Clear job descriptions and defined career paths help candidates understand their roles and growth opportunities.

Structured interviews and skills assessments are effective tools for evaluating applicants. Employers also benefit from leveraging social media platforms and professional networks to reach a broader audience. A strong onboarding process and ongoing employee engagement initiatives contribute to long-term retention and productivity.

Freelancing & Independent Contracting in Jamaica

Freelancing is becoming increasingly popular in Jamaica, particularly in creative and technical fields such as graphic design, software development, and content creation. While this offers flexibility for both businesses and workers, it is important to distinguish between employees and independent contractors.

Employees are entitled to statutory benefits and protections, whereas contractors operate independently and are responsible for their own tax obligations. Misclassification can lead to legal and financial penalties, so companies should seek legal guidance or use an EOR to ensure proper classification and compliance

Key Labor Laws & Employment Regulations in Jamaica

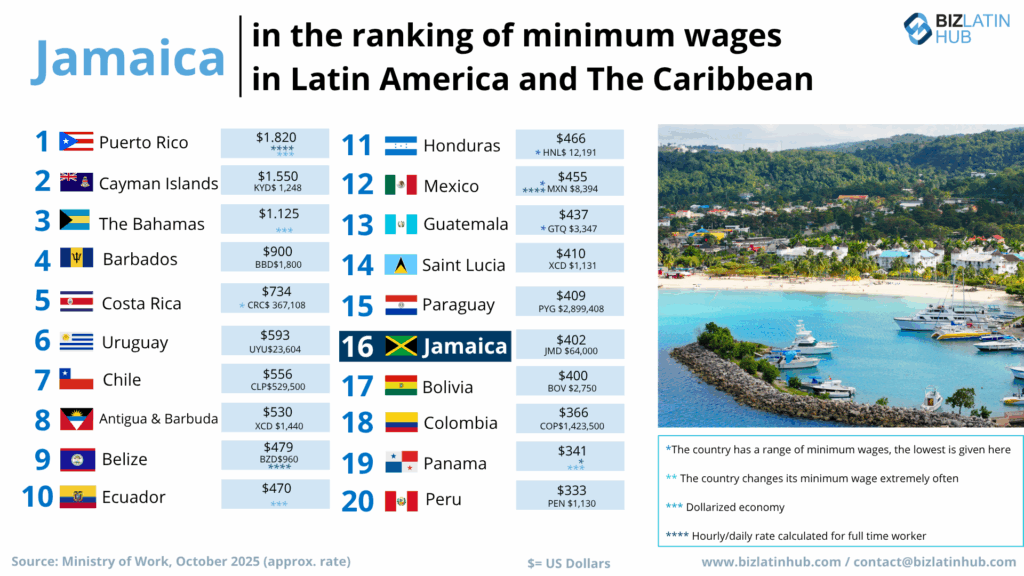

Jamaica’s labor laws are designed to protect both employers and employees. The Employment (Termination and Redundancy Payments) Act outlines procedures for ending employment and compensating workers. Minimum wage rates are reviewed annually and must be adhered to by all employers.

Companies are required to contribute to the National Insurance Scheme (NIS), the National Housing Trust (NHT), and the Human Employment and Resource Training (HEART) program. Written employment contracts are the best option and must specify terms such as salary, working hours, and leave entitlements. Oral contracts are also legally binding in Jamaica but it is advised to create a written contract. Compliance with these regulations is essential to avoid penalties and maintain a positive reputation.

Work Permits and Visas for Foreign Talent

Hiring foreign nationals in Jamaica requires a work permit issued by the Ministry of Labour. Employers must submit a formal application detailing the role and justification for hiring a non-resident.

The process includes documentation, fees, and a review period that can take several weeks. It is advisable to begin the application process early to avoid delays. Work permits are typically granted for specific roles and durations, and employers must ensure that foreign hires remain compliant throughout their employment.

Employers in Jamaica are responsible for registering with Tax Administration Jamaica (TAJ) to manage Pay As You Earn (PAYE) deductions and General Consumption Tax (GCT) obligations. In addition to income tax, companies must contribute to NIS, NHT, and HEART on behalf of their employees.

These contributions are calculated based on salary and must be submitted regularly to the appropriate agencies. Accurate payroll processing and timely tax submissions are critical to maintaining compliance and avoiding fines

Avoiding Misclassification: Employees vs. Contractors

Distinguishing between employees and contractors is a key aspect of hiring in Jamaica. Employees typically work under the direction of the employer, receive regular wages, and are entitled to benefits such as paid leave and social security. Contractors, on the other hand, operate independently, set their own schedules, and handle their own taxes.

Misclassifying workers can result in legal action and financial penalties. To mitigate this risk, companies should clearly define roles in contracts and consult with legal experts or EOR providers.

Frequently Asked Questions About Hiring in Jamaica

No. You can hire staff in Jamaica without setting up a local entity by partnering with an Employer of Record (EOR), which handles legal employment, payroll, and compliance on your behalf.

Yes, but it’s important to classify them correctly. Misclassifying employees as contractors can lead to legal and financial penalties.

Employers must contribute to the National Insurance Scheme (NIS), National Housing Trust (NHT), and HEART Trust, in addition to deducting Pay As You Earn (PAYE) taxes.

Work permits typically take 4–6 weeks to process, depending on the completeness of the application and the role being filled.

Employers must comply with the Employment (Termination and Redundancy Payments) Act, minimum wage regulations, and provide written employment contracts outlining terms and benefits.

Payroll involves multiple statutory deductions and timely submissions to government agencies. Many companies use EOR services or local payroll providers to ensure compliance.

Non-compliance can result in fines, legal disputes, and reputational damage. It’s essential to understand employment contracts, tax obligations, and worker classification

Partner with Biz Latin Hub for Hiring in Jamaica

At Biz Latin Hub, our multilingual team of corporate support specialists has the knowledge and expertise to support you in doing business in Jamaica. Our comprehensive portfolio of services, including company formation, accounting, tax advisory, and hiring & PEO, means we can provide tailored packages of integrated back-office solutions and be your single point of contact for doing business in Jamaica, or any of the other markets around Latin America and the Caribbean where we have local teams in place.

Contact us now to discuss how we can support your business.

Or learn more about our team and expert authors.