Corporate legal compliance in Jamaica ensures transparency and combats corruption. Understanding these regulations is fundamental when incorporating a business in Jamaica, guaranteeing compliance from the beginning. Local tax compliance is handled by the Tax Administration of Jamaica (TAJ) and the Companies Office of Jamaica (COJ). This guide details the recurring legal obligations required to maintain a company’s ‘Good Standing’ status with the Companies Office of Jamaica (COJ).

Key Takeaways on Corporate Compliance in Jamaica

| Fiscal Address Requirements | A registered fiscal address is required for companies in Jamaica to receive legal correspondence and governmental visits. |

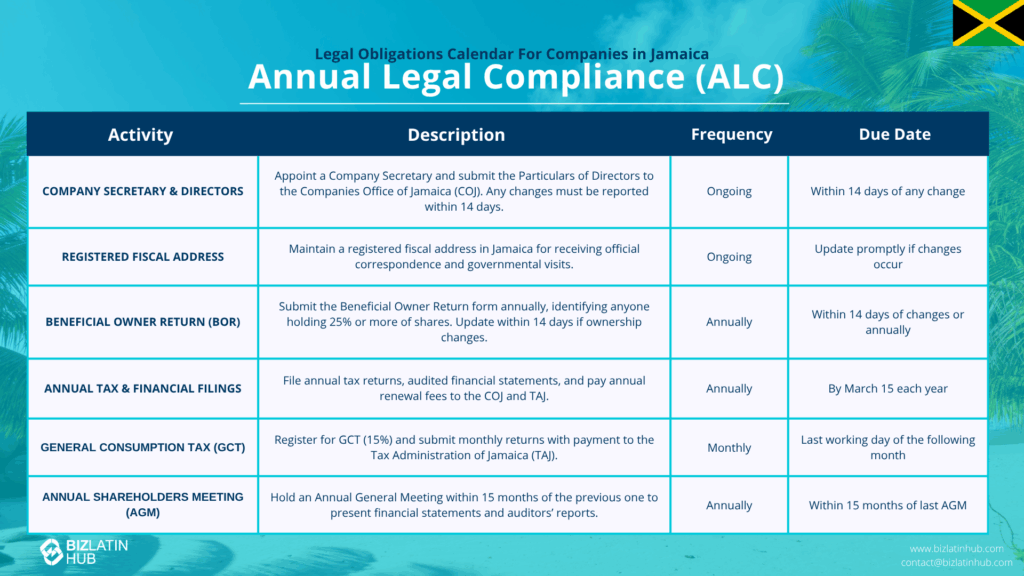

| What Are the Steps For Annual Legal Compliance? | Appoint a company secretary and particulars of directors Register a fiscal address Beneficial Owner Return form (BOR) |

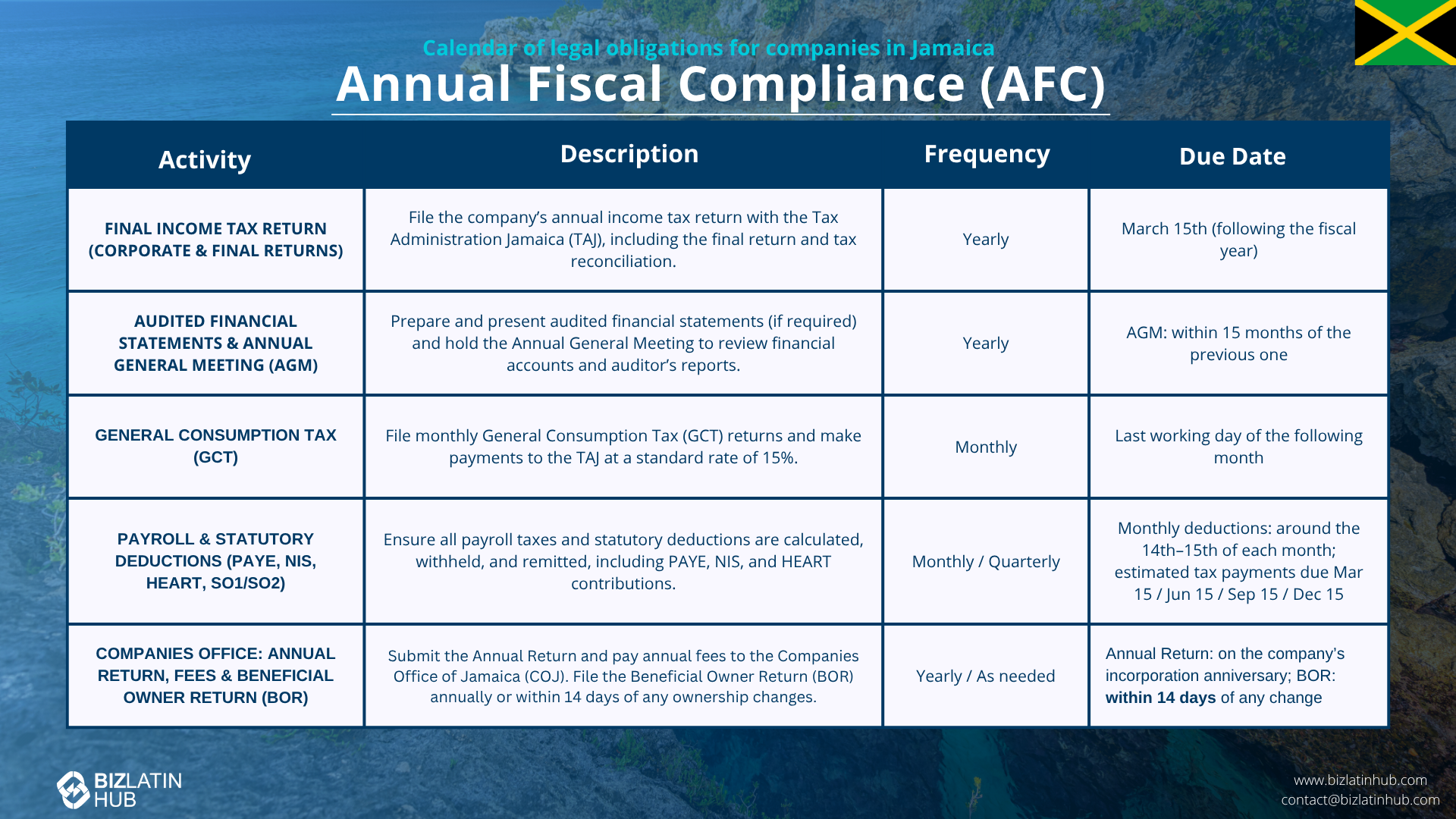

| What Are The Steps For Annual Fiscal Compliance? | Submit Annual Tax Returns Form to the Tax Administration of Jamaica (TAJ) Provide Financial statements annually Paying Annual Fees to Companies Office of Jamaica (COJ) |

| Why Invest in Jamaica? | Jamaica is strategically located in the centre of the Caribbean with good connectivity. The country has a stable economy, opportunities in many growing sectors and tax incentives. |

| What other filing is necessary throughout the year? | Tax compliance involves monthly GCT and payroll filings. |

Overview of Corporate Compliance in Jamaica

Once duly incorporated, all legal entities in Jamaica must meet some minimum statutory requirements:

- Appoint a Company Secretary and Particulars of Directors

- Register a fiscal address

- File Annual Tax returns

- Register for General Consumption tax

- Beneficial Owner Return Form

- Maintain accurate company records

They are not overly complex, however, it is important that all companies meet the following requirements and ensure full corporate compliance while engaging in commercial activities in Jamaica.

Steps for corporate compliance

Appoint a Company Secretary and Particulars of Directors

All companies in Jamaica must submit forms declaring who their Company Secretary and Particulars of Directors are. This means that individuals working with the business know who to make contact with. It also allows transparency about who is making transactions on behalf of the company, for the role of Particulars of Directors, and compliance as the Company Secretary must be appointed as part of the company’s records.

The documents must be signed by an existing director or authorised official of the Company. If the person occupying one of the roles changes, the documents must be adjusted and submitted to COJ within 14 days.

Register Fiscal Address

During the business registration process, companies must register a permanent fiscal address for the company. In Jamaica, this is the official registered office address and is obligatory for all incorporated companies. This address is used to receive correspondence and formal notices from governmental authorities, investors, financial institutes, shareholders, and the general public.

File Annual Tax Returns

All companies in Jamaica, regardless of their commercial activity, must file annual tax declarations. They should be declared up to a date or on the same day as the last return filed the previous year to avoid penalties.

It is also mandatory for businesses to provide quarterly estimated payments of tax and submit them to the TAJ.

This needs to be filed with COJ along with details about directors, the company secretary, shareholders, and the registered office address. It helps to identify changes in the ownership or management structure of the company.

All companies are also required to file Audited Financial Statements along with their Annual Returns.

Expert Tip: “Good Standing” for Contracts

From our experience, in Jamaica, a “Letter of Good Standing” from the COJ is the golden ticket for business. Banks require it for loans, and it is mandatory for bidding on any government tender. The COJ will not issue this letter if a single Annual Return is outstanding or if the Beneficial Ownership form hasn’t been filed. We advise filing returns promptly not just to avoid late fees, but to ensure you are “tender-ready” at all times.

Register for general consumption tax

Every registered company in Jamaica must register for the General Consumption Tax (GCT) with TAJ, which is currently at 15%. Some will need to also register for the payroll tax and corporate income tax, if applicable, to remain compliant. Failure to comply with any tax regulations can lead to penalties including fines or legal action.

Beneficial Owner Return Form (BOR)

Recent amendments to the Companies Act have introduced a mandatory Beneficial Ownership Return. Companies must identify the natural persons who own or control 25% or more of the shares or voting rights. This form must be filed with the COJ, and failure to do so can result in court action against the directors.

A BOR form is required annually for companies to lay out the names and particulars of the Beneficial Owners of the company. The COJ needs to receive it within 14 days of any changes to the Particulars of the Beneficial Owners or Members of the Company.

Identification documents need to be supplied so that all shareholders and Beneficial Owners can be identified. It is a legal obligation for it to be submitted as part of the incorporation package.

Maintain accurate company records

It is important to uphold accurate company records including records of all financial transactions, board meetings and shareholder information. A data protection impact assessment (DPIA) is necessary for businesses that hold personal data and must be submitted to the Commissioner within the first 90 days of each calendar year.

This ensures transparency and effective management of the company as well as upholding the company in good standing.

In Jamaica, rules around Annual shareholder meetings are governed by the Companies Act and are an annual requirement, within 15 months of the previous one. 21 days notice, as a minimum, must be given to all shareholders. During this meeting financial accounts and auditor’s reports need to be presented.

Hybrid and virtual meetings are now permitted, allowing for remote participation and a modernised process. All companies, except one-person companies, must hold Annual Shareholders Meeting, with all directors in attendance as well as the Auditor and every shareholder.

Key Annual Filing Obligations

- Estimated Income Tax Returns, for the company and individuals, and payments every quarter

- Final income tax return: annually by 15th March

- General Consumption tax: filed monthly with a payment on the last working day of the following month.

- Annual fee to maintain registration

Penalties for Non-Compliance in Jamaica

- Financial fines: regulators including the Financial Investigations Division (FDI) have authority to impose such sanctions.

- Suspension or revocation of licenses: failure to renew licenses can lead them to being revoked.

- Restrictions on business activities: for non-compliance, imposed by FDI and BOJ.

- Criminal prosecution: for serious violations such as not complying with Anti-money Laundering Laws.

FAQs on Entity Legal Compliance in Jamaica

Based on our extensive experience these are the common questions and doubts of our clients on corporate compliance in Jamaica:

The following are the most common statutory appointments for Jamaican legal entities:

Directors, responsible for the company’s governance.

A secretary to handle administrative tasks and compliance.

Auditors to manage financial statements.

Yes, a registered local fiscal address is required by COJ for all entities in Jamaica for the receipt of legal correspondence and governmental visits.

The ordinary General Shareholders’ Meeting must be held within 15 months following the previous one and requires a minimum of 21 days notice.

Companies must submit this report within 14 days after there has been a change in the shareholder or director. It must be signed off by an existing director or authorised official

The deadline for declaring income tax returns is on 15th March.

Companies must appoint a Company Secretary and Particulars of Directors, register a fiscal address, file monthly and annual tax declarations, hold annual shareholder meetings, and register for General Consumption tax with the Tax administrator of Jamaica. These steps ensure legal operation and alignment with Jamaican regulations.

Failure to hold the annual meeting or approve financials can lead to compliance issues, disputes among shareholders, and regulatory sanctions such as fines.

It is a fixed annual tax payable to Tax Administration Jamaica (TAJ) based on the value of the company’s assets. It is due by March 15th.

It is a document (Form 19A) filed annually with the COJ listing the current directors, shareholders, and registered office. It is distinct from a tax return.

Why Choose to Invest in Jamaica?

Jamaica has seen lots of investment from foreign companies, leading to improved infrastructure across the country. With a central location in the Caribbean and growing sectors in manufacturing, construction and technology, Jamaica is a growing economy in the region. Their democratic governance and fiscal incentives make it a great option for investment.

All companies interested in doing business here should be aware of their obligations for corporate compliance in Jamaica. Personalized support and advice from a local firm can ensure that your business remains in good standing with governmental authorities.

Biz Latin Hub can help you with corporate compliance in Jamaica

With an infinite amount of business opportunities available in the region, it is not surprising that keen investors are looking towards Jamaica as an attractive location to set up business operations.

Before jumping in, it is vital to have a sound understanding of your corporate obligations in Jamaica. While the opportunities are great, so are the risks for individuals and companies who do not comply with local Jamaican law.

For this reason and more, working with a trusted local legal and accounting firm can ensure that your company remains compliant when operating in Jamaica. Biz Latin Hub was established in 2014 to assist foreign companies in setting up their business in Latin America and the Caribbean.

Given the favorable conditions in the country and its strong economic growth, Biz Latin Hub offers experience and support on market entry in Jamaica. Feel free to contact us now.

Learn more about our team and expert authors.