Navigating employment law in Antigua and Barbuda involves compliance with regulations on wages, contracts, leave, termination, and worker protections. Whether you’re a local business or an international employer, understanding these rules is essential to maintaining a fair, safe, and legally sound workplace. A company formation in Antigua and Barbuda can only succeed taking these rules into account.

Key Takeaways on Employment Law in Antigua and Barbuda

| What are the working hours mandated by employment law in Antigua and Barbuda? | Up to 48 hours (usually 40 hours over 5 days). |

| What is the minimum wage? | The national minimum wage is set at EC$9.00 (≈ US $3.33) per hour as of January 1, 2025. |

| Types of Employment Contracts in Antigua and Barbuda | Fixed term or Indefinite. |

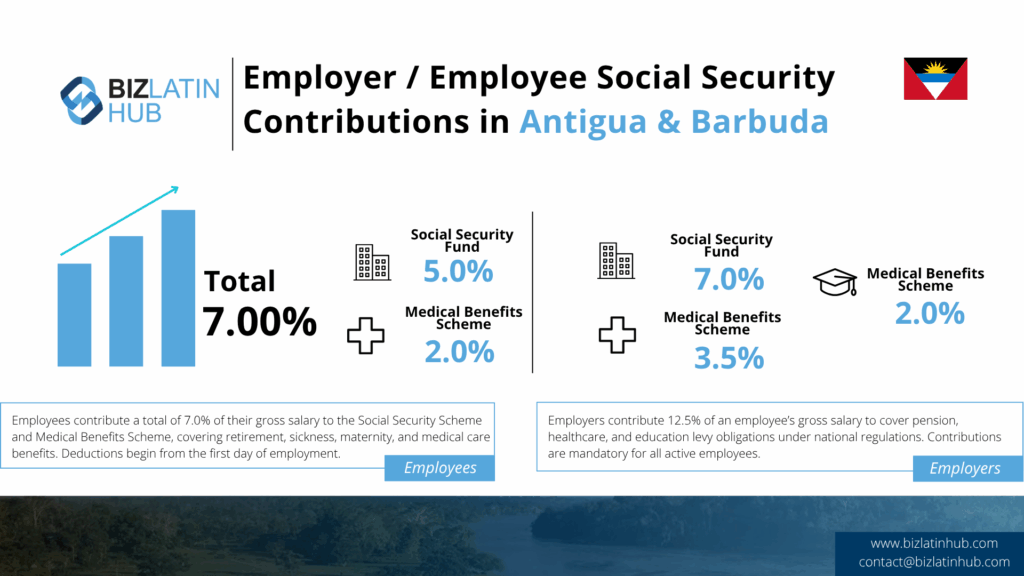

| What social security contributions are necessary in Antigua and Barbuda? | Employers are required to contribute to the Social Security Scheme and the Medical Benefits Scheme on behalf of their employees. |

Overview of Labor Law in Antigua and Barbuda

Employment in Antigua and Barbuda is governed by legislation that balances business flexibility with worker protections. Whether you’re hiring local talent or managing international employees, staying compliant with minimum wage standards, contracts, leave entitlements, termination rules, and workplace safety is vital.

Minimum Wage & Wage Protections

- The national minimum wage is set at EC$9.00 (≈ US $3.33) per hour as of January 1, 2025, updated from the previous EC$8.20 per hour. Employers must display the current rate on a notice board at the workplace.

- Failing to pay at least the minimum wage may result in fines up to EC$5,000 plus double the unpaid wages for first-time violations, and EC$10,000 plus potential imprisonment for repeat offenders. Authorities may demand back pay plus 10% annual interest.

Working Hours, Overtime & Rest Periods

| Topic | Standard |

|---|---|

| Workweek | Up to 48 hours (usually 40 hours over 5 days) |

| Overtime Pay | Typically 150% of standard rate (1.5x); 200% for night or statutory holiday work |

| Rest Periods | At least one hour for meals during full-day shifts; and at least 24 consecutive hours off per week |

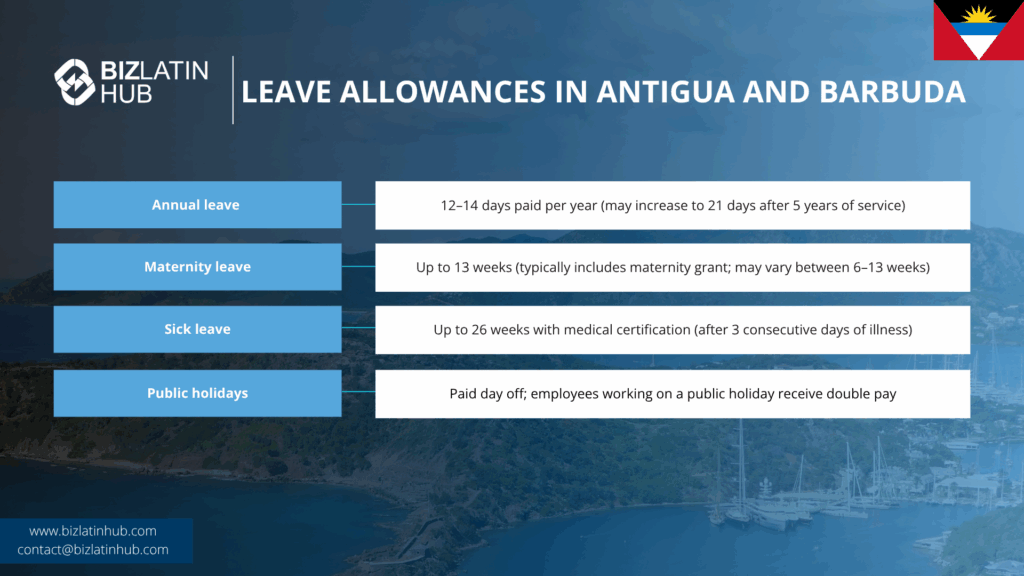

Leave Entitlements & Public Holidays

- Annual Leave: Common entitlement is 12–14 days paid leave per year. Some provisions offer 21 days after five years of service.

- Public Holidays: Employees scheduled off on a holiday are entitled to a compensatory paid day off. Working on a public holiday generally entitles the employee to double pay.

- Sick Leave: After the third consecutive day of illness, with a doctor’s certificate, sick leave may be granted—possibly up to 26 weeks totaling medical-certified pay.

- Maternity Leave: Typically ranges from 13 weeks including a maternity grant, though some sources mention a range between 6 and 13 weeks.

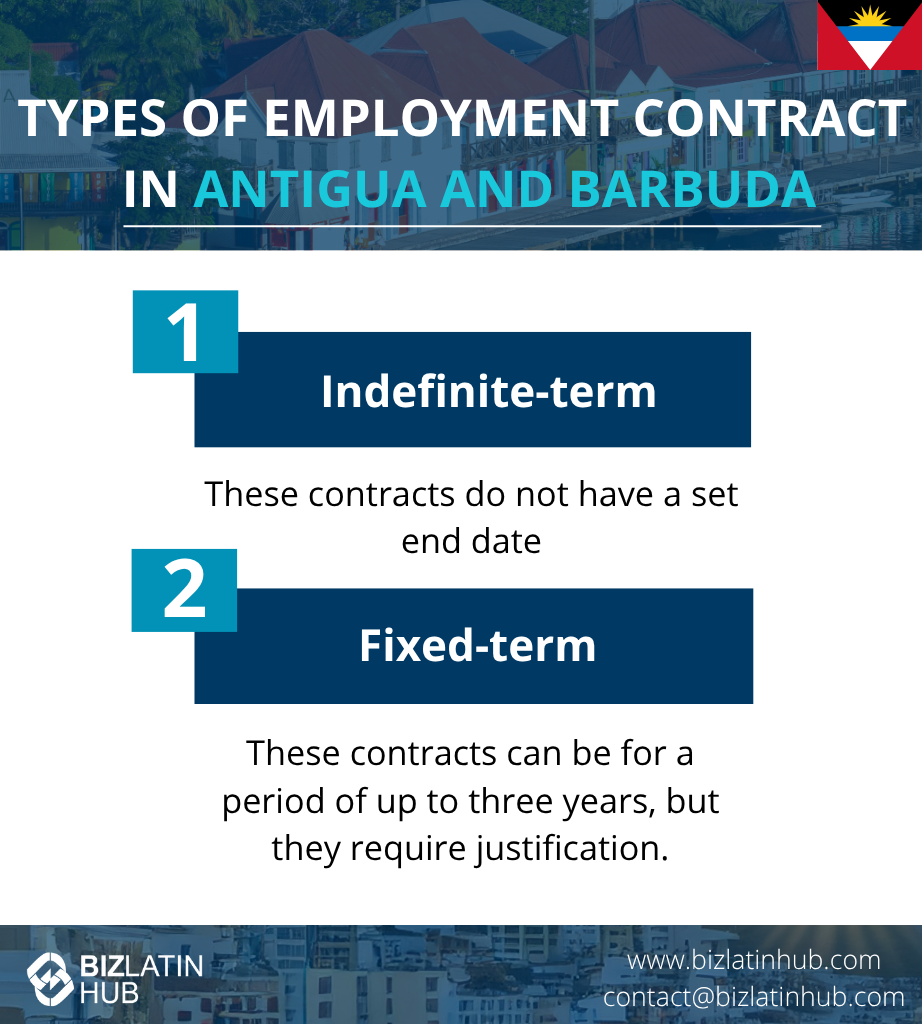

Employment Contracts & Work Permits

- All employees must have written employment contracts, which include terms for leave, working hours, and probation periods (typically up to 3 months).

- Fixed-term contracts (up to 3 years) require justification under 2019 amendments.

- Employers must prioritize local hires. Foreign nationals need work permits unless they are OECS/CARICOM skilled nationals. A work permit requires proof of unsuccessful local recruitment attempts.

Termination & Severance

- When terminating without cause, employers must provide notice or payment in lieu:

- <1 year of service: 1 week’s notice

- 1–5 years: 2 weeks

- >5 years: 4 weeks

- Dismissals for cause require documentation and a written explanation within 7 days if requested.

- Employers and employees contribute to the Social Security Fund, governed by the Social Security Act, 1972.

- Anti-discrimination laws prohibit bias based on race, gender, marital status, pregnancy, religion, and national origin. Enforcement is through the Labour Department or Industrial Court.

Health, Safety & Dispute Resolution

- Employers are responsible for providing safe workplace conditions, including PPE, sanitation, ventilation, and emergency readiness.

- Disputes can be resolved via internal grievance procedures, or escalated to the Industrial Court or Labour Department.

Frequently Asked Questions (FAQs) on Employment Law in Antigua and Barbuda

Yes—Antigua and Barbuda’s Labour Code mandates written contracts detailing terms like leave, hours, and probation.

A standard workweek is up to 48 hours (typically 40 hours over five days). Overtime is paid at 1.5× (150%) the regular rate, with 2× pay for night shifts or public holidays.

Employers must pay at least EC$9.00 per hour as of January 1, 2025. Displaying the rate at the workplace is required. Failing to comply could lead to heavy fines or imprisonment.

Employees generally receive 12–14 days of paid annual leave. Additional entitlement and maternity leave apply depending on length of service and legislation.

Depending on length of employment:

Less than 1 year: 1 week

1–5 years: 2 weeks

Over 5 years: 4 weeks

Termination “with cause” requires documentation and explanation on request.

Yes, but they must obtain a work permit. Employers must demonstrate that local candidates were considered first. Exemptions may apply to OECS/CARICOM nationals with qualifications.

Employees and employers must contribute to Social Security. Employers are also required to maintain anti-discriminatory practices and ensure workplace safety.

Disputes can be handled internally or escalated to the Labour Department or the Industrial Court for formal resolution.

Biz Latin Hub can help you with employment law in Antigua and Barbuda

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.