Whether your business in Antigua and Barbuda is focused on tourism, international trade, or offshore financial services, maintaining compliance is crucial. An Entity Health Check provides a structured review of your company’s legal and regulatory standing, ensuring your operations remain protected, up to date, and ready for growth or scrutiny. From routine filings to corporate governance and beneficial ownership disclosures, this diagnostic process can prevent unexpected penalties and support future business activity.

Key Takeaways

| Verifies corporate compliance with the Companies Act and local regulations | Avoids late fees, penalties, and possible strike-off |

| Checks accuracy of accounting records, minutes, and statutory registers | Ensures audit readiness and proper governance |

| Assesses Beneficial Ownership filing and Economic Substance obligations | Supports transparency and satisfies international compliance expectations |

| Reviews whether the company has met all filing and renewal deadlines | Prevents administrative dissolution or de-registration |

| Ensures directors and officers are properly appointed and recorded | Reduces risks of director liability or administrative errors |

1. Corporate Registry Compliance and Annual Returns

In Antigua and Barbuda, companies must file annual returns with the Companies and Intellectual Property Office (CIPO) in accordance with the Companies Act. These filings confirm that the company is active, compliant, and in good standing.

Failure to file on time can result in late penalties and—if left unresolved—your company may be struck off the register. Inactive companies that have not submitted annual returns for two or more years may also be dissolved administratively.

An entity health check ensures these filings have been made and that your company remains legally recognized and operational.

2. Record Keeping: Books, Minutes, and Statutory Registers

Every company in Antigua and Barbuda must maintain proper accounting records, minute books, and statutory registers of shareholders and directors. While audits are not always required, maintaining accurate documentation is essential for governance and future due diligence, especially if the business is preparing for investment or regulatory review.

An entity health check can uncover gaps in your corporate records and help you put the necessary systems in place.

3. Beneficial Ownership and Economic Substance Compliance

Antigua and Barbuda is part of the Caribbean Financial Action Task Force (CFATF) and has implemented beneficial ownership legislation to improve corporate transparency. Companies are required to maintain up-to-date beneficial ownership information and may need to file this with the relevant authority (CIPO or the Financial Services Regulatory Commission, depending on the company type).

In addition, businesses carrying out relevant activities (e.g. holding companies, shipping, financial services) may be subject to Economic Substance regulations under the International Business Corporations Act and are required to demonstrate local substance (physical presence, employees, management, etc.).

A health check reviews whether your business has met these obligations and identifies areas of non-compliance.

4. Renewal Fees and Licence Compliance

For both domestic and international business corporations (IBCs), annual licence renewal fees must be paid on time. Late payment can lead to fines, administrative delays, or even suspension of the company’s legal standing.

Health checks verify that:

- All licence or registration fees are current

- Annual returns and supporting documents have been submitted

- There are no outstanding penalties or compliance flags

This ensures business continuity and keeps your entity ready for banking, partnerships, or government interactions.

5. Directors, Officers, and Corporate Governance

According to the Companies Act, all directors and officers of a company in Antigua and Barbuda must be properly appointed and recorded with the corporate registry. Changes in directorship or officer roles must be reported promptly.

Non-compliance could lead to:

- Personal liability for directors

- Loss of confidence from partners or financial institutions

- Ineligibility for future licensing

An entity health check ensures that the board of directors, secretary, and other key roles are documented correctly and that all filings relating to appointments or resignations have been made.

Final Thoughts

In Antigua and Barbuda, maintaining a compliant business isn’t just about filing documents—it’s about safeguarding the integrity and continuity of your operations. Whether you’re an international investor or a local entrepreneur, an Entity Health Check gives you peace of mind, aligns your business with national and international expectations, and strengthens your credibility in the market.

Frequently Asked Questions (FAQs) about entity health checks in Antigua and Barbuda

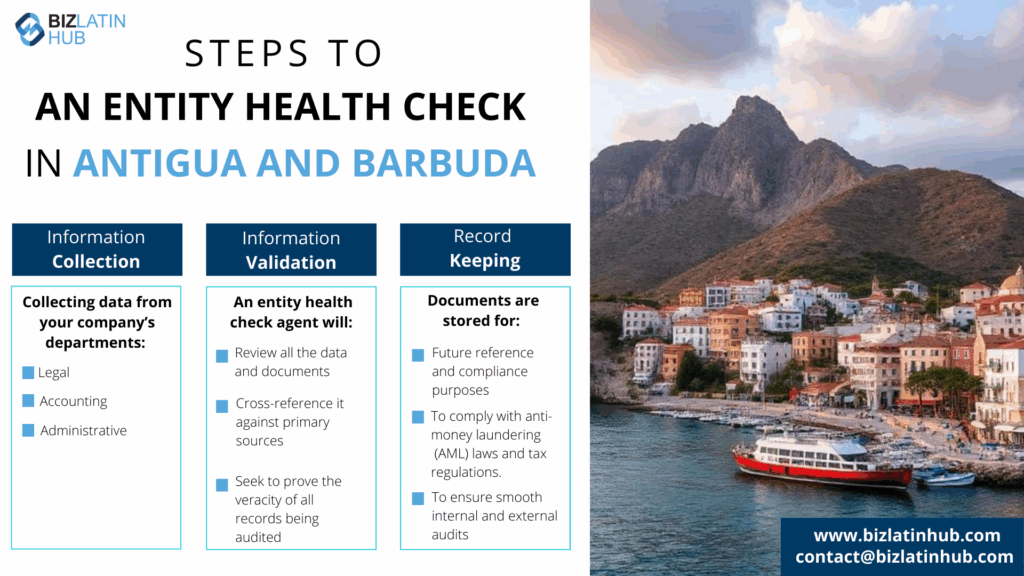

It’s a structured compliance review for your company in Antigua and Barbuda. It covers filings, record-keeping, beneficial ownership, economic substance requirements, and governance to help you avoid penalties and ensure legal soundness.

Typically, it takes a few days to two weeks, depending on the size of the company and availability of documents.

Late annual returns, missing director filings, outdated statutory registers, non-compliance with beneficial ownership laws, or unpaid government fees.

Yes—by identifying areas where your company is non-compliant, you can fix issues before they result in fines, suspension, or deregistration.

A professional corporate service provider, lawyer, or accountant with expertise in Antigua and Barbuda’s company law and regulatory framework.

No, it’s not mandatory. However, it is strongly recommended to maintain good standing and reduce compliance risk—especially for companies engaging in international business.

Absolutely. It prepares your entity for audits, mergers, acquisitions, or partnerships by confirming that all records are in order.

Annually, or before any major event such as a company restructure, investment, or regulatory submission.

Biz Latin Hub can help you with an entity health check in Antigua and Barbuda

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.