A corporate Entity Health Check is a strategic review designed to ensure your Cayman Islands company remains in full compliance with legal, regulatory, and operational standards. Even with minimal tax obligations, Cayman companies face evolving transparency, governance, and regulatory requirements. A health check helps you identify potential risks either for company formation in the Cayman Islands, or before they become serious issues.

Key Takeaways on an Entity Health Check in the Cayman Islands

| Verifies annual return filings and Registrar standing | Prevents penalties and de‑registration |

| Tests completeness of accounting records, minutes & statutory registers | Ensures your books are audit-ready and governance-aligned |

| Checks Beneficial Ownership (BOI) and Economic Substance compliance | Critical for meeting local and international standards |

| Assesses regulatory obligations and internal controls for regulated entities | Keeps you aligned with CIMA and global transparency expectations |

| Confirms director registration under Cayman’s licensing regime | Avoids serious fines or criminal liability |

1. Registrar & Annual Return Compliance

Cayman exempted companies must file an annual return—typically every January—alongside the renewal fee to stay in good standing. Late filings incur steep penalties: 33%, then 66%, and ultimately 100% of the fee. After 12 months, a company may be deemed defunct and struck off the register.

A health check verifies that annual filings are up-to-date and that your corporate status remains active.

2. Maintenance of Books, Minutes & Registers

While Cayman does not mandate audited financial statements for exempt companies, maintaining accurate accounting records, minute books, and statutory registers (directors, members, beneficial owners) is essential. These records must be accessible for inspection and support good governance.

An entity health check ensures these records exist, are maintained correctly, and reflect the company’s operations.

3. Beneficial Ownership & Economic Substance Compliance

Under the Beneficial Ownership Transparency Act (July 2024), most Cayman entities must maintain an internal beneficial ownership register and submit required details via the BOSS system. Omissions may result in fines or deregistration.

Companies conducting relevant activities must also satisfy Economic Substance requirements by filing notifications and returns through the appropriate channels.

A health check confirms these critical compliance obligations have been met within required deadlines.

4. Internal Controls & Reporting for Regulated Entities

If your Cayman entity is regulated by CIMA—such as funds, insurers, or licensed managers—the jurisdiction’s updated regime requires robust internal controls and corporate governance processes. This includes documented risk management, reporting structure, business continuity, and transparency frameworks.

A health check reviews whether your entity has adequate policies, procedures, and oversight to meet these elevated standards.

5. Director Registration & Licensing Compliance

Cayman’s Directors Registration and Licensing Law mandates that individuals serving as directors of “Covered Entities” must be registered or licensed with CIMA prior to acting in that role. Breach of this requirement may result in fines up to CI$50,000 (~US$61,000) or even imprisonment.

A health check audits director records to verify compliance with the licensing regime.

Final Thoughts

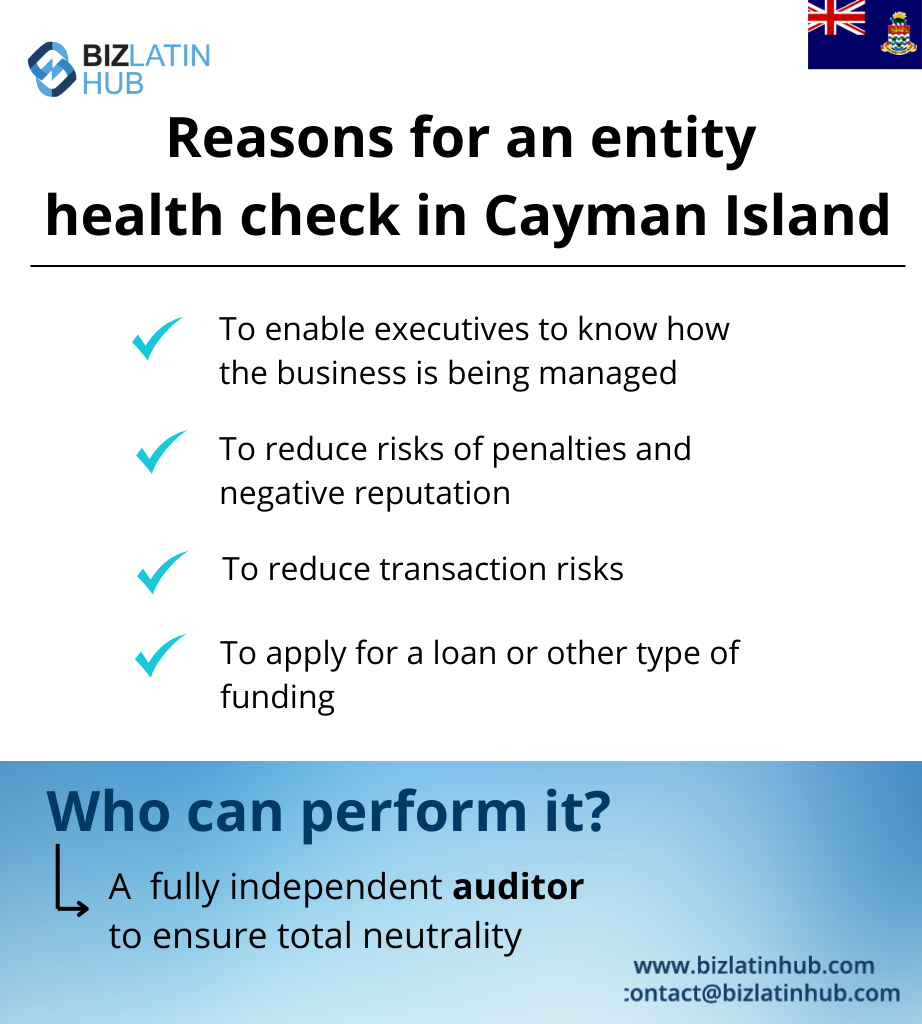

An Entity Health Check in the Cayman Islands isn’t just a nice-to-have—it’s a powerful tool to maintain corporate integrity and compliance. From annual filings to BOI, substance rules, and director licensing, regular reviews ‘future-proof’ your operations and provide confidence to stakeholders.

Frequently Asked Questions (FAQs) on an Entity Health Check in the Cayman Islands

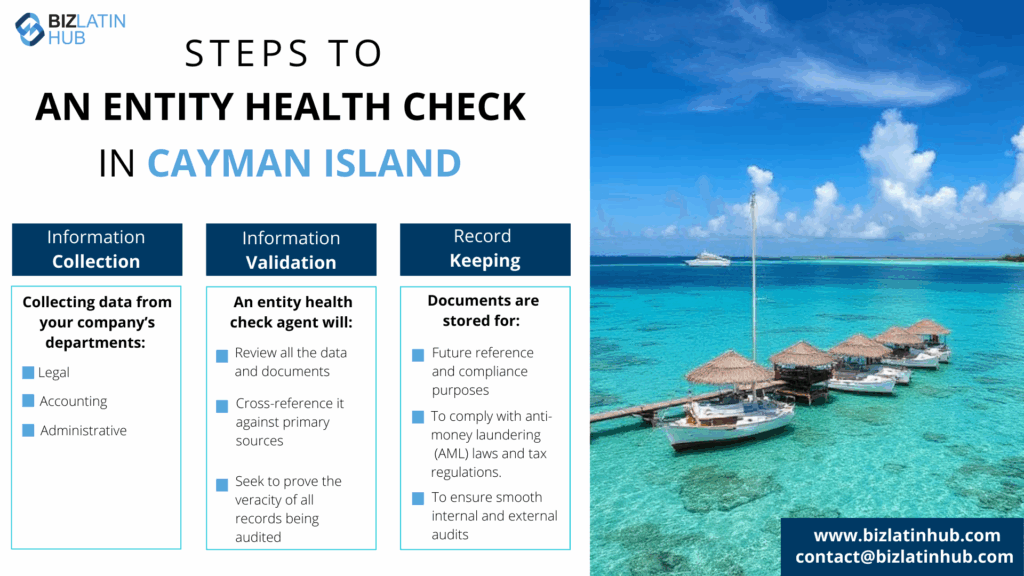

It’s a structured compliance review for your Cayman Islands company—covering filings, record-keeping, BOI and economic substance requirements, regulatory controls, and director licensing—to mitigate risks proactively.

Typically, a few days to a couple of weeks—depending on the size and complexity of your entity and the availability of documentation.

Often, late or missing annual returns, incomplete statutory registers, failure to file BOI or ES notifications, gaps in internal control documentation, or unregistered directors.

Yes—it helps you identify and fix compliance gaps early, reducing the risk of penalties, deregistration, or enforcement by authorities.

A qualified corporate service provider, accountant, or legal advisor experienced with Cayman regulatory and governance standards.

No—it’s voluntary. However, for regulated or high-risk entities, it’s a vital proactive measure.

Absolutely—it helps demonstrate strong governance and reliability to banks, investors, and regulators.

Annually, or in advance of key events—such as director changes, upcoming filings, or regulatory reviews.

Biz Latin Hub can help you with an entity health check in the Cayman Islands

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.