Liquidating a company in Antigua and Barbuda involves several legal, financial, and regulatory steps. Whether you are voluntarily winding up or being wound up by the courts, you’ll need to ensure compliance with the Companies Act, regulatory filings, tax obligations, and creditor claims. Of course, in initial company formation in Antigua and Barbuda, you don’t want this to happen, but if it is necessary you should remain compliant.

Key takeaways on how to liquidate your business in Antigua and Barbuda

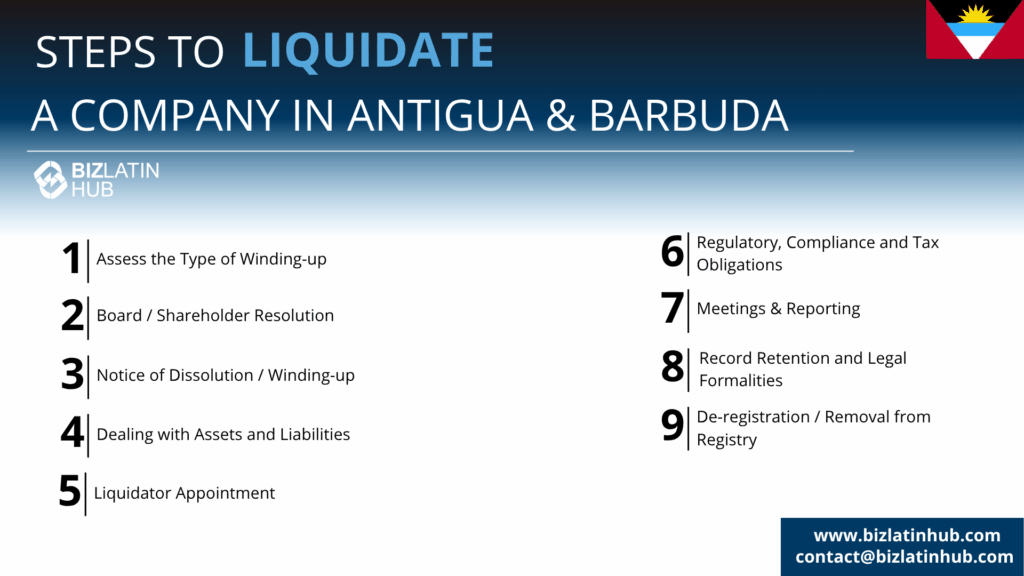

| 9 steps to liquidate a company in Antigua and Barbuda | 1. Assess the Type of Winding-up 2. Board / Shareholder Resolution 3. Notice of Dissolution / Winding-up 4. Dealing with Assets and Liabilities 5. Liquidator Appointment 6. Regulatory, Compliance and Tax Obligations 7. Meetings & Reporting 8. Record Retention and Legal Formalities 9. De-registration / Removal from Registry |

| What is the timeframe needed to liquidate your business in Antigua and Barbuda? | For a small, simple company, voluntary liquidation might take a few months. More complex involuntary or court‑ordered liquidations can take significantly longer. |

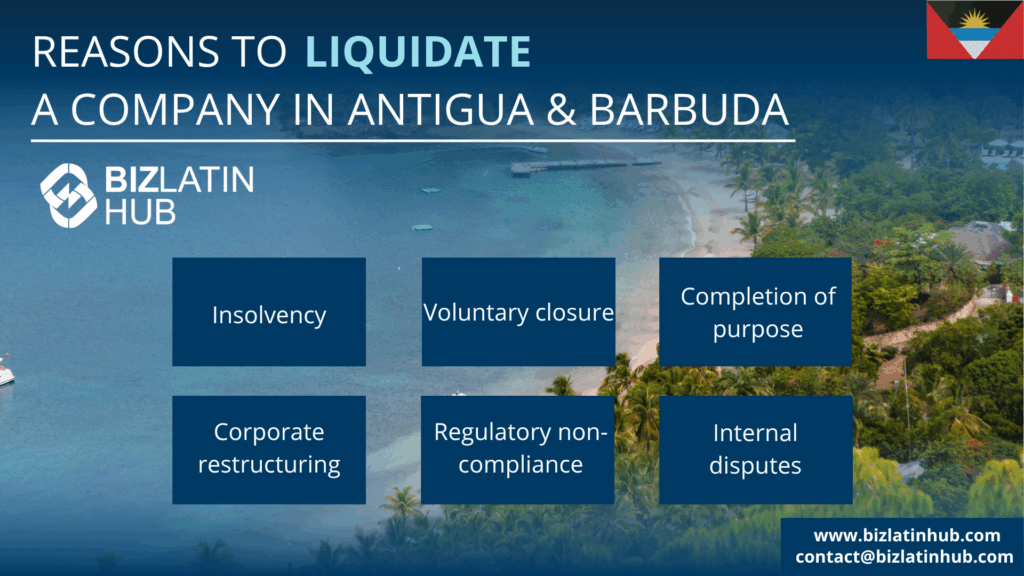

| What are the reasons to liquidate a business in Antigua and Barbuda? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in Antigua and Barbuda? | This can be ordered by the court (for example, when creditors apply) due to insolvency or other legal grounds. |

1. Assess the Type of Winding-up

First, determine whether the liquidation will be voluntary or compulsory.

- Voluntary winding‑up: initiated by the shareholders (or by the directors under direction of shareholders) when the company is solvent or when it is just no longer viable.

- Compulsory winding‑up: ordered by the court (for example, when creditors apply) due to insolvency or other legal grounds.

The Companies Act (No. 18 of 1995), as amended, governs these processes.

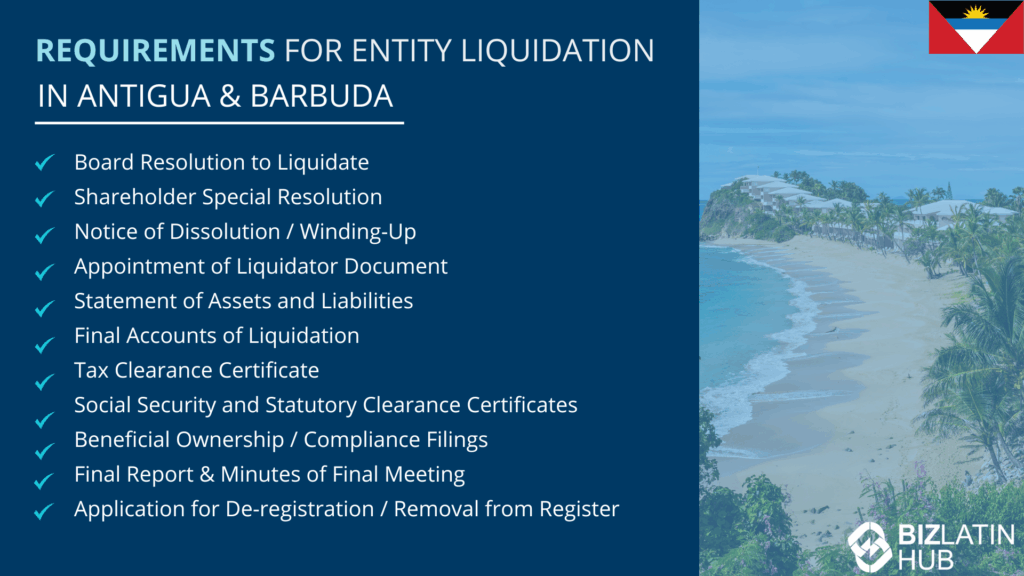

2. Board / Shareholder Resolution

For voluntary liquidation:

- The board of directors must convene and propose the winding‑up, often via written resolutions.

- Shareholders must pass a special resolution approving the liquidation. The company’s Articles may specify requirements (e.g. majority thresholds).

3. Notice of Dissolution / Winding-up

Once a resolution is passed:

- You must file notice of the winding‑up or dissolution with the relevant authorities.

- For certain types of companies (for example under the International Limited Liability Companies Act, 2007) there’s a requirement to file a written notice of dissolution and winding up within a prescribed time (e.g., 120 days) signed by authorized persons.

- The Registrar of Companies (under ABIPCO) must be notified.

4. Dealing with Assets and Liabilities

- Identify and value all assets of the business.

- Pay off creditors: all lawful claims must be satisfied (as far as possible).

If the company is solvent, the remaining assets are distributed among shareholders in accordance with their rights. If insolvent, priority is given to creditor claims under the law.

5. Liquidator Appointment

- In voluntary liquidation, the resolution often provides for the appointment of a liquidator.

- For compulsory winding‑up, the Court may appoint a liquidator.

The liquidator is responsible for collecting assets, paying debts, distributing any remaining assets, and preparing financial accounts.

6. Regulatory, Compliance and Tax Obligations

Before or during liquidation:

- Ensure annual returns are up to date. Companies must file annual returns with ABIPCO on or before 30 days after the anniversary of incorporation.

- Ensure beneficial ownership or change of ownership filings are updated.

- Settle any corporate taxes, sales taxes / VAT, social security or other statutory obligations. Deal with the Inland Revenue Department (IRD) to ensure no outstanding liabilities remain.

7. Meetings & Reporting

- The liquidator must prepare regular reports to creditors and shareholders, including periodic accounts showing how the winding‑up is progressing.

- Once winding‑up is complete, a final meeting is called to present a final account showing how assets have been disposed of, how obligations have been discharged, and how any distributions were made.

8. Record Retention and Legal Formalities

- Under recent amendments, liquidators must keep company records for at least seven years after dissolution.

- Also, the Registrar of Companies must retain records of dissolved companies for a similar period.

- All filings (resolutions, notices, final reports) must be submitted to ABIPCO and other regulatory entities.

9. De-registration / Removal from Registry

Once the affairs are fully wound up:

- File final documents with the Registrar of Companies to have the company removed (or struck off) from the Register.

- The company ceases to exist on the date shown in the certificate of dissolution or official order.

10. Practical Tips

- Engage legal and accounting professionals familiar with Antigua and Barbuda law early in the process.

- Ensure good communication with creditors and relevant statutory bodies.

- Keep thorough records throughout.

Legal & Regulatory Context

- The Companies Act, 1995 is the primary legislation governing companies in Antigua and Barbuda. It has been amended over time (e.g. in 2020, 2023).

- Amendments have recently increased record retention requirements, especially with respect to liquidation and post‑dissolution records.

- There are also statutes governing specific types of companies such as International Business Corporations (IBCs), Limited Liability Companies under special Acts, etc.

Common Challenges & Pitfalls

- Overlooking unpaid tax or social security / employee obligations.

- Failing to properly notify or advertise according to law.

- Not filing required returns or beneficial ownership information. Such omissions can delay or complicate the winding‑up process.

- Not maintaining proper records or disposing them too early.

FAQs on company liquidation in Antigua and Barbuda

The cost depends on several factors: whether the liquidation is voluntary or court‑ordered; the complexity of assets and liabilities; legal, accounting, and liquidator fees; clearing all tax and regulatory obligations; and the filing fees with ABIPCO. You may also incur fees for advertising notices, valuing assets, and other professional services. There is no fixed flat rate that applies universally, so obtaining estimates from lawyers/accountants is crucial.

It depends on the size and complexity of the company, whether it’s solvent, how many creditors there are, whether there are disputes, and how quickly you can prepare financial statements and fulfill statutory obligations. For a small, simple company, voluntary liquidation might take a few months. More complex involuntary or court‑ordered liquidations can take significantly longer.

You will generally need to notify: (1) the Registrar of Companies (ABIPCO); (2) the Inland Revenue Department for tax obligations; (3) Social Security, Medical Benefits, and other agencies as required; (4) all known creditors; (5) shareholders; (6) sometimes the public (via notices in the Gazette or local newspapers); (7) any external or offshore authorities if the business is an external company or IBC.

Generally, shareholders’ liability is limited (according to the company’s constitution and how shares are structured). However, directors may be held personally liable in certain circumstances, especially if there has been misconduct, fraud, negligence, or violation of directors’ duties. Ensure that all statutory filing obligations and bookkeeping are properly maintained to reduce risks.

The liquidator assumes responsibility for dealing with existing obligations: evaluating contracts, deciding whether to fulfill or terminate them, settling leases, terminating where possible, and paying off liabilities. Sometimes contracts may need to be renegotiated or ended in accordance with their terms. Until the winding‑up is officially under way, directors retain power (as per the law), but once a liquidator is appointed many powers shift to them.

Yes. Before liquidation you must ensure that all corporate income taxes, VAT/sales taxes, payroll taxes, social security contributions, and any other statutory dues are filed and paid. The final tax return or returns must be completed, and clearance from relevant taxation authorities may be required. Failure to settle tax obligations can delay the process or expose directors/shareholders to penalties.

Biz Latin Hub can help you with entity liquidation in Antigua and Barbuda

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.