Liquidating a company in Guyana requires navigating both legal and practical steps under the Companies Act and relevant corporate regulations. Whether due to insolvency, strategic exit, or operational closure, it’s essential to follow formal procedures to ensure the company is legally wound up and fully deregistered. Staying compliant will make future new company formation in Guyana easier if you decide to restart in the country.

Key takeaways on how to liquidate a company in Guyana

| Main Steps | Initiate shareholder resolution: voluntary or court‑mandated; appoint liquidator; settle debts; transfer or dispose of assets; file final accounts; remove from register. |

| Typical Duration | Depends on circumstances—voluntary liquidation may take several months if records and taxes are current; compulsory or complex cases may take longer. |

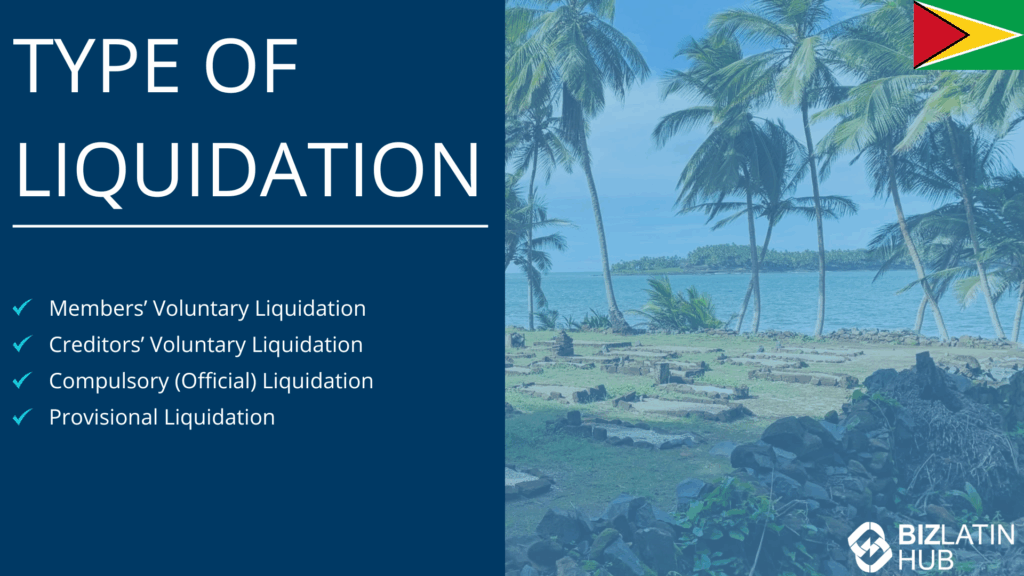

| Types of Liquidation | Voluntary (by shareholders when solvent or strategic); Compulsory (initiated by creditors or court order due to insolvency or statutory breaches). |

| Key Authorities | Registrar of Companies (Deeds Registry branch) and Guyanese courts. |

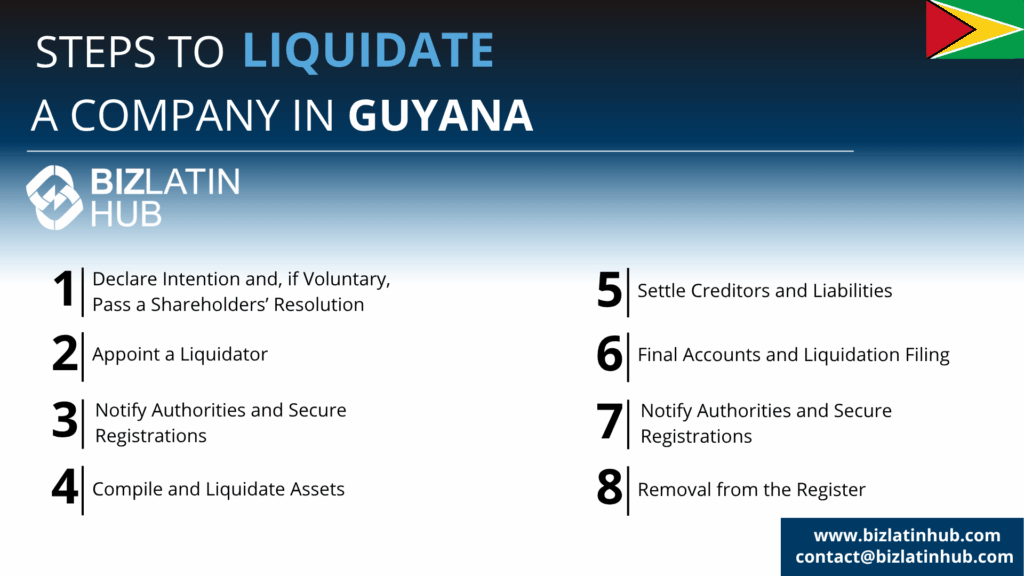

Step-by-Step Process to Liquidate a Company in Guyana

Step 1 – Declare Intention and, if Voluntary, Pass a Shareholders’ Resolution

For a voluntary liquidation, shareholders pass a resolution in a general meeting to dissolve the company and appoint a liquidator. If the company is insolvent or creditors initiate, the court may order liquidation under the Companies Act.

Step 2 – Appoint a Liquidator

In a voluntary case, shareholders appoint a liquidator to oversee asset disposal and creditor settlement. In compulsory or court-ordered liquidation, the court appoints a liquidator.

Step 3 – Notify Authorities and Secure Registrations

The liquidator and company must notify the Registrar at the Deeds Registry (Companies Office) of intent to liquidate. External (foreign) companies must also notify the Registrar within 28 days of ceasing operations to cancel their registration.

Step 4 – Compile and Liquidate Assets

The liquidator inventories company assets and liabilities, sells or disposes of assets, and collects receivables to generate funds for creditor payments.

Step 5 – Settle Creditors and Liabilities

Creditors are paid in legal priority. Once liabilities are cleared, any remaining assets are distributed to shareholders.

Step 6 – Final Accounts and Liquidation Filing

The liquidator prepares a final account or statement recording asset realization, debt settlements, and distributions. This must be filed with the Registrar.

Step 7 – Dissolution and Vesting of Outstanding Assets (if needed)

If residual assets remain after dissolution, these vest in the Registrar by operation of law for up to two years—enabling recovery or court action if necessary.

Step 8 – Removal from the Register

Upon completion of liquidation, the Registrar removes the company from the register. Directors and officers should ensure all returns and fees are up to date to facilitate this.

Considerations When Liquidating a Company in Guyana

- Record Keeping: Companies must maintain statutory records, including articles, minutes, registers, and accounts. Failing to do so can result in fines.

- External Company Compliance: Foreign companies must ensure timely notification and cancellation upon cessation of business; failure can delay deregistration.

- Registrar’s Role: Outstanding assets post-dissolution fall under the Registrar’s control and can be managed or disposed of by that office.

- Legal Oversight: Compulsory (court-ordered) liquidations remove control from company actors and involve judicial oversight, which may extend the timeline.

FAQs on How to Liquidate an Entity in Guyana

These are the most common questions from our clients

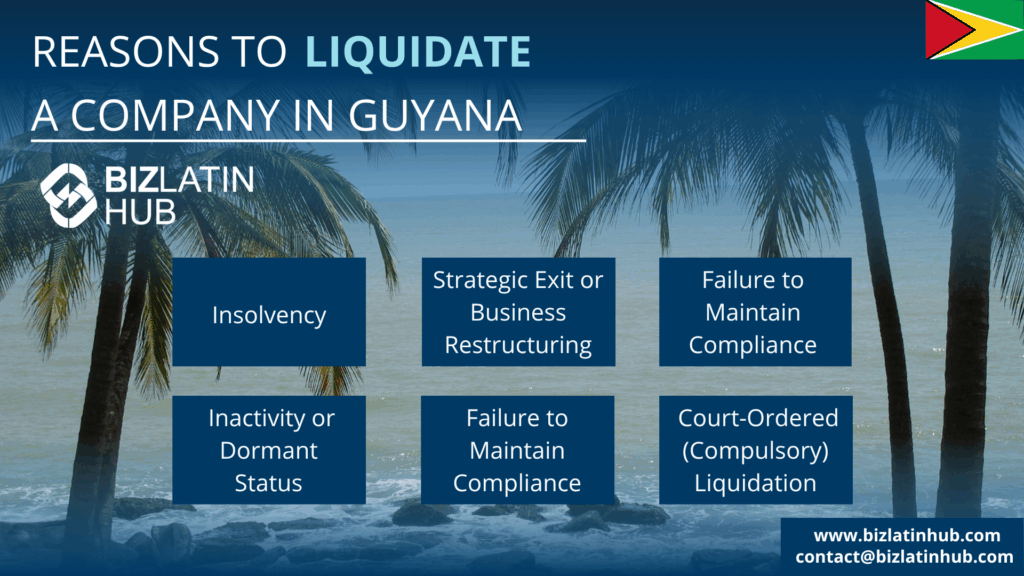

Liquidation can be voluntary, initiated by shareholders when solvent or strategically closing, or compulsory, initiated by creditors through a court. For voluntary processes, shareholders pass a resolution, appoint a liquidator, settle debts, close records, and deregister. Court-ordered liquidation follows a similar asset-focused path but under judicial supervision.

If all records are current and assets and debts are straightforward, a voluntary liquidation may take several months. Court-driven or complex cases can take significantly longer, depending on legal proceedings and asset resolution.

Common reasons include insolvency (inability to meet debts), strategic decisions to exit the market, inactivity, or failure to maintain compliance. The Companies Act provides the framework for both voluntary and compulsory winding-up.

Yes. Creditors can petition the court if the company fails to pay debts or breaches statutory obligations. The court may order compulsory liquidation.

Yes, but effective coordination is required. Foreign shareholders can appoint local representatives or liquidators. External companies must notify the Registrar within 28 days of ceasing operations to cancel registration.

Inactive companies that remain registered without formal liquidation remain liable for statutory filings and fines. The company can be struck off, but liability persists and may be enforced.

No. If the company is solvent and shareholders agree, a voluntary liquidation is possible without court intervention. Court processes are only mandatory in insolvency or contested scenarios.

Key documents generally include the shareholder resolution to liquidate, liquidator’s appointment documentation, final accounts, clearance of debts, and filing at the Registrar. Any assets remaining post-dissolution vest with the Registrar automatically.

Biz Latin Hub can help you with entity liquidation in Guyana

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.