CChoosing the right legal entity is a critical first step when incorporating a company in Guyana. The country offers a range of legal structures tailored for both local entrepreneurs and foreign investors, from the highly flexible LLC to more traditional structures like sole traders and partnerships, as well as branch offices for multinationals. This guide will walk you through the key company types, how they work and how to choose the best option for your business goals.

Key Takeaways

| What are the common legal entity types in Guyana? | Sole proprietorship. Partnership. Private Limited Liability Company (PLLC or LLC). Public Liability Company (PLC). |

| What is the most common Guyanan business entity? | The LLC |

| What are the primary considerations when choosing a business entity in Guyana? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

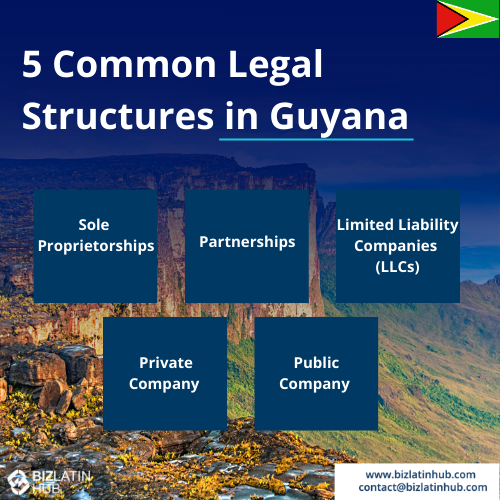

Overview of Legal Structures for Companies in Guyana

There are four main types of legal entities in Guayana to choose, including:

- Sole proprietorship.

- Partnership.

- Private Limited Liability Company (PLLC or LLC).

- Public Liability Company (PLC).

Given the convenience of establishing an LLC in Guyana, this tends to be the most popular choice among foreign investors and, as such, is the focus of the step-by-step guide for company formation. Note that, while the shareholders of an LLC can be foreign and do not have to reside in Guyana, in the case that all of them are based abroad, a local agent should be appointed to receive legal and other official documents at a Guyanese address.

1. LLC

Who should choose this: Entrepreneurs, startups, and foreign-owned companies that need flexibility and want to incorporate with just one shareholder. The LLC is the most commonly used structure for foreign investors due to its ease of formation, operational flexibility, and limited liability.

An LLC can be fully foreign-owned by a minimum of two and a maximum of 20 shareholders, with each shareholder’s liability limited to what they have contributed to the company’s share capital. On that note, there is no minimum required capital, making this entity type low-cost to establish. If you set up an LLC, only one director is required to be appointed, and that can be one of the shareholders.

2. PLC

Who should choose this: Larger or publicly traded companies that need to issue shares, raise capital from external investors, or meet higher corporate governance standards.

A PLC is a company for which ownership is divided into shares that are publicly traded on a stock exchange, and requires a minimum of two directors to be appointed. In both cases, a director can be anyone of legal age who is not otherwise prohibited from occupying such a role.

3. Sole Traders and Partnerships

Who should choose this: Small partnerships or family-run businesses where control is kept among a limited group of partners.

A sole proprietorship is one of the easiest types of companies in Guyana to set up, however the liability is not limited, so the owner holds full responsibility for all assets and debts. A partnership is similar, however that liability is spread across the named partners.

Our recommendation: Simplified Stock Company (SAS) offers a streamlined and efficient incorporation process, making it attractive for foreign businesses seeking to establish a presence in Guyana. In addition, SAS entities are subject to simplified corporate governance requirements compared to other legal entity types, making them a practical choice for foreign investors.

Branch of a Foreign Company

Who should choose this: International companies that wish to conduct business in Guyana without creating a new legal entity. This structure allows centralized control but places full legal and financial liability on the parent company.

Opening a foreign branch office could be an attractive option for a company that has its head office headquartered in another country. Guyanese legislation recognizes foreign branch offices as an extension of the parent company, so branches and the parent company are viewed as the same legal entity. Key documentation required to establish a foreign branch office include:

- Certificate of incorporation document and legal representation of the parent company

- Authorization of a representative to act on the company’s behalf by the power of attorney

- Bylaws of the parent company

Each of the legal entities discussed has its advantages and disadvantages. LLCs tend to be the most popular for convenience.

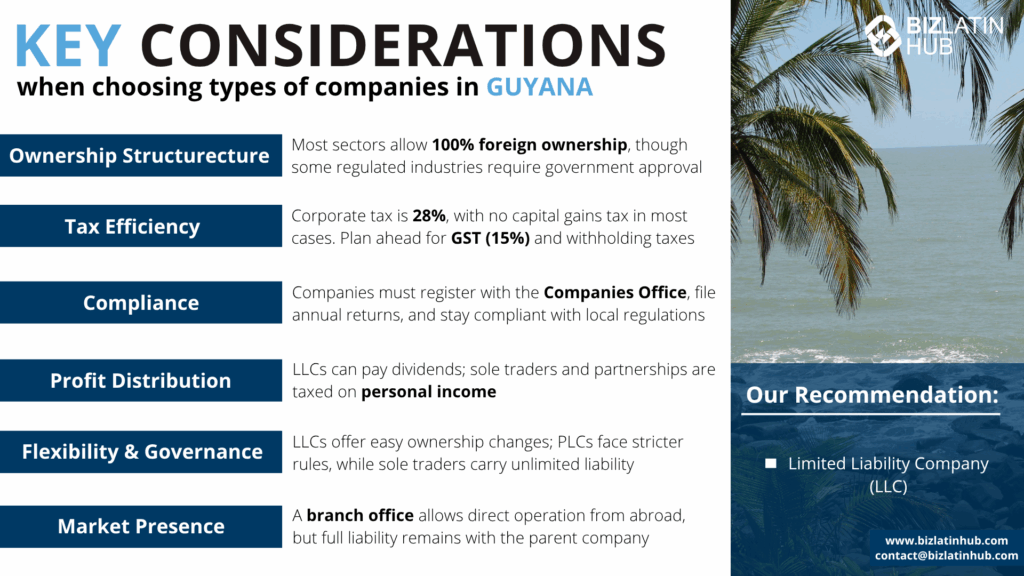

Key Considerations When Choosing an Entity Type in Guyana

The key considerations when deciding on which is the best entity type in Guyana are the following:

Ownership Structure

Determine whether the chosen entity allows full foreign ownership or requires local partners, as this varies by sector in Guyana. Sectors such as defense, agriculture, or mining often have specific restrictions or quotas favoring local involvement. Understanding these limitations will help you align your business structure with local regulations and ensure long-term operational stability.

Tax Efficiency

Analyze the effects of Guyana’s corporate tax rate, from 25-40% depending on various factors, and the VAT, which stands at 14%, on your profitability and cash flow. Proper tax planning is essential to optimize costs while remaining compliant with local regulations.

Compliance

Prepare to meet Guyana’s rigorous compliance requirements. Large companies must adopt International Financial Reporting Standards (IFRS) for financial statements. Annual tax filings are mandatory, and statutory audits are required for entities surpassing revenue or asset thresholds. These obligations may increase administrative efforts and costs but are crucial to maintaining legal standing in the country.

Steps to Incorporate a Company in Guyana

We outline below the 7 steps it takes to form an LLC in Guyana. It is critical for your business’s future success in this region that you follow these steps meticulously.

Step 1 – Choose a name.

Step 2 – Receive a declaration of compliance.

Step 3 – Register your company formation in Guyana.

Step 4 – Apply for a tax identification number (TIN).

Step 5 – Register for a Value Added Tax (VAT).

Step 6 – Register for the Social Security.

Step 7 – Create a company seal.

Are you Interested in the Types of Legal Structures in Guyana?

Whichever of the types of legal structures in Guyana you choose, setting up a business can be a challenge. That-s why its best done with an expert. Ideally, work with a local partner who knows both the country and the region.

Get in contact with Biz Latin Hub – our team of local experts and professionals can support you and your business venture in Guyana with our services ranging from legal and commercial representation to market entry. Feel free to contact us now for personalized information.

FAQs on Types of Legal Structures in Guyana

Yes. Guyana allows 100% foreign ownership.

An LLC is our recommendation.

The steps typically involve choosing a company name, drafting articles of incorporation, obtaining a tax identification number (TIN), registering with the Deeds and Commercial Registries Authority, and paying the necessary registration fees. It will then be necessary to open a corporate bank account in Guyana.

An LLC can be fully foreign-owned by a minimum of two and a maximum of 20 shareholders, with each shareholder’s liability limited to what they have contributed to the company’s share capital. On that note, there is no minimum required capital, making this entity type low-cost to establish. If you set up an LLC, only one director is required to be appointed, and that can be one of the shareholders.

No. You do not need a Guyanan partner or shareholder. However, you do need a legal representative who is either a Guyanan national or a foreigner with the right to reside in the country.

3-4 weeks, if everything is in order.

Businesses in Guyana are subject to corporate income tax, value-added tax (VAT), and other taxes. It’s important to consult with a tax advisor to understand your specific tax obligations and incentives available for certain industries or investments.

No. A branch is taxed as a Guyanan resident company, but the foreign parent assumes legal liability for its actions and debts.

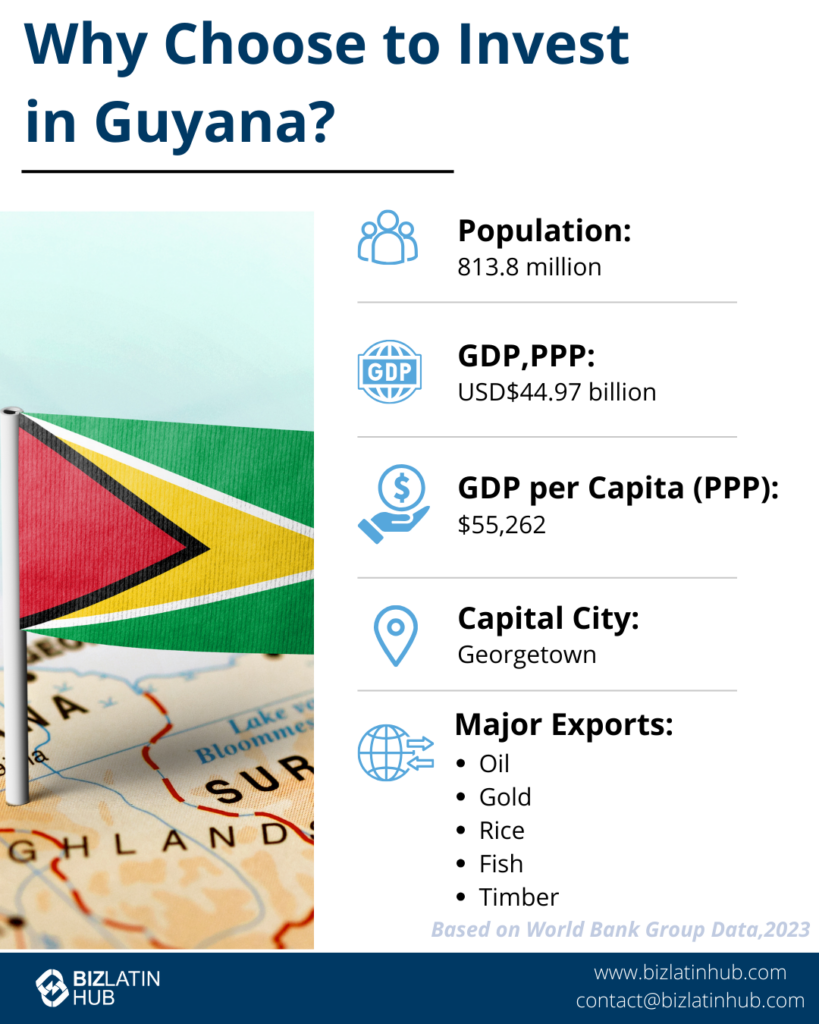

Why Invest in Guyana?

Guyana’s recent discovery of massive offshore oil reserves has made it the fastest-growing economy in the world. This has created a boom that extends far beyond the energy sector, generating demand and opportunities across all areas of the economy. The government actively encourages foreign direct investment to help build the capacity needed to support this growth.

Guyana is considered a Caribbean nation and, along with Belize and Suriname, is one of only three mainland members of the Caribbean Community (Caricom) – an economic association that also includes thirteen island nations as full members and five British Overseas Territories as associate members. Caricom’s headquarters is located in Georgetown, the capital of Guyana.

Guyana’s economy has seen significant growth in recent years. The GDP of Guyana for 2024 is projected to be US$ 21.18 billion, a significant increase from the US$ 5.17 billion in 2019. This represents a growth of over 120% in just four years. In terms of Foreign Direct Investment (FDI), Guyana also saw substantial growth. The FDI for 2021 was $2.24 billion, a considerable increase from the $1.695 billion in 2019.

This growth has been driven largely by the hydrocarbons sector, driven by companies tapping into the business opportunities in Guyana. Moreover, the ongoing development of infrastructure and the expansion of sectors such as tourism and agriculture present a fertile ground for exploring business opportunities in Guyana across various segments of the economy.

These figures highlight the rapid economic development in Guyana, making it an attractive destination for international investors. With a stable socio-political landscape now is the time to tap into the unprecedented growth and find the business opportunities in Guyana that will assist your business strategy.

Caricom has free trade agreements established with the Dominican Republic and Costa Rica, while the Caribbean Basin Trade Partnership Act (CBTPA) – an extension of the 1983 Caribbean Basin Initiative (CBI) – gives Guyana-based companies preferential access to the US market.