Nearshoring in Mexico is rapidly becoming the preferred strategy for U.S. companies rethinking global supply chains, as the country has overtaken China to become America’s largest trading partner. In 2024, Mexico exported USD$505 billion in goods, an almost 7% increase from 2023, underscoring its dominant role regionally, solidifying itself as a strategic hub for nearshoring and U.S.-bound manufacturing. Biz Latin Hub can help you with company formation in Mexico, as well as providing our full suite of back-office services, and our network of dedicated local offices across the region, in order to benefit from this growing market.

Key Takeaways on Nearshoring in Mexico

What makes Mexico a strategic hub for nearshoring? | Its geographic proximity, strong trade agreements like USMCA, and established industrial clusters. |

What industries are nearshoring in Mexico? | The most common nearshoring industries are automotive, aerospace, electronics, technology, medical and consumer goods. |

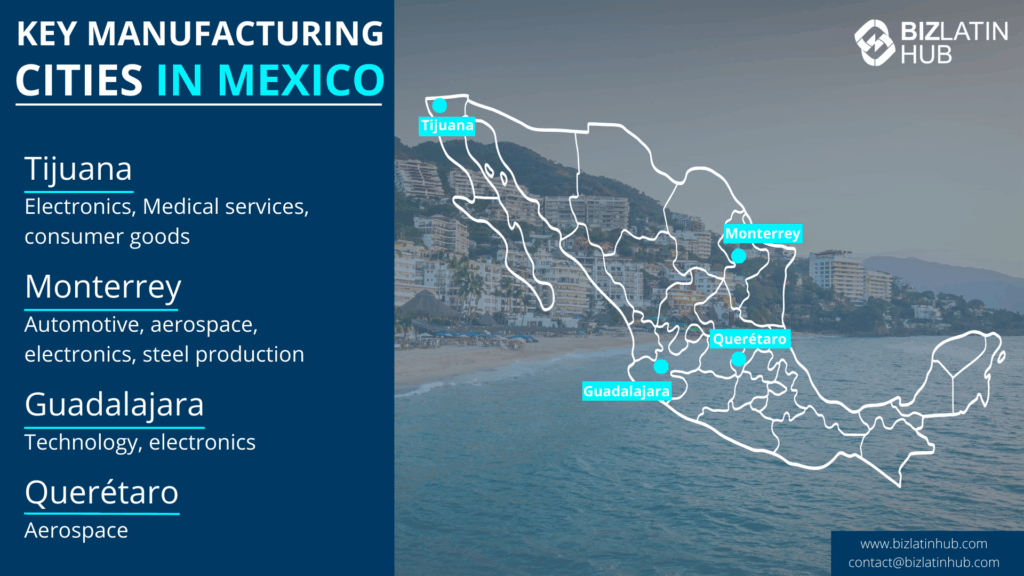

Which industries and cities lead nearshoring in Mexico? | Monterrey (automotive, aerospace, electronics), Querétaro (aerospace), and Tijuana (electronics, medical, consumer goods). |

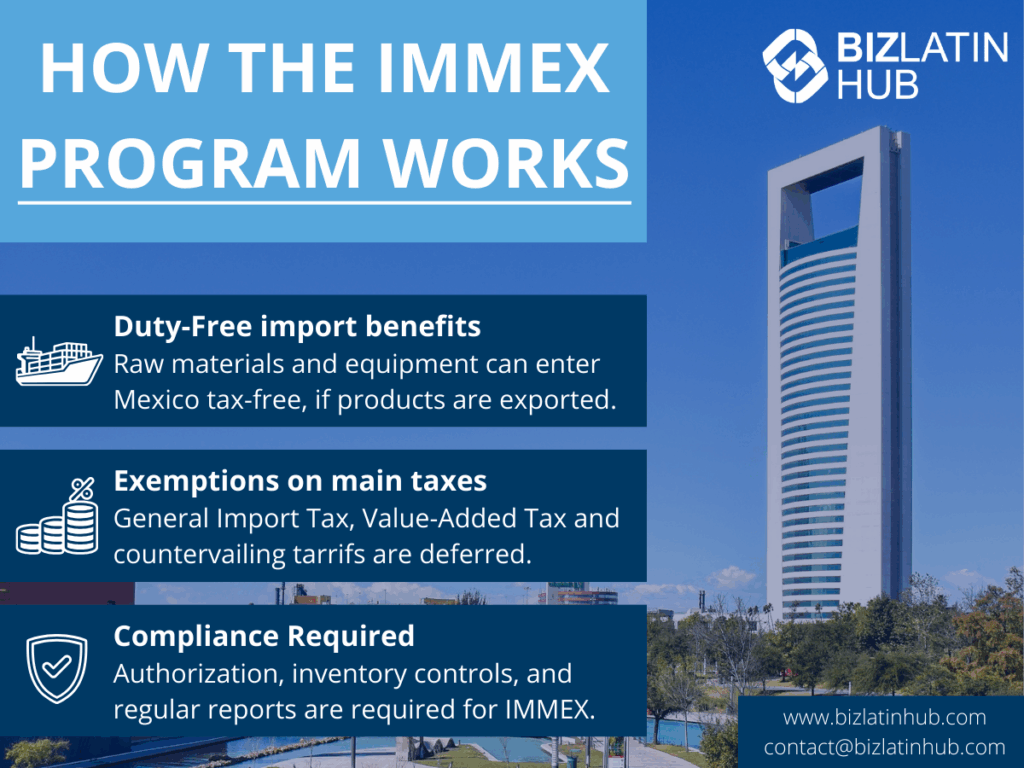

How does the IMMEX program support nearshoring? | IMMEX allows tax-free imports of raw materials for export manufacturing, reducing costs and boosting competitiveness. |

What are the main benefits for U.S. companies nearshoring in Mexico? | Faster shipping, lower costs, aligned time zones, and access to a skilled, youthful workforce. |

Nearshoring to Mexico: A Strategic Advantage for American Firms

Nearshoring is an outsourcing strategy where a country transfers production to a different country located nearby which has a similar time zone. The concept emerged as a response to offshoring challenges, supply chain disruptions, and as a way to reduce costs, for example, choosing Mexico over China or elsewhere in Asia.

Friendshoring is a strategic evolution of nearshoring. It prioritizes outsourcing to countries that are politically and economically aligned, offering greater supply chain reliability over low-cost options.

Mexico exemplifies this model with its close ties to the U.S. in terms of their trade connections. Despite global disruptions and shifting alliances, it maintains a reliable supply chain and benefits from the United States-Mexico-Canada Agreement (USMCA) trade deal.

Since 2019, manufacturing FDI in Mexico has grown by an average of 20% annually, with 40% directed to the automotive sector, a stark contrast to the global average increase of just 7%.

Many Mexican cities act as strategic locations for nearshoring, offering diverse industrial sectors. Monterrey is home to important automotive, aerospace, and electronics industries. Kia is one of the many international companies in the city.

Querétaro has become one of the most important clusters for aerospace in all of Latin America, with educational programs tailored to aerospace manufacturing. In the north, Tijuana hosts several industries from electronics to medical services and even consumer goods. Its proximity to the 2,000 mile US-Mexico border and San Diego also proves advantageous.

There are several benefits of nearshoring in Mexico from the United States:

- Geographical proximity reduces shipping times and costs, while minimizing vulnerability to global supply chain disruptions.

- Streamlined logistics through shorter supply chains enables faster delivery, without waiting for long-distance shipping.

- Time zones alignment supports real-time collaboration and smoother communication compared to offshoring alternatives in Asia.

- Skilled talent pool, with a growing number of graduates in engineering and electronics, and other technical fields.

- Cost-effective operations, offering competitive labor rates and lower overhead costs compared to US-based production.

How IMMEX Makes Nearshoring in Mexico Even More Profitable

In 2006, Mexico established the IMMEX program, an updated version of the Maquiladora program, which allows companies to import raw materials and equipment without paying up-front taxes on the condition that the final products are destined for export. This significantly reduces production costs and enhances competitiveness.

Currently, IMMEX encompasses more than 6,000 export assembly and manufacturing plants, underscoring its scale and importance to Mexico’s industrial base.

The Mexican market is more competitive thanks to the deferral or exemption of:

- General Import tax (locally known as IGI)

- Value-Added tax (VAT)

- Countervailing duties

To benefit from this program, companies need to obtain the required permits and authorization from the Mexican Secretariat of Economy and comply with control and reporting obligations. This includes filing monthly and annual reports on imports and exports as well as implementing inventory control systems.

The IMMEX Program presents many advantages for nearshoring in Mexico:

- Lower production costs through exemptions on import duties, VAT, and countervailing tariffs

- Stronger supply chain resilience, supported by ongoing tax incentives and streamlined import/export processes.

- Regional expansion made easy, with Mexico serving as a strategic launchpad into other manufacturing hubs like Costa Rica and the Dominican Republic.

- Established trade infrastructure, supported by IMMEX and USMCA, positioning Mexico as a reliable friendshoring partner for U.S. businesses.

- Demographic and geopolitical advantage, as Mexico benefits from a younger workforce and rising global interest amid U.S.–China trade tensions.

Labor and Logistics: Mexico’s Competitive Edge

Mexico offers a cost-effective labor force compared to the US and now, boosts efficiencies comparable to China. In the Northern Border Free Zone the wage is MNX$419.88 (USD $22) per day, slightly higher than the rest of Mexico, at MNX$278.80 (USD $15), giving Mexico a clear labor cost advantage.

Nevertheless, choosing Mexico over China isn’t about wages but also time and money on shipping. The country is also home to many graduates and experienced workers in fields such as automotive, aerospace, electronics, and medical services.

Mexico is also a globally integrated economy with over 50 major trading partners that add up to over 50% of the global economy. One of the factors enabling this is the USMCA trade agreement, allowing most goods to enter the US and Canada with minimal duties or tariff-free. With this in place, it offers predictable and stable operation, providing a strategic long-term plan for friendshoring in the region.

Logistics are a crucial factor to consider when outsourcing production, and Mexico presents many attractive incentives. Time-to-market advantage is often critical in the manufacturing and production of goods, and Mexico’s proximity to the US helps cut weeks down to days, instead of shipping from China or Southeast Asia. Unlike the volatility of China-dependent supply chains, Mexico as a closer ally and friendshoring destination, offers greater stability for long-term growth.

With coasts on both the Atlantic and Pacific, as well as almost 50 US-Mexico road crossings, the transportation of goods is streamlined and cost-efficient. This is even more important when considering the rise in shipping and transportation costs, and aids in reducing companies’ carbon footprints. There is also streamlined cross-border collaboration with teams located closer, in similar time zones.

The long-established supply chain between the two neighboring countries with decades of experience also provides security with existing logistics partners and specialized industry clusters in place. With trade deals and IMMEX in place, importation costs are reduced to keep costs down and promote trade. All of these factors make the nearshoring advantage in Mexico evident.

Seizing the Nearshoring Opportunity

The opportunities available for nearshoring in Mexico are bright, extending beyond just one industrial sector and across several cities. The trade agreements and tax benefits offered, thanks to IMMEX, position Mexico as the option for friendshoring from the US. With several benefits to nearshoring (in Mexico) and moving away from outsourcing to countries located further away, it is the perfect moment to seize the possibilities in Mexico.

Frequently Asked Questions about Nearshoring in Mexico

Nearshoring in Mexico refers to U.S. companies relocating production or supply chain operations to Mexico, a nearby country with aligned time zones. This strategy reduces costs, shortens shipping times, and improves collaboration compared to offshoring to distant regions like Asia.

Mexico has overtaken China as the U.S.’s largest trading partner, exporting over USD$505 billion in goods in 2024. Its proximity, skilled workforce, strong industrial clusters, and trade agreements such as USMCA make it a reliable and cost-effective hub for U.S.-bound manufacturing.

IMMEX is a Mexican government program that allows companies to import raw materials and equipment tax-free, provided the final products are exported. It reduces production costs, strengthens supply chain resilience, and supports regional expansion.

Monterrey leads in automotive, aerospace, and electronics; Querétaro is a major aerospace cluster; and Tijuana excels in electronics, medical services, and consumer goods, with the added advantage of being close to the U.S. border.

Mexico offers affordable labor, a young skilled workforce, and faster shipping thanks to its proximity and extensive transport links.

Biz Latin Hub can assist with Nearshoring in Mexico

Ready to explore nearshoring in Mexico? Contact Biz Latin Hub to unlock your expansion strategy across Latin America. We provide a range of market entry and back-office services that can support your commercial success in Mexico.

With our full suite of back-office solutions, including legal, accounting, and recruitment services, we can be your single point of contact to help you enter and operate in any of the countries around Latin America and the Caribbean where we operate.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Contact us today to learn more about how we can assist you in doing business in Latin America and the Caribbean.