The Bahamas, an archipelago off the Atlantic coast of the United States, offers a highly attractive environment for investors and companies. It combines favorable tax laws, a well‑developed financial services sector, strategic location, and political stability. Below are some of the main benefits of doing business in The Bahamas. If you are interested in company formation in the Bahamas, this guide will set you straight.

Key takeaways on opportunities in the Bahamas

| Is foreign ownership allowed in the Bahamas? | Yes, up to 100% ownership by foreign investors is permitted, although you will need a resident representative. |

| Company types that offer limited liability | Both the LLC and IBC offer liability limited to capital. |

| What international links does the country have? | The Bahamas is part of the U.S.-Caribbean Basin partnership (CBTPA), Canada’s CARIBCAN program, and the European Union’s Lome IV Agreement. |

| What is the business culture in the Bahamas? | Largely similar to North America and Europe, with limited cultural differences. |

Overview of opportunities in the Bahamas

The Bahamas offers a compelling proposition for businesses: essentially tax‑neutral environments, duty or import reliefs, free trade zones, proximity to the U.S., a mature financial services sector, and political stability. For sectors such as tourism & hospitality, financial services, trade & logistics, real estate, and corporate / asset management, the Bahamas can be an especially attractive base.

1. Strategic Location & Market Access

- Proximity to the U.S. & major markets: The Bahamas is very close to the U.S. mainland (especially Florida), making it a natural hub for trade, logistics, shipping and services targeting North America.

- Tourism gateway: As a major global destination for tourism, the Bahamas gives businesses in hospitality, leisure, travel services, and real estate excellent opportunities.

2. Business‑Friendly Regulatory & Tax Environment

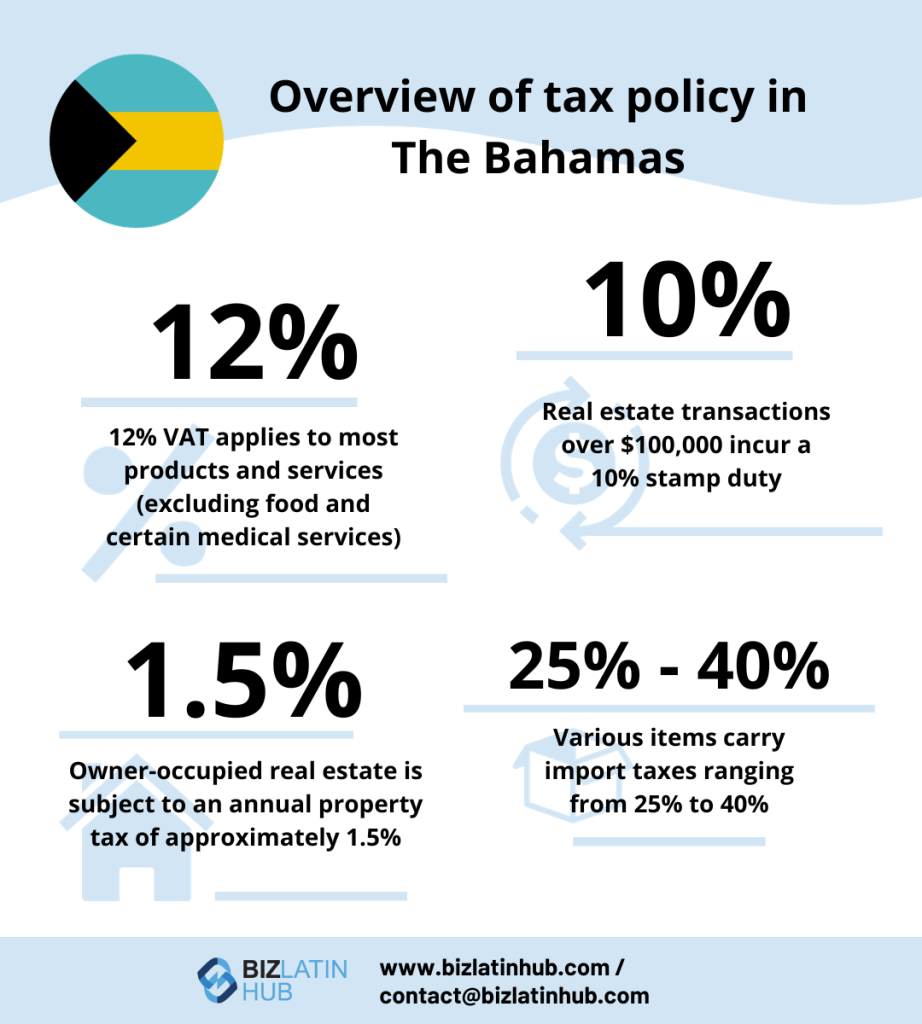

- Tax neutrality: One of the Bahamas’ biggest draws is that it does not impose corporate income tax, personal income tax, capital gains tax, or inheritance tax.

- Low sales/consumption tax: The country has a Value‑Added Tax (VAT) rate of 7.5%, which is relatively low compared to many other jurisdictions.

- Import duty / customs exemptions and incentives: There are incentives for industrial inputs, machinery, etc., particularly for businesses that bring in equipment for transformation or export‑oriented operations.

3. Developed Financial Services Sector & Asset Protection

- Strong financial & banking services: The Bahamas is well known for being a respected international financial centre. It has a mature industry in banking, trust & fiduciary services, wealth management, etc.

- Confidentiality & corporate structuring: Laws and practices allow for privacy in certain corporate structures, including international business companies (IBCs), use of nominee shareholders/directors, etc., subject to compliance with international standards.

- No requirement of large minimum share capital in many cases: This makes it easier for smaller investors to set up operations.

4. Skilled Workforce & Quality of Life

- Skilled / educated labour force: The Bahamas has trained professionals in fields relevant to financial services, tourism, hospitality, maritime services, etc.

- Quality infrastructure in key areas: Especially in major islands like New Providence (Nassau) and Grand Bahama (Freeport), there is good connectivity by air and sea, modern telecommunications, and tourist infrastructure.

5. Political Stability & Governance

- Stable democratic system: The Bahamas is a parliamentary democracy, independent since 1973, with well‑established institutions.

- Regulatory alignment / compliance: The government has taken steps to address international standards around AML/CFT (anti‑money laundering and counter terrorist financing). This enhances its credibility as a financial centre.

6. Supportive Incentives & Free Trade Zones

- Freeport & Free Trade / Duty‑Free Zones: Areas like Freeport in Grand Bahama offer tax and duty exemptions, which can significantly lower operational costs for manufacturing, warehousing, logistics, and import/export businesses.

- Customs / equipment duty relief for industrial inputs: Companies that import machinery or raw materials for production or export are often eligible for relief from import duties.

Potential Challenges & Considerations

As with any jurisdiction, there are risks and areas that need careful management:

- High cost of living and operational costs: Many goods, materials, and energy are imported, which drives up costs—both for business inputs and for living expenses.

- Crime and security concerns: While the political system is stable, the Bahamas does face challenges with crime rates, especially in certain urban areas. Businesses may need to factor in increased costs for security, insurance, and risk mitigation.

- Regulatory compliance burden in financial services: Because of its status as a financial centre, the Bahamas is under strong international pressure (and regulation) to ensure transparency, AML/CFT compliance, etc. That means higher compliance costs and due diligence.

- Infrastructure & geographic dispersion issues: Because it’s an archipelago, logistics between islands, transport, and delivery of services to remote areas can be more complex. Natural hazard risks (hurricanes, storms) also pose real threats.

Frequently Asked Questions (FAQs) on Opportunities in The Bahamas

There is no corporate income tax in The Bahamas. Businesses operating there are not subject to tax on profits.

No. The Bahamas does not impose a personal income tax on individuals. Employees and residents generally do not pay tax on personal income.

Yes. The Bahamas has a consumption tax, commonly referred to as Value‑Added Tax (VAT), set at about 7.5% for most goods and services.

Yes. Foreign (and domestic) businesses may benefit from:

Duty exemptions or import duty reliefs for machinery, industrial inputs, equipment, etc.

Free Trade Zones (like Freeport) which provide tax / duty advantages.

Incentives for export‑oriented businesses or those transforming imports for re‑export.

Generally, yes. The Bahamas has a long history of democratic governance, stable political institutions, and is widely recognized internationally. However, there are considerations around security (especially certain local crime issues), and operating costs (including compliance, import duties, logistics between islands) that investors should assess carefully.

Biz Latin Hub can help you with opportunities in the Bahamas

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.