Explore your options to get an entity health check in Colombia, also known as corporate due diligence in Colombia, for your own business or an existing company you may be planning to acquire. An entity health check or legal due diligence after or before company formation in Colombia performed by local professionals allows you to identify compliance gaps, mitigate risks, and concentrate on growing your business with confidence. This guide explains why a proactive compliance audit is a crucial part of good corporate governance and details the primary areas of review for any company in Colombia.

Key Takeaways: Entity Health Check in Colombia

| Aspect | Details |

|---|---|

| What is a corporate entity health check? | An entity health check is a detailed diagnostic of a company’s statutory records and filings. |

| Which authorities will a health check look at? | It verifies compliance with the DIAN, the Chamber of Commerce, and other superintendencies. |

| What are the key areas reviewed for a Colombian company? | Legal and fiscal compliance, although AML, labor registration and so on are also common. |

| Will a health check look at annual registrations? | A health check ensures the annual renewal of the commercial registration. |

| Why is a health check vital before any major corporate transaction? | It is part of due diligence for acquisitions and also allows you to resolve problems before the authorities get involved. |

The Importance of a Corporate Health Check in Colombia

An entity health check is a comprehensive review of a company’s statutory records and obligations. It is designed to proactively identify any compliance deficiencies—such as an unrenewed commercial registration or missed social security payments—and provide a clear plan for remediation.

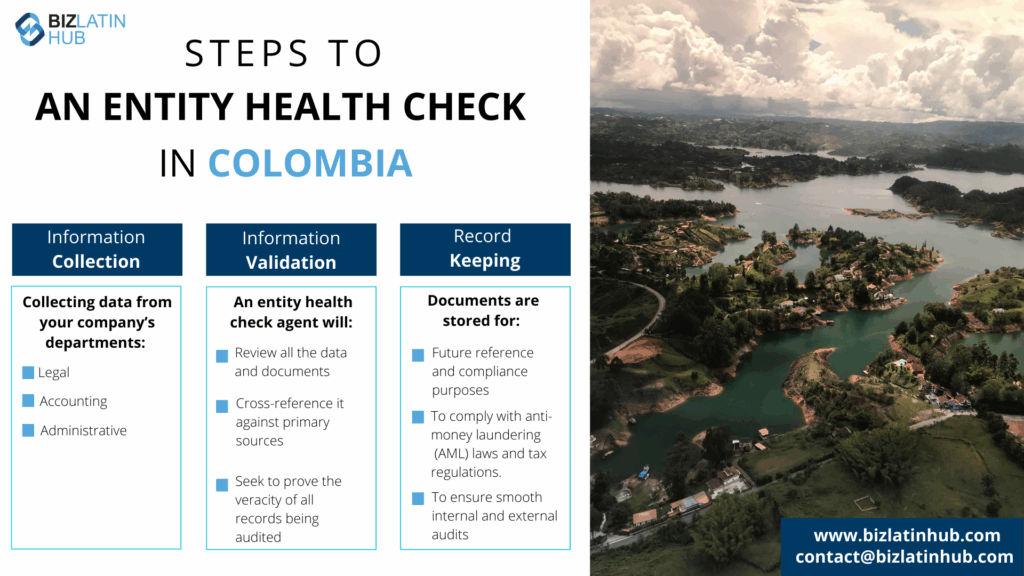

Entity health checks, also called corporate due diligence reports, are reviews carried out by financial and legal auditors. Employing an external provider that is specialized in entity health check provides commercial reassurance.

Prospective business owners may authorize the provider to examine the legal, financial and accounting records of a company.

The reason for checking the legal and fiscal states of an organization is to identify whether there are any non-compliance problems that the investors should take into account before buying an existing company. In a minefield of legal and accountancy regulations, it is simple for organizations to oversee or simply ignore compliance regulations.

Main Areas of a Colombian Entity Health Check

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Expert Tip: The Annual Renewal of the Commercial Registration

From our experience, the most fundamental compliance point in Colombia is the annual renewal of the Commercial Registration (Matrícula Mercantil) with the local Chamber of Commerce. This must be done by March 31st of every year.

Failure to renew on time results in financial penalties and, more importantly, can signal to the authorities that the company is inactive, potentially leading to audits or other investigations. Verifying that the commercial registration has been renewed every year without fail is the first and most essential step of any health check in Colombia.

1. Corporate Compliance with the Chamber of Commerce

This audit verifies that the annual commercial registration has been renewed, that the company’s official books (meeting minutes, shareholder register) are up-to-date, and that all corporate information is correct.

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in Colombia.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

2. Tax Compliance with the DIAN

This involves a comprehensive review of all monthly and annual tax filings (income tax, VAT, withholding tax) to confirm they were submitted correctly and on time.

3. Labor and Social Security Compliance

This review checks that the company is correctly making all monthly contributions for its employees to the health (EPS), pension (AFP), and professional risk (ARL) systems, as well as the parafiscal contributions.

4. Foreign Exchange and Investment Compliance

For companies with foreign capital, this check verifies that the investment has been correctly registered with the Central Bank and that all foreign exchange procedures are being followed.

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

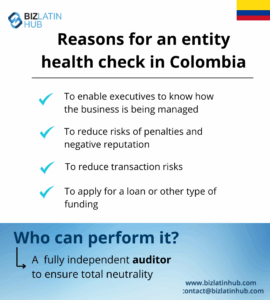

Why Conduct Due Diligence in Colombia?

Entity health checks done by experts save you time because local external auditors are able to obtain information quickly. When buying an existing company, health checks in Colombia will make it possible to verify that the selling party has the legal title to sell ownership of all assets and that regulatory and litigation matters are fully covered.

For Existing Operations:

- Identify and correct DIAN compliance issues before audits

- Ensure proper SAGRILAFT (Anti-Money Laundering) implementation

- Verify all Colombian labor law requirements are met

- Confirm accurate RUT classifications and activities

- Validate proper invoice management (facturación electrónica)

For Acquisitions:

- Uncover hidden tax liabilities with Colombian authorities

- Verify the legitimacy of commercial registers

- Confirm intellectual property registrations with SIC

- Assess pending litigation in Colombian courts

- Evaluate compliance with sector-specific regulations

Colombia-Specific Risk Factors

Colombia’s regulatory environment presents unique challenges:

- Frequent tax reform changes (most recently in 2022-2024)

- Strict foreign exchange controls

- Complex labor regulations including apprenticeship quotas

- Industry-specific requirements (especially for mining, oil & gas, and financial services)

- Regional variations in local tax obligations

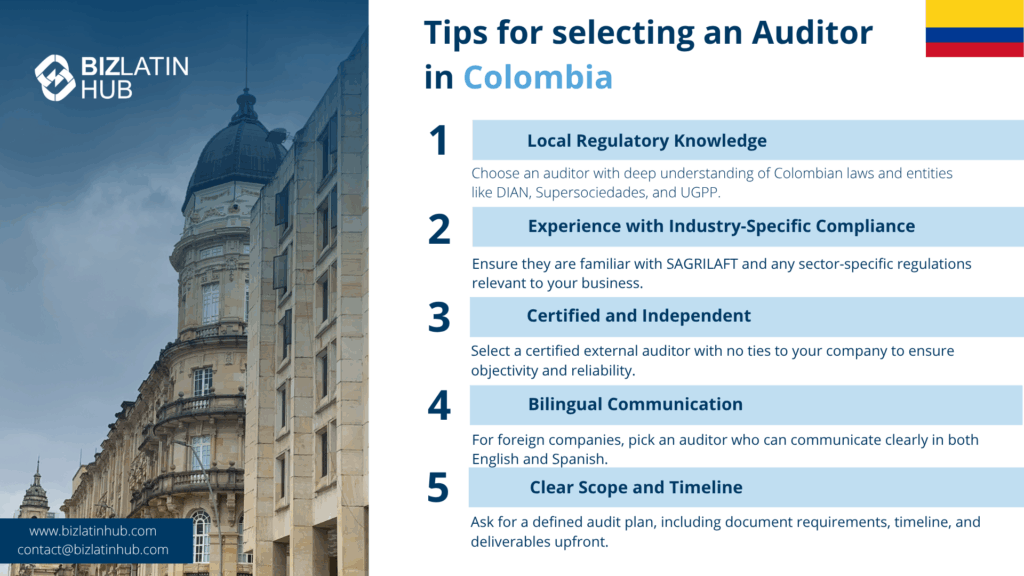

Engage with trusted local auditors

To get the assurance you need from your entity health check in Colombia, contact an external services provider with a trusted background and depth of knowledge of Colombian regulations.

Local expertise can guarantee greater familiarity with Colombian corporate and other regulations. Experienced entity check auditors can provide a comprehensive review for foreign multinational companies operating in Colombia.

As a foreign multinational company, you may also seek a bilingual services provider who can manage language barriers between yourselves and local authorities.

Colombia-Specific Compliance Requirements

Critical Colombian Regulatory Bodies

DIAN (Dirección de Impuestos y Aduanas Nacionales)

- Tax registration and RUT updates

- Electronic invoicing compliance

- VAT (IVA) and income tax obligations

- Customs documentation (for importers/exporters)

- Information reporting (medios magnéticos)

Supersociedades (Superintendencia de Sociedades)

- Annual financial statement filing

- Corporate governance reports

- Insolvency law compliance

- Related-party transaction disclosures

- Business group reporting

UGPP (Unidad de Gestión Pensional y Parafiscales)

- Social security payment accuracy

- Parafiscal contribution compliance

- Independent contractor vs. employee classification

- Pension fund reporting

Industry-Specific Requirements

Mining & Energy Sector:

- ANM (Agencia Nacional de Minería) registrations

- Environmental licenses from ANLA

- Royalty payment verification

- Community consultation documentation

Financial Services:

- Superfinanciera reporting

- SARLAFT implementation (stricter than SAGRILAFT)

- Capital adequacy compliance

- Consumer protection protocols

Healthcare & Pharmaceuticals:

- INVIMA registrations

- Supersalud compliance

- Price control adherence

- Clinical trial authorizations

FAQs on an entity health check in Colombia

How often should I conduct a Colombia compliance check?

Compliance checks in Colombia should be conducted annually for established businesses, quarterly in the first year, and whenever major transactions, regulatory changes, or DIAN audit notifications occur.

What documents are required for legal due diligence in Colombia?

Key documents include a valid Certificado de Existencia, updated RUT, three years of tax returns (Renta, IVA, ICA), financial statements, shareholder registry, board minutes, payroll records, SAGRILAFT documentation, commercial contracts over COP 100 million, and banking certificates.

What is the DIAN?

The DIAN (Dirección de Impuestos y Aduanas Nacionales) is the National Directorate of Taxes and Customs, Colombia’s main tax authority. A health check ensures all filings for income tax and VAT are current.

What is the Chamber of Commerce?

The Chamber of Commerce (Cámara de Comercio) in each city is where companies are registered. Businesses must renew their registration annually and file key corporate documents, such as the appointment of legal representatives.

What is the UGPP?

The UGPP (Unidad de Gestión Pensional y Parafiscales) is a special government unit that audits companies to ensure they are making correct social security and parafiscal contributions for their employees. A health check helps prepare a company for a potential UGPP audit.

What are parafiscal contributions?

In addition to standard social security, Colombian employers must pay “parafiscal” contributions to three entities: the Colombian Institute of Family Welfare (ICBF), the National Apprenticeship Service (SENA), and a Family Compensation Fund (Caja de Compensación Familiar). A health check verifies these payments are correct.

What’s unique about Colombia compliance checks vs. other Latin American countries?

Colombia has unique compliance features, including SAGRILAFT obligations, strict electronic invoicing mandates, formal labor law requirements, complex local tax structures, robust foreign exchange controls, and extensive reporting through medios magnéticos.

Biz Latin Hub can do your entity health check in Colombia

Biz Latin Hub specializes in a full range of business solutions for foreign companies in Colombia and the wider Latin American region. Our team of accounting and legal experts in Colombia are have comprehensive experience in conducting regular entity health checks for companies unfamiliar with local compliance legislation.

Partner now with Biz Latin Hub’s legal and accounting specialists in Colombia to ensure your company can be fully compliant with the Colombian regulations.

Contact us today for a consultation.

Learn more about our team and expert authors.