For companies operating in, or considering company formation in El Salvador, undertaking a proactive Entity Health Check is crucial to maintaining compliance with local laws and safeguarding against regulatory, operational, and reputational risks. A comprehensive health check provides confidence that your business remains in good standing amid evolving legal and fiscal requirements.

Key takeaways on an entity health check in El Salvador

| What is an entity health check? | A systematic evaluation of your company’s compliance with legal, fiscal, and statutory obligations in El Salvador. |

| Which authorities and requirements are verified? | These include the Registry of Commerce, the Ministry of Finance, the Tax Service Department, and institutions overseeing audit, accounting, and AML/CFT obligations. |

| What are the main areas reviewed? | Corporate records, annual meeting documentation, financial statements, external auditor appointments, tax filings (income tax, VAT, tax advances), AML/CFT compliance mechanisms, and reporting of beneficial ownership if required. |

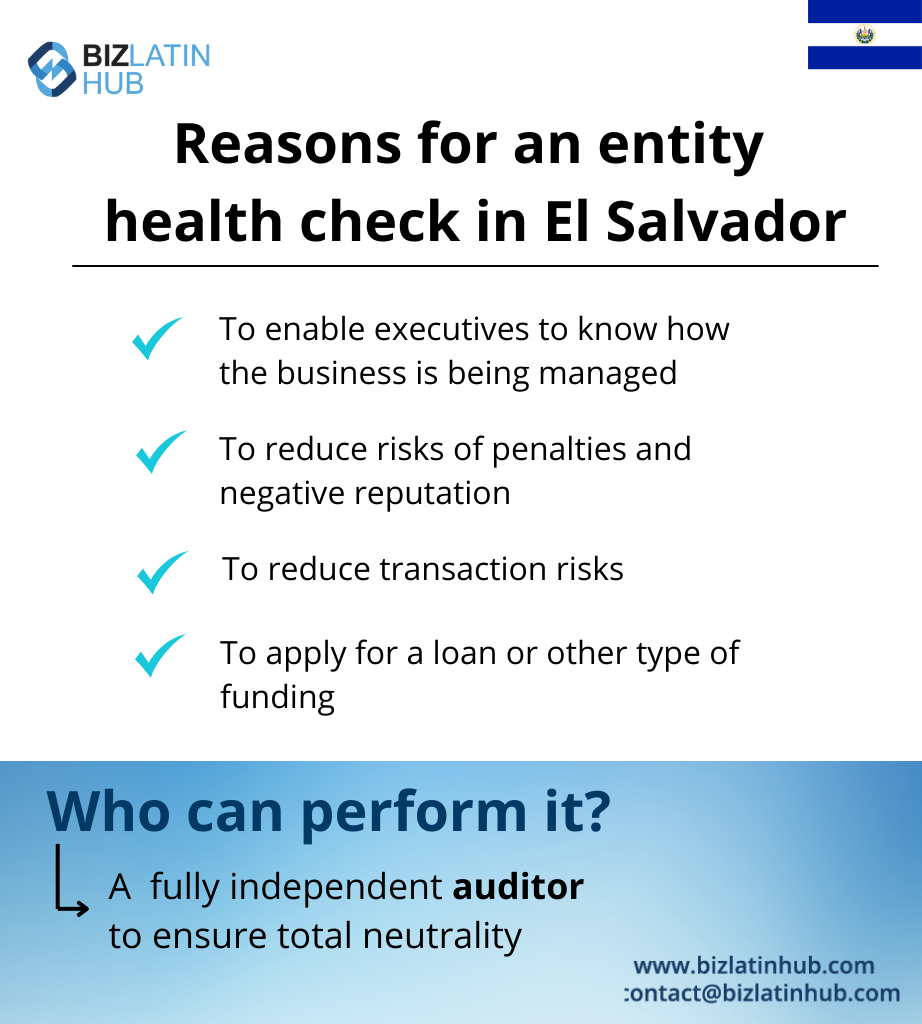

| Why is a health check important? | Early detection and remediation of irregularities—such as missed filings, untimely tax payments, audit gaps, or deficient AML controls—reduce exposure to fines, regulatory action, or reputational damage. |

The Importance of a Corporate Health Check in El Salvador

An Entity Health Check for a Salvadoran company is a structured audit of your statutory, financial, and governance records. It helps identify risks like:

- Missed annual shareholders’ meetings or failure to record them and file approved financial statements.

- Non-renewal of commercial registration or failure to deposit annual financial statements with the Registry of Commerce.

- Missing external auditor appointments or deficiencies in accounting records (e.g., books not properly legalized).

- Tax non-compliance such as late income tax returns (due by April 30), VAT filings, or employer advance taxes.

- Incomplete AML/CFT frameworks, including absence of a compliance officer or failure to monitor/report unusual transactions — a particular concern amid El Salvador’s Bitcoin integration.

These checks are especially relevant where management may be unfamiliar with dynamic regulatory shifts or sector-specific obligations.

Main Areas of an El Salvadoran Entity Health Check

1. Corporate & Statutory Records

- Confirm valid company registration and the annual renewal of registration (on the anniversary month) with fines assessed if overdue.

- Ensure the annual General Shareholders’ Meeting occurs within the first five months of the fiscal year, with minutes, reports, and appointments (external auditor, tax auditor) properly documented and shared with the Commercial Registry and Ministry of Finance.

- Validate deposition of audited financial statements into the Commercial Registry, securing effectiveness against third parties.

2. Tax & Accounting Compliance

- Verify timely filing of annual Corporate Income Tax returns by April 30; ensure monthly tax advances (1.75% of gross revenue) and monthly VAT (13%) returns are submitted and paid as required.

- Confirm compliance with potential municipal taxes and employer contributions to social security (ISSS) and pension schemes (AFP) for employees.

- Audit the accuracy and retention of accounting records and ledgers (e.g., general, sales, purchase books), legalized and maintained locally in Spanish and U.S. dollars.

3. AML/CFT Compliance & Beneficial Ownership

- Verify appointment of an AML Compliance Officer, implementation of internal controls, client due diligence, and submission of Suspicious Transaction Reports to the Financial Investigation Unit (UIF).

- Assess readiness related to Bitcoin and virtual assets, given regulatory complexity after El Salvador’s adoption of Bitcoin as legal tender and pending mutual evaluations.

4. Ongoing Monitoring & Sector‑Specific Oversight

- If operating in regulated sectors (e.g., financial institutions, tech startups with tax incentives), ensure proper licensing, compliance with sector rules, and updates with relevant authorities.

When should I get an Entity Health Check for my company?

Consider conducting a health check:

- Ahead of M&A, restructuring, or investor engagement, to address potential liabilities.

- Before deadlines like April 30 (tax returns) or May (shareholder meeting and statement deposit).

- After incorporating Bitcoin or virtual assets in operations, given evolving AML/CFT requirements.

- Proactively as part of annual governance planning, to avoid administrative lapses or financial penalties.

Corporate Compliance in El Salvador

This encompasses:

- Corporate governance: Entities must hold and document annual meetings, properly maintain minute books, share registrar, and accounting ledgers.

- Fiscal discipline: Timely tax returns, VAT, payroll deductions, and accounting record-keeping.

- AML/CFT readiness: Internal policies, reporting channels, and compliance structures aligned with UIF obligations.

- Sector-specific rules: For regulated industries or innovative areas like virtual assets.

Legal Compliance Requirements

- Up-to-date company registry and renewal via the Registry of Commerce.

- Documented shareholder meetings, appointment of external auditors, and deposit of financial statements.

- Proper maintenance of legalized accounting books and adherence to accounting frameworks and formats (Spanish language, USD).

Fiscal Compliance Requirements

- Filing Corporate Income Tax returns by April 30.

- Ensuring monthly VAT and tax advance (1.75%) compliance.

- Submission of tax-related documentation—including audit certificates for large entities (> assets thresholds).

- Keeping employee payroll contributions current, with proper records maintained.

Frequently Asked Questions: Entity Health Check in El Salvador

To identify and rectify late filings, audit gaps, tax exposures, or AML deficiencies before they result in legal or financial penalties.

To reinforce trust with investors, lenders, or partners by demonstrating robust compliance frameworks.

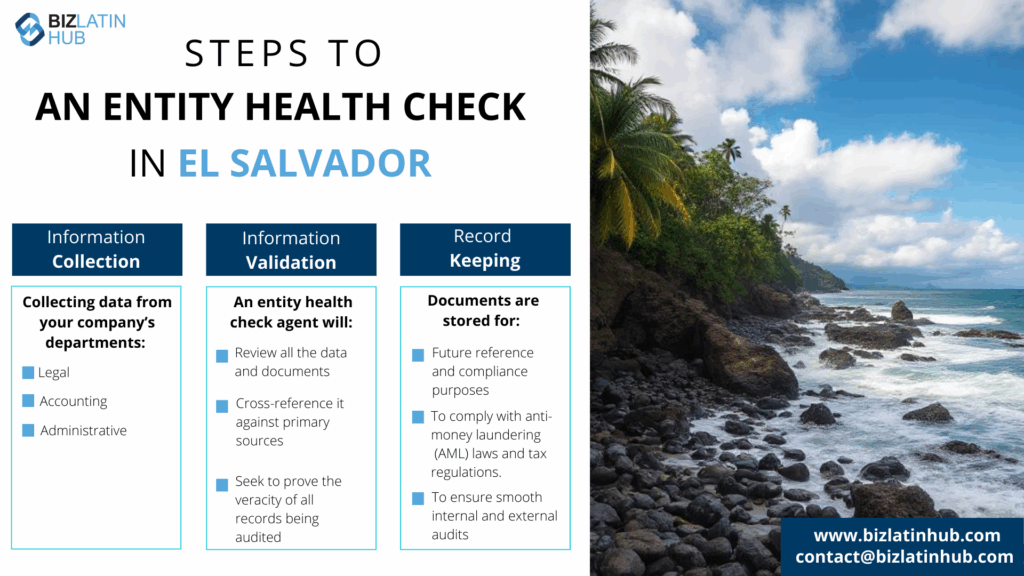

Information collection: Assemble corporate, financial, tax, audit, and AML documentation.

Validation: Check records against authorities—Commercial Registry, Ministry of Finance, UIF, and sector regulators.

Documentation: Consolidate findings and remedial actions into an audit trail for future review.

Examination of incorporation status, licensing, financial filings, auditor appointments, AML/CFT measures, and beneficial ownership documentation.

Qualified local professionals—such as legal firms, certified public accountants/auditors, compliance specialists, or corporate service providers experienced in Salvadoran regulatory requirements.

Biz Latin Hub can help you with an entity health check in El Salvador

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.