What to expect: If you wish to withdraw your consent and stop hearing from us, simply click the unsubscribe link at the bottom of every email we send or contact us at social@bizlatinhub.com. We value and respect your personal data and privacy. To view our privacy policy, please visit our website. By submitting this form, you agree that we may process your information in accordance with these terms.

Company Formation in El Salvador: Incorporation Guide for Foreign Investors

Deciding to incorporate a company in El Salvador presents significant opportunities for foreign investors, thanks to its steady economic growth, investment incentives, and a strategic location in Central America. To successfully incorporate a company in El Salvador, it is essential to adhere to local corporate laws. This will involve providing documentation to the Centro Nacional de Registros and opening a bank account, among other things.

For ongoing compliance, you will need to register with the Ministerio de Hacienda, who manage taxation after company formation in El Salvador. Biz Latin Hub provides tailored support and comprehensive back-office services to guide you through the process of starting a business in El Salvador, setting your company up for success in this emerging market.

Key Takeaways On How To Incorporate a Company in El Salvador

| Is Foreign Ownership Permitted? | 100% foreign-ownership is possible by either legal persons (legal entities) or natural persons (individuals). |

| Steps to Incorporate a Company in El Salvador: | Step 1 – Obtain local tax ID numbers for shareholders. Step 2 – Create and sign the company bylaws. Step 3 – Pay 5% of the share capital. Step 4 – Register the company bylaws, initial balance and obtain the license of commerce. Step 5 – Obtain a local company tax ID number (NRC – Número de Registro de Contribuyente). Step 6 – Open a corporate bank account. Step 7 – Deposit of the required minimum capital to activate the corporate bank account. Step 8 – Register the company with all relevant government authorities |

| What Are The Most Common Entity Types to Incorporate a Company in El Salvador? | The Limited Liability Company (Ltda.). The Public Limited Company (S.A de C.V). The Branch Office Company (Sucursal). |

| Why Set-up an LLC in El Salvador? | Positioned as a gateway to Central and North America with excellent trade access. |

Step-by-Step Guide to Incorporate a Company in El Salvador

In this detailed overview, we’ve laid out the main steps on how to incorporate a business in El Salvador and explained what foreign or local investors need to do. Our goal is to give a clear understanding of how to set up a business and what requirements investors must fulfill, making it easier for them to start their venture confidently:

- Step 1 – Obtain local tax ID numbers for shareholders.

- Step 2 – Create and sign the company bylaws.

- Step 3 – Pay 5% of the share capital.

- Step 4 – Register the company bylaws, initial balance and obtain the license of commerce.

- Step 5 – Obtain a local company tax ID number (NRC – Número de Registro de Contribuyente).

- Step 6 – Open a corporate bank account.

- Step 7 – Deposit of the required minimum capital to activate the corporate bank account.

- Step 8 – Register the company with all relevant government authorities

Company Types Available for Foreign Investors in El Salvador

Companies in El Salvador can adopt different legal structures based on their specific business requirements. Typically, a legal entity in El Salvador is established under one of three main types. Below is a detailed overview of the main types of companies in El Salvador:

- The Limited Liability Company (Ltda.).

- The Public Limited Company (S.A de C.V).

- The Branch Office Company (Sucursal).

1. Limited Liability Company (Ltda.)

The Sociedad Anónima de Capital Variable (S.A. de C.V.), is a limited liability corporation with variable shares and a minimum requirement of two shareholders. It is the most widely used legal entity among foreign and local investors looking to incorporate a company in El Salvador. One great advantage of this legal entity type is that the shareholders can indicate several business activities, even if only a small number of those are ultimately executed.

The main distinguishing feature of this company structure is that capital investment is not based on stocks, but rather is an established process of social participation. In this system, partners replace shareholders. The administration can only be established by the management, who chooses the partners and manager/s who will serve as legal representatives of the company. In cases where partners do not select a manager or his legal function has expired, partners can assume the role of Legal Representative for the company.

This company structure is most commonly employed by private companies, and in circumstances where partners and a third party want to participate in the company formation. Once the partners have agreed on the aforementioned selection process, the denomination or name of the company must include the words Sociedad de Responsabilidad Limitada for registration purposes.

2. Public Limited Company (S.A de C.V).

This is the most common type of company found in El Salvador. This structure does include shareholders and corporate capital is based on stocks. The legal representation of this company structure is done by a Board of Directors or through Unique Administration. Similarly to the Ltda. structure, there are naming rights that must be fulfilled. All companies in this category must include the words Sociedad Anónima in their titles.

The main benefit of having a company based on stocks is that shareholders can endorse them independently to other shareholders. This type of company also does not hold a limit to the number of shareholders that can participate at an administrative level.

3. Branch (Sucursal)

The Branch Office model is the least common structure seen in El Salvador, as a result of a much longer/complicated incorporation process, which requires registration at the Ministry of Economy, as well as the following documents and/or information:

- A minimum capital investment of USD$12,000

- The necessary documents that prove the company is properly and legally incorporated in its country of origin

- The presentation of initial financial statements from the branch office

- A functioning corporate bank account

- Finally, the branch must contain the name of the head office, with the additional words Sucursal El Salvador (El Salvador Branch)

The aforementioned steps must be followed before a company can present itself to the Commerce of Registry in El Salvador and incorporate it into the country. The legal representation of such a company can be done in one of two ways:

- The Board of Directors that directly manage the El Salvador branch can legally represent the company, or:

- Via the appointment of a legal representative and establishing a Power of Attorney (POA)

Differences between an S.A and S.R.L

| S.A. DE C.V. | SRL | |

|---|---|---|

| Share Capital | Consists of shares | Represented by cuotas |

| Transfer of Shares | Easier to transfer shares | More difficult to transfer cuotas |

| Minimum Partners/Shareholders | Minimum of 2 shareholders | At least 2 partners |

| Administration | Directors or Sole Administrators (appointed by shareholders) | Can have partners or external managers |

| Capital | Investors receive shares usually in exchange for cash | Constituted by partner contributions (cash, assets, or services) determining ownership interest |

Legal Requirements to Register a Business in El Salvador

If you have decided to incorporate a company in El Salvador, you will need to provide possible company names and a list of business activities you plan to undertake.

- Company Shareholders.

- Company Share Capital.

- Company Local Director / Legal Representative.

In addition, the following main points must be taken into consideration.

Company Shareholders

A shareholder is a natural or legal person (i.e. an individual or a company) that owns part of the company corresponding to the share contribution the person has made. Shareholder regulations in Central America differ by country, so it is a good idea to become well-acquainted with regulations specific to El Salvador.

Since the shareholder’s liability is limited to their share contribution, this contribution may be significant. In El Salvador, corporate law denotes requires an S.A. de C.V. to have two or more shareholders.

Local banks will request additional documentation if the company shareholder is a legal person (i.e. a company) when you attempt to set up a bank account at a later step in the incorporation process.

Company Share Capital

To incorporate a company in El Salvador, investors need a minimum of USD$2,000 share capital.

The share capital contribution is the company’s starting capital. It also becomes important when requesting highly-graded bank loans or entering a joint venture. If desired, the share capital may be increased or decreased at any point during or after the incorporation process, but the amount should reflect the company’s size and business operations.

5% of the share capital must be paid at the moment of company formation and the remaining 95% must be paid within the first year of the company’s start of operations. Please note that depending on the type of business activities, local authorities may require additional registration.

Company Local Director / Legal Representative

The local director/legal representative represents the company and its operations. They play an important role in ensuring that the company operates by with local laws and regulations. Once the legal representative certificate has expired, it can be renewed for another 7 years. A legal substitute for the local director must also be appointed.

Fiscal / Legal Address

All legal entities incorporating a company in El Salvador require a fiscal address and the address must be recorded by the Salvadoran tax authority (Ministerio de Hacienda). In turn, the newly established company receives its unique taxpayer number (NRC), which acts as general identification and will be used for all tax purposes and other official communication.

Corporate Bank Account

One of the last steps to finish incorporating a company in El Salvador is opening a corporate bank account with a Salvadoran bank. Depending on the local bank chosen, the minimum required capital may be between USD$100-USD$500.

DON’T FORGET: All newly opened bank accounts have restrictions on sending and receiving money internationally for the first 3 to 6 months.

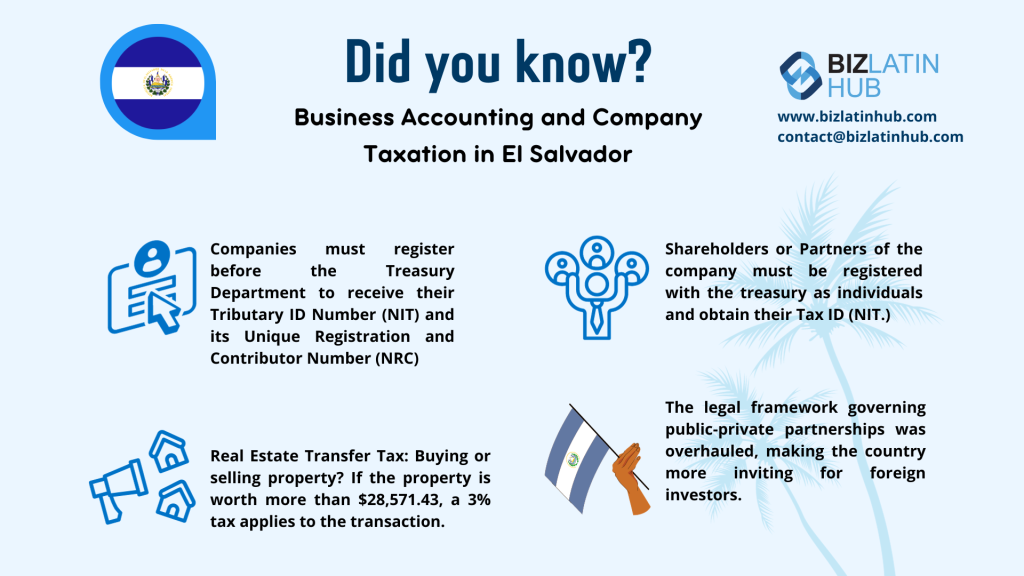

Tax obligations after company formation in El Salvador

Businesses in El Salvador are taxed primarily through corporate income tax and Value Added Tax (VAT). The corporate income tax is levied on their taxable income, which is determined by subtracting allowable deductions from total revenue. The current corporate tax rate is 30%.

– Value Added Tax (VAT) on goods and services sales is currently 13%. Businesses are required to collect VAT from their customers and remit it to the government. Input VAT (VAT paid on business expenses) can be credited against output VAT (VAT collected from customers).

– Income Tax Withholdings: Businesses are also responsible for withholding income tax on certain payments, such as salaries, professional fees, and payments to foreign entities. These withheld amounts must be remitted to the tax authorities.

– Pago a Cuenta: This is a provisional monthly payment that businesses have to make, based on a percentage of their gross income. It serves as an advance payment of the annual income tax liability. These payments are later credited against the total tax liability for the year.

FAQs About Company Formation in El Salvador

Answers to some of the most common questions we get asked by potential clients.

1. Can a foreigner own a business in El Salvador?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. What is the El Salvador Company Tax ID?

In El Salvador, Tax IDs are known as “Número de Identificación Tributaria” (NIT), also known as Tax Identification Number and are required for a variety of financial transactions.

3. How long does it take to register a company in El Salvador?

It takes 4 weeks to register an operating company in El Salvador.

4. What types of companies can foreign investors register in El Salvador?

Foreign investors can register a Sociedad Anónima de Capital Variable (S.A. de C.V.), a Sociedad de Responsabilidad Limitada (S.R.L.), or a Branch Office. The S.A. de C.V. is the most flexible and widely used for both local and international operations.

5. What does an S.A. de CV company name mean in El Salvador?

In El Salvador, an S.A. de CV is known as Sociedad Anónima de Capital Variable (S.A. de C.V.). It is a type of business entity where the liability of its members (shareholders) is limited to their contributions to the company’s capital. This means that the personal assets of the members are protected from the company’s debts and liabilities.

6. What does an SRL company name mean in El Salvador?

In El Salvador, SRL means Sociedad de Responsabilidad Limitada, which is similar to a Limited Liability Company in English. This distinct legal construct operates independently of its shareholders, providing them with valuable limited liability protection. The prominence of SRL companies can be attributed to their simplified requirements, establishing them as a highly sought-after preference for structuring businesses.

7. What entity types offer Limited Liability in El Salvador?

In El Salvador, both Sociedad Anónima de Capital Variable (S.A. de C.V.) and Sociedad de Responsabilidad Limitada) (S.R.L) are limited liability entity types.

8. What is the process to incorporate a company in El Salvador?

Incorporation begins by choosing a business structure such as an S.A. de C.V. or S.R.L., then reserving a company name, drafting and notarizing the articles of incorporation, and registering the business with the Commercial Registry (CNR). You will also need a tax identification number (NIT) from the Ministry of Finance and a fiscal address. If you plan to hire employees, registration with the social security institute is also mandatory. The process typically requires local legal guidance and Spanish-language documents.

9. What are the legal requirements for company registration?

You need a company name, local fiscal address, at least two shareholders, a legal representative (can be foreign), and notarized bylaws. Additionally, all businesses must obtain a NIT and register for municipal taxes.

10. What are the tax obligations for companies in El Salvador?

Corporate income tax is 30%. A 13% VAT applies to most goods and services. Companies must also make monthly and annual filings, pay municipal taxes, and contribute to employee social security if hiring staff.

Benefits of Starting a Business in El Salvador

In total, exports make up 64% of Salvador’s GDP, making them the country’s most important driver of economic growth. Policies that support international trade are active, and it remains an attractive idea to incorporate a company in El Salvador. It is the first nation to recognize Bitcoin as a legal currency. This move has contributed significantly to increasing foreign investment and incentivizing investors to incorporate companies in El Salvador.

The international trade sector in El Salvador is strong because the country is part of the multilateral agreement CACM between Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua, and the Free Trade Agreements (FTA) with the European Union, México, Colombia, Taiwan, and the United States.

Of course, there are bureaucratic regulations, which is where we come in. If you decide to incorporate a company in El Salvador, you must be aware of the requirements you must comply with. In this article we have compiled some information on the key steps of the process.

Biz Latin Hub can help you incorporate a business in El Salvador

El Salvador offers numerous opportunities for investors looking to diversify their international business portfolio and incorporate a business in El Salvador.

If you are interested in incorporating a company in El Salvador, Biz Latin Hub can provide you with all necessary market-entry and back-office services and support.

Feel free to contact us now for personalized support.