For anyone looking to register a business in El Salvador or already active in this Central American market, getting to grips with and properly implementing employment law in El Salvador is critical to maintaining your company’s good standing and maximizing its chances of success.

Employment law in El Salvador is overseen by the Ministry of Labor and Social Welfare, and while many aspects of regulations are similar to those seen elsewhere, the system has its particularities to understand. This is why it makes sense to partner with an experienced operator in the field.

That’s where Biz Latin Hub can help. This basic guide to employment law in El Salvador provides a good guide to the depth and range of knowledge we have in Central America and across the region, with 18 dedicated offices spanning Latin America and the Caribbean. Our array of back office services can help you with any business matter, whether that’s in San Salvador or elsewhere.

Why conduct business in El Salvador?

El Salvador presents a compelling environment for conducting business due to various factors. Employment law in El Salvador ensures a balanced and business-friendly framework that promotes growth. The nation’s strategic location within the Americas facilitates trade and connectivity. Companies benefit from a skilled and cost-effective workforce, reinforced by the Employment law in El Salvador, which provides clarity and security for both employers and employees.

Moreover, the country’s proactive efforts to attract foreign investment, including streamlined procedures and incentives, make it an enticing destination for entrepreneurs. Employment law in El Salvador consistently prioritizes fairness and productivity, contributing to a stable labor environment. Overall, El Salvador’s advantageous business climate, guided by sound Employment law, positions it as an attractive choice for those seeking growth and success in Central America.

What are the standard working hours in El Salvador?

Under employment law in El Salvador, a standard working week lasts for 44 hours, with a normal shift lasting no longer than eight hours.

For employees who work at night (specified as being standard hours that fall between 19:00 and 06:00 the following day) the maximum work week is 39 hours long, based on seven-hour shifts.

Note that in El Salvador, there are generally between 10 and 11 national holidays that fall on weekdays each calendar year, as well as two or three regional holidays.

Common contracts under employment law in El Salvador

There are two types of contract allowed under labor law in El Salvador that are most commonly used by foreign investors:

- Indefinite-term employment contracts are the most common type of contract and only end when both the employer and employee come to a mutual agreement, or when one of the parties has the right to act unilaterally. Examples of such circumstances include the employee resigning from their role, or an instance of employee misconduct that warrants dismissal as set out by the contract.

- Fixed-term employment contracts typically last for days, weeks, or months, and generally for no longer than one year. However, they can last for up to two years when the employee holds a professional or technical qualification, or when the task at hand warrants such a contract duration. Such contracts must properly outline the tasks being undertaken and include explicit mention of the conditions under which employment can be terminated, including how the designated task will be deemed complete.

How does termination work in El Salvador?

An employee can have their contract terminated without notice within the probation period laid out in their contract, which will usually last for 30 days, however for certain types of employees it can extend for longer. This is one vital aspect of labor law in El Salvador.

Once the probation period has been served, an employee must be guilty of one of a number of actions or behaviors listed under Article 50 of the Salvadoran Labor Code in order to be dismissed with just cause. This is a second important code within employment law in El Salvador.

They include the likes of negligence, failure to properly fulfill duties for two consecutive days, intoxication in the workplace, and disrespectful behavior towards the employer or a fellow employee.

In the event of an employee’s contract being terminated without cause, they will receive a liquidation payment totaling 15 days of standard pay for every year of service they have provided the company. This is standard within labor law in El Salvador.

This benefit is similarly conferred to employees when they resign, and the employer is obliged to provide the payment within 15 days of the employee’s final day of employment.

Departing employees under both circumstances are also entitled to receive a proportion of their statutory end-of-year bonus and payment for outstanding vacations based on the amount of the corresponding year they have worked.

Note that under employment law in El Salvador, most employees are not required to give a notice period when they resign, however, they must provide notification of their resignation in written form.

However, if they are in a management position or undertaking a specialized task, they are obliged to provide 30 days of written “advanced notice” of their intention to resign.

Employment law in El Salvador: Vacations, leave, and other absences

After completing one year of employment — during which they have worked at least 200 days — an employee is entitled to 15 days of paid vacation leave. That leave is paid at a rate of 130% of their standard daily earnings and must be paid prior to the employee commencing the vacation period. This is standard under employment law in El Salvador.

Note that vacation allowance cannot be exchanged for additional pay unless the employee is leaving their role. For jobs that include room and board allowance, the vacation pay rate is increased by an additional 25%.

- Maternity and paternity leave: A total of 16 weeks of paid maternity leave are granted to new mothers, divided into prenatal and postnatal periods. The leave must be taken with at least six weeks after the due date of the birth. Maternity leave is paid by the state social security fund at a rate of 75% of the salary.

Note that during pregnancy a worker cannot be dismissed and cannot be assigned tasks that pose any sort of risk to the unborn child. Under employment law in El Salvador, paternity leave totals three days, both in the case of a birth or adoption, and that leave must be taken within 15 days of the birth or adoption. - Sick leave: Employees are entitled to leave due to sickness based on the length of service they have provided the company. In the case of employees who have served between one and five months, an entitlement of 20 days of paid sick leave paid at 75% of base salary is given.

For employees who have served between five and 12 months, that leave allowance is extended to 40 days at the same 75% pay rate, while those who have served more than one year are entitled to 60 days of paid sick leave. Note that, following a reform of the labor code that came into force in June 2020, an employee who has been diagnosed with a chronic illness cannot be dismissed once that diagnosis has been issued and until three months after the conclusion of related medical treatment. - Bereavement leave: Bereavement leave is granted in the event of the loss of a parent, child, partner, or another dependant, and lasts for as long as required. However, the employer is only obliged to provide payment equivalent to two days of salary for each calendar month, and a maximum of 15 days of bereavement leave pay in the course of a calendar year.

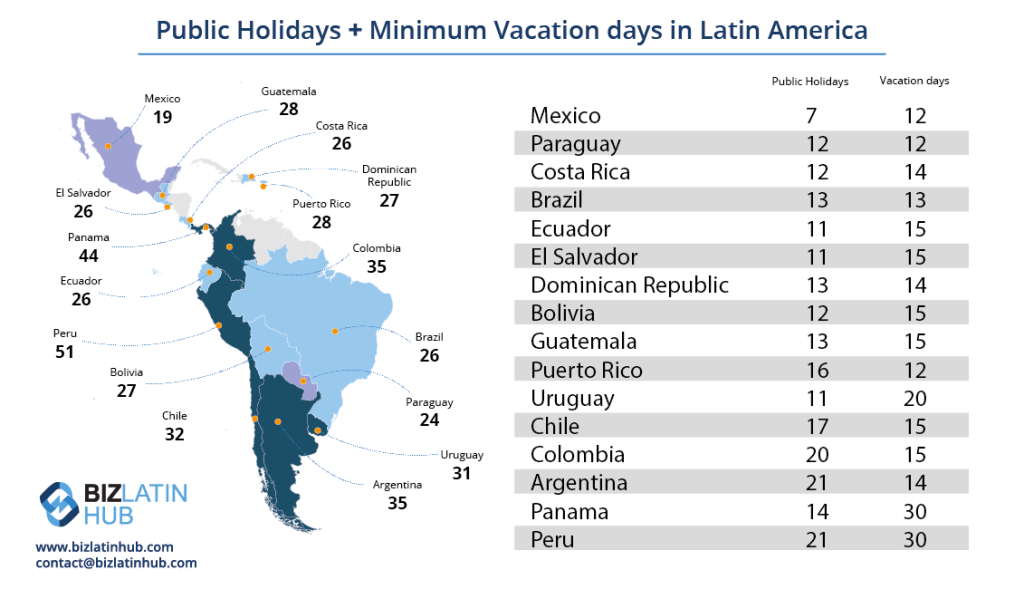

How many public holidays and vacations does El Salvador have?

El Salvador observes several public holidays throughout the year. The key holidays include January 1st (New Year’s Day), Holy Week (Thursday, Friday, and Saturday), May 1st (International Labor Day), May 10th (Mother’s Day), July 17th (Father’s Day), August 6th (Patron Saint’s Day of San Salvador), September 15th (Independence Day), November 2nd (All Souls Day), and December 25th (Christmas Day). Additionally, local holidays are observed based on regional traditions.

Employment law in El Salvador: statutory contributions

- Employee deductions: Under employment law in El Salvador, deductions are made from employee salaries for both social security and the national death and pension fund, with deductions totaling 10.25% on any salary up to USD$1,000. For social security, a 3% deduction is made, and for the pension fund, a 7.25% deduction is taken from any salary up to USD$7,029 per month.

- Employer contributions: Employer contributions to social security and the pension fund total the equivalent of 15.25% of any salary up to $1,000 per month. That is based on a 7.5% contribution to social security, and a 7.75% contribution to the pension fund. Additionally, companies with more than 10 employees must contribute the equivalent of an additional 1% of salaries to the Salvadoran Institute for Professional Education (INSAFORP).

- Annual bonus: Any employee who has provided at least one year of continuous service by December 12 of a given year is entitled to an annual bonus, also known as an aguinaldo. Those who have worked for less than a year are entitled to a proportional bonus. The bonus must be paid between December 12 and 20 and is based on the length of service:

- Up to 3 years of service: Minimum bonus equivalent to 15 days of base salary.

- Between 3 to 10 years of service: Minimum bonus equivalent to 19 days of base salary.

- Over 10 years of service: Minimum bonus equivalent to 21 days of base salary.

FAQs about employment law in El Salvador

In our experience, these are the common questions and doubtful points of our clients.

In El Salvador, the typical workweek spans 44 hours, providing flexibility through both fixed-term and indefinite employment contracts. The nation establishes a mandated minimum wage, and employees enjoy the privilege of annual paid leave. Maternity leave is generously granted with full compensation and social security contributions ensure comprehensive health and retirement benefits. The labor laws in place acknowledge the importance of collective bargaining and uphold the right to strike.

In El Salvador, a standard work day consists of 8 hours, totaling 44 hours per week. The work week usually spans five and a half days. Employees are given 30-minute breaks, which are included in the working time. Minors aged 14 to 18 are only allowed to work for a maximum of 6 hours per day. Overtime work is compensated at a rate of 200% of the basic salary.

The minimum wage in El Salvador varies depending on the industry. For retail employees, the minimum wage is US$365.00 per month. Industrial laborers earn a minimum wage of US$359.16 per month. Apparel assembly workers have a minimum wage of US$272.66 per month, while agriculture industry workers earn a minimum wage of US$243.46 per month.

Valid grounds for terminating an employee in El Salvador include economic reasons, the worker’s conduct, and the worker’s capacity.

In the case of unjustified dismissal, the employer is legally obligated to pay compensation of 30 days of pay for each year of work under the employer.

It is good practice to give notice of termination, although it is not a legal requirement in El Salvador.

The notice period is specified in the employee’s employment contract.

Severance payments are common and typically amount to one month of salary for every year of service.

It is common practice to request that an employee provide a minimum of 7 days’ notice after completing their probation.

When an employee quits in El Salvador, they are not required to give notice, but they must provide written notification. Upon employment termination, employees are entitled to receive their final pay, which includes wages and other payment entitlements. It is important to note that severance pay is not provided when an employee resigns or when the employment contract’s duration term has ended. However, if a labor court determines that the dismissal was unfair, the employee is entitled to receive pay from the date of dismissal and severance pay. The amount of severance pay is calculated as 30 days’ salary for each year worked.

Biz Latin Hub can assist you when doing business in El Salvador

At Biz Latin Hub, our team of bilingual corporate support experts is available to help you understand and properly implement employment law in El Salvador, as well as many other aspects of doing business in the country.

Our comprehensive portfolio of back-office services includes company formation, accounting & taxation, corporate legal services, visa processing, and hiring & PEO, and we offer tailored packages of integrated services to suit every need.

We also have teams in place in 15 other markets around Latin America and the Caribbean and trusted partners that extend our coverage to almost every corner of the region.

Contact us today to find out more about how we can support you in doing business in El Salvador.

Or learn more about our team and expert authors.