In recent years, the Cayman Islands have emerged as a beacon for investors and foreign business owners seeking lucrative opportunities and a stable environment for financial growth. Learn more about a PEO in Cayman Islands.

This British Overseas Territory has rapidly gained a reputation as a premier global financial hub, drawing investors, and corporations from around the world.

Using a Professional Employer Organization in the Cayman Islands helps simplify the complexities of global expansion. It also guarantees a stable base for your company’s growth and success in this tropical paradise.

Read on to discover the advantages of a PEO in the Cayman Islands and how to recruit talent in this beautiful territory.

See also: Company formation Cayman Islands

What is a PEO in the Cayman Islands?

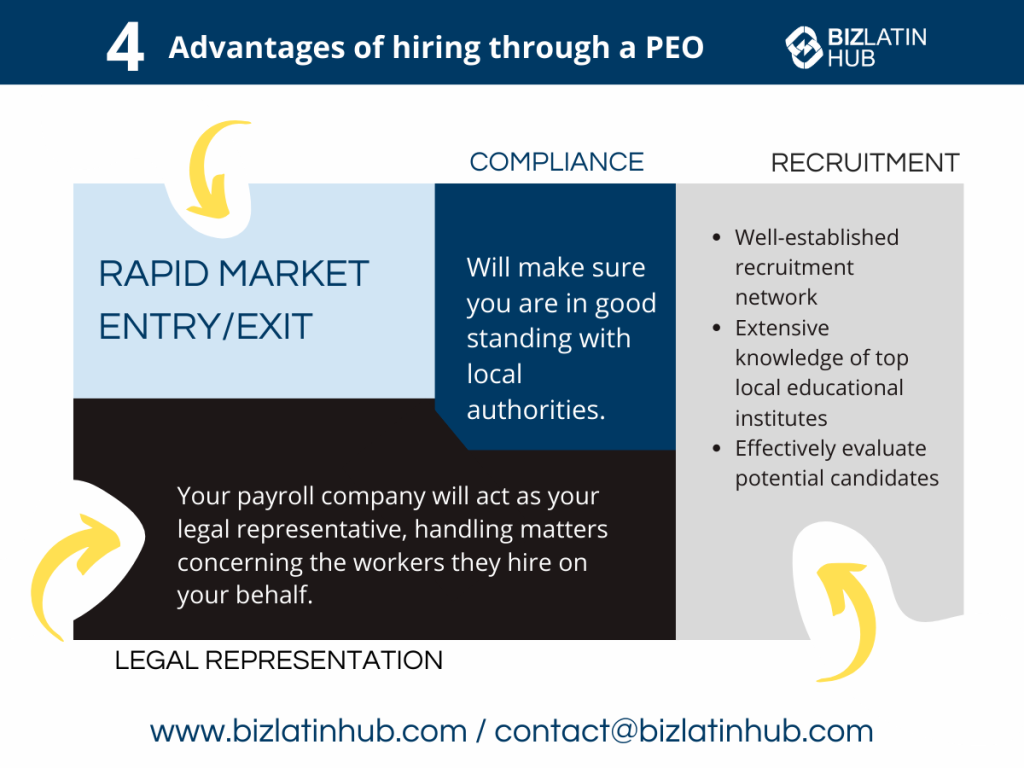

A PEO serves as a valuable ally for businesses, managing complex HR responsibilities such as hiring, tax handling, and benefits administration. In the Cayman Islands, a PEO efficiently handles these tasks, allowing businesses to focus on growth without the burden of compliance and paperwork.

This is especially useful if a company wants to employ local workers but doesn’t want to go through the hassle of forming a legal entity in the country.

Main Advantages of Working with a PEO in the Cayman Islands

Collaborating with a PEO in the Cayman Islands enables companies to swiftly enter the local market, ensuring rapid commencement of business operations. Using a PEO for talent acquisition provides various advantages, such as:

- Focus on core business

- Cost-effective approach

- Efficient hiring process

- Time savings

- Local expertise and compliance

- Fast setup

Focus on core business

By entrusting HR duties to a Cayman Islands-based PEO, your company liberates valuable time and resources. This strategic move allows your organization to channel its energy into core operations and direct employee management. With administrative burdens lifted, there’s room for an enhanced focus on business growth and innovation.

Cost-effective approach

Hiring a PEO saves money by cutting down recruitment and administrative costs. This is especially beneficial if you want to hire local staff but haven’t fully set up your company in the Cayman Islands.

Efficient hiring process

A PEO helps in finding the right employees by sourcing and selecting suitable candidates tailored to your company’s needs. This saves time and effort in finding the perfect staff.

Time savings

Outsourcing payroll and other HR tasks to a PEO means you don’t have to deal with time-consuming paperwork. This allows you to use your time and resources more efficiently for strategic business activities.

Local expertise

Engaging a Professional Employer Organization guarantees strict compliance with local labor laws and regulations for your company. Their in-depth local knowledge ensures that all employment relationships align with legal mandates, significantly minimizing the risk of fines or legal complications.

Fast setup

A PEO service in the Cayman Islands should already be recognized as a legal entity, so using it will allow you to rapidly enter the market. There is no need for a lengthy entity establishment.

Hiring Staff in the Cayman Islands with a PEO

A reputable PEO in the Cayman Islands can navigate the intricacies of various employment contracts. The crucial employment regulations overseen by a Cayman Islands PEO include:

- Working Hours: The standard workweek spans 45 hours or 9 hours per day.

- Holidays: The Cayman Islands observe 11 national holidays. Employees are entitled to 10 days of annual leave for the first four years of employment, 15 days for 4 to 10 years, and 20 days if employed for over 10 years with the same company.

- Overtime: Overtime must be paid by an employer at a time and a half based on the employee’s basic hourly rate.

- Sick Leave: Employees are entitled to 10 days of sick leave per year.

- Maternity/Paternity Pay: By law, there is a maximum paid 12-week maternity leave period.

- Tax: The Cayman Islands do not levy income tax on individuals.

- Value Added Tax (VAT): There is no VAT in the Cayman Islands.

- Social Security: There are no social security contributions.

- Termination of Contracts: Grounds for dismissal that are considered to be justified are:

Serious misconduct Less serious misconduct or failure to perform satisfactorily, following completion of the statutory warning procedure. Redundancy. Where continuing the employment would contravene the Labor Law or any other law. Any other substantial reason where the employer acts reasonably. The notice period is the same as the time between paydays (subject to completion of any probationary period and the terms of the employment contract).

Biz Latin Hub Can Help You With a PEO in the Cayman Islands

At Biz Latin Hub, we offer an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in the Cayman Islands, legal services, accounting and taxation, company incorporation, and visa processing.

Our presence extends across major cities in the region, bolstered by robust partnerships in numerous other markets. This extensive network equips us with a wealth of resources ideally customized to facilitate cross-border initiatives and market entry strategies in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.

If this article on PEO in the Cayman Islands interests you, check out the rest of our coverage of the region. Or read about our team and expert authors.