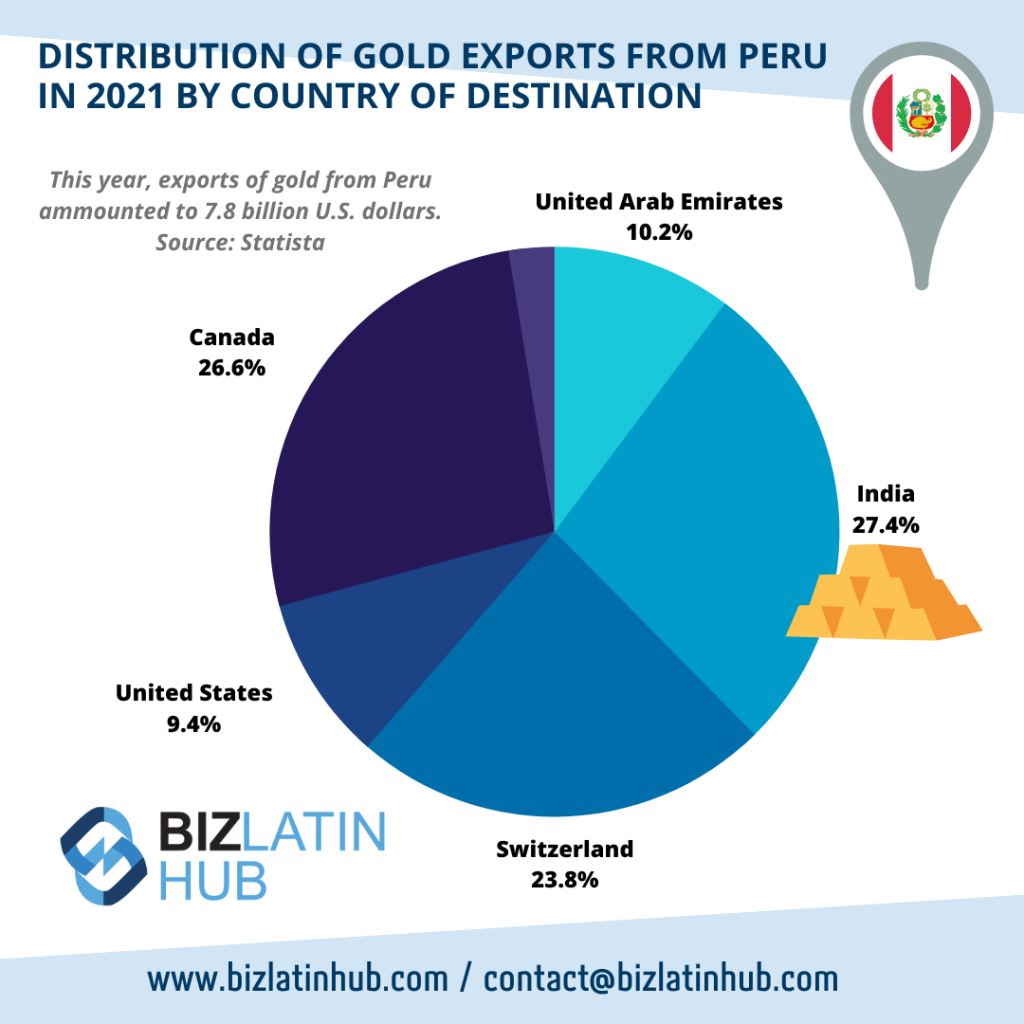

Over the past couple of weeks, Peru has made headlines for all the wrong reasons. A political crisis saw Pedro Castillo ousted as president, and protests have broken out across the country. What’s not in the headlines, however, is that Peru’s economic indicators look promising; the Andean nation’s GDP grew 2.3 percent this year, and GDP is expected to grow by 2.9 percent in 2023. Companies that set up shop in the country may be required to hire an auditor in Peru if business takes off and revenues hit a certain threshold.

You may now be thinking: With all the legal and financial headaches surrounding starting a business in Peru, now I have to worry about having my company audited as well? Well, that depends on the size of the business you open.

According to Peruvian tax law, “all companies with annual revenues from the sale of goods or services that are equal to 3,000 tax reference units (UITs) or more must submit audited financial statements” to the relevant authorities in the Peruvian Ministry of Economy.

The UIT (Unidad Impositiva Tributaria in Spanish) is a unit of financial measurement set annually by the Ministry of Economy to determine taxes, penalties, fines, processing fees, deductions, etc. It functions much like the salario mínimo does in other Latin American countries. In 2022, one UIT is 4,600 Peruvian soles, or $1,205 USD. So, a company that generates 13.8 million soles ($3.6 million USD) or more in revenue is legally required to hire an auditor in Peru each year.

Companies that don’t pull in such tidy revenues annually are not legally required to audit their accounts, but there are a few reasons why hiring an auditor in Peru might be a good idea nonetheless.

Why should your company hire an external auditor in Peru?

- Enhance business credibility with investors

- List the company on the Lima Stock Exchange

- Detect potentially fraudulent activity

- Improve the internal accounting process

- Prepare the company for mergers and acquisitions

Let’s take a closer look at why companies – from large corporations to small and medium-sized enterprises (SMEs) – might seek to employ the services of an auditor in Peru.

5 reasons to open your books to an external auditor in Peru

1. Enhance the company’s credibility with investors

By bringing in an outside auditor to inspect your business in Peru, the business becomes more transparent and credible. Companies that get a “clean bill of health” through an audit will find it much easier to receive approval for bank loans, or drum up interest in the company among investors

2. List the company on the Lima Stock Exchange

Audited financial statements from a certified auditor in Peru are necessary for companies that wish to list their shares on the Lima Stock Exchange (Bolsa de Valores de Lima in Spanish). A company audit is also required for companies to be listed on international indices such as the S&P 500.

3. Detect potentially fraudulent activity

That someone in the company might be committing fraud is an ugly thought, but there is really only one way to know for sure. External auditors examine bookkeeping without the filter of personal relationships clouding their judgment. An impartial inspection of financial records will reveal the cold, hard facts about the company’s accounting practices and determine whether any fiduciary funny-business is afoot.

4. Improve internal accounting/bookkeeping processes

An outside audit by a certified auditor in Peru could find areas where your accountant could improve their internal controls, or make certain processes more efficient and/or less time-consuming. Knowing the source of waste and inefficiency in the accounting process will help to address the problems over time.

5. Prepare the company for mergers and acquisitions

In cases where a company’s owner(s) are keen to be acquired by a larger company, or to merge with a separate firm (and the shareholders are on board), a thorough external audit needs to take place before such deals can proceed. Due diligence is essential to maximize the company’s overall financial value.

SEE ALSO: Auditor in Guatemala: Why do you need an auditor for your company?

Now that you’re sold on the idea of a company audit, how do you go about choosing the right auditor in Peru for your business?

Key factors in selecting the right auditor in Peru

- Qualifications – Be sure that any auditor in Peru or auditing agency is fully licensed and qualified. Ask if they are a member of an industry organization such as the Institute of Internal Auditors of Peru (Instituto de Auditores Internos del Perú in Spanish).

- Industry experience – If your auditor in Peru has experience in your company’s industry, the audit will likely be more efficient, as they’ll avoid asking generic questions. Their analysis will also translate into concrete actions that your business can take.

- Cost – Before signing an agreement with an auditor in Peru, be sure to ask for a detailed list of services for the price you’ll be paying. And if you feel the cost of an audit is too steep, shop around for a more reasonably-priced auditor.

- Independence – When hiring an auditor, make sure that you do not hire someone from your own company or who knows you well. Hiring someone who is not part of your business means getting an unbiased audit and review, which is essential.

- Post-audit support – A good external auditor in Peru delivers more than reporting results of past financial measures. They should be a business partner who is checking in periodically to see if recommendations are being implemented, and available to give future-focused advice about best practices in bookkeeping.

Biz Latin Hub can help you find an auditor in Peru

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Lima, Perú, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about auditors in Peru, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding talent, or otherwise do business in Latin America and the Caribbean.

If this article about auditors in Peru was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.