Nicaragua is an attractive destination for global companies. Starting a business in Nicaragua is straightforward, and the tax system encourages ventures in tourism, energy, and innovation. Before launching a company in the country, it is essential to understand corporate compliance in Nicaragua. Don’t let legal complexities stop you from launching or expanding in this beautiful Central American country. This guide outlines the strict annual reporting requirements necessary to maintain a Nicaraguan company’s legal and fiscal standing.

Key Takeaways On Corporate Legal Compliance in Nicaragua

| Is a physical address in Nicaragua necessary for doing business? | Companies in Nicaragua must maintain a registered office, which acts as their legal address. This office is essential for receiving official correspondence and legal documents. |

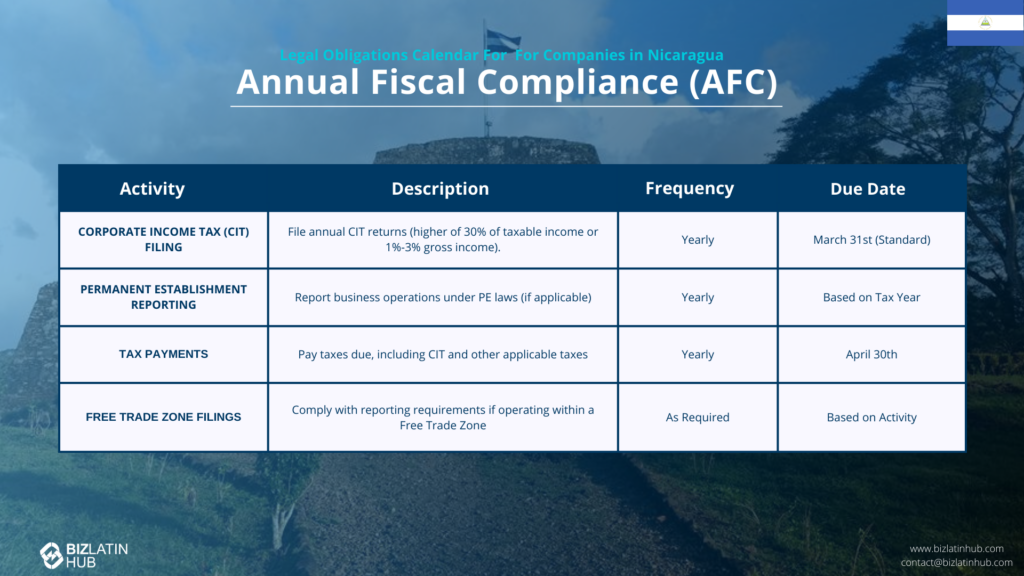

| What are the annual entity fiscal compliance requirements? | Compliance with local tax obligations is required. This includes paying corporate income tax and payroll taxes by specific deadlines. Keeping accurate financial records at the registered office is mandatory. If you operate in a Free Trade Zone, you may have to file separate documents there as well. |

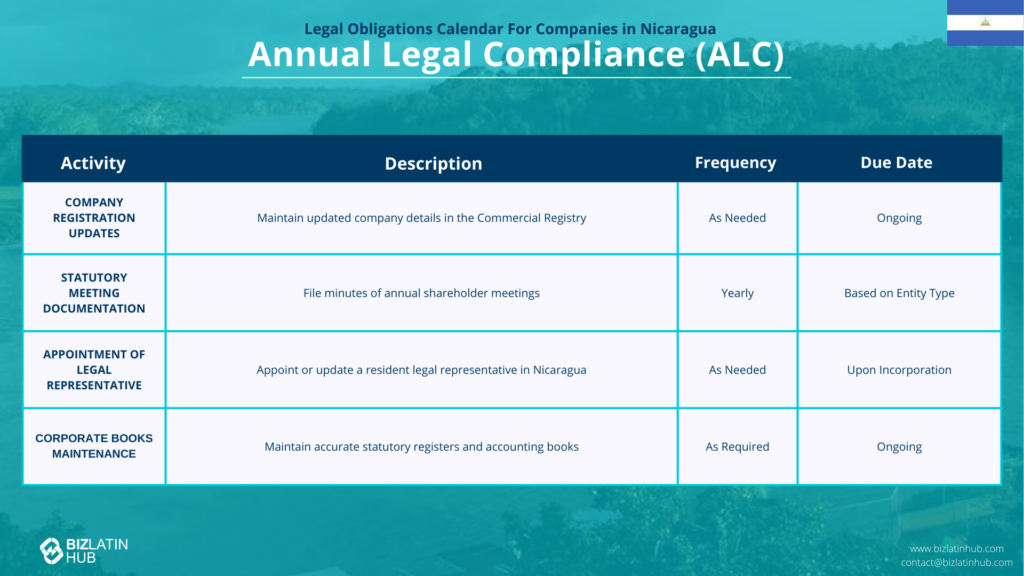

| What are the annual Entity Legal Compliance Requirements? | An annual return detailing the company’s structure and status must be filed with authorities to ensure legal compliance. These returns, along with annual financial statements, are crucial. |

| What common statutory appointments do companies make in Nicaragua? | A Nicaraguan resident legal representative must be appointed. |

| Why Choose to Invest in Nicaragua? | Nicaragua boasts a favorable investment climate with competitive labor costs, tax incentives, and free trade agreements that provide access to key international markets. |

| What are the three mandatory corporate books a company must maintain? | These are the Journal, Ledger, and Minutes Book. |

| Are there any licenses to manage? | A municipal business license must be renewed each year. |

Corporate Legal Compliance in Nicaragua

Companies in Nicaragua must maintain a registered office, which acts as their legal address. This office is essential for receiving official correspondence and legal documents.

An annual return detailing the company’s structure and status must be filed with authorities to ensure legal compliance. These returns, along with annual financial statements, are crucial. Companies must prepare and submit these statements, which reflect financial performance and status, to regulatory bodies.

Expert Tip: Expiry of Director Appointments

From our experience, a common issue is the expiry of the Board of Directors’ term. Unlike in some countries where appointments are indefinite, in Nicaragua, directors are elected for a specific period (defined in bylaws). If the term expires and a new Board is not elected and registered immediately, the company loses its legal representation. Banks will freeze accounts, and contracts cannot be signed. We advise tracking the expiry date closely and holding the re-election assembly at least a month in advance.

1. Maintain Official Corporate and Accounting Books

Every company must keep three official books: a Journal Book, a Ledger Book, and a Minutes Book for shareholder and board meetings. These books must be authorized by the relevant authorities before use.

2. Hold an Annual Shareholders’ Meeting

An ordinary shareholders’ meeting must be held once per year to approve financial statements and appoint the board. All resolutions must be recorded in the official Minutes Book.

3. Fulfill Tax Obligations

Companies must register with the DGI, make monthly provisional income tax payments, and file an annual definitive income tax return.

Expert Tip: Stamping and Sealing Corporate Books

From our experience, a critical but often overlooked step is the official authorization of corporate books. Before any entries are made, the three main books (Journal, Ledger, and Minutes Book) must be presented to the DGI for stamping and to the Mercantile Registry for sealing.

We have seen companies face significant issues because they began recording minutes or transactions in unauthorized books, which renders the records legally invalid. Always ensure your books are officially authorized immediately after incorporation and before any business activity commences.

4. Appoint a Legal Representative

All companies must have a designated legal representative who has the legal authority to act on behalf of the company and sign official documents.

5. Renew Municipal Registrations

Businesses must register with the municipality where they operate and renew their registration and business license annually.

Fiscal Compliance Requirements for Businesses

Businesses in Nicaragua must adhere to several compliance requirements. The corporate tax rate is 30%, while the value-added tax (VAT) is 15%. Both local companies and branches of foreign companies, known as permanent establishments, face the same tax obligations.

Compliance with local tax obligations is required. This includes paying corporate income tax and payroll taxes by specific deadlines. Keeping accurate financial records at the registered office is mandatory. These records should show the company’s financial position and include consolidated financial statements of any subsidiaries.

Key Compliance Points:

- Corporate Tax Rate: 30%

- Value-Added Tax (VAT): 15%

- Incorporation Time for S.A.: 30 days

- Share Capital Requirement: None for S.A.

- Shareholder Rights: Equal unless stated

These requirements ensure businesses operate within the legal framework. Companies must maintain accounting books and submit tax returns to comply with Corporate Law.

What is the Legal System in Nicaragua?

The Judicial Branch in Nicaragua oversees all national trials and executes judicial sentences. Justices and judges operate independently, adhering to constitutional and legal mandates.

The Organic Law of the Judicial Branch, enacted in 1998, governs this power, establishing a two-tier system and granting the Supreme Court the authority to modify or revoke sentences. The legal system includes local judges, district judges, Courts of Appeals, and the Supreme Court of Justice.

Corporate Compliance in Nicaragua – Registering a Company

To incorporate a company in Nicaragua, organizations must follow these steps:

Draft Act of Incorporation: Require two shareholders with a minimum startup capital of C$10,000. A Nicaraguan resident legal representative must be appointed. The final act needs certification by a Nicaraguan public notary.

Purchase Accounting and Corporate Books: Obtain necessary books for company registration from local bookstores.

Submit Act of Incorporation at VUI: Present documents at the Investment Service. Processing by the Commercial Registry requires a payment of 1% of the company’s capital, up to C$30,000.

Register as a Trader and Accounting Books: After processing, register as a trader and the accounting books at the Commercial Registry through VUI.

Secure Single Registration Document: This document, obtained concurrently with the previous step, provides Municipal License, INSS License, and Tax Payer Registration. It involves a payment of 1% of the company’s capital.

Appoint Legal Representation: Shareholders must appoint a Nicaraguan resident legal representative. The representative’s powers can be limited by the Board of Directors. Choosing a trustworthy individual is essential.

Corporate Compliance in Nicaragua – Liabilities

In Nicaragua, directors of corporations are generally not personally liable for the company’s obligations according to the Code of Commerce.

However, they can be held accountable if they fail to fulfill the company’s administrative duties, violate its bylaws, or breach the law, facing liabilities to both the corporation and third parties.

Criminal sanctions, including imprisonment, can be imposed if directors participate in self-serving decisions harmful to the company or the public.

Regarding parent company liability, specific regulations are lacking, but claimants can attempt legal action against parent companies in case of disputes.

Consumers can pursue claims against parent companies if the parent company is responsible for the production, distribution, or commercialization of goods in Nicaragua through a local distributor. The legal framework allows consumers to seek redress against suppliers in such instances.

The Role of the DGI and Mercantile Registry

Two main bodies oversee corporate compliance in Nicaragua. The Public Mercantile Registry is where the company’s incorporation deed and all subsequent corporate resolutions are recorded. The General Directorate of Revenue (DGI) is the national tax authority responsible for collecting corporate income tax and other duties.

The UBO Registry

Nicaragua has implemented a rigorous “Registro de Beneficiario Final.” Companies must declare their ownership structure. Crucially, if there are any changes to shareholding, the registry must be updated. Failure to comply results in the immediate blocking of the company’s Tax ID (RUC), halting all business.

FAQs for Corporate Compliance in Nicaragua

Based on our extensive experience these are the common questions and doubts of our clients.

The corporate income tax rate is 30% on net income. There is also a definitive minimum payment of 1% to 3% of gross income, and companies must pay whichever amount is higher.

Law 822 in Nicaragua has introduced a clear understanding of ‘permanent establishment’ within the country’s income tax system. This term refers to a location where a non-resident taxpayer conducts business either entirely or partially. This encompasses various entities such as a place of management, branch, office, agent, factory, workshop, or sites for resource extraction like mines, oil wells, or quarries.

Additionally, it includes construction or installation projects lasting more than six months and consultancy services extending beyond six months within a year. This definition provides a comprehensive framework for taxation, ensuring clarity for businesses operating in Nicaragua.

Yes, the Nicaraguan government repealed Decree No. 46-91 and introduced Law 917/2015, known as the Export Free Trade Zone Law. This law establishes various types of export-free zones, including those for processing, industrial production, logistics, and outsourcing services.

In Nicaragua, the typical tax year runs from January 1 to December 31. Nonetheless, businesses can request approval from tax authorities to adopt different fiscal year-end dates: March 31, June 30, or September 30.

The Annual Shareholders’ Meeting is held to approve the financial statements from the previous year, decide on the distribution of profits, and appoint or ratify the Board of Directors and the official Vigilance Officer.

No, the legal representative does not have to be a Nicaraguan citizen. However, a foreigner appointed as a legal representative must have legal residency in Nicaragua.

The Vigilance Officer (Vigilante) is a unique role in Nicaraguan corporations. This person is appointed by the shareholders and is responsible for overseeing the company’s administration. They have unlimited rights to inspect the company’s books and operations to ensure everything is being managed correctly on behalf of the shareholders.

It is the business license obtained from the local Mayor’s Office (Alcaldía). It must be renewed annually, usually in January.

Companies must file a declaration with the Public Mercantile Registry updating their general information (address, directors, etc.) annually.

Why Choose to Incorporate a Company in Nicaragua?

Incorporating a company in Nicaragua offers businesses access to a growing economy with a wealth of opportunities in agriculture, manufacturing, tourism, and renewable energy. Nicaragua boasts a favorable investment climate with competitive labor costs, tax incentives, and free trade agreements that provide access to key international markets.

Its strategic location in Central America serves as a gateway to both North and South America, making it an ideal base for regional operations. Additionally, the Nicaraguan government actively encourages foreign investment through its pro-business policies and streamlined incorporation processes.

The country’s infrastructure is steadily improving, with ongoing investments in transportation, energy, and telecommunications that support business development. Nicaragua also enjoys a youthful and skilled workforce, ensuring access to capable talent for businesses across various industries.

By choosing to incorporate a company in Nicaragua, investors can leverage these advantages to establish a strong foothold in a promising and expanding market. Whether you are a small business owner or a multinational enterprise, Nicaragua offers a dynamic environment for growth and profitability.

Biz Latin Hub Can Oversee Your Corporate Compliance in Nicaragua

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in corporate compliance in Nicaragua, with legal services, accounting and taxation, hiring, and visa processing available.

We retain a large presence in LATAM with strong partnerships throughout the region. This far-reaching network gives us lots of tools to help with international projects and entering new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.