Company Formation in The Bahamas offers exciting potential for foreign investors. However, understanding the legal landscape demands specialized expertise. Avoid costly legal issues by partnering with an experienced local corporate legal firm. If you want to enter this thriving market, acquiring corporate legal services in The Bahamas is essential. This article focuses on the benefits of using corporate legal services in The Bahamas for foreign business owners. Discover key insights into the entity legal landscape for this attractive Caribbean marketplace. This guide outlines the critical compliance framework for International Business Companies (IBCs), particularly the recent transparency and substance laws.

Key Takeaways On Corporate Legal Compliance in the Bahamas

| Is a physical address in the Bahamas necessary for doing business? | Yes, every entity in The Bahamas must have a registered local Fiscal Address. It’s necessary for receiving legal mail and government visits. |

| What is the primary type of offshore company in the Bahamas? | This is known as an International Business Company (IBC). |

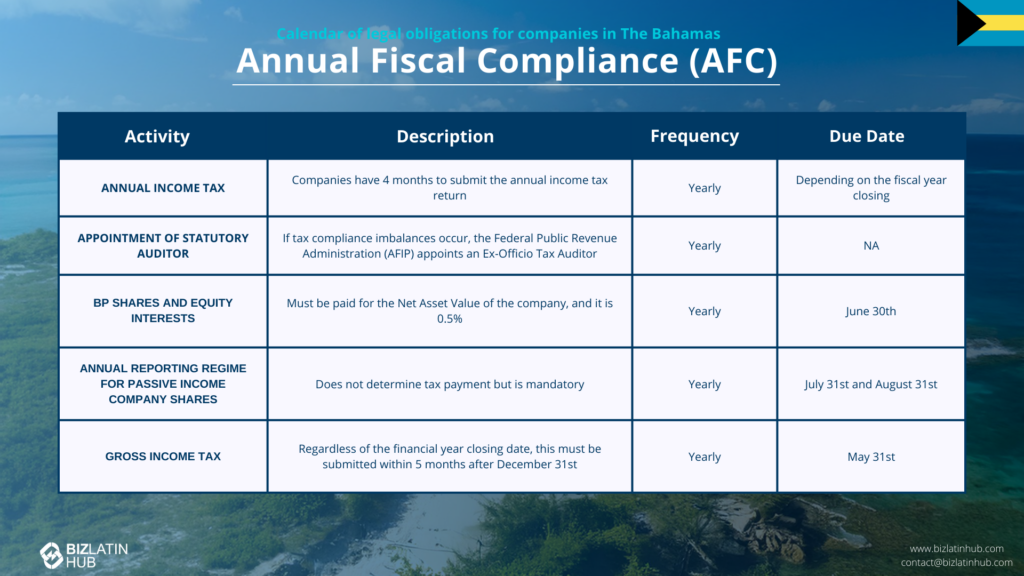

| What are the annual entity fiscal compliance requirements? | Compliance with local tax obligations is required. This includes paying corporate income tax and payroll taxes by specific deadlines. Keeping accurate financial records at the registered office is mandatory. |

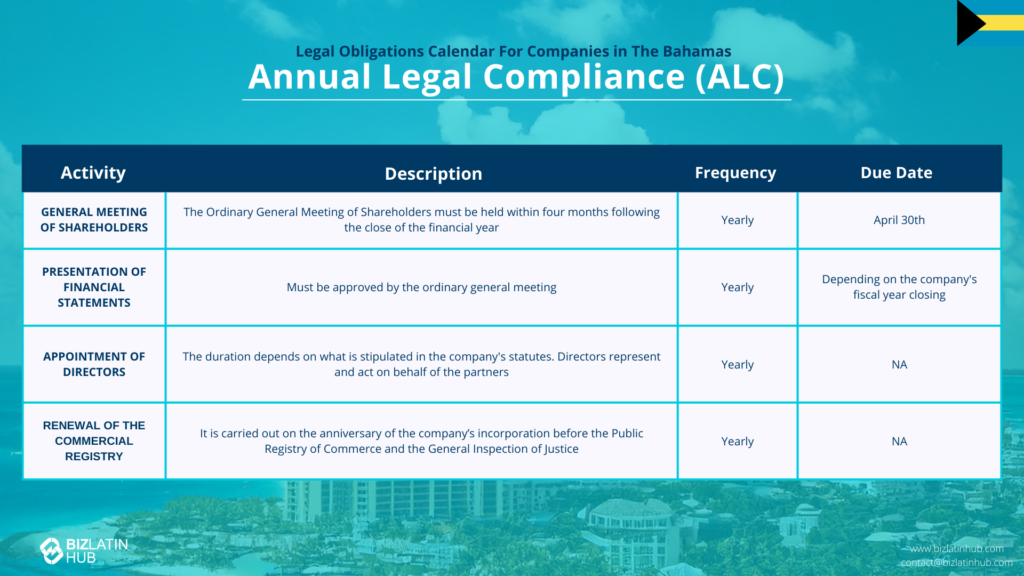

| What are the annual Entity Legal Compliance Requirements? | An annual return detailing the company’s structure and status must be filed with authorities to ensure legal compliance. These returns, along with annual financial statements, are crucial. Companies must pay an annual government license fee to remain in good standing. |

| What common statutory appointments do companies make in the Bahamas? | A registered agent with a physical office in the Bahamas is a mandatory requirement. |

| What records must an International Business Company (IBC) maintain? | An IBC must maintain accurate records, including minutes of all meetings and a share register listing all shareholders as well as a list of all directors and officers. |

| What are the main advantages of an IBC in the Bahamas? | The Bahamas offers several compelling advantages for businesses looking to establish operations in a tax-neutral and investor-friendly environment. |

Key Compliance Requirements for a Bahamian IBC

Companies in The Bahamas must maintain a registered office, which acts as their legal address. This office is essential for receiving official correspondence and legal documents.

An annual return detailing the company’s structure and status must be filed with authorities to ensure legal compliance. These returns, along with annual financial statements, are crucial. Companies must prepare and submit these statements, which reflect financial performance and status, to regulatory bodies. There should also be an annual AGM.

1. Pay Annual Government Fees

Every IBC must pay an annual license fee to the government to maintain its good standing. The amount of the fee depends on the company’s authorized share capital.

2. Maintain a Registered Agent and Office

All companies are required to have a licensed registered agent and a physical registered office address in the Bahamas at all times. The registered agent acts as the official intermediary between the company and the government.

3. Keep Company Records

An IBC must maintain accurate records, including minutes of all meetings and a share register listing all shareholders. These records do not have to be kept in the Bahamas, but their location must be known to the registered agent.

Expert Tip: Location of Corporate Records

From our experience, a point of confusion for new IBC owners is where corporate records must be kept. While the official Register of Directors must be filed with the Registrar, other sensitive records like meeting minutes and the share register can be held anywhere in the world.

However, the company must provide the full address of this location to its registered agent in the Bahamas. We advise clients to choose a secure and stable location for these records and to inform their registered agent immediately of any changes to this address to remain compliant.

4. Maintain a Register of Directors and Officers

A company must keep an updated register of all its directors and officers. A copy of this register must be filed with the Registrar General’s Department.

Filing Requirements and Fiscal Compliance for Businesses

Compliance with local tax obligations is required. This includes paying corporate income tax and payroll taxes by specific deadlines. Keeping accurate financial records at the registered office is mandatory. These records should show the company’s financial position and include consolidated financial statements of any subsidiaries.

Expert Tip: Substance Reporting Deadlines

From our experience, clients often confuse the substance reporting deadline with the financial year-end. In the Bahamas, the Economic Substance Report (CESRA filing) must be made within nine months of the entity’s financial year-end. For a standard year ending Dec 31st, the filing is due by September 30th. Missing this leads to substantial fines (starting at BSD $10,000). We advise setting a compliance calendar with your legal provider to ensure this specific date is not missed.

Benefits of corporate legal services in The Bahamas

- Local expertise

- Regional network

- Intellectual property

- Corporate entity structure

- Complimentary services

Let’s examine the key advantages of partnering with experienced corporate legal services in The Bahamas.

Local expertise

Using a local legal firm offers several advantages for ensuring compliance with local business laws. Local lawyers possess in-depth knowledge of the specific laws and regulations in The Bahamas. Their expertise enables them to offer customized legal advice that aligns with local customs and practices, enabling businesses to navigate legal matters with greater efficiency.

Regional network

By using local corporate legal services in The Bahamas, you can leverage an extensive network of local connections that can greatly benefit your business. These connections encompass service providers, officials, and other stakeholders who can offer valuable assistance in various capacities.

Intellectual property

As you begin your business venture, it may be necessary to register intellectual property (IP), such as a trademark, brand, or product. An experienced corporate lawyer in The Bahamas will have experience in handling such registration procedures. One less thing for you to worry about as you launch your business in this new market.

Corporate entity structure

If your business plans involve more than just selling goods or services in a foreign country you will need to carefully consider the most suitable in-country corporate structure to achieve your goals. An expert legal team in The Bahamas can ensure you choose the right company structure and are compliant with local business laws.

Complimentary services

You will likely need more than just legal services and require additional professional support. An ideal solution is to choose a legal firm in The Bahamas that also provides back-office services. These providers offer a comprehensive package of services that not only include legal assistance but also encompass accounting, recruitment, and other related services.

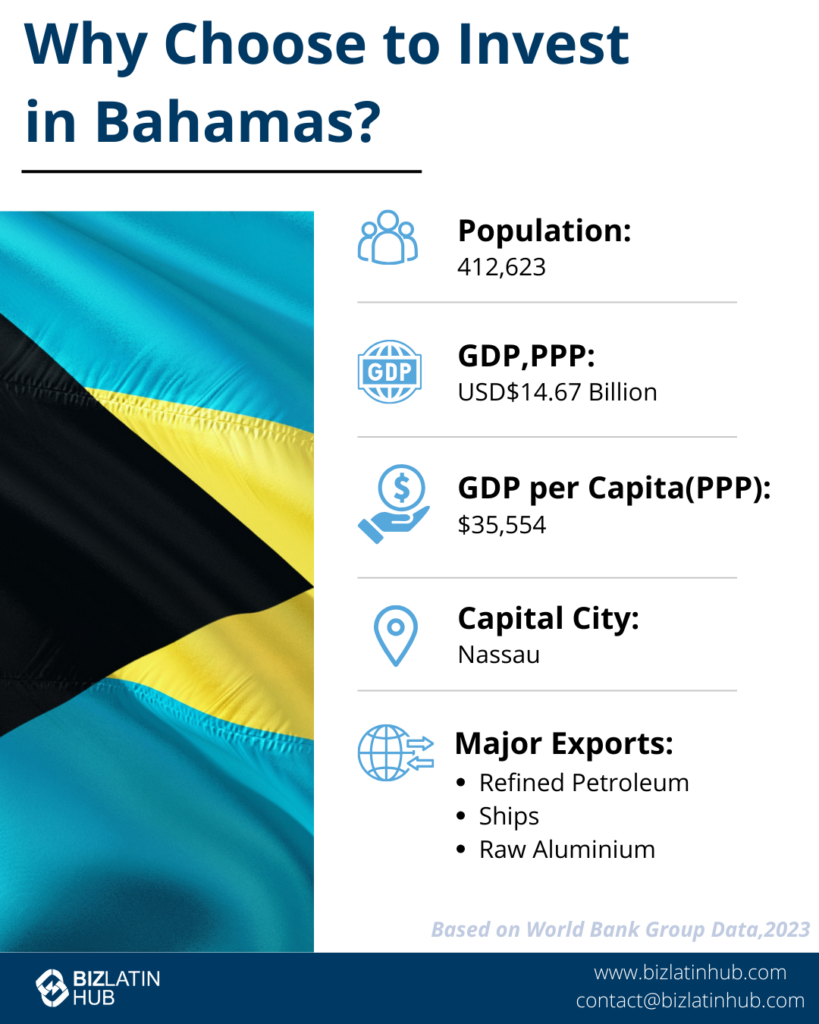

Understanding the legal entity landscape in The Bahamas

The Bahamas is open to international investors looking to start a business there. If you’re not a Bahamian or a Permanent Resident and want to do business in The Bahamas, you’ll need to send a Project Proposal to the Bahamas Investment Authority (BIA).

It’s important to note that The Bahamas recently updated its legislative framework with the Business License Act and the Commercial Entities Act 2023.

Collaborating with experienced corporate legal services in The Bahamas can help you navigate these regulatory changes and avoid severe penalties for non-compliance.

Important qualities to consider when choosing corporate legal services in The Bahamas

When searching for the best corporate legal services in The Bahamas, it is essential to consider the following factors:

- Experience level

- Solid Reputation

- Effective Communication

- Highly Responsive

Experience level

Experience is vital, and it’s advisable to find a legal firm that has experience in assisting clients in similar situations to yours, including working with foreign investors and a deep understanding of your industry.

Solid reputation

The reputation of a lawyer or legal firm in The Bahamas holds immense importance, and it is advisable to seek those with a proven track record of satisfied clients. To assess the quality of service they provide, you can gauge their reputation by reviewing online feedback and testimonials.

Effective communication

Communication is critical, especially if you plan to be outside the country for extended periods. A lawyer or legal firm that is comfortable with online management and reporting tools can help you stay informed and up-to-date on your work.

Highly responsive

It is essential to select corporate legal services in The Bahamas that respond quickly to your inquiries and concerns. When entering a new market, time plays a crucial role in determining the success or failure of a launch. Therefore, having local lawyers who can swiftly resolve legal issues and provide immediate feedback is vital for a seamless and successful entry into the market.

The Role of the Registrar General’s Department

The Registrar General’s Department is the government body responsible for the incorporation and registration of all companies in the Bahamas. It maintains the official corporate registry and is the entity to which annual government fees are paid. The Registrar has the authority to strike off companies that fail to meet their statutory obligations.

The BOSS System

The Register of Beneficial Ownership of Companies and Other Legal Entities Act is enforced through the “BOSS” system (Secure Search System). Every IBC must have its Registered Agent enter the details of its beneficial owners into this secure, offline database. This is a private registry, accessible only by designated officials for specific investigations, but participation is mandatory.

FAQs for Corporate Legal Services in The Bahamas:

Yes, businesses in The Bahamas can be 100% foreign-owned by legal entities or individual investors.

To form a Bahamas company, the following is required:

A minimum of one shareholder and one director.

A registered agent located in The Bahamas.

A company name that is not already in use and meets certain naming conventions.

Incorporation documents, including the memorandum and articles of association.

Yes, every entity in The Bahamas must have a registered local Fiscal Address. It’s necessary for receiving legal mail and government visits.

Yes. Every person conducting business within The Bahamas is required to have a business license (Business Licence Act, 2010.)

Business Licence applications can be completed online via the RMS-Web system at vat.revenue.gov.bs

An IBC is a corporate structure designed for offshore business activities. It is exempt from all local taxes in the Bahamas, including income tax, capital gains tax, and inheritance tax. It cannot, however, conduct business with residents of the Bahamas.

The annual government license fee must be paid by March 31st of each year to avoid penalties. Companies incorporated in the second half of the year pay a reduced fee for their first year.

No, the names of the shareholders are not on public record, providing a high degree of privacy. While a register of directors and officers must be filed with the Registrar, it is not publicly accessible.

If a company fails to pay its annual fees, it will incur late penalties. If the fees remain unpaid, the Registrar General’s Department will strike the company from the corporate register. Once struck off, the company legally ceases to exist and cannot conduct business.

The Bahamas has strict exchange controls managed by the Central Bank. Domestic companies need permission for many foreign currency transactions. IBCs are generally deemed “non-resident” and exempt, but legal confirmation of this status is important.

Biz Latin Hub can help you with corporate legal services in The Bahamas

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about corporate legal services in The Bahamas, our range of services includes hiring and PEO, accounting and taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or doing business in Latin America and the Caribbean.