For foreign investors looking to enter Latin America and the Caribbean, doing business in Puerto Rico can offer something of a “best of both worlds” in terms of providing many of the benefits that come with a commercial launch in the region, while retaining some of the advantages that investors enjoy at home. If you’re looking at company formation in Puerto Rico, this page will let you know what benefits you can expect. This guide details the primary benefits of the jurisdiction, from its unique tax incentive programs to its stable economic environment, for companies considering market entry.

Key takeaways on doing business in Puerto Rico

| Is foreign ownership allowed in Puerto Rico? | Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). |

| Most important sectors in Puerto Rico | Industry accounts for more than 50% of GDP, while the services sector makes up most of the rest. Pharmaceuticals, medical equipment, computers, and garments are some of the key export goods produced in Puerto Rico, along with fish and rum |

| Are there Free Trade Zones in Puerto Rico? | Yes, all of Puerto Rico’s main ports have sizeable FTZs which offer significant tax incentives for trade with other parts of the United States and elsewhere. |

| Are there incentives for Foreign Direct Investment in Puerto Rico? | Act 60 provides significant tax incentives for export services and manufacturing. |

| What are the main advantages of doing business in Puerto Rico? | The island is a part of the US, meaning the US dollar is the official currency, eliminating exchange risk. There are also significant tax breaks. |

Key Advantages of the Puerto Rican Market

1. Significant Tax Incentives under Act 60

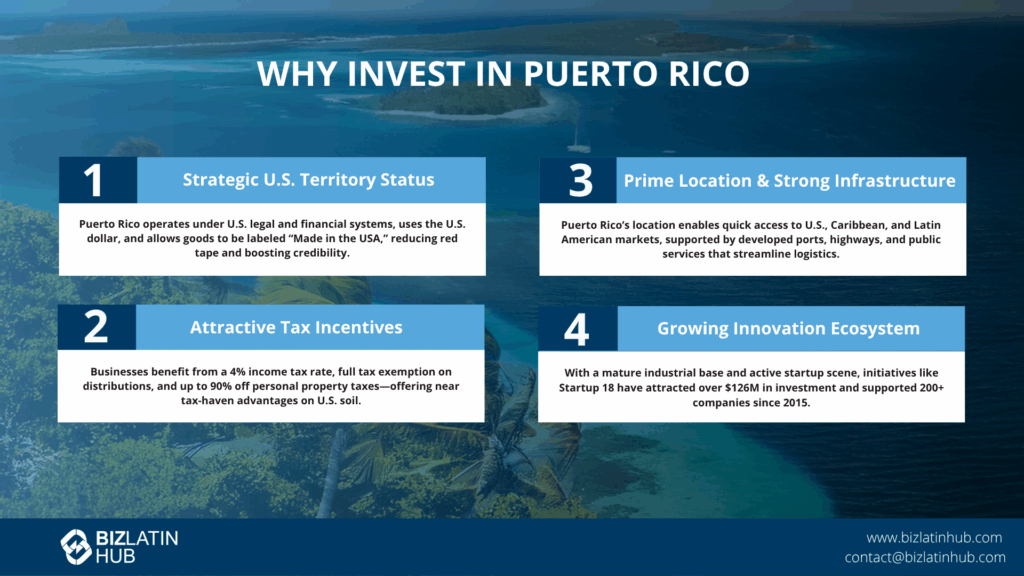

Puerto Rico offers powerful tax incentives, most notably a 4% corporate tax rate for eligible export service and manufacturing companies. This provides a major competitive advantage over operating in mainland US or other high-tax jurisdictions.

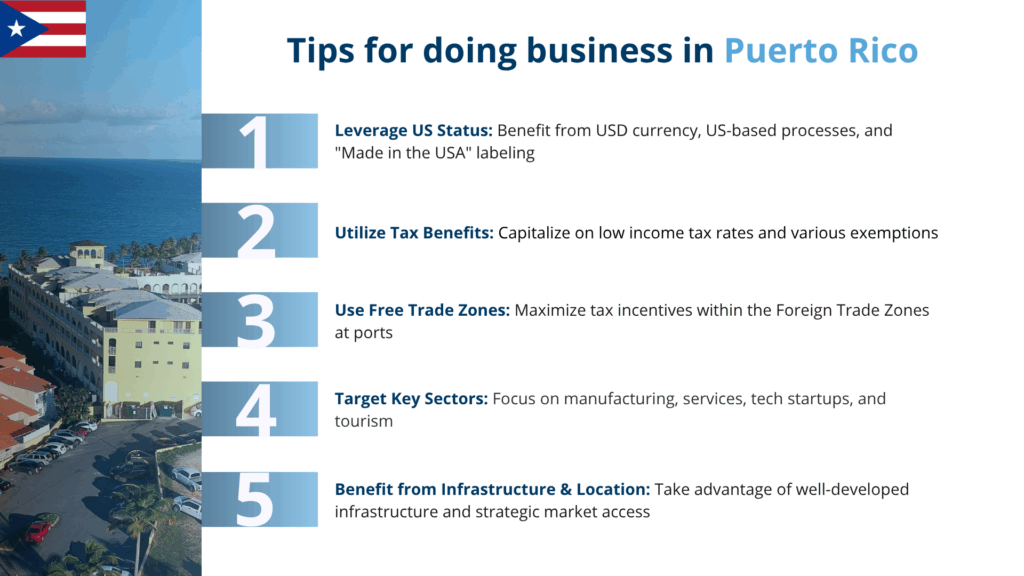

Doing business in Puerto Rico brings with it a range of tax benefits that makes it enticing to investors, including a 4% income tax rate, a 100% tax exemption on distributions from earnings and profits, and a 90% exemption from personal property taxes for some types of businesses.

That makes many goods and services significantly cheaper than they are in the United States or elsewhere, while effectively providing some of the benefits investors seek from a tax haven, while remaining on US soil.

Expert Tip: The Export Services Incentive

From our experience, the most powerful tool within Act 60 for many foreign businesses is the Export Services incentive. This incentive offers a flat 4% corporate tax rate on income derived from services performed in Puerto Rico for clients outside of Puerto Rico. This is ideal for a wide range of businesses, including consulting firms, software developers, and call centers.

To qualify, a business must apply for a tax exemption decree with the Office of Incentives for Businesses in Puerto Rico. We advise clients to work with a local legal and tax expert to navigate the application process and ensure their business activities meet the specific criteria of the incentive.

2. A US Legal and Financial Framework

As a US territory, Puerto Rico operates under the protection of US federal law. Businesses use the US dollar, have access to the US banking system, and are protected by US intellectual property laws, which provides stability and security.

Its status as a US territory provides a number of advantages for doing business in Puerto Rico, beyond the simple fact that having the US dollar as its official currency means significant savings on transferring capital into and out of the country for investors based in the US, or who do significant business in dollars.

Because being a US territory also means official processes are often based on US systems, meaning significantly less red tape than some other countries in the region. While manufacturers benefit from being able to label their goods as “Made in the USA.”

3. A Skilled, Bilingual Workforce

The local workforce is well-educated and fluent in both English and Spanish, making it easy to serve both the US and Latin American markets from a single location.

As well as having a well-established industrial base that is primed for investment, Puerto Rico also boasts a strong startup ecosystem, with the island becoming a hub for innovation over recent years.

Bolstering that ecosystem is a program called Startup 18, an accelerator based in San Juan that has already raised more than $126 million in investment and boosted more than 200 companies since being founded in 2015.

4. Strategic Location and Access

Puerto Rico is strategically located as a bridge between North and South America. It has excellent shipping and air travel infrastructure, providing easy access to key markets.

Situated between the Dominican Republic and the US Virgin Islands, Puerto Rico’s prime location sees it enjoy easy access to markets throughout the Latin America and Caribbean region.

Meanwhile, its strong ties with the United States means that regular flights connect capital San Juan’s Luis Muñoz Marín International Airport to a range of major US cities, with direct flights to Miami lasting less than three hours.

How to Establish a Business Presence

To do business in Puerto Rico, a foreign company will typically establish a local legal entity. The most common structures are the Corporation and the Limited Liability Company (LLC). Both provide limited liability protection and can be 100% foreign-owned. The process involves registering the entity with the Puerto Rico Department of State.

Doing business in Puerto Rico: The Economy

While Puerto Rico retains many of the cultural and economic features commonly associated with Latin America and the Caribbean, its status as a US territory and the strong ties it has with the United States can be favourable to foreign investors, particularly those from the US mainland and Canada, or other English-speaking countries.

The Puerto Rican economy is characterized by significant manufacturing activity, with industry accounting for more than 50% of GDP, while the services sector accounts for most of the rest, with agriculture generating less than 1%.

That economic division is reflected in the territory’s trade profile, with pharmaceuticals, medical equipment, computers, and garments some of the key export goods produced in Puerto Rico, along with fish and rum. In 2018, the total value of exports reached an impressive $60.57 billion.

Call centers are also a growing business activity because of the high level of English proficiency on the island. Puerto Rico is also home to a dynamic startup scene and an increasing pool of tech talent.

For investors looking to take advantage of these growing sectors and incorporate a business in Puerto Rico, the island has three free trade zones (FTZs) — known as foreign trade zones in the United States and its territories — that offer lucrative financial incentives to businesses located within their boundaries. Beyond the FTZs, the island also has a huge tourism sector that draws significant overseas investment.

The vast majority of Puerto Rico’s foreign trade is with the mainland United States, but US participation in a range of free trade agreements, offers businesses based in Puerto Rico preferential access to a large number of markets around the region. Nevertheless, the economy relies heavily on the United States, and receives several forms of federal economic aid.

Puerto Rico has seen a significant increase in interest from international investors over recent years, accompanied by a rise in foreign direct investment (FDI), particularly from the likes of Canada, Germany, Mexico, and Spain. The most popular sectors for investment include the telecommunications industry, software and IT services, food and beverages, and manufacturing.

FAQs on doing business in Puerto Rico

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Puerto Rico?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Puerto Rico?

| Yes, all of Puerto Rico’s main ports have sizeable FTZs which offer significant tax incentives for trade with other parts of the United States and elsewhere. |

3. How long does it take to register a company in Puerto Rico?

Registering a company in Puerto Rico takes 4 weeks.

4. Which sectors are important in Puerto Rico?

Industry accounts for more than 50% of GDP, while the services sector makes up most of the rest. Pharmaceuticals, medical equipment, computers, and garments are some of the key export goods produced in Puerto Rico, along with fish and rum

5. Does Puerto Rico have trade agreements with other countries?

The vast majority of Puerto Rico’s foreign trade is with the mainland United States, but US participation in a range of free trade agreements, offers businesses based in Puerto Rico preferential access to a large number of markets around the region.

6. What entity types offer Limited Liability in Puerto Rico?

In Puerto Rico, the S.R.L (Sociedad de Responsabilidad Limitada) is the limited liability company.

7. What is Act 60?

Act 60, also known as the Puerto Rico Incentives Code, is a law that consolidates over 50 previous tax incentive programs into one. It offers significant tax benefits to businesses and individuals who relocate to or establish operations in Puerto Rico, particularly in the export services, manufacturing, and technology sectors.

8. What is Puerto Rico’s relationship with the United States?

| Puerto Rico is a US territory. This means it is subject to US federal law, its residents are US citizens, and its currency is the US dollar. However, for most tax purposes, it is treated as a foreign jurisdiction, which allows it to offer its own unique tax incentives. |

9. Is the workforce in Puerto Rico skilled?

Yes, Puerto Rico has a highly skilled and educated workforce, particularly in the fields of engineering, manufacturing (especially medical devices and pharmaceuticals), and professional services. The workforce is largely bilingual in English and Spanish.

10. What is the corporate tax rate for businesses that do not qualify for incentives?

For businesses that do not qualify for Act 60 or other incentives, the corporate income tax system is progressive and can reach a maximum rate of 37.5%.

Biz Latin Hub can help you doing business in Puerto Rico

At Biz Latin Hub, our multilingual team of company formation specialists is equipped to help you doing business in Puerto Rico.

With our complete portfolio of back-office solutions, including legal, accounting, and hiring & PEO services, we can be your single point of contact for entering the market and operating in Puerto Rico, or any of the 17 countries around Latin America and the Caribbean where we are present.

Contact us now to get a free quote.

Or learn more about our team and expert authors.