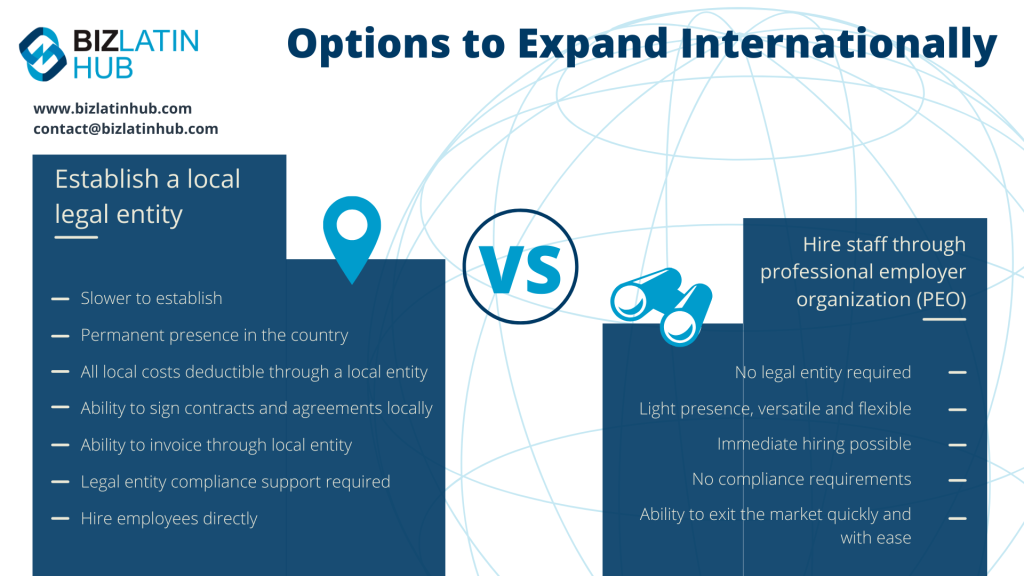

If you are interested in doing business in Puerto Rico, but are only planning a short-term or limited-scale operation, or would like to get to know the market better before making a larger commitment, you may find that hiring staff via a professional employer organization, or PEO in Puerto Rico is your best option. TFor non-US investors, that is particularly appealing because it means they can work in the local market before company formation in Puerto Rico.

Key takeaways on using a PEO in Puerto Rico

| What are the benefits of hiring through an PEO in Puerto Rico? | Hiring through a PEO in Puerto Rico provides quick access to the market without the need to establish a local entity, letting you focus on scaling-up. |

| Is it legal to hire in Puerto Rico through PEO services? | It is Fully legal to work with PEO Providors in Puerto Rico. |

| Steps to hire through a PEO in Puerto Rico | Sign an agreement with the third-party provider (PEO). Confirm the employment offer for the candidate. Share the employment offer with the candidate. Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record. The candidate reviews and signs the employment contract. The PEO completes all mandatory employee registrations in Puerto Rico. The employee starts work and reports to the hiring foreign company. |

| What are the working hours in Puerto Rico? | 48 hours weekly |

| What is the minimum monthly wage covered by a PEO in Puerto Rico? | The minimum salary in Puerto Rico is USD$10.50/hr. Workers in Puerto Rico are entitled to be paid the higher state minimum wage. |

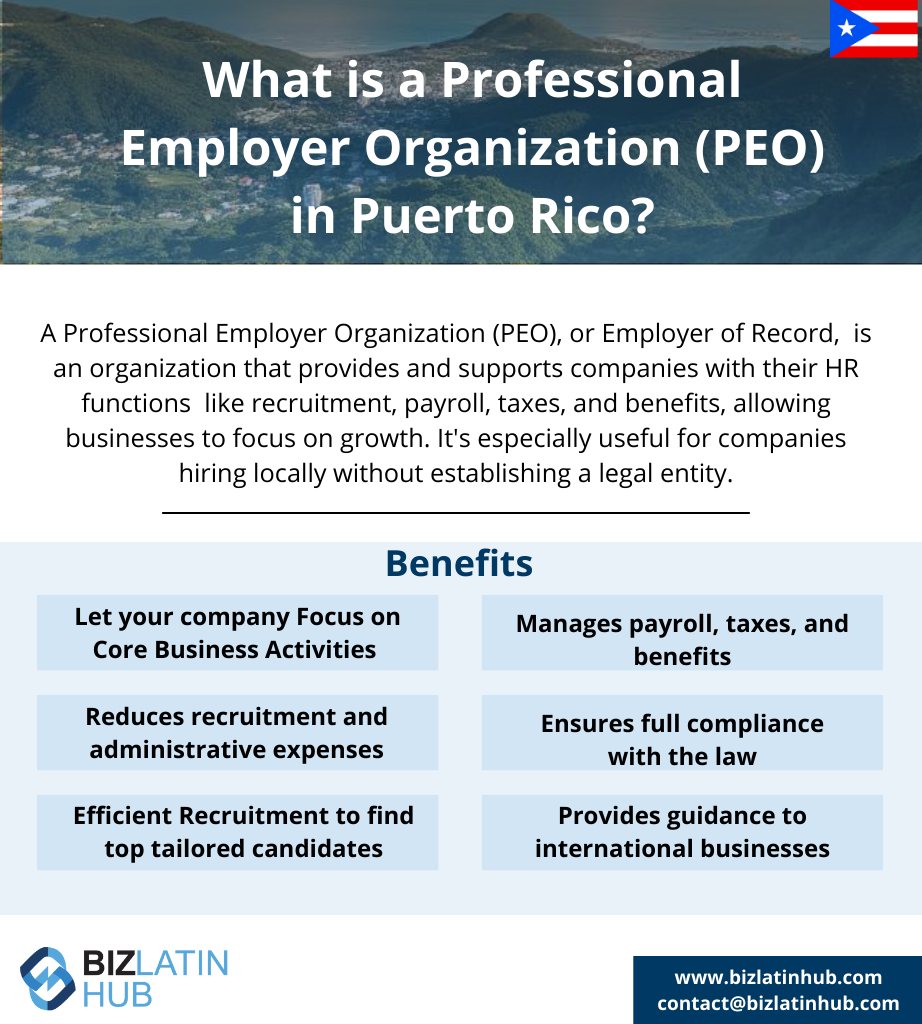

What is a PEO in Puerto Rico?

A PEO in Puerto Rico (professional employer organization) is a third-party organization that provides comprehensive HR (human resources) services to businesses. PEOs act as co-employers, sharing employer responsibilities with the client company.

They handle various HR functions, including payroll, benefits administration, employee onboarding and offboarding, compliance with employment laws, risk management, and other administrative tasks.

When a company partners with a PEO in Puerto Rico, they enter into a co-employment relationship. This means that the PEO takes on certain employment responsibilities, such as payroll processing and tax filing, while the client company retains control over day-to-day operations and retains ownership of the business.

One of the key advantages of partnering with a PEO is that it allows small and medium-sized businesses to access cost-effective HR services and expertise that they might not have in-house. PEOs often leverage their purchasing power to offer competitive employee benefits packages, which can help attract and retain talented employees.

Additionally, a PEO in Puerto Rico can provide guidance on compliance with employment laws and regulations, which can be complex and time-consuming for businesses to navigate on their own.

In summary, a PEO is a professional organization that helps businesses outsource and streamline their HR functions, enabling them to focus on their core operations while ensuring compliance and providing comprehensive HR support.

Why use a PEO in Puerto Rico?

One of the advantages of hiring through a PEO in Puerto Rico is cost savings. The fees you pay the PEO firm are typically much lower than the expenses involved in forming a company, hiring staff, and managing payroll and compliance obligations.

Avoiding company formation also brings time savings. With a PEO in Puerto Rico, you can quickly find suitable candidates and hire them without the need to establish a legal entity. It takes only a few days after signing the services agreement.

Another advantage of hiring through a PEO in Puerto Rico is the limited commitment it entails. If you choose to discontinue operations, you can swiftly exit the market by offboarding outsourced employees, without the need for company liquidation.

Hiring through a PEO in Puerto Rico provides access to local knowledge and a better understanding of the market, regulatory requirements, and business culture. This allows you to make informed decisions before making a deeper commitment.

Additionally, your PEO in Puerto Rico will have an established recruitment network to assist in finding suitable staff. Moreover, they will have strong connections within the local business community, which can provide additional benefits to your business.

Finally, by signing a service agreement with a PEO in Puerto Rico, you can enjoy the guarantee of compliance with all local regulations and norms. This ensures that your business remains in good standing with local authorities, giving you peace of mind.

What does a PEO in Puerto Rico do?

Managing and ensuring compliance of the legal requirements that come with hiring employees in Puerto Rico is a big part of the responsibility of a PEO. As part of the guaranteed compliance that your PEO in Puerto Rico will provide, some of the legal requirements it will take care of include:

- Drawing up and registering signed employee contracts.

- Managing all aspects of payroll, including paying salaries in a timely manner.

- Adhering to standard daily and weekly working hours as agreed.

- Honoring all national holidays celebrated in Puerto Rico.

- Honoring sick and other personal leave entitlements.

- Meeting statutory employee and employer contributions for social security.

How to Partner With an Professional Employer Organization in Puerto Rico?

To partner with a PEO, the hiring company enters into an agreement with a third-party organization, designating them as the professional employer of record (EOR) for the employees they wish to hire in Puerto Rico. This arrangement ensures that the third-party organization (the PEO/EOR) is legally responsible for meeting all employment regulations for the staff, as reflected in official documentation in Puerto Rico.

This partnership eliminates the need for the foreign company to navigate the complexities of Puerto Rico’s labor laws independently. By reducing the risks associated with non-compliance, the foreign company can focus its resources on business growth and market expansion within the region.

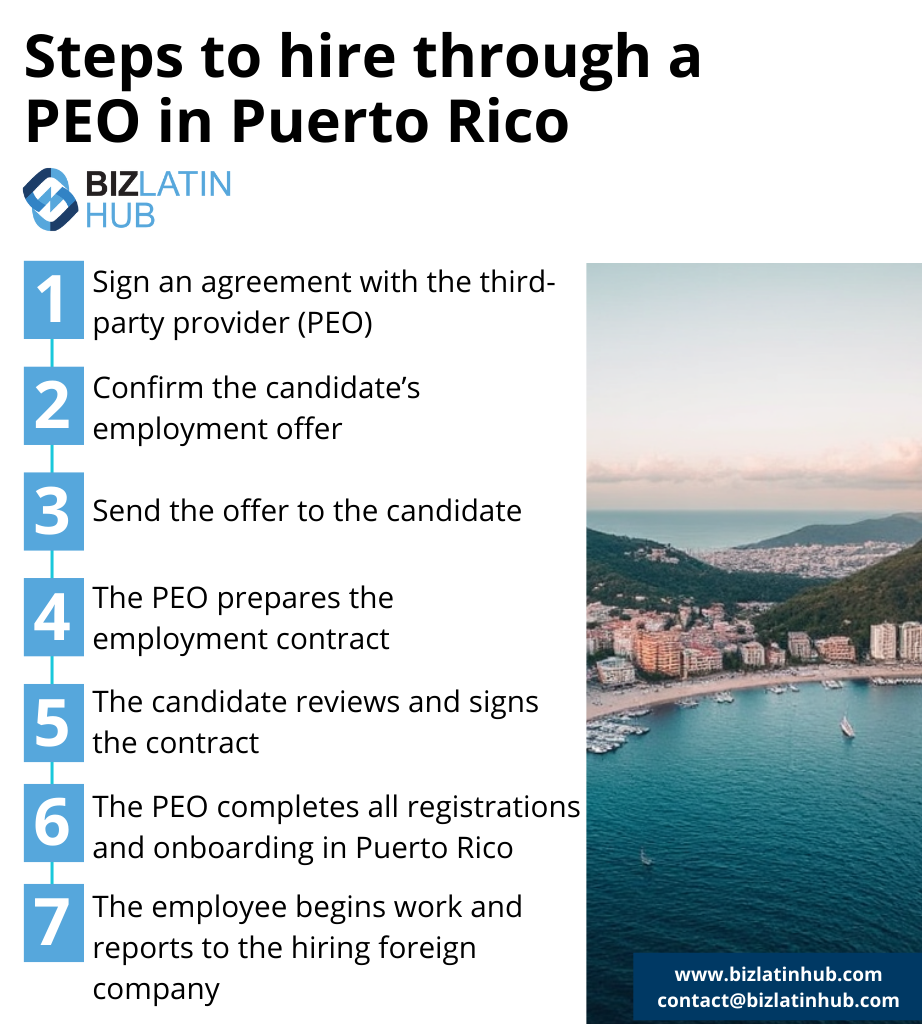

The process of hiring an employee through an Professional Employer Organization in Puerto Rico is straightforward. Below is an outline of the steps involved:

- Sign an agreement with the third-party provider (PEO).

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record.

- The candidate reviews and signs the employment contract.

- The PEO completes all mandatory employee registrations in Puerto Rico.

- The employee starts work and reports to the hiring foreign company.

What Labor Laws Will a PEO in Puerto Rico cover?

For employers in Puerto Rico, unique challenges arise compared to other U.S. regions, as local authorities prioritize employee rights. Dismissing an employee demands substantial evidence of just cause to avoid the risk of providing substantial compensation, known as “una mesada,” which can resemble an enhanced severance package. This encompasses a minimum of two months’ salary along with additional compensation based on their service duration.

Vacation time: In Puerto Rico, employees receive 15 days of annual leave. Upon completing a minimum of one hundred and thirty (130) hours of work each month, every employee becomes eligible for vacation leave accrual. The rate of vacation leave accrual varies: starting with one-half (1/2) day in the initial year of service, increasing to three-fourths (3/4) of a day from the second to fifth (5) years of service, reaching one (1) day after the fifth year up to the fifteenth (15) year of service, and culminating at one and one-fourth (1 1/4) days after the fifteenth (15) year of service.

Employee Probation Period: The probationary period occurs automatically without requiring a written agreement. It lasts for a duration of up to nine (9) months for non-exempt employees and can be extended to twelve (12) months for exempt employees, including executives, administrators, and professionals as defined by relevant regulations.

Working Hours: In Puerto Rico, a standard workday consists of eight hours, while a regular workweek comprises forty hours.

Overtime in Puerto Rico: If your earnings surpass the minimum wage in Puerto Rico, you have the right to receive a minimum of 1.5 times your standard hourly wage for any overtime hours worked. In Puerto Rico, a unique overtime rate is set at twice the regular hourly wage for any hours worked exceeding 8 in a day or 40 in a week.

Sick Leave: For eligibility to accrue sick leave, employees are obliged to complete a minimum of 130 working hours per month. This translates to an approximate daily average of just under 6.5 hours or around 32.5 hours per week. Workers who meet this hourly threshold are entitled to earn one day of paid sick leave for each month of employment. Importantly, sick leave utilization contributes to the fulfillment of the 130-hour minimum requirement for subsequent months’ sick leave accrual.

Maternity Leave: According to Act No. 3, a pregnant employee typically has the right to take a maternity leave lasting eight (8) weeks. To initiate this leave, the employee needs to provide a medical certificate confirming her pregnancy and the anticipated childbirth date. The maternity leave is divided into two parts: a four (4) week prenatal leave and a four (4) week postnatal leave.

PEO vs. EOR in Peru – What’s the Difference?

When expanding into Peru, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Peru, with all employment laws of Peru applying to employees hired through this means.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Peru. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate Peru’s regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

How to use a payroll calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Puerto Rico, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Puerto Rico would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on using a PEO in Puerto Rico

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an EOR or PEO in Puerto Rico:

You can hire someone in Puerto Rico by either setting up your own legal entity in the country and using it for recruitment, or by utilizing the services of an employer of record (EOR) or PEO in Puerto Rico. These are third-party entities that allow you to employ individuals in the country while they act as the official employer before the law. When using an EOR or PEO in Puerto Rico, you do not need a local entity to hire employees.

A standard employment contract in Puerto Rico should be written in Spanish (and can also be in English) and outline the terms and conditions of employment to establish a clear understanding between the employer and the employee. Some elements that are typically included in a standard employment contract in Puerto Rico are:

– Parties to the contract.

– Position and responsibilities.

– Employment status.

– Work schedule.

– Compensation.

– Benefits.

– Probationary period.

– Termination clause.

– Confidentiality and non-compete clauses.

– Intellectual property.

– Code of conduct and policies.

– Governing law and Jurisdiction.

The mandatory employment benefits in Puerto Rico are the following:

-Paid Time Off (PTO)

-Meal and Rest Breaks

-Workers’ Compensation

-Unemployment Benefits

-Disability Benefits

-Parental and Maternity Leave

The total cost for an employer to hire an employee in Puerto Rico varies depending on the salary. However, as an indication, the employer cost for mandatory employment benefits is approximately 12.2% on top of the employee’s salary.

Please use our Payroll Calculator to calculate employment costs.

When working with an employer of record (EOR), the contractual handling of the employment relationship is crucial. The EOR serves as the legal employer and needs a contract with the worker, which may or may not include your company. The agreement must be compliant with the law and aligned with your company’s practices across all locations the EOR supports.

Contracts vary across territories. Some have detailed tripartite agreements, clearly defining responsibilities, with the EOR handling payments, taxes, and local matters, while you retain policy control. Benefits and statutory requirements should be discussed. When choosing an EOR, examine their template agreements for consistency and consider how they ensure uniformity while complying with local practices.

You do need to ensure that the EOR can provide its services in Puerto Rico. It is also worth checking which other countries they operate in. Not all providers have global advisory services. Hiring one with such services eliminates the need for multiple consultants to manage compliance in all your countries of operation.

Biz Latin Hub can be your PEO in Puerto Rico

At Biz Latin Hub, we can provide the high-quality hiring & PEO services you need to find the right staff and get to work in Puerto Rico in the shortest time possible.

With our comprehensive portfolio of back-office solutions, including legal, accounting, and company formation services, we can be your single point of contact for entering the market and operating in Puerto Rico, or any of the 17 countries around Latin America and the Caribbean where we have local teams in place.

Contact us now for personalized assistance or a free quote.

Learn more about our team of expert authors.