Understanding employment & labor law in Jamaica is essential for companies hiring locally. This guide outlines key legal obligations under the Labor Relations and Industrial Disputes Act, including employment contracts, working hours, severance pay, and social security contributions. If you want to register a company in Jamaica, this guide will make sure you stay compliant.

Key Takeaways on Employment & Labor Law in Jamaica

| What are the working hours in Jamaica? | The standard working week in Jamaica is 40 hours, with a schedule of 8 hours per day, not including overtime. |

| What is the Jamaican minimum wage? | The current minimum wage as of June 2025 is J$16,000 per week (approx USD $100/week). |

| Types of Employment Contracts in Jamaica | The 2 most common types of contracts in Jamaica are: Fixed-Term Indefinite-term |

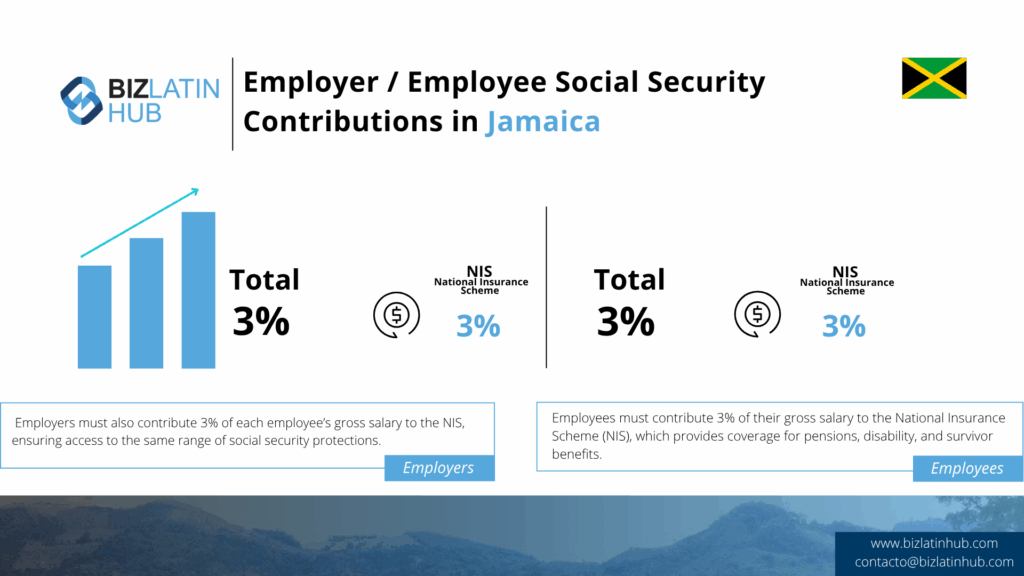

| What percentage of an employee’s salary is contributed to national insurance in Jamaica? | Employees and employers contribute at a rate of 3% (each). |

Types of Employment Contracts in Jamaica

Employment contracts in Jamaica can be oral or written but it is best advised to put a written contract in place, in English, which includes the employee’s salary in Jamaican dollars, benefits and termination requirements.

Fixed-Term Contracts

Lasting for a period of specific amount of time, a fixed-term contract allows a particular project to be completed and is often used for temporary needs. It must clearly state the start and end dates or the conditions for completion.

Indefinite-Term Contracts

This contract is the standard for ongoing positions with no predetermined end date. The contract will only end when both the employer and employee come to a mutual agreement, or when one of the parties has the right to act unilaterally, such as an employee resigning or an employer firing them for misconduct.

Work Hours & Overtime

Under employment & labor law in Jamaica in Jamaica, a standard working week is 40 hours, with an employee able to work 12 hours in a 24 hour period. After 5 hours of continuous work, an employee is entitled to 1 hour of rest. All days of the week are considered working days in Jamaica.

After 40 hours, the employee is entitled to overtime pay at 150%. Work on rest days or public holidays is paid at a rate of 200%.

Paid Leave and Public Holidays

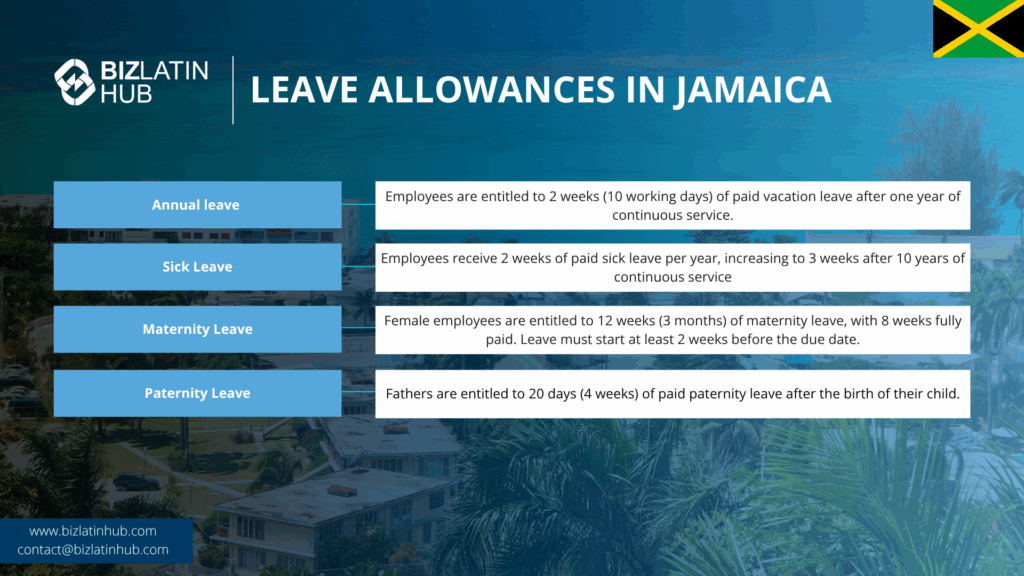

After one full year of service with the same employer, employees are entitled to 2 weeks (10 working days) of paid vacation leave. If an employee has been working for the same company for more than 10 consecutive years, this rises to 3 weeks.

Employees are granted 2 weeks of sick leave per year, but it rises to 3 weeks for those with over 10 years of continuous service.

Maternity & Paternity Leave

Female employees are entitled to 12 weeks (3 months) of maternity leave, with 8 weeks paid at the full salary rate. It must commence at least 2 weeks before the due date. Fathers are granted 20 days (4 weeks) of paid paternity leave after the birth of their child.

Employers are required to contribute 3.0% of an employee’s gross salary to the National Insurance Scheme (NIS), which provides employees with benefits such as retirement pensions, disability and survivor benefits. The employee’s contribution rate is 3.0% of gross earnings.

Providing health insurance is not a mandatory requirement but can be offered as an additional benefit.

Termination of Employment and Severance Pay

The amount of notice for termination depends on the length of employment;

- Less than 5 years of employment entitles workers to 2 weeks’ notice

- 5-10 years of service entitles workers to four weeks’ notice

- 10-15 years of service entitles workers to 6 weeks’ notice

- 15-20 years of service workers to 8 weeks’ notice

- 20 + years of service workers to 12 weeks’ notice

Severance pay is only given in cases of redundancy, and not other types of contract termination. The amount to pay is calculated at 2 weeks’ pay per year for the first 10 years of service, and then increases to 3 weeks pay per year thereafter. To qualify for the payment, the employee must have been working at the company for at least 2 calendar years continuously.

Common FAQs about Employment Law in Jamaica

In Jamaica, labor laws dictate a 40-hour workweek, overtime regulations, minimum wage, paid vacations, sick leave, maternity and paternity leave, workplace safety, and union rights.

Working conditions in Jamaica include a 40-hour workweek, paid vacation, and social security benefits.

The standard working week in Jamaica is an 8 hour working day, from Monday to Friday, in total 40-hours a week. Overtime must be paid for excess hours.

As of June 2025, Jamaica’s minimum wage is J$16,000, approximately USD $100/week.

Overtime is paid at 150% of the regular wage. Work on rest days and public holidays is paid at 200%.

The amount of severance pay is calculated at 2 weeks’ pay per year for the first 10 years of service, and then increases to 3 weeks pay per year thereafter.

Employees who have worked for at least 4 weeks need to provide the employer with 2 weeks’ notice to cancel the contract.

No, oral contracts can be legally binding but it is best practice to have a written contract in place for clarity and enforceability.

No, Companies must set up a legal entity or use an Employer of Record (EOR) to legally hire and pay Jamaican employees.

At Biz Latin Hub, our multilingual team of corporate support specialists has the knowledge and expertise to support you in doing business in Jamaica. Our comprehensive portfolio of services, including company formation, accounting, tax advisory, and hiring & PEO, means we can provide tailored packages of integrated back-office solutions and be your single point of contact for doing business in Jamaica, or any of the other markets around Latin America and the Caribbean where we have local teams in place.

Contact us now to discuss how we can support your business.

Or learn more about our team and expert authors.