The Bahamas is a globally recognized offshore financial center offering tax-neutral structuring, robust privacy laws, and a pro-business legal system. However, company formation in the Bahamas means staying aligned with local laws, international compliance standards, and evolving regulations. That’s where an Entity Health Check becomes essential. Whether you’re managing a domestic company or an international business company (IBC), a health check helps ensure your business is compliant, up to date, and positioned for long-term success.

Key Takeaways on entity health checks in the Bahamas

| Verifies annual filings and Registry status | Prevents penalties, late fees, and potential strike-off |

| Checks accuracy of financial records and statutory registers | Ensures good governance and readiness for audits |

| Assesses compliance with Beneficial Ownership and Economic Substance rules | Avoids regulatory breaches and satisfies international standards |

| Confirms payment of renewal fees and licence obligations | Maintains good standing and uninterrupted business operation |

| Validates directorship and officer records | Reduces legal risk and ensures Registry alignment |

1. Compliance with Registrar and Annual Return Requirements

All companies incorporated in The Bahamas—whether under the Companies Act or the International Business Companies (IBC) Act—must file annual returns and pay renewal fees with the Registrar General’s Department. Failure to file can result in:

- Late fees

- Loss of good standing

- Strike-off or dissolution

A health check confirms whether your company is active on the public register and whether any outstanding filings or payments are due. For IBCs, which are commonly used for offshore structuring, the deadline is typically tied to the anniversary of incorporation.

2. Accounting Records, Corporate Registers, and Meeting Minutes

While The Bahamas does not impose corporate income taxes, businesses are still required by law to maintain proper accounting records and statutory registers, including:

- Register of members and directors

- Accounting books (held in The Bahamas or another jurisdiction)

- Minutes of shareholder and director meetings

Under the IBC Act (2020 Revision), failure to maintain records could expose the company to fines or prevent proper due diligence processes.

An entity health check ensures that:

- Your accounting and statutory records exist and are properly maintained

- Corporate governance documentation is up to date and audit-ready

3. Beneficial Ownership and Economic Substance Compliance

Since the introduction of the Register of Beneficial Ownership Act, most Bahamas IBCs must file beneficial ownership information with the Competent Authority (typically the Attorney General’s Office), unless specifically exempted. Fines and sanctions may apply for non-compliance.

Additionally, companies conducting relevant activities—like banking, insurance, fund management, and headquarters operations—must comply with the Commercial Entities (Substance Requirements) Act, which requires:

- Demonstrating economic presence in The Bahamas

- Filing annual substance reports

A health check confirms whether your business is properly classified and compliant with these international transparency standards.

4. Payment of Fees and Regulatory Licence Renewals

In The Bahamas, both domestic companies and IBCs are subject to annual government renewal fees. For companies involved in regulated activities—like securities, trust services, or digital assets—there are also specific licensing and reporting obligations under the Securities Commission, Central Bank, or Digital Assets and Registered Exchanges (DARE) Act.

Missing these renewals or failing to submit updated information can lead to:

- Revocation of licences

- Regulatory sanctions

- Disqualification from regulated markets

Health checks make sure your entity is up to date with all required financial and compliance filings.

5. Corporate Governance and Director Compliance

It’s essential that your directors, officers, and beneficial owners are properly appointed and recorded with the Registry. Changes to company structure, ownership, or board composition must be reported promptly.

Inaccuracies or unreported changes can lead to:

- Fines

- Legal disputes

- Delays during audits or regulatory reviews

An entity health check will verify whether:

- All appointments and resignations have been filed

- The company has an accurate register of directors and officers

- Governance procedures match legal requirements

Final Thoughts

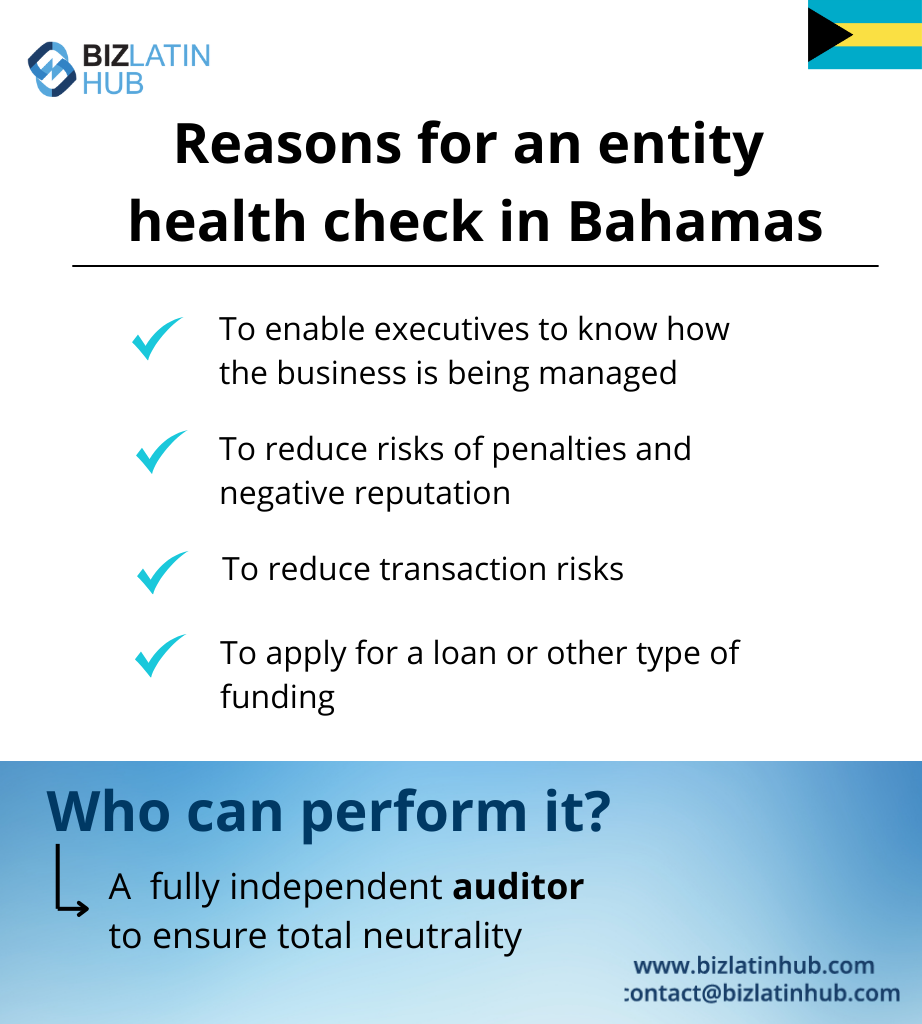

The Bahamas offers a powerful and flexible jurisdiction for doing business, but with that comes the responsibility to stay compliant. Whether you operate an IBC or a locally licensed firm, a regular Entity Health Check ensures your company remains active, compliant, and ready for growth.

Staying ahead of filing deadlines, beneficial ownership regulations, and economic substance rules will help preserve your company’s standing—and avoid costly penalties or delays in future transactions.

Frequently Asked Questions on Entity Health Checks in the Bahamas

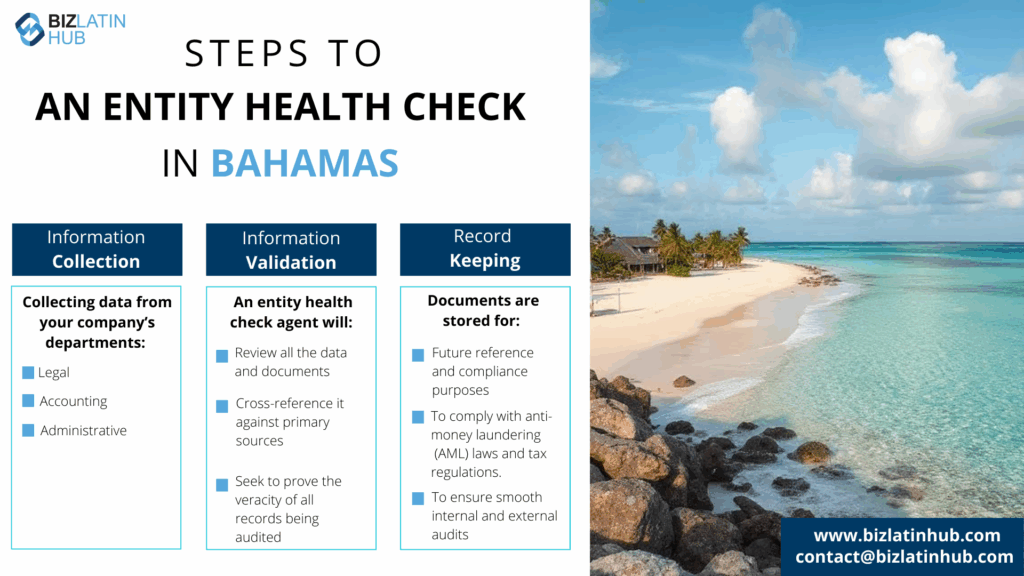

It’s a structured compliance review for your Bahamas company. It assesses filings, financial records, corporate governance, beneficial ownership obligations, and regulatory requirements—ensuring your company meets all legal standards.

Typically, it takes between a few days and two weeks, depending on the complexity of the business and how readily available records are.

Late annual filings, outdated registers, unreported director changes, unpaid fees, missing beneficial ownership filings, or non-compliance with economic substance rules.

Yes. Identifying issues early can prevent late filing fees, regulatory breaches, or company strike-off—potentially saving thousands of dollars.

A licensed corporate services provider, legal advisor, or accountant familiar with Bahamas corporate regulations and international compliance standards.

No, but it’s highly recommended, especially for companies in international trade, financial services, or regulated sectors.

Absolutely. It ensures your entity is clean, compliant, and due diligence-ready for banks, regulators, or investors.

At least once a year, or whenever there’s a major corporate event—like a change in ownership, a merger, or a license renewal.

Biz Latin Hub can help you with an entity health check in the Bahamas

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.