For companies operating in the country or considering company formation in Belize, conducting regular Entity Health Checks is essential to remain compliant with local laws and guard against regulatory, financial, and reputational risks. A health check is a detailed audit that helps maintain good standing with Belizean authorities and ensures your business is prepared for any regulatory changes.

Key takeaways on an entity health check in Belize

| What is a corporate entity health check? | A systematic review of a company’s legal, tax, and regulatory compliance status. |

| Which authorities will a health check look at? | Key agencies include the Companies and Corporate Affairs Registry (BCCAR) via the Online Business Registry System (OBRS), the Financial Intelligence Unit (FIU) under the Money Laundering and Terrorism (Prevention) Act (MLTPA), the Central Bank of Belize, and the Financial Services Commission (FSC). |

| What are the key areas reviewed for a Belizean company? | Corporate filings and statutory records, tax and accounting compliance, AML/CFT obligations (including beneficial ownership), and sector-specific regulatory duties. |

| Why is a health check vital for good corporate governance? | It enables early detection of compliance gaps—such as missing annual returns, unresolved financial exposures, or inadequate AML frameworks—and helps you address them before regulators take action. |

The Importance of a Corporate Health Check in Belize

An Entity Health Check is a holistic assessment of your company’s statutory and operational records in Belize. It identifies issues like missing filings, outdated beneficial ownership data, or poorly maintained financial records that could lead to penalties, administrative complications, or reputational harm if left unaddressed.

Directors or managers may not always be fully aware of evolving regulatory requirements—especially amid recent legislative reforms like the Belize Companies Act, 2022 and its push for digitization and transparency.

Main Areas of a Belizean Entity Health Check

1. Corporate and Statutory Records Review (BCCAR / OBRS)

- Confirm proper incorporation and adherence to the Belize Companies Act, 2022.

- Verify annual returns have been filed via OBRS, including re-registration for older entities.

- Ensure any changes—such as amendments to directors, registered agents, or capital—are accurately recorded.

- Check issuance of Good Standing certificates and other extracts where required.

2. Tax & Accounting Compliance

- Ensure annual tax returns are filed with the Belize Tax Service Department by March 31, and financial statements (possibly audited under IFRS) are maintained.

- Confirm accounting records are stored for at least five years, as mandated by law, and that backups are maintained appropriately.

3. AML/CFT and Beneficial Ownership Compliance

- Review compliance with the Money Laundering & Terrorism (Prevention) Act (MLTPA) and recent amendments strengthening AML/CFT obligations.

- Ensure reporting entities—including financial institutions and DNFBPs—adhere to customer due diligence, recordkeeping, and reporting requirements.

- Verify functional operation of the National Anti-Money Laundering Committee (NAMLC) and coordination among supervisory authorities—Central Bank, FSC, FIU—under the Group of Supervisors framework.

- Confirm beneficial ownership details are up-to-date and support transparency, especially following regulatory changes under the new Companies Act.

4. Ongoing Monitoring & Sector-Specific Oversight

- For regulated sectors such as banking, financial services, or insurance, check compliance with oversight from the Central Bank, FSC, or other relevant bodies.

- Also ensure licensing, renewals, and specialized filings (e.g., mergers, changes in share capital) are current.

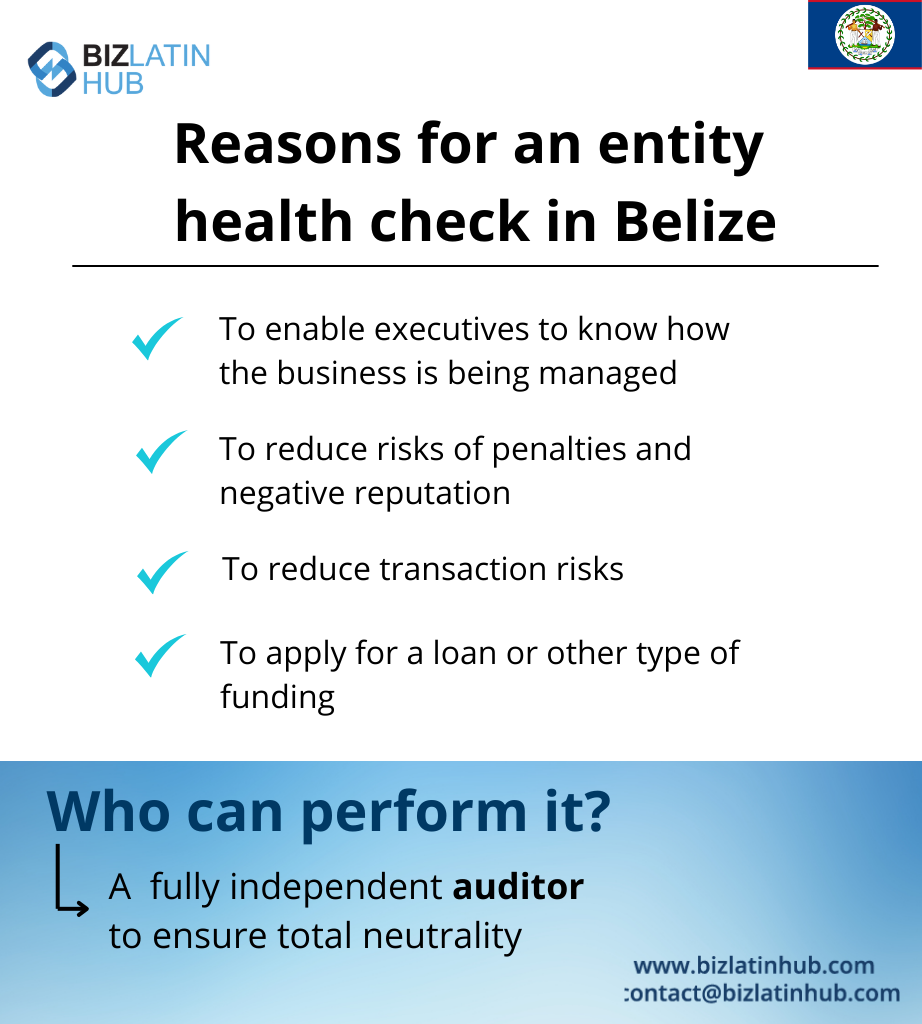

When should I get an Entity Health Check for my company?

Health checks are especially prudent:

- Before mergers, acquisitions, or restructuring, to uncover and resolve liabilities.

- When preparing for funding or financing, as lenders and investors often require proof of compliance.

- Ahead of key filing deadlines or annual planning cycles, to prevent lapses or late penalties.

- After legislative changes, such as the Companies Act, 2022, or new AML/CFT regulations.

Corporate Compliance in Belize

Key compliance dimensions include:

- Corporate governance and statutory documentation: properly filed minute books, updated shareholder and director records, agent changes, and other legal documents.

- Fiscal and accounting discipline: timely tax returns, well-maintained accounting books, and adherence to retention requirements.

- Anti‑money laundering, reporting, and beneficial ownership clarity: conformity with MLTPA, effective KYC procedures, and accurate beneficial ownership disclosures.

- Sector-specific regulation: compliance with industry-specific oversight—especially for financial institutions, insurance entities, or other regulated sectors.

Legal Compliance Requirements

Ensure your entity:

- Is properly incorporated under the Companies Act, 2022, through OBRS, with required filings and re-registrations completed.

- Maintains up-to-date records for changes in shareholding, directors, company name, or registered agent.

- Has formal documentation for corporate decisions, licenses, and powers of attorney in place and accurately registered.

Fiscal Compliance Requirements

- File tax returns and financial statements (where applicable) with the Tax Service Department by March 31.

- Retain accounting records for at least five years to avoid penalties—up to BZD$100,000 for non-compliance.

Frequently Asked Questions: Entity Health Check in Belize

To identify and rectify gaps (such as late filings, incomplete ownership data, or AML deficiencies) before they incur fines, legal action, or damage your reputation.

To showcase governance strength and regulatory compliance to banks, investors, or partners.

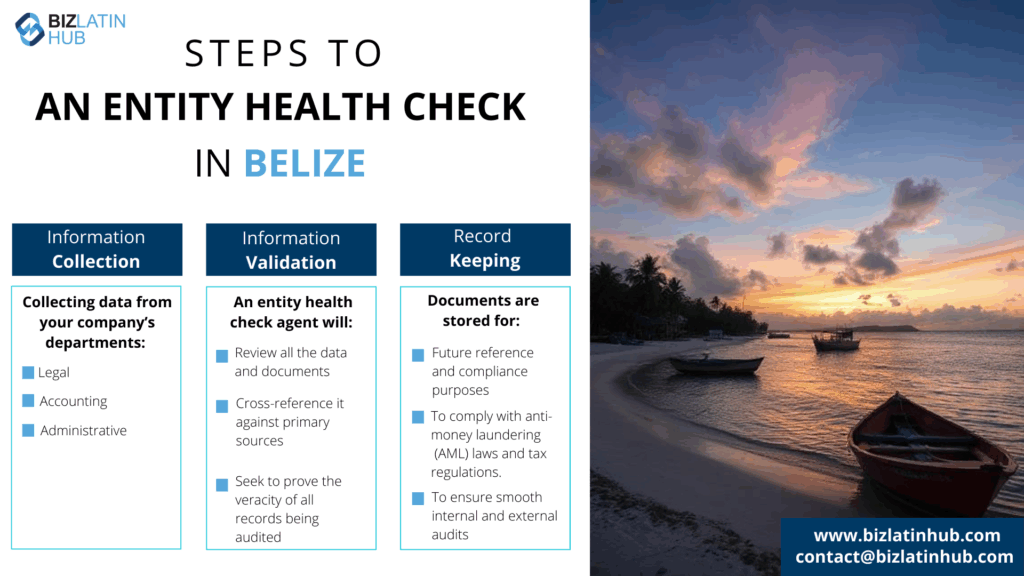

Information collection: Gather all corporate, legal, financial, and compliance documents.

Validation: Cross-check filings with BCCAR/OBRS, Tax Authority, FIU, and sector regulators.

Documentation: Record assessments and remediation actions for audit trails and future reference.

A thorough review of incorporation status, filing history, statutory compliance, tax and accounting records, AML/CFT controls, and beneficial ownership disclosure.

Trusted local compliance professionals—such as law firms, corporate service providers, registered agents, or audit and due-diligence specialists experienced in Belize’s legal and regulatory landscape.

Biz Latin Hub can help you with an entity health check in Belize

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.