For companies already operating in the country or considering company formation in Guyana, regular Entity Health Checks are critical to ensure compliance with local laws and safeguard against legal, financial, and reputational risks. A health check serves as comprehensive due diligence, helping entities stay in good standing with authorities and remain resilient amid evolving regulatory demands.

Key takeaways on an Entity Health Check in Guyana

| What is an entity health check? | A thorough and complete audit of a company’s legal, fiscal, and operational compliance. |

| Which authorities will be reviewed? | Focus areas include the Deeds and Commercial Registries Authority (DCRA) for incorporation, Guyana Revenue Authority (GRA) for taxes, and relevant supervisory bodies (e.g., Financial Intelligence Unit via AML/CFT frameworks). |

| What are the main areas reviewed? | Legal & statutory filings, tax and financial compliance, AML/CFT and beneficial ownership, and—where relevant—sector-specific regulations. |

| Why is a health check vital? | It enables problem resolution before escalation and demonstrates robust governance to stakeholders and investors. |

The Importance of a Corporate Health Check in Guyana

A company health check is a complete assessment of your entity’s statutory records and fulfillment of regulatory obligations. It identifies shortcomings—whether unfiled annual returns, incomplete beneficial ownership declarations, or non‑compliance with AML/CFT—that could lead to administrative or legal sanctions if not addressed.

These checks are especially useful where directors or managers may not fully grasp the evolving compliance landscape in Guyana. Engaging external experts helps guarantee an accurate and current evaluation.

Main Areas of a Guyanese Entity Health Check

1. Corporate and Statutory Records Review (DCRA)

- Verify company incorporation documents and ensure filings such as annual returns and financial statements are current.

- Confirm that beneficial ownership declarations, as required under AML/CFT rules, are properly submitted.

- Review notices of defaults, voluntary or involuntary winding up procedures, and any restorations for compliance issues

2. Tax Compliance (GRA)

- Examine timely submission of income tax, withholding, VAT, and other statutory obligations.

- Review documentation supporting tax filings and assess any outstanding liabilities with the Guyana Revenue Authority.

3. AML/CFT Compliance & Beneficial Ownership

- Confirm that disclosures and KYC requirements are met under the AML/CFT Act, including the role of supervisory bodies like GGMC for mining or precious goods trading.

- Ensure beneficial ownership is transparent and accurately declared, in line with EITI expectations.

4. Ongoing Monitoring & Sector-Specific Oversight

- For companies in high‑risk sectors (e.g., mining, gold trading, oil and gas), ensure compliance with sectoral oversight measures.

- Agencies such as GGMC supervise reporting entities in the mining sector to enforce AML/CFT obligations.

When should I get an Entity Health Check for my Company?

Routine health checks are essential:

- Before M&A deals or restructuring, to uncover potential liabilities.

- Prior to seeking financing or loans, as banks or investors often require documented compliance.

- Pre-annual cycle planning, to rectify issues before they escalate or result in non-compliance.

Corporate Compliance in Guyana

Compliance spans several domains:

- Corporate governance and legal documentation: Contracts, bylaws, meeting minutes, powers of attorney, and related records must be well-maintained.

- Fiscal and tax accountability: Ensure all required taxes are filed, supported, and paid on time.

- AML, beneficial ownership, and transparency: Demonstrated compliance with anti-money laundering laws and accurate reporting of ownership structures.

- Sectoral regulation: Tailor compliance measures to specific industry requirements—particularly in extractives, finance, or export-import sectors.

Legal Compliance Requirements

Ensure your entity:

- Has properly registered articles of incorporation and company structure with DCRA.

- Maintains updated corporate records—including meeting minutes and registered bylaws.

- Accurately documents representative powers and formal agreements with third parties.

Fiscal Compliance Requirements

- Confirm timely filing of all tax returns and resolution of any discrepancies or outstanding liabilities.

- Maintain thorough financial documentation to support filings and internal audits.

Frequently Asked Questions: Entity Health Check in Guyana

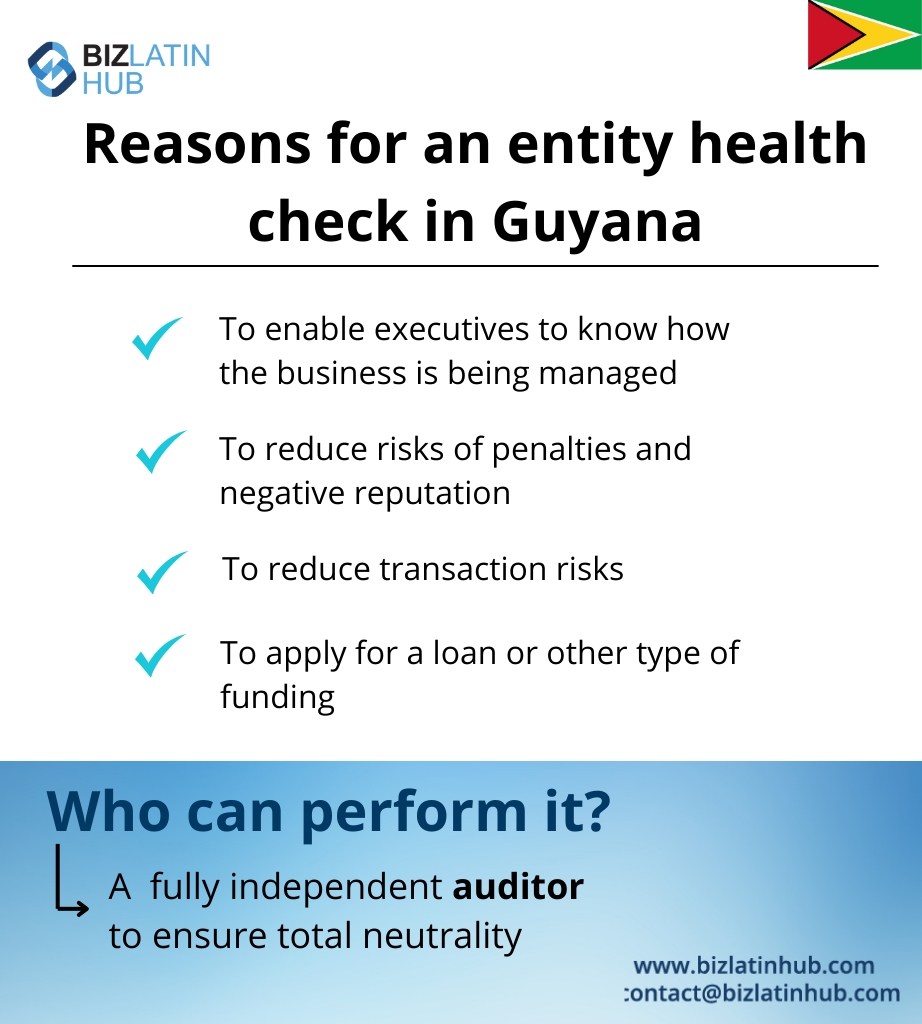

To mitigate risks of fines, government notices, or reputational damage.

To demonstrate compliance and governance strength to partners, investors, and regulatory bodies.

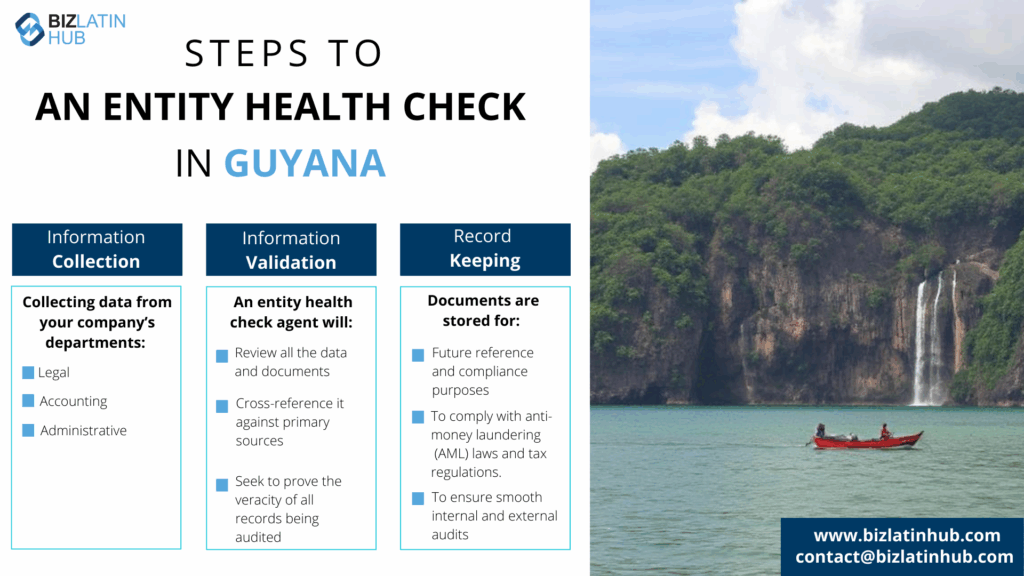

Information collection: Gather legal, financial, and administrative documentation.

Validation: Cross-check filings with DCRA, GRA, and regulatory databases.

Record keeping: Maintain documentation of the assessment and resolution steps for future reference—especially important in AML or tax audits.

An in-depth review covering corporate registration, statutory filing status, tax record scrutiny, beneficial ownership compliance, and sectoral oversight.

Qualified local professionals experienced in corporate compliance and familiar with Guyana’s regulatory framework—such as specialized law firms, compliance consultants, or security & risk advisers offering due diligence services (e.g., Amalgamated Security Services Guyana).

Biz Latin Hub can help you with an entity health check in Guyana

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.