Nicaragua’s business environment is dynamic. For successful company formation in Nicaragua, you need more than basic compliance for long-term success and viability. An entity health check in Nicaragua thoroughly assesses an organization’s overall condition. This assessment includes regulatory adherence, financial stability, operational efficiency, strategic positioning, and risk management frameworks. This evaluation is critical. It identifies strengths and potential issues. It helps companies make informed decisions. These decisions promote sustainable growth and resilience. This guide explains the importance of a proactive compliance audit and details the primary areas of review necessary to ensure a company operates in accordance with Nicaraguan law.

Key Takeaways: Entity Health Check in Nicaragua

| What is a corporate entity health check? | An entity health check is a detailed examination of a company’s statutory records and obligations. |

| What are the key areas reviewed for a Nicaraguan company? | It verifies compliance with the DGI, INSS, and the Mercantile Registry. |

| Will a health check look at your accounting? | A health check ensures the mandatory corporate books are properly maintained. |

| Why is a health check important for risk mitigation? | It is a key part of due diligence before acquisitions as well as highlighting potential problems before getting to the stage of fines. |

The Purpose of a Corporate Health Check

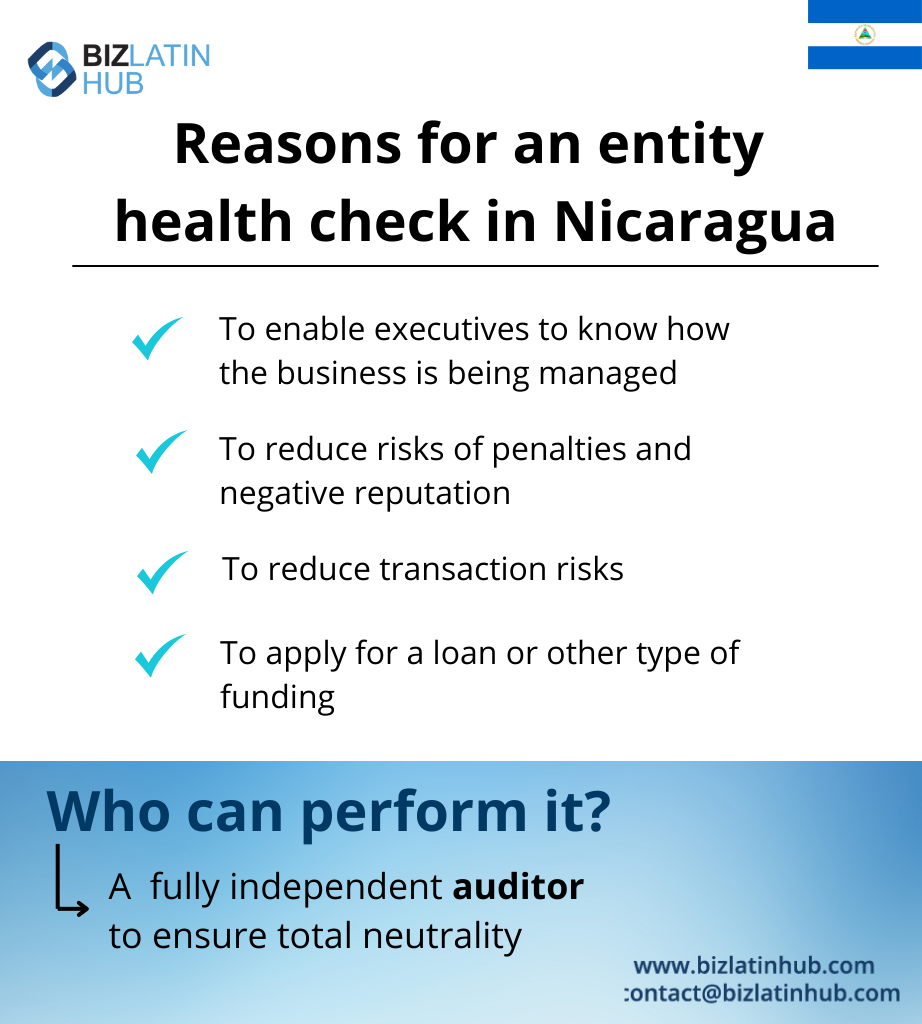

An entity health check is a detailed examination of a company’s statutory records and obligations. It is designed to identify compliance weaknesses, such as improperly authorized corporate books or unfiled tax returns, and provide a clear plan to resolve them.

Main Areas of a Nicaraguan Entity Health Check

Expert Tip: Auditing the Corporate and Accounting Books

From our experience, a critical part of any health check in Nicaragua is the physical inspection of the three mandatory books: the Journal Book, the Ledger Book, and the Minutes Book. Nicaraguan law requires these books to be physically sealed and stamped by the authorities before any entries are made.

We often find that companies have either failed to get the books authorized or are not keeping them up-to-date. Improperly maintained books can invalidate corporate actions and create significant problems during a tax audit. A thorough health check must include a physical verification of these essential records.

1. Corporate and Mercantile Registry Status

This review verifies that the company’s incorporation is in good standing and that its official corporate books (especially the meeting minutes) are properly maintained and up-to-date.

2. Tax Compliance with the DGI

This involves a review of all monthly and annual tax filings, including income tax and VAT, to confirm they were submitted correctly and on time.

3. Social Security Compliance with INSS

This audit checks that the company is correctly registered as an employer and that all required monthly social security contributions have been paid for its staff.

4. Municipal License and Registration

This check confirms that the company is properly registered with the local municipality and that its monthly municipal tax payments are current.

Entity Health Check in Nicaragua: A Compliance and Performance Guide

Nicaragua’s business environment is dynamic. Companies need more than basic compliance for long-term success and viability. An entity health check in Nicaragua thoroughly assesses an organization’s overall condition. This assessment includes regulatory adherence, financial stability, operational efficiency, strategic positioning, and risk management frameworks. This evaluation is critical. It identifies strengths and potential issues. It helps companies make informed decisions. These decisions promote sustainable growth and resilience.

This guide explains how to conduct an effective entity health check in Nicaragua. We will examine key assessment areas, from financial soundness and operational integrity to legal compliance (including local requirements like Nicaraguan Social Security Institute contributions and tax obligations) and the crucial role of international standards like ISO 45001 in ensuring occupational well-being. By adopting a thorough approach for an entity health check in Nicaragua, businesses can optimize performance, safeguard their assets and people, and build a strong foundation for the future.

Main Areas of an Entity Health Check in Nicaragua

An effective entity health check gives a complete view of the business. For an entity health check in Nicaragua, it means examining several connected areas. Here is an overview:

| Area | Main Focus |

|---|---|

| 1. Financial Stability and Performance | Profitability, cash flow, debt management, tax status |

| 2. Legal and Regulatory Compliance | Registrations, tax duties, Social Security, labor law, data rules |

| 3. Operational Effectiveness | Process efficiency, supply chain, quality, technology use, inventory |

| 4. Worker Health, Safety, and Environment (OHSE) | Ministry of Health (MINSA) rules, risk checks, ISO 45001, emergency plans, environment |

| 5. Business Strategy and Market Adaptation | Market knowledge, business planning, competitive edge, new ideas |

| 6. Company Governance and Full Risk Management | Leadership structure, internal checks, ethics, risk control, stakeholder relations |

1. Financial Stability and Performance

Assessing financial health is essential for any entity health check in Nicaragua. It means understanding the company’s overall financial stability. It also means understanding sustainability, not just current profits.

- Financial Statement Review: Regularly review balance sheets, income statements, and cash flow statements. This review identifies trends, strengths, and weaknesses.

- Cash Flow Control: The business must have enough liquidity. This liquidity meets short-term obligations. Nicaragua’s economic conditions can affect cash flow. Careful monitoring is important.

- Profitability Check: Evaluate gross and net profit margins. Understand cost structures.

- Debt Review: Assess debt levels. Assess the company’s ability to pay its debt.

- Budgeting and Outlook: Compare actual performance to budgets. Develop realistic financial forecasts.

- Tax Status: Ensure full compliance. Also, review legitimate tax planning opportunities. These opportunities are within Nicaraguan fiscal law.

2. Legal and Regulatory Compliance

Operating legally is very important in Nicaragua. Compliance includes many local and some international regulations. A key part of an entity health check in Nicaragua is ensuring all company formalities are current.

- Company Formalities: The company must be properly registered with the Public Mercantile Registry (Registro Público Mercantil). Licenses must be current. Corporate records must be carefully kept.

- Tax Duties:

- Número de Identificación Tributaria (NIT): Obtain and correctly use this identification number from the Dirección General de Ingresos (DGI) for all tax-related matters.

- Tax Submissions: Submit all applicable taxes timely and accurately. This includes Income Tax (Impuesto sobre la Renta – IR) and Value Added Tax (Impuesto al Valor Agregado – IVA). Get professional accounting and tax advice. This advice helps with Nicaragua’s specific tax regulations.

- Social Security Payments:

- Nicaraguan Social Security Institute (INSS): Register the business and employees. This is mandatory. Make INSS contributions. The employer’s total contribution is approximately 21.5% to 22.5% of the employee’s gross salary. This rate covers various branches like disability, old age, death, professional risks, and sickness/maternity. It may vary slightly based on factors like the number of employees. Employees contribute approximately 7.0% to 7.25% of their gross salary.

- Labor Law Adherence: Follow the Nicaraguan Labor Code. These laws cover employment contracts, working hours, wages, benefits, and termination procedures.

- Sector-Specific Rules: Comply with laws and regulations for the business’s specific industry.

- Data Rules: If the business handles personal data, understand and comply with any applicable Nicaraguan data privacy regulations.

3. Operational Effectiveness

Efficient operations improve profitability and customer satisfaction. This is a vital component of an entity health check in Nicaragua.

- Process Check: Analyze core business processes. Identify bottlenecks, inefficiencies, and areas for improvement.

- Supply Chain Review: Evaluate supply chain reliability and cost-effectiveness.

- Quality Assurance: Ensure products or services meet required quality standards.

- Technology Use: Assess if current technology supports business needs effectively and securely.

- Inventory Control: Optimize inventory levels. This reduces costs and meets demand.

4. Worker Health, Safety, and Environment (OHSE)

A safe and healthy workplace is a legal and ethical duty. It also affects productivity and insurance costs. An entity health check in Nicaragua must cover OHSE.

- Ministry of Health (MINSA) / Ministry of Labor (MITRAB): Understand the roles of relevant government bodies in overseeing public health and workplace safety standards. Nicaragua has general and specific regulations related to occupational health and safety.

- Risk and Hazard Checks: Proactively identify potential workplace hazards. These hazards are specific to the company’s operations in Nicaragua.

- ISO 45001 – Worker Health and Safety Systems:

- System: Adopting ISO 45001 provides a structured way to manage OHS risks. It prevents work-related injuries and illnesses. It continually improves OHS performance.

- Main Parts: It focuses on leadership commitment and worker participation. It includes hazard identification, risk assessment and control, emergency plans, and performance monitoring.

- Advantages: It helps reduce workplace accidents. It can lead to lower insurance premiums. It improves legal compliance and employee morale. It shows corporate responsibility. It uses principles from earlier standards like OHSAS 18001. It aligns with ILO-OSH Guidelines.

- Emergency Plans: Have clear plans for emergencies relevant to Nicaragua. Examples include earthquakes, volcanic activity, and hurricanes.

- Environmental Rules: Follow Nicaraguan environmental regulations, managed by agencies like the Ministry of the Environment and Natural Resources (MARENA). Manage waste correctly. Minimize environmental impact.

5. Business Strategy and Market Adaptation

The business strategy must be relevant. It must adapt to Nicaraguan market conditions. This is a forward-looking aspect of an entity health check in Nicaragua.

- Market Study: Understand the target market and customer needs. Understand the competitive landscape in Nicaragua.

- Business Planning: Review and update the business plan. Ensure it aligns with current conditions and future goals.

- Competitive Edge: Identify and use the company’s unique selling points.

- Adaptability and New Ideas: Assess the company’s ability to adapt to changing market conditions. Assess its ability to adopt new ideas.

6. Company Governance and Full Risk Management

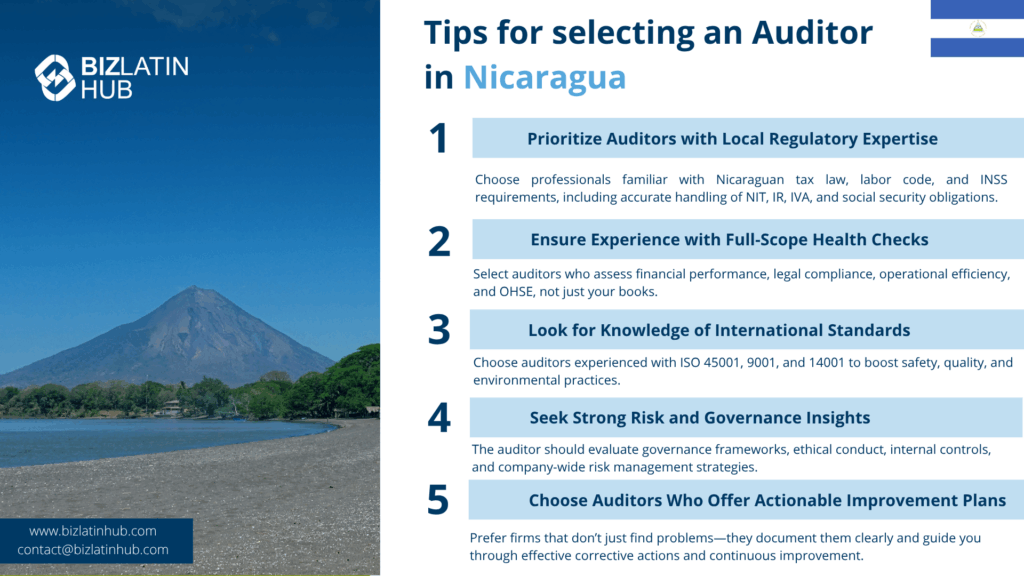

Good governance and proactive risk management create long-term stability. These elements are crucial for a thorough entity health check in Nicaragua.

- Governance Framework: Ensure clear roles, responsibilities, and accountability in the organization.

- Internal Checks: Implement effective internal checks. These prevent fraud and errors. They ensure operational integrity.

- Ethical Conduct: Promote a culture of ethical behavior and transparency.

- Full Risk Management: Identify, assess, and reduce financial, operational, legal, strategic, and reputational risks. This is in addition to OHS. Develop backup plans.

- Stakeholder Relations: Maintain positive relationships. This includes employees, customers, suppliers, government authorities (like the DGI, INSS, MINSA, MARENA), and the community.

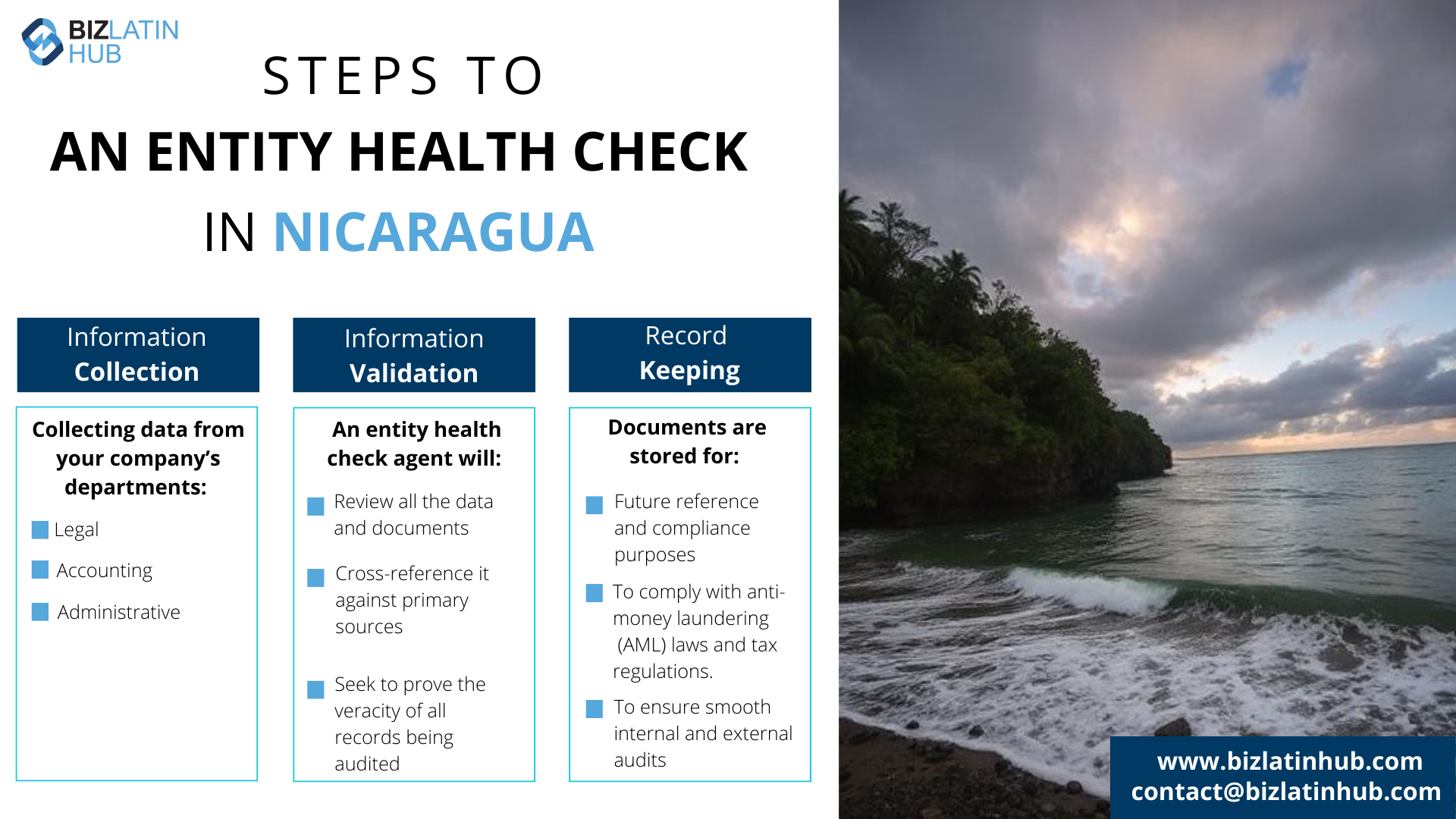

How to Conduct Business Health Checks

- Frequency: Conduct your entity health check in Nicaragua regularly. It should be a scheduled process, not a one-time event.

- Impartiality: Involve internal teams. Also use external experts where needed. Examples are auditors, legal counsel, and specialist consultants. This gives an unbiased view.

- Record Keeping: Document findings thoroughly. Document identified issues and action plans.

- Correction and Progress: The goal is to identify and solve problems. Develop and implement effective strategies for correction and continuous improvement. Senior management commitment is necessary.

- Worker Input: Involve employees in the health check process. This is important for OHS, as ISO 45001 highlights. Employee input provides useful insights. It fosters a stronger compliance culture.

Value of International Standards

Local Nicaraguan regulations are primary. However, international standards offer globally recognized systems. Examples are ISO 45001 (Occupational Health and Safety), ISO 9001 (Quality Management), and ISO 14001 (Environmental Management). These can be valuable considerations for an entity health check in Nicaragua.

- ISO 45001: This standard is key for managing OHS risks, as detailed earlier. It helps prevent work-related injuries and diseases. It aligns with other ISO management systems. It builds on successful older protocols like OHSAS 18001 and ILO-OSH Regulations. Certification can improve a company’s reputation. It may also reduce insurance costs.

Adopting ISO standards offers significant advantages, including:

- More efficient operations

- Better overall risk management

- Increased stakeholder confidence

- Easier access to international markets

- A structured method for continuous improvement

- A clear commitment to quality, safety, or environmental care

Supporting Employee Well-being

A healthy company values its employees. Supporting well-being is an important outcome of an entity health check in Nicaragua.

- Beyond Rules: Following labor laws and safety standards is basic. A supportive work environment also improves employee well-being, engagement, and productivity.

- ISO 45001’s Role: This standard directly helps employee well-being. It systematically addresses OHS. Implementing it can mean fewer accidents and illnesses. This can reduce insurance claims and related costs. Senior management’s commitment is vital for a strong safety culture.

Conclusion: Proactive Checks for Nicaragua Business Success

Conducting a full entity health check in Nicaragua is a proactive step for a company’s future. Businesses can identify areas for improvement by systematically checking:

- Financial stability

- Legal compliance (including Nicaraguan Social Security and tax rules)

- Operational efficiency

- OHSE practices (using standards like ISO 45001)

- Strategic direction

- Governance

This process helps mitigate risks and use opportunities.

Regular monitoring, evaluation, and a dedication to continuous improvement are vital. Organizations in Nicaragua performing an entity health check should consider expert help for their processes. This is especially true for specialized areas like ISO standard implementation. This complete approach ensures compliance. It also builds a resilient, efficient, and responsible organization ready for long-term success.

Frequently Asked Questions: Entity Health Check in Nicaragua

The DGI (Dirección General de Ingresos) is the General Directorate of Revenue, the main tax authority in Nicaragua. A health check ensures all filings and payments to the DGI are current.

The INSS (Instituto Nicaragüense de Seguridad Social) is the Nicaraguan Social Security Institute. A compliance check verifies that the company has paid all mandatory monthly contributions for its employees.

The Mercantile Registry (Registro Mercantil) is where the company is legally incorporated. The health check verifies that the company’s registration details are correct and that major corporate decisions have been properly recorded.

Every company must be registered with the local municipality (Alcaldía) where it operates and pay a monthly tax. A health check confirms this registration is active, as failure to comply can disrupt business operations.

Biz Latin Hub can help you with an entity health check in Nicaragua

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.