Liquidation in the Cayman Islands involves legal, regulatory, tax, and procedural steps. Depending on whether your company is solvent or insolvent, and whether it is a regulated entity (e.g. a fund under CIMA), different requirements will apply. Below is an overview and a detailed breakdown of what to do if your company formation in the Cayman Islands goes wrong.

Key takeaways on how to liquidate your business in the Cayman Islands

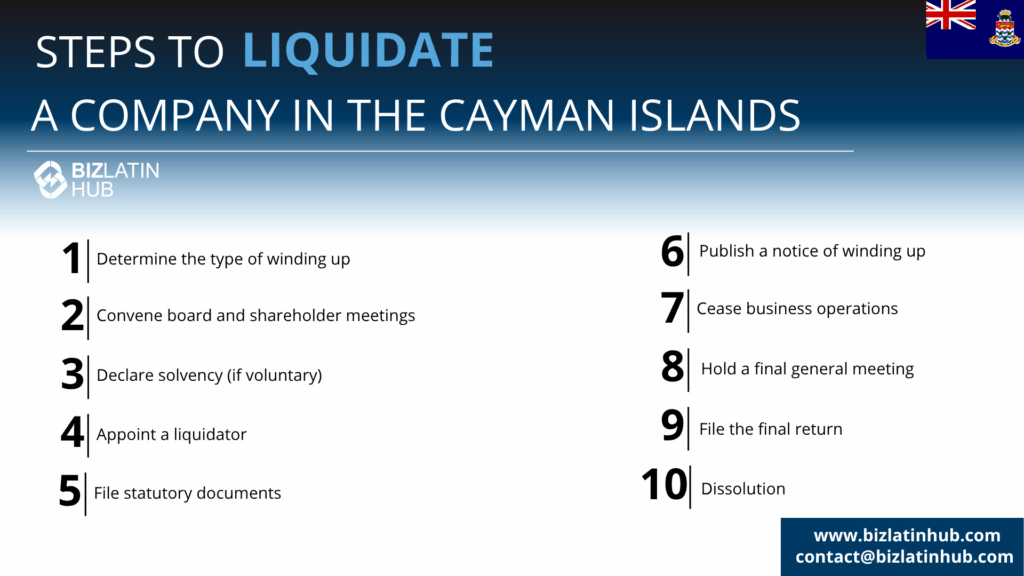

| Steps to liquidate a company in the Cayman Islands | Determine type of winding up needed: voluntary (solvent) or compulsory (insolvent / court‑ordered). For voluntary liquidation, convene board meeting(s) and prepare a shareholders’ resolution. Directors to declare solvency (if voluntary liquidation). Appoint one or more liquidators. File required notices/forms with the Registrar of Companies. Publish notice of winding up. Cease carrying on business operations. Once affairs are wound up, liquidator holds a final general meeting. After final meeting, file a final return with the Registrar. The company is deemed dissolved three months after filing the final return / Certificate of Dissolution. |

| What is the timeframe needed to liquidate your business in the Cayman Islands? | A relatively simple voluntary liquidation (solvent company, no major assets/liabilities issues, not regulated) often takes about 3‑4 months from the commencement of winding up to dissolution. |

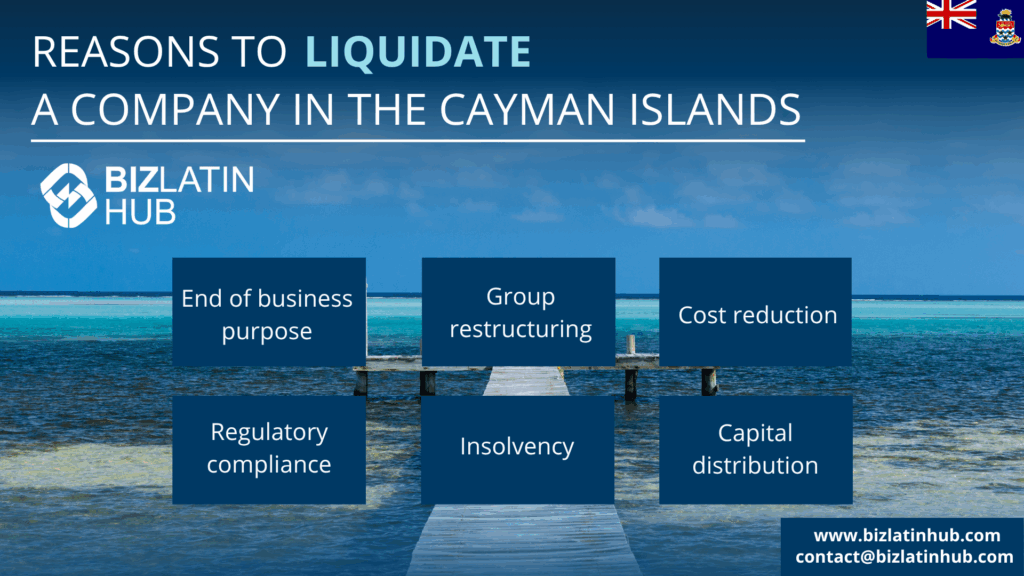

| What are the reasons to liquidate a business in the Cayman Islands? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in the Cayman Islands? | Insolvency / winding‑up rules define criteria for when a company is “unable to pay its debts,” when the court may intervene, what notifications are required, etc. |

Key Steps for Liquidation in the Cayman Islands

Here’s a bulleted list of the general steps involved in liquidating a company in the Cayman Islands (voluntary liquidation / striking off / court‑ordered winding up, as appropriate):

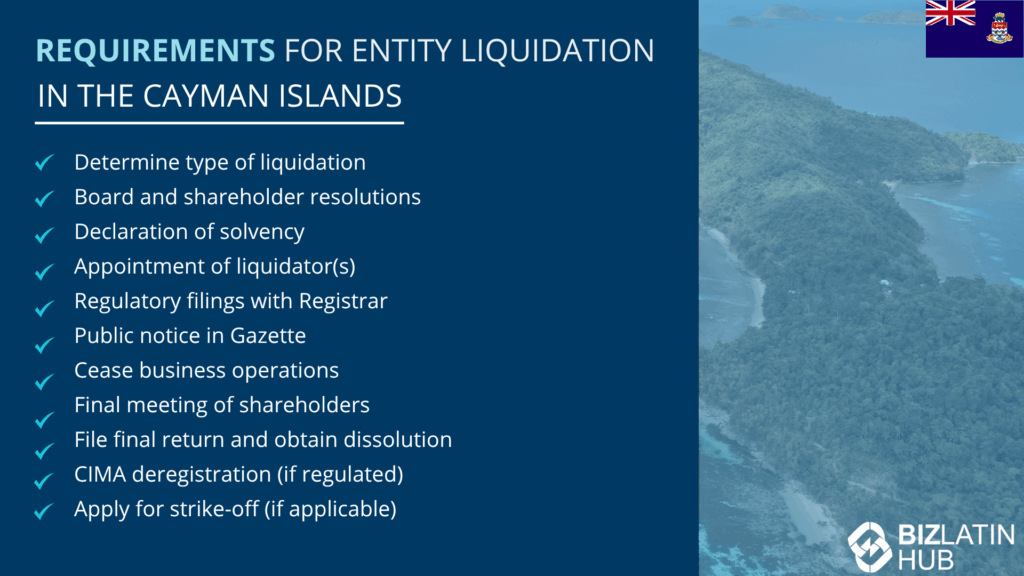

- Determine type of winding up needed: voluntary (solvent) or compulsory (insolvent / court‑ordered).

- For voluntary liquidation, convene board meeting(s) and prepare a shareholders’ resolution (often a special resolution) to wind up the company. Ensure Articles/Memorandum allow or mandate such resolution.

- Directors to declare solvency (if voluntary liquidation) — they must believe the company can pay its debts, with interest, for a period (commonly 12 months) following commencement.

- Appoint one or more liquidators. The resolution will usually name or empower the liquidator.

- File required notices/forms with the Registrar of Companies: notice of voluntary winding up, liquidator’s consent to act, declaration of solvency (if applicable).

- Publish notice of winding up in the Cayman Islands Gazette, inviting creditors to submit claims.

- Cease carrying on business operations except for what is necessary for winding up.

- Once affairs are wound up, liquidator holds a final general meeting: present report, accounts, summary of how assets were disposed, debts paid, etc. Notice of meeting must be given to contributories, and published.

- After final meeting, file a final return with the Registrar, request a Certificate of Dissolution.

- The company is deemed dissolved three months after filing the final return / Certificate of Dissolution.

- If the company is regulated (e.g. funds regulated by the Cayman Islands Monetary Authority, “CIMA”), fulfil deregistration or notification requirements with CIMA, including final audited accounts, de‑registration fees, etc.

- Alternatively, if the company has never carried on business, or has no assets and liabilities, apply for strike‑off rather than full liquidation.

Legal & Regulatory Context

- The primary statute is the Companies Act (as revised), which contains sections dealing with voluntary liquidation, court (official) liquidation, and strike off.

- Insolvency / winding‑up rules define criteria for when a company is “unable to pay its debts,” when the court may intervene, what notifications are required, etc.

- The Cayman Islands Monetary Authority (CIMA) plays a role for regulated entities (mutual funds, private funds) in ensuring they satisfy licensing, reporting, deregistration obligations.

Common Challenges & Pitfalls

- Mis‑declaring solvency: if the directors declare solvency but the company cannot meet its liabilities, there are penalties (fines, possibly more serious)

- Overlooking regulatory obligations with CIMA for funds, which may delay or block deregistration.

- Delays in final meetings or filing final return; missing filings or publications (Gazette) can extend the process.

- Strike‑off is easier but riskier: liabilities are not necessarily removed; assets may vest in government; interested parties may restore a struck‑off company.

Estimated Time / Costs

- A relatively simple voluntary liquidation (solvent company, no major assets/liabilities issues, not regulated) often takes about 3‑4 months from the commencement of winding up to dissolution.

- For regulated entities (funds), or where CIMA deregistration is required, or more complex creditor claims, time can be significantly longer.

- Costs vary depending on liquidator fees, professional (legal/accounting) fees, regulatory fees, publication fees, etc. For non‑complicated matters, the fees might run in thousands of U.S. dollars (plus gov/regulatory charges).

FAQs on entity liquidation in the Cayman Islands

Here are frequently asked questions (numbered) with answers customized for the Cayman Islands.

The cost depends on: whether the liquidation is voluntary or court‑ordered; whether the company is regulated (e.g. a fund); how complex the asset and liability structure is; professional (legal, accounting, liquidator) fees; regulatory and government filing fees; and costs of notices and publications. For simple voluntary liquidations, base professional and government/registry fees might run into a few thousand U.S. dollars; more complex cases (regulated entities, many creditors, disputed claims) cost more.

For a simple voluntary liquidation (solvent company with minimal complications, no regulation issues), you might expect approximately 3‑4 months from start to final dissolution. For regulated entities or more complex insolvency cases, or when official (court) winding up is required, it can take significantly longer due to additional regulatory, creditor, or court involvement.

You will need to notify or deal with:

The Registrar of Companies: file the required forms (notice of winding up, liquidator’s consent, declaration of solvency, final return/dissolution certificate).

The Gazette: publish notice of winding up, invite creditors.

Creditors: they must be invited to prove their debts.

Shareholders (members/contributories): via general meeting, final meeting.

If the company is regulated, then CIMA (Cayman Islands Monetary Authority) and any regulatory/licensing body relevant to your business.

Generally, in a solvent voluntary liquidation, shareholders have limited liability in accordance with the company’s constitution. However, directors may face liability or penalties if:

They make a false or reckless declaration of solvency;

They fail to comply with statutory/regulatory obligations;

There is misconduct, fraud, or knowingly dealing improperly with creditors.

The appointed liquidator assesses existing contracts, obligations, and leases. The company should cease doing new business beyond what is necessary for winding up. The liquidator may decide to perform, renegotiate, assign, or terminate certain contracts depending on their terms and whether they are beneficial or burdensome. Liabilities like leases must be addressed, and the liquidator may have the power under the liquidation rules to disclaim or terminate onerous contracts.

Yes. Even though Cayman Islands has no corporate income tax, there are regulatory or licensing fees, possibly GST/VAT equivalents if relevant, and other obligations tied to regulatory authorities. Also, if the entity is a fund or otherwise regulated, final audited financial statements might need to be filed; de‑registration with CIMA usually requires that all fees, penalties, and compliance filings are up to date. Assets disposed, investor or creditor claims must be properly handled.

Biz Latin Hub can help you with entity liquidation in the Cayman Islands

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.