Liquidation (winding up) of a company in The Bahamas involves legal, regulatory, and practical steps under the Companies Act and related legislation. Whether the winding up is voluntary or compulsory, there are statutory obligations, creditor claims, reporting requirements, and court‑supervision in certain cases. Just as it is important to stay compliant in company formation in the Bahamas, so too in liquidation.

Key takeaways on how to liquidate your business in the Bahamas

| Steps to liquidate a company in the Bahamas | Determine if liquidation is voluntary (company is solvent or wishes to cease operations) or compulsory (court‑ordered, insolvency, etc.). If voluntary, hold a meeting of members (shareholders). File notice of the resolution to the Companies Registry. File the liquidator’s consent to act. Notify relevant regulatory authorities. Appoint a liquidator (or liquidators). Publish notice of winding‑up to creditors. Cease ongoing operations. Liquidator collects and realises assets. Prepare report and accounts of winding up. Call final general meeting. File a return with the Registrar of Companies |

| What is the timeframe needed to liquidate your business in the Bahamas? | For a straightforward voluntary liquidation (company solvent, few creditors, no regulatory issues), the process might take a few months |

| What are the reasons to liquidate a business in the Bahamas? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in the Bahamas? | This is usually court-ordered as a result of not being able to pay creditors. |

Key Steps for Liquidation in The Bahamas

Here’s a bulleted list of the general process for liquidating a Bahamian company (voluntary winding up or compulsory / court‑ordered if needed):

- Determine if liquidation is voluntary (company is solvent or wishes to cease operations) or compulsory (court‑ordered, insolvency, etc.).

- If voluntary, hold a meeting of members (shareholders) and pass a resolution to wind up the company. Typically a 75% vote is required.

- File notice of the resolution to the Companies Registry within the prescribed timeframe (often 28 days) and publish in the Gazette.

- Along with the resolution, file the liquidator’s consent to act, and, if required, a directors’ declaration of solvency (if the company is claiming to be solvent).

- If the business is regulated, notify relevant regulatory authority(ies), obtain any required approvals, ensure all licensing and regulatory obligations are met.

- Appoint a liquidator (or liquidators). For voluntary winding up, shareholders normally appoint; for court winding up, the court appoints.

- Publish notice of winding‑up to creditors, inviting claims.

- Cease ongoing operations, except what is strictly required for winding up.

- Liquidator collects and realises assets, settles liabilities and creditors in priority order as per the law.

- Prepare report and accounts of winding up, showing how assets were disposed, liabilities paid, distributions among members.

- Call final general meeting to present the liquidator’s report and accounts. Provide notice in advance to contributories (shareholders) and publish notices as required.

- File a return with the Registrar of Companies after the final meeting, giving details of the meeting and resolution.

- After registration of that return, wait three months, after which the company is deemed dissolved, unless a court orders otherwise.

Legal & Regulatory Context

Here are the legal rules and authority framework you need to know in The Bahamas:

- The Companies Act, 1992 (as amended) is the primary statute governing company formation and winding up.

- The Companies (Winding Up Amendment) Act, 2011 introduced significant changes to Bahamas’ liquidation regime. It aligns procedures for “regular” Bahamian companies and International Business Companies (IBCs).

- The Companies Liquidation Rules, 2012 (CLR) and the Insolvency Practitioners’ Rules, 2012 supplement the statutory regime.

- The court has jurisdiction to wind up foreign companies under certain circumstances: for example, if they have assets in The Bahamas or carry on business here.

- Director/declaration of solvency is required for voluntary solvent windings; false declarations can lead to liability.

Common Challenges & Pitfalls

Some of the common issues people encounter when liquidating in The Bahamas:

- Mis‑assessing solvency; making a declaration of solvency without sufficient grounds.

- Missing the required notices, publications (Gazette), or failing to file with the Registrar in time.

- Not properly dealing with creditor claims — especially preferences / priority under law.

- Failing to notify or comply with regulatory requirements if company is in a regulated sector.

- Not keeping up with fees, outstanding filings, or annual statutory requirements before winding up. Outstanding obligations can delay or complicate the process.

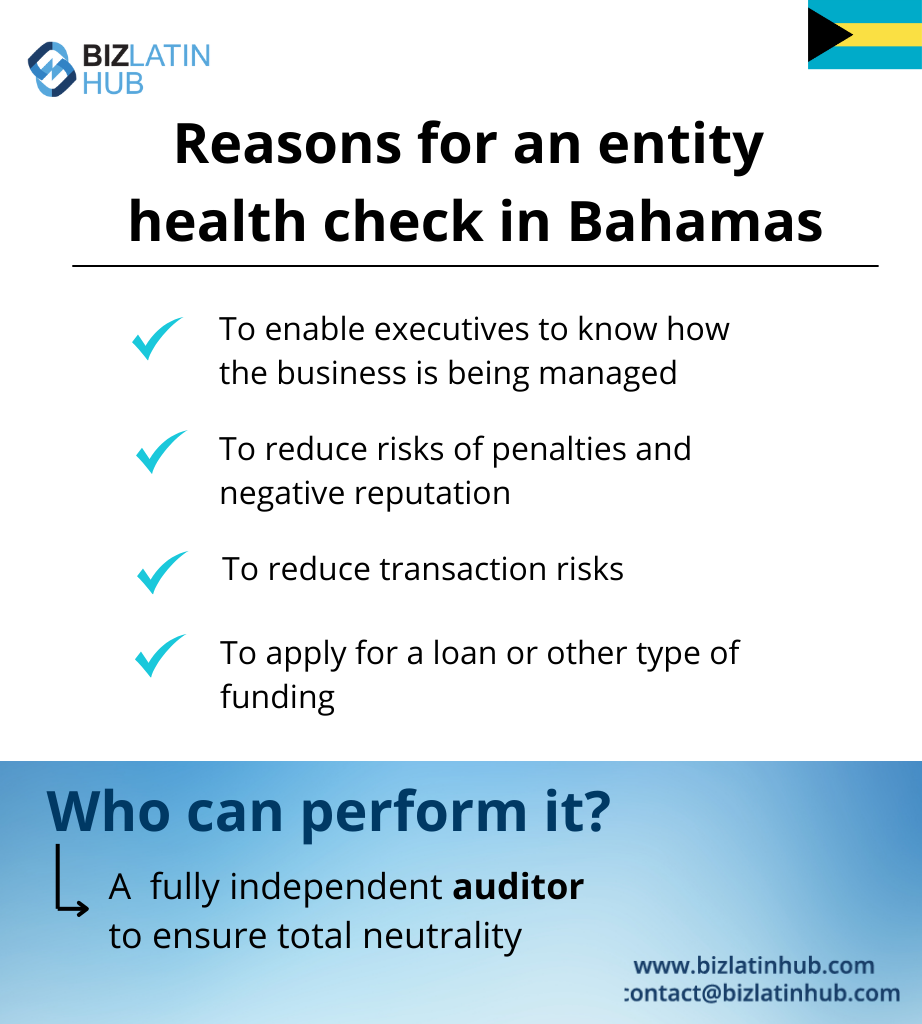

FAQs on entity liquidation in the Bahamas

Here are the queries we receive from clients:

The cost depends on several factors: whether the liquidation is voluntary or court‑ordered; if the company is regulated; how many assets, liabilities, and creditors there are; professional fees (lawyers, accountants, liquidator); fees for filing, publications, notices; plus any regulatory/licensing body fees. For a simple, solvent, voluntary winding up with minimal complications, costs may be relatively modest. More complex or insolvent cases will cost significantly more.

For a straightforward voluntary liquidation (company solvent, few creditors, no regulatory issues), the process might take a few months — often 2‑4 months after the resolution, final meeting and return. For complicated cases (court involvement, insolvency, contested creditor claims, regulatory clearance), the timeframe can be much longer.

You will generally need to notify:

The Registrar General’s Department / Companies Registry.

Creditors: via notices inviting claims.

Shareholders (or members/contributories): through meetings and notices.

Publication in the Gazette (legal notices) and usually a newspaper as required.

If in a regulated sector, the regulatory body(ies) overseeing licensing or compliance.

Generally, shareholders have limited liability under Bahamian company law. However, directors can be liable if they:

Make a false or reckless declaration of solvency.

Fail to comply with duties under the Companies Act or regulations.

Engage in misconduct, fraud, or knowingly allow mismanagement.

Also “shadow directors” or persons acting in equivalent capacity may be exposed under some circumstances.

Once liquidation starts, the liquidator assesses all contracts, leases and other obligations. Some may be terminated, others fulfilled or renegotiated. Contracts that are burdensome can sometimes be disclaimed or rejected under the liquidation rules. Liability under such obligations will need to be settled as part of the winding up, in accordance with priority rules.

Yes. The company must ensure all taxes, statutory licenses, fees, or governmental dues are filed and paid. Even though The Bahamas does not have certain kinds of corporate income tax regimes that exist elsewhere, there are regulatory/licensing fees and other statutory obligations. Final filings, possibly audited accounts, might be required in some contexts. The liquidator must ensure there are no outstanding obligations to governmental authorities before final dissolution.

Biz Latin Hub can help you with entity liquidation in the Bahamas

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.