Do you live in a foreign country? Do you meet non-residency requirements? Are you engaged as an EXPAT employee? If so, you may be able to benefit from investing in various offshore investments. But first lets learn more about Investing an an EXPAT.

What is an offshore investment?

An offshore investment is simply an investment that capitalizes on the advantages of being an EXPAT, or outside the investors home country. It is where you make an investment, whilst continuing to maintain non-residency in your home-country. Often these investments present unique advantages that make them attractive for EXPATs as investments and also the flexibility to continue to invest and grow these investments whilst living the exiting EXPAT lifestyle. These investments as an EXPAT could be in the form on one-off investments or on regular investments through incremental monthly payments.

With inflation running high and banks offering low investment returns, it’s imperative that your money works for you. Otherwise, you are in effect losing money each year.

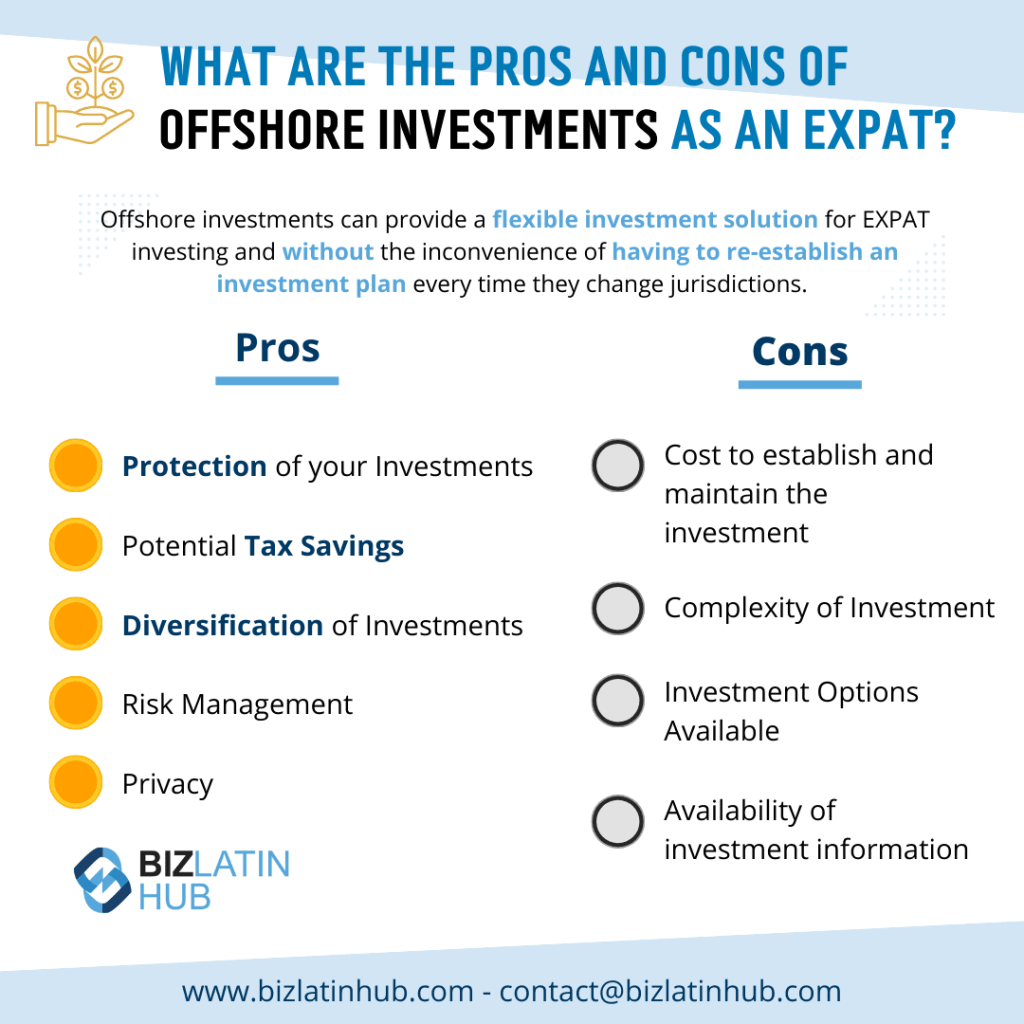

So what are the Pros and Cons of offshore investments as an EXPAT?

Pros:

- Protection of your Investments

- Potential Tax Savings

- Diversification of Investments

- Risk Management

- Privacy

- Permits both once-off and frequency based investments

Cons:

- Cost to establish and maintain the investment

- Complexity of Investment

- Investment Options Available

- Availability of investment information

Note: Offshore investments can provide a flexible investment solution for EXPAT investing and without the inconvenience of having to re-establish an investment plan every time they change jurisdictions.

How could I make an offshore investment as an EXPAT?

Understanding the world of offshore EXPAT investments can be quite confusing, with often a lot of the available information quite misleading, incomplete or even nonexistent.

As such it it always encouraged that EXPATs investing seek expert advice when considering financial decisions and this is no different. In most countries within Latin America there are numerous expert resources available, that is financial advisors located within the country who specialize in offering these types of financial products to specifically designed for EXPATS that are investing.

You should expect these advisors to understand your needs, to present you investment options based on your needs, objectives and risk tolerances, and then to support you along the way to both make the financial investment and with any on-going enquiries.

And how are EXPAT financial advisors paid?

This will vary, however usually this is linked to a financial commissions of the products sold. You should expect that your financial advisor will be open and transparent about how they earn money and likewise to ensure that their interests are aligned with yours. Investing as an EXPAT is an exciting time, although a serious time and you should ensure that your EXPAT financial advisor is trustworthy, available and professional in order to ensure that you get the best financial returns on your investments.

We would always encourage that you do your research when investing as an EXPAT.

What are common EXPAT offshore Investments?

This will vary, however the most common types are:

- Single Portfolio Investment Funds

- Multiple Portfolio Investment Funds

- High yielding Interest accounts

- Investment Grade Bonds

- Other Structured Investment Products

All options present unique investment profiles and you should seek expert advice from an EXPAT financial advisor about what best suites your needs, financial objectives and risk tolerances.

So how we can help at the Biz Latin Hub?

At the Biz Latin Hub we have a strong reputation for being the market leaders in working with clients to understand and operate within the local market, and likewise we are well positioned to direct you to a reputable financial advisor that you support your investment decisions. Choosing the right investment advisor when investing an EXPAT can mean the difference between low or high returns.

Contact us today to find out more about how we can assist you.

Also about our team and expert authors.