In the first nine months of 2023, foreign investment in Guatemala (FDI) reached a record high of US$1.35 billion. This represents a significant increase compared to the same period in 2021. While the country has traditionally been overshadowed by more famous neighbors, it has great potential.

The surge in foreign investment in Guatemala reflects economic growth and resilience, even amidst global challenges like the COVID-19 pandemic. Notably, the telecommunications sector received the most foreign investment in 2021, surpassing the traditionally dominant finance and insurance sector.

Biz Latin Hub can help you with foreign investment in Guatemala, a country we know very well. We can make sure that your market entry and legal compliance goes smoothly and navigate the bureaucracy, so you can focus on business development. Our back office services can help you register a company in Guatemala or elsewhere in the region thanks to our network of local offices across Latin America and the Caribbean.

Why invest in Guatemala?

In 2023, foreign direct investment (FDI) into Guatemala hit record levels, after the country saw the lowest levels of FDI in a decade the previous year. But what made foreign investment in Guatemala spike so radically?

Guatemala is Central America’s largest economy by gross domestic product (GDP), as well as one of the fastest growing among the seven nations on the isthmus, only experiencing two years of GDP decline since the turn of the century.

Along with Nicaragua, Guatemala was also one of only two countries from the sub-region not to register GDP decline in 2020 – a year when many of the world’s economies were rocked by the COVID-19 pandemic. However, both countries were still adversely affected by the crisis.

There has been some recovery in global FDI inflows by 2023, but the situation remains uncertain due to ongoing pandemic-related challenges and economic uncertainties. Recovery is expected to be uneven across regions and sectors.

Guatemala has experienced a steady increase in FDI inflows over the past few years. According to the World Bank, in 2022, FDI inflows reached a record high of $1.3 billion, representing a 47% increase compared to the previous year

In another notable turn, Luxembourg also leapt into the top spot among the nations from which FDI in Guatemala originated, jumping ahead of the likes of Colombia, Mexico, and the United States, which have been the biggest sources of investment into the country in recent years.

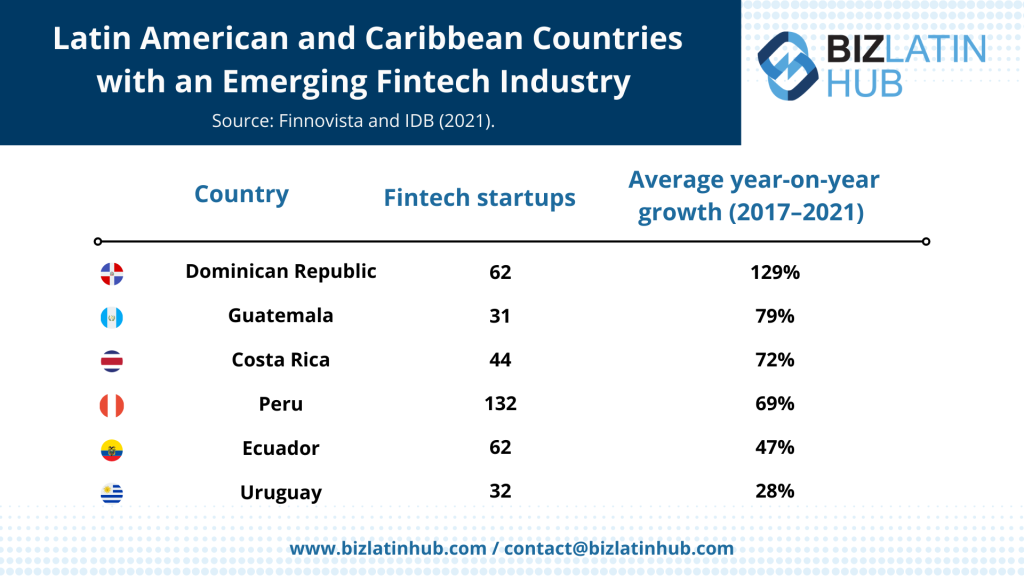

That shift was accompanied by another notable twist: in 2021, the sector that received the most foreign investment in Guatemala was telecommunications, leapfrogging the finance and insurance sector, which traditionally occupies the top spot, according to a report from Prensa Libre.

U.S. technology company Microsoft recently announced that it will invest US$1.5 million in Guatemala to boost digital talent and technological development in the Central American country. Besides, the Mexican dairy company Lala announced a US$20 million investment for the construction of a new production plant in Guatemala, which will generate employment and contribute to the country’s economic development.

The increasing popularity of foreign investment in Guatemala mirrors economic growth

Guatemala’s economy has grown exponentially over recent decades, hitting USD$77.6 billion in 2020, and FDI has followed suit, with World Bank statistics showing it more than doubling between 2009 and 2019.

While the figures published by Prensa Libre, one of Guatemala’s most well-respected newspapers, differ somewhat, they still show FDI in 2019 being almost twice what it was in 2009.

Guatemala’s strong economic performance comes on the back of major security advances, with the country’s notoriously high levels of violence significantly reduced, as highlighted by the intentional homicide rate more than halving during that same period.

Guatemala benefits from having a highly strategic location, occupying the majority of Mexico’s southern border, and acting as a gateway between the three major North American economies and the rest of Central America.

Spanning the width of the Central America isthmus, Guatemala has high-volume ports serving both the Pacific Ocean and Caribbean Sea, offering easy freight access to all of the Americas as well as Asia-Pacific and Europe.

The Central American country is well-known for its agricultural output, with coffee, bananas, and sugar among its key exports and the sector providing almost 10% of GDP. The country’s manufacturing sector is also significant, providing 22% of GDP, with the garment manufacturing industry particularly significant.

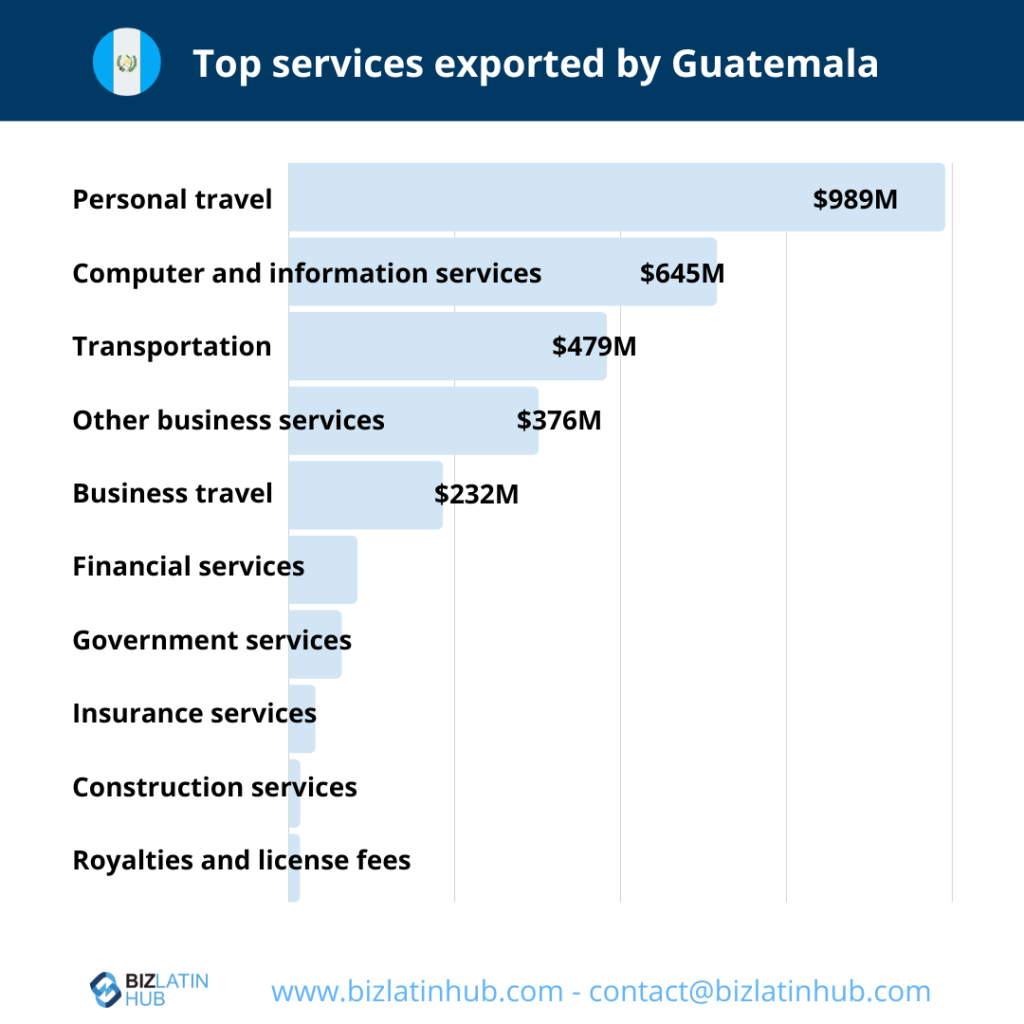

Beyond that, a fast-growing services sector, including key destinations for foreign investment in Guatemala, such as financial services and insurance, generates more than 60% of GDP.

Meanwhile, telecommunications has been an important destination for FDI in Guatemala, although the figures being invested previously have not come close to the more than $2 billion in investments in the sector seen in 2021.

How can you start a company in Guatemala?

When you register a company in Guatemala, whether you are supported by a company formation agent or otherwise, you must complete the following 5 steps:

- Step 1 – Choose the Type of Entity.

- Step 2 – Register a Company in Guatemala with an appropriate name.

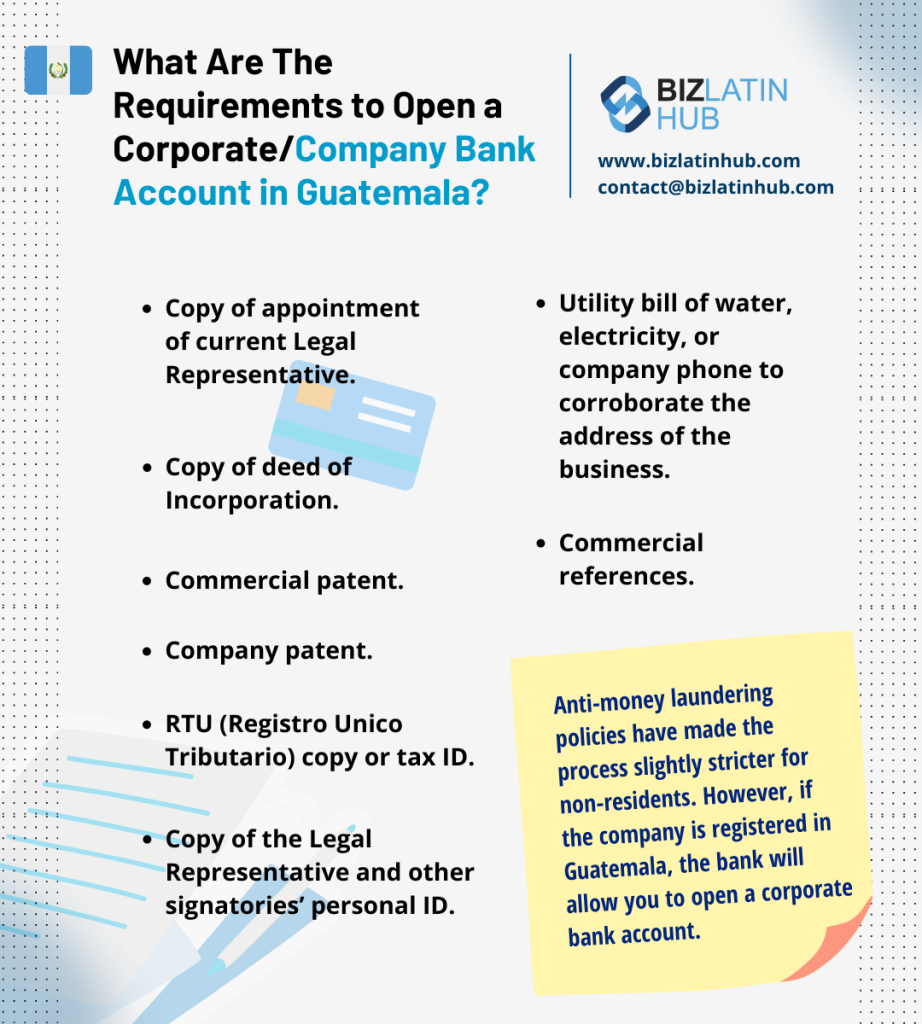

- Step 3 – Determine the Amount of Initial Share Capital and Open a Corporate Bank Account.

- Step 4 – Notarize and Establish the Bylaws of Your Company.

- Step 5 – Registration of the Company Before Guatemalan State Entities.

Understanding the spike in foreign investment in Guatemala

The massive spike in foreign investment in Guatemala in 2021, as well as the emergence of Luxembourg as the primary origin of capital and telecommunications as its main destination, can all be understood in the context of one major deal struck at the end of the year.

In November 2021, it was announced that Luxembourg-based telecom company Millicom was investing $2.2 billion to take full control of Tigo Guatemala, one of the biggest players in the Central American country’s telecommunications sector.

The deal saw Millicom, a company focused on telecommunications in Latin America, increase its 55% stake in Tigo Guatemala to take full equity and become the country’s biggest player in the sector.

The deal represented the largest single foreign investment in Guatemala and saw Millicom further consolidate its status as a key force in telecommunications in Central America. Millicom also has a major presence in Costa Rica, El Salvador, Honduras, Nicaragua, and Panama, as well as in the South American nations of Bolivia, Colombia, and Paraguay.

That reportedly took acquisitions by the Luxembourg-based company in the sub-region beyond $5 billion within three years, while the company followed up its Guatemala investment with a pledge.

In a sign of the Luxembourg-based company’s faith in the region, the company stated in 2021 that it would be selling all operations in Africa in order to focus on the nine Latin American markets where it is active. In early 2022, the company pledged to invest a further $3 billion in the region over the coming three years.

According to the Financial Times, Millicom has a total of 44 million mobile customers and 4 million home broadband customers, and the $3 billion is set to be pumped into infrastructure and the expansion of its existing interests.

While some commentators have highlighted the risks involved in Millicom’s investments in Latin America’s sometimes volatile economies, according to Mauricio Ramos, the company’s chief executive, the region presents significant opportunities for growth.

“Our basic premise is: these are growing economies, very stable [foreign exchange], significantly underpinned by this increasing amount of remittances,” he was quoted as saying by the Financial Times.

Biz Latin Hub can assist you with foreign investment in Guatemala

At Biz Latin Hub, we provide integrated market entry and back office services throughout Latin America and the Caribbean, with offices in 17 key cities around the region, including Guatemala City. Our unrivalled regional presence means we are ideal partners to support multi-jurisdiction market entries and cross-border operations.

Our comprehensive portfolio includes accounting and taxation, hiring & PEO, legal services, and company formation, among others.

Contact us today to find out more about how we can assist you.

If you found this article on foreign investment in Guatamala of interest, check out the rest of our coverage of this rising Central American economy.

Or read about our team and expert authors.