Closing a business in Nicaragua requires careful planning. You must understand the country’s legal and financial rules. Just like initial company formation in Nicaragua, everything must be done by the book and according to the laws of the land. This guide provides a step-by-step overview of the voluntary liquidation process, from the initial shareholder decision to the final cancellation of the company’s registration.

Key Takeaways: Liquidating a Business in Nicaragua

| What are the common reasons for liquidating a company? | Financial insolvency Strategic market exit Changes in business environment Shareholder decision |

| Are approvals necessary? | Shareholder approval is the first step in a voluntary liquidation. |

| What are the main responsibilities of a liquidator in Nicaragua? | The appointed liquidator is responsible for selling the company’s assets, paying off all its creditors, and then distributing any remaining funds to the shareholders. |

| Is the process fully public? | Public notices of the liquidation must be published. |

| What are the final steps for dissolving a company? | The final step is cancelling the company’s registration at the Mercantile Registry. |

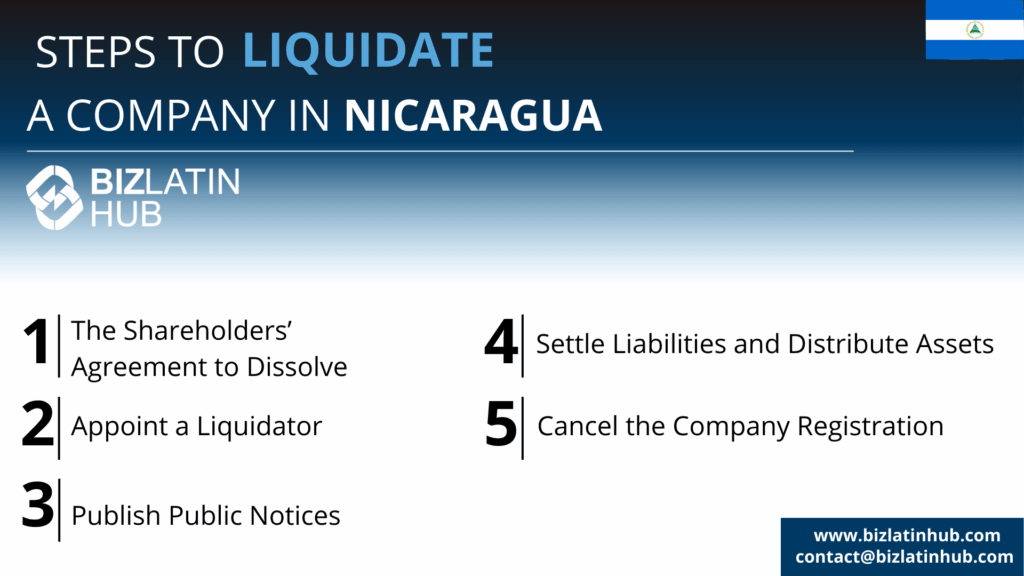

The 5-Step Company Liquidation Process

Nicaraguan law controls how a business must close. A company must follow these laws to shut down its operations legally. This includes paying all debts and taxes. If you mismanage this process, you could have the corporate veil removed. It is important to understand the laws for dissolution before you begin.

Expert Tip: Obtaining Tax Clearance from the DGI

From our experience, the most challenging and time-consuming step in the Nicaraguan liquidation process is obtaining the final tax clearance from the tax authority (DGI). Before the company can be cancelled at the Mercantile Registry, the liquidator must prove that all tax obligations have been met.

This often involves a final tax audit by the DGI. We advise clients to ensure their accounting and tax records are perfectly in order before starting the liquidation process. Having clean, well-organized records can significantly accelerate the DGI’s review and the issuance of the final clearance.

Step 1: The Shareholders’ Agreement to Dissolve

The process begins when the shareholders hold a formal meeting and pass a resolution to dissolve the company.

Step 2: Appoint a Liquidator

In the same meeting, the shareholders appoint one or more liquidators to manage the winding-up of the company.

Step 3: Publish Public Notices

The liquidator must publish notices of the company’s dissolution in the official government gazette to inform the public and creditors.

Step 4: Settle Liabilities and Distribute Assets

The liquidator prepares a final inventory of assets, settles all of the company’s debts, and distributes any remaining assets among the shareholders.

Step 5: Cancel the Company Registration

After obtaining final shareholder approval and tax clearance, the liquidator files the final documents with the Public Mercantile Registry to have the company’s registration officially cancelled.

Managing Your Finances During Liquidation

You must handle your finances carefully when closing a business in Nicaragua. Pay all taxes to the Tax Administration. This prevents future legal problems. A company that does not close properly can continue to have legal and financial duties. An audit of your tax history is required before you can finalize the liquidation. This review helps ensure a clean closure.

Business Dissolution Laws

Business dissolution is the formal legal process to end a company. After you decide to dissolve, you must start the liquidation phase. In this phase, you will settle all company debts and activities. You must also resolve all tax issues with the Tax Administration (DGI). The company must be removed from the Single Taxpayers Registry. This final step can take up to one year and may require a tax audit.

U.S. Sanctions on Nicaragua

The United States has sanctions against Nicaragua. The Office of Foreign Assets Control (OFAC) manages these rules. The sanctions can block property and assets of certain individuals and entities. These measures respond to the political situation in the country. You should be aware of these sanctions as they can affect business operations and financial transactions.

Key Taxes to Consider

Nicaragua’s tax system has specific rules for a business liquidation. Here are the main taxes to know:

| Tax Type | What It Means |

|---|---|

| Transfer Taxes | Nicaragua does not have a transfer tax on transactions. This simplifies some parts of selling assets. |

| Municipal Registration Tax | You pay this tax to record official business actions, like the company’s dissolution, in public records. |

| Real Estate Municipal Tax | If the business owns property, you must pay this local tax. Keeping payments current ensures you receive a Municipal Solvency document, which proves you have paid your property taxes. |

Key Government Bodies in the Liquidation Process

Two primary government bodies are involved in the liquidation process. The decision to liquidate and the final dissolution must be recorded in a public deed and registered with the Public Mercantile Registry (Registro Público Mercantil). The company’s tax registration must also be formally cancelled with the General Directorate of Revenue (DGI).

How to Ensure Legal Compliance

To close a business in Nicaragua, you must follow the complete legal process. This includes dissolving the company, paying all debts, and removing the business from the public tax registry. An audit of your company’s tax history is required.

Managing Social Security

Employers must register all employees with the Social Security System. Both the employer and employee pay into this system monthly. Foreign employees need a work permit and a registered employment contract to be included. You must keep these payments current during the liquidation process.

Shareholder Rules and Liabilities

The closure process follows a clear legal order:

- Pay Employee Debts First: Nicaraguan law requires you to settle all labor obligations before any other debts.

- Get Shareholder Approval: A 75% majority vote from shareholders is usually needed to approve the closure.

- Appoint a Liquidator: Shareholders must appoint a person to manage the liquidation process.

- Prepare Final Accounts: The liquidator prepares the final financial accounts for approval.

- Publish and Register the Closure: The final accounts and the Deed of Dissolution must be published in the Official Gazette and registered with the Public Mercantile Registry.

- Notify Government Offices: You must inform the Mayor’s Office and the DGI to finalize the company’s termination.

Using Professional Services

Hiring professional help is important when you close a business in Nicaragua. Lawyers and financial advisors can guide you through the process. They help you follow local laws and settle all financial matters correctly.

Why You Need Legal and Financial Advisors

Experts make the closing process smoother. They help you meet tax rules and other legal duties. They check that you pay all debts before the company closes. This support reduces the risk of fines and penalties.

The Importance of Due Diligence

Due diligence means checking all facts before making a business decision. In Nicaragua, this is very important for property investments. You should verify property ownership to avoid legal issues. Good due diligence also protects your intellectual property rights. This practice helps secure your investments.

Communicating with Your Stakeholders

Clear communication with stakeholders is key during a liquidation. Inform shareholders, employees, and creditors about your plans. This transparency helps the process run smoothly. You should explain the need for a tax audit and discuss any financial risks, such as fines.

Informing Shareholders and Employees

Shareholders must hold a General Meeting to appoint liquidators. The liquidators will manage the closure. They provide a final report to shareholders for approval. After approval, the results are published in the Official Gazette. This formal process keeps everyone informed.

Following Regulatory Notification Rules

Your company must follow all rules for notifying government agencies. This includes formally closing your tax accounts with the DGI. The company must also publish a final balance sheet in the Official Gazette to comply with the Commercial Code.

How liquidation Affects Asset Distribution

When a business closes, its assets are used to pay its debts. All debts must be paid before any remaining assets can be distributed to partners or owners. Unpaid tax obligations can stop the asset distribution process. This can also create personal financial problems for the company’s directors. The full process, including audits, can take a year to complete.

Handling Business Operations During Closure

Closing a business means you must dissolve the company and pay its debts. This process formally ends the company’s legal status. Paying off all tax obligations is a critical part of this. Plan carefully to avoid delays or problems.

Rules for International Money Transfers

Nicaragua regulates financial transactions with foreign entities. Here are the key rules:

- Non-residents pay a 20% tax on their income.

- You must report any money transfer of $10,000 USD or more to the authorities.

- Dividends paid to foreign shareholders have a 10% tax.

- Foreign court decisions can be enforced if a mutual agreement exists between the countries.

The Role of the U.S. Office of Foreign Assets Control (OFAC)

OFAC enforces U.S. economic sanctions. For Nicaragua, OFAC blocks the assets of specific individuals and groups on the Specially Designated Nationals (SDN) List. This is part of U.S. foreign policy. OFAC can issue licenses to permit some transactions that would otherwise be blocked.

Frequently Asked Questions: Company Liquidation in Nicaragua

The liquidator is responsible for managing the entire dissolution. This includes taking control of company assets, preparing a final balance sheet, paying off all creditors, distributing any remaining assets to shareholders, and representing the company in all legal matters during the process.

Public notices of the liquidation are a legal requirement. They are published in an official newspaper to inform the public, and most importantly, any potential creditors, that the company is being dissolved. This gives creditors a formal opportunity to present their claims.

The liquidator must use the company’s assets to pay off all its debts and liabilities before any funds can be distributed to the shareholders.

Once the liquidator has paid all debts, distributed all assets, and obtained tax clearance, they present the final liquidation balance sheet to the shareholders for approval. This approval is then recorded in a public deed and filed with the Mercantile Registry, which then proceeds to formally cancel the company’s registration.

Biz Latin Hub can help you with company liquidation in Nicaragua

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.