Starting a business in Nicaragua or just hiring remote workers from Nicaragua can offer a strategic benefit. Businesses can improve their market position. Nicaragua has many skilled professionals. Understanding Nicaragua’s employment system is important for success. You need to know labor laws. Cultural points and local job practices also matter. Key topics include payroll and tax rules. Defining job terms and offering good salaries are also important. This guide will give you information on data protection. It also covers visa needs and building good work relationships. This guide outlines the primary methods for engaging talent, the benefits of the Nicaraguan workforce, and how to navigate local labor laws.

Key Takeaways: Hiring Remote Workers in Nicaragua

| What are the main benefits of hiring remote workers in Nicaragua? | Nicaragua offers a competitive talent pool at a cost-effective rate. |

| How does an EOR manage payroll and compliance for remote staff? | An Employer of Record (EOR) allows you to hire without a local entity. |

| What are the key labor law considerations when hiring? | Nicaragua’s labor laws protect employees. Day shift workweeks are a maximum of 48 hours. Overtime is limited to 9 extra hours weekly. Overtime pay is double the normal rate. Job contracts must be in the employee’s language. Salaries must be in Nicaraguan currency. |

Methods for Hiring Remote Workers in Nicaragua

1. Hire Directly Through a Local Entity

This involves formally incorporating a company in Nicaragua. It provides full control but is the most time-consuming and expensive option, best suited for companies making a large-scale, long-term investment.

2. Engage Independent Contractors

This involves hiring workers on a freelance basis. It offers flexibility but carries the risk of misclassification if the working relationship resembles that of an employee, which can lead to legal and financial penalties.

3. Use an Employer of Record (EOR)

This is often the ideal solution. An EOR hires the worker on your behalf, managing all legal and administrative responsibilities. It is fast, compliant, and requires no local entity setup.

Expert Tip: EOR as the Safest Method for Remote Hiring

From our experience, using an Employer of Record (EOR) is the most secure and efficient method for hiring remote workers in Nicaragua. While hiring independent contractors may seem simpler, it carries a significant risk of “employee misclassification.” If the Nicaraguan authorities determine that a contractor functions like an employee (e.g., they work exclusively for you and follow your direct instructions), your company could be held liable for back-pay of social security contributions and other benefits. An EOR eliminates this risk entirely by placing the worker on a fully compliant local payroll from day one, ensuring adherence to all labor laws.

Nicaraguan labor laws

Nicaragua’s labor laws protect employees. Day shift workweeks are a maximum of 48 hours. Overtime is limited to 9 extra hours weekly. Overtime pay is double the normal rate. Job contracts must be in the employee’s language. Salaries must be in Nicaraguan currency.

Main Points of Nicaraguan Labor Laws:

- Work Hours:

- Maximum 48 hours per week.

- Overtime: 9 extra hours at double pay.

- Contracts:

- Must be in the native language.

- Salaries in local currency.

- Employee Rights:

- No discrimination based on race, religion, political views, or gender.

- Right to form or join unions.

- Equal pay for equal work.

Nicaragua’s termination laws strongly protect employees. Severance pay is often required. These rules stop dismissals without a good reason. Employers and employees must respect equal rights. They must also respect union freedom.

This system meets international standards. This makes Nicaragua a good place for foreign investment. It also creates job chances while protecting worker rights.

Why Labor Laws and Culture Matter

Nicaraguan labor laws ensure fairness in the workplace. These laws stop discrimination. Discrimination based on religion, political views, race, or gender is illegal. The laws also require equal pay for equal work. This protects employee rights.

Job contracts are very important. Employers must give contracts in the employee’s language. The trial period in these contracts cannot be more than one month. The Nicaraguan constitution states this.

Ending a job needs careful rule following. Unfair dismissals can cause large costs for employers. Following the correct termination steps is vital.

Cultural understanding is important in Nicaragua. The country has a rich history. European, Caribbean, and Iberian cultures influence it. These influences affect its work and business environment. Understanding these helps communication and teamwork.

Important Labor Laws:

- No discrimination.

- Equal pay for equal work.

- One-month maximum trial period.

- Contracts in native language.

- Strict rules for ending employment.

Knowing these laws and cultural points is key for hiring in Nicaragua. Employers can build better work relationships if they respect these items.

Using an Employer of Record (EOR) in Nicaragua

Working with an Employer of Record (EOR) in Nicaragua gives businesses a key benefit. This is true for companies entering this Central American market. An EOR helps you follow Nicaraguan labor rules. This applies to hiring and ending employment. An EOR manages employee benefits. It strictly follows local job laws. Some services help with parts of international hiring. However, an EOR greatly lowers compliance risks. An EOR fully handles administrative work. EORs also manage work visas and permits. They do this through complete application and registration steps. These services make business operations easier. They simplify global growth. They handle HR and payroll. This means businesses do not need to create a local company in Nicaragua.

EOR Benefits

An EOR in Nicaragua offers large benefits. It ensures you meet legal and social duties for employees. Key benefits are:

- Full Compliance: Ensures you follow legal and social duties for employees.

- Benefit Management: Makes sure employees get required benefits. This includes paid vacation, social security, and health coverage.

- Better Benefit Packages: Lets companies offer good extra benefits. Examples are private health insurance and meal vouchers.

- Simple Payroll: Makes payroll easier. It manages salaries, taxes, and benefits. This frees company resources.

- Legal Operation: Lets companies work legally without a local company. This saves time and money.

- Global Payroll Control: Helps manage payroll in different countries. It gives central control and efficient operations.

EOR Services

An Employer of Record (EOR) in Nicaragua does many tasks. These tasks ensure you follow local labor laws. They also ensure good employee management. Main services usually are:

- Benefit Management: Manages all required employee benefits. This includes paid vacation, public holidays, and social security. It also includes optional benefits like private health insurance.

- HR Work: Handles difficult administrative tasks. Examples are healthcare payments and pension registration.

- Termination Support: Manages employee departure processes. It follows Nicaraguan labor laws strictly. This lowers legal risks.

- Rule Updates: Informs businesses about changes in labor laws.

- Record Keeping: Makes sure all employee benefits and HR items are tracked and recorded correctly.

These services give businesses confidence. They know that compliance is part of every employment stage.

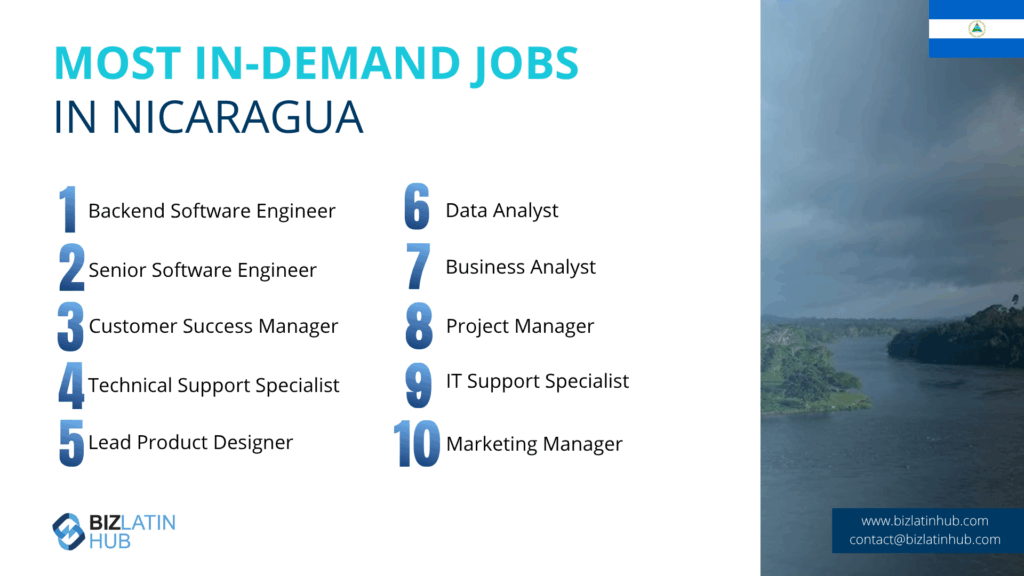

Key Benefits of Hiring a Remote Team in Nicaragua

Nicaragua presents a compelling opportunity for companies seeking to build remote teams. The country offers a growing pool of skilled professionals, particularly in sectors like customer support and software development, at a highly competitive cost compared to North American and European markets.

Incorporating a company in Nicaragua offers businesses access to a growing economy with a wealth of opportunities in agriculture, manufacturing, tourism, and renewable energy. Nicaragua boasts a favorable investment climate with competitive labor costs, tax incentives, and free trade agreements that provide access to key international markets.

Its strategic location in Central America serves as a gateway to both North and South America, making it an ideal base for regional operations. Additionally, the Nicaraguan government actively encourages foreign investment through its pro-business policies and streamlined incorporation processes.

The country’s infrastructure is steadily improving, with ongoing investments in transportation, energy, and telecommunications that support business development. Nicaragua also enjoys a youthful and skilled workforce, ensuring access to capable talent for businesses across various industries.

By choosing to incorporate a company in Nicaragua, investors can leverage these advantages to establish a strong foothold in a promising and expanding market. Whether you are a small business owner or a multinational enterprise, Nicaragua offers a dynamic environment for growth and profitability.

Payroll and Tax Management

In Nicaragua, managing payroll and taxes means knowing specific payments. Employers and employees both make these payments. Tax rates and payment percentages can change. Check with official Nicaraguan groups (like DGI and INSS) for the newest numbers.

Main Payroll & Tax Duties:

- Employer Payroll Payments:

- About 24.5% on top of an employee’s gross salary.

- This pays for:

- Pension and disability funds.

- Health insurance.

- A training fund.

- Registration with the Nicaraguan Institute of Social Security (INSS) is required. INSS covers health benefits, maternity leave, and pensions.

- An extra 2% of salary goes to the National Technological Institute (INATEC).

- Other Employer Money Duties:

- 13th-Month Salary: A full extra month’s salary. Paid to employees by mid-December each year.

- Severance Pay: Needed when ending jobs without a good reason. Labor laws require this.

- Employee Rights & Payments:

- Paid Vacation: Employees get 15 days of paid vacation every six months.

- Public Holidays: Right to paid time off for national public holidays.

- Employee Payroll Tax: Employees pay about 7% of their salary for:

- Pension and disability.

- Health insurance.

Nicaragua’s Tax System Explained

Nicaragua’s tax system needs a full approach from businesses. Companies are tax residents if they are registered Nicaraguan businesses. They are also tax residents if their main finance office is in the country. Nicaragua taxes only income made in its territory. This includes active and passive income. Company income tax has two different systems. These systems change based on the type and source of income. Employer payroll payments, as listed above, fund social security benefits. Employees also pay their own payroll tax. Understanding these payments is key to staying compliant. It also helps businesses work smoothly.

Income Tax and VAT Details

Income tax and VAT are important parts of Nicaragua’s money duties for businesses. The country uses a progressive income tax system. Rates are from 0% to 30% based on income amount. Employers must withhold these taxes from employee pay. They must send them to the tax office. Understanding the VAT system is also vital for businesses. Nicaragua’s standard VAT is 15%. It applies to the sale price of most goods and services. Some items like basic foods, medicines, and school costs are free from VAT. The VAT system uses a credit and transfer process for companies. This lets them reduce VAT paid on input goods. They offset it against VAT collected on sales. This system needs correct record-keeping. It also needs careful reporting. This helps improve tax processes and follow Nicaraguan laws.

Employment Terms: Hours, Overtime, Benefits

Hiring in Nicaragua means knowing key job terms. These include work hours, overtime, and benefits. Businesses must follow Nicaraguan labor laws. This ensures employee rights and company peace. Employers should focus on creating a good work environment. This environment respects standard work rules. It also offers legally required benefits. Following these rules helps stay compliant. It also supports worker happiness and output. Clear knowledge of these parts helps manage human resources well. It also matches business actions with legal needs.

Standard Work Hours and Overtime

Nicaraguan labor law sets standard work hours and overtime pay as follows:

- Standard Workweek (Day Shift): Maximum of 48 hours, usually 8 hours per day.

- Standard Workweek (Night Shift): Maximum of 45 hours, usually 7.5 hours per day.

- Overtime Pay: Paid at 200% (double) of the normal hourly wage.

- Overtime Limits: Cannot be more than 3 hours per day or 9 hours per week.

- Paid Rest Break: Employees have a right to a 30-minute paid rest break each workday. This is usually after four straight hours of work.

- Weekly Rest Time: At least 24 straight hours of rest each week is required. This is usually on Sundays.

These rules show the importance of rest. They aim to protect employee health.

Required Benefits: Maternity Leave, 13th Salary

In Nicaragua, pregnant employees get large maternity leave benefits. They receive 12 weeks of paid leave. This is 4 weeks before the expected birth date and 8 weeks after delivery. For multiple births, this time increases to 14 weeks. This allows 4 weeks before birth and 10 weeks after birth. During maternity leave, employers pay 40% of the salary. Social Security pays the other 60%.

Another key benefit is the 13th-month salary. Employees get an extra month’s pay for each year of service. This extra salary is a financial help. It rewards long-term work and effort. Nicaraguan law ensures employees can use their 13th-month salary. This supports money stability at the end of the service year. These benefits show a focus on employee well-being and fairness.

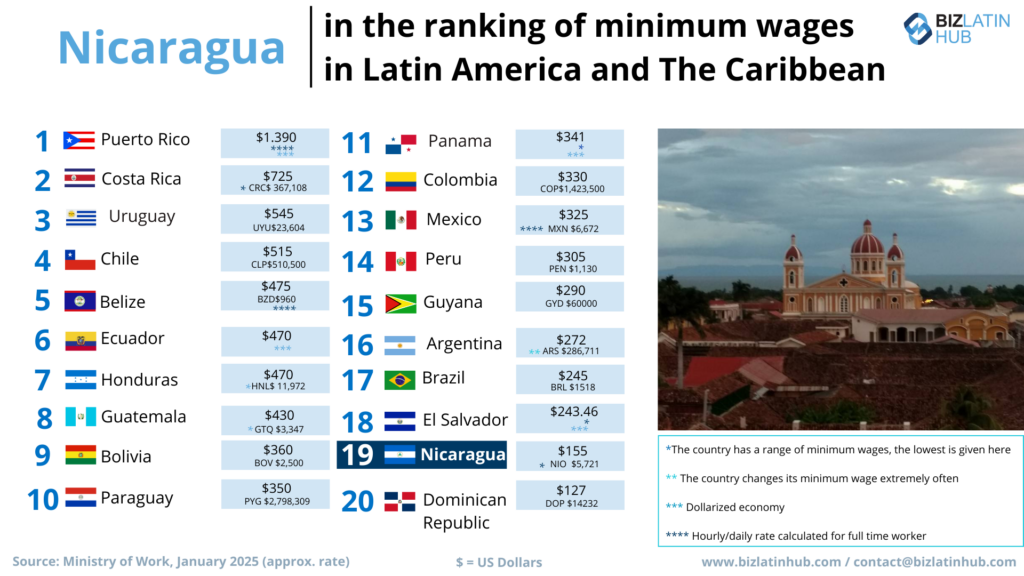

Offering Good Salaries

To get good workers in Nicaragua, employers must offer good salaries. This means following national minimum wage rules. These rules change by industry.

Examples of Monthly Minimum Wages (NIO): Note: These numbers are examples. They change regularly based on Nicaraguan government updates. For the newest minimum wage rates, check the latest official announcements.

| Industry | Minimum Monthly Wage (NIO) |

|---|---|

| Agriculture | 5,196.34 |

| Construction/Finance | 11,628.95 |

Also, employers must give a required 13th-month salary. This is paid by mid-December. It is a key part of salary packages. Overtime pay at double the hourly rate also affects budgets. Employers must plan for payroll payments. These add about 24.5% to the employee’s salary. Clear job contracts in the employee’s language help with openness and good salary offers.

Understanding Living Costs in Nicaragua

The cost of living in Nicaragua is important when deciding salary offers. The Nicaraguan Córdoba (NIO) is its currency. The country has a fairly low cost of living. The numbers below are general estimates. They can change based on place, personal lifestyle, and current money conditions. A single person can live on about USD $544.92 monthly, not including rent. Rent is between USD $100 and USD $200 per month. This is affordable for many. However, the minimum wage is often not enough to cover this cost. This creates money problems for locals. Still, international hires might find the cost easy to manage. Employers must think about these points in salary talks. This ensures salaries meet employee hopes and needs.

Comparing Average Wages

Average wages in Nicaragua change across different jobs. This gives an idea of industry standards. Knowing these numbers helps employers create fair and good salary packages. Note: The average salary numbers below are examples. They can change a lot based on experience, specific job, company, place, and data source. For exact salary information, check multiple current local sources.

Average Annual Salaries (USD) for Some Jobs:

| Profession | Average Annual Salary (USD) |

|---|---|

| Software Engineer | $10,457 |

| Marketing Manager | $9,699 |

| Cashier | $2,905 |

| Attorney | $10,552 |

| Operations Manager | $8,915 |

These numbers show that pay varies in different fields. They help create packages that meet industry standards and employee hopes.

Data Protection Law Compliance

EORs in Nicaragua must follow the Personal Data Protection Law (Law No. 787). This law needs specific actions to protect employee data. EORs must keep this data safe. They must follow Nicaraguan rules.

Employee permission is very important. EORs need permission before they collect or use personal data. This ensures openness. It also follows local laws.

Data use is strictly controlled. EORs can only use collected data for job-related reasons. Here is a short checklist for compliance:

- Get employee permission for data collection.

- Use security actions to protect data.

- Use data only for proper job reasons.

To comply, create clear steps for handling data. This method protects employee information. It also follows Nicaraguan data protection standards.

Visa and Work Permit Processes

Nicaragua has two main visa types for workers. The Work Permit is valid for up to one year. It is for foreign citizens in short-term jobs. The Temporary Residence Visa can be renewed each year. It is good for long-term plans. Needed papers include an employer letter and a medical certificate.

The Permanent Residence Visa is an option for those with temporary status for at least three years. This visa allows living there indefinitely. It needs similar papers as the temporary visa.

To get a work permit or visa in Nicaragua, you need:

- Proof of a job

- A criminal background check

- Medical papers (showing no contagious diseases)

The process can take a long time. Starting early is important. Specialized visa and immigration services can help. An experienced Employer of Record also often manages these needs well as part of their complete job solutions.

| Visa Type | Duration | Key Needs |

|---|---|---|

| Work Permit | Up to 1 year | Proof of job, medical certificate |

| Temporary Residence | Renewable yearly | Employer letter, medical certificate |

| Permanent Residence | Indefinite | Similar to temporary needs |

Understanding these steps will help you work in Nicaragua more easily.

Building Good Work Relationships

Building good work relationships with remote employees in Nicaragua means understanding local labor laws. It also means creating clear work conditions. Using a global employment platform or other professional HR services can ensure you follow regional rules. Job contracts must clearly state terms. This provides a strong base for the relationship. In Nicaragua, paying correctly and on time is key for trust with your team. Knowing local payroll systems or using payroll service providers can help with this. Also, written notices are needed for ending jobs. This shows the importance of following the legal system to keep good relationships.

Good Communication Methods

Good communication with your team in Nicaragua is key for a successful remote work setup. Use a dependable platform to manage administrative tasks. This ensures clear, regular interaction. Communication must be in your team members’ native language. This reduces confusion. This makes important papers like job contracts clearer. Quick and open communication about payroll and benefits is vital. This includes legal rights, national holidays, and maternity leave. This method helps build a healthy work relationship. It prevents possible confusion. Also, understanding cultural communication points is important. This includes respecting local customs and non-discrimination laws. This helps avoid cultural mistakes.

Understanding Cultural Norms

Understanding cultural norms can greatly help workplace success in Nicaragua. Nicaraguan culture values strong personal relationships. Building trust is important. It can positively affect professional interactions. The workplace often follows set power structures. Knowing and respecting these is key. Also, community work and group involvement are culturally important. They show the value of teamwork. Nicaraguan business culture uses both formal and informal communication. Using these styles can improve professional relationships. By using these cultural insights in workplace plans, businesses can create a more peaceful and effective work environment.

An EOR is a third-party service that legally hires employees on your behalf through its own local company. The EOR manages all HR, payroll, tax, and compliance obligations, allowing you to have a remote employee without setting up a Nicaraguan subsidiary.

While Nicaragua’s labor code does not have a separate chapter specifically for remote work, the standard employment laws apply. This includes requirements for a written contract, minimum wage, social security contributions, and vacation pay.

In addition to the employee’s gross salary, employers are responsible for social security contributions (currently 22.5% of salary) and contributions to the National Institute of Technology (INATEC), which is 2% of the total payroll.

Internet infrastructure has improved significantly in major urban centers like Managua. Fiber optic connections are widely available, providing reliable, high-speed internet suitable for most remote work arrangements.

Biz Latin Hub can help you with hiring in Nicaragua

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.