There is great potential for foreigners to invest in Colombia making it an ideal destination if you are looking to start a business. Its political stability, strong and ever-growing economy and new worldwide free trade deals mean there are lots of opportunies for smart investors. We outline the reasons to invest, key industries and advice on how to incorporate a company in Colombia. Biz Latin Hub can help you expand to the country or elsewhere in the region with our complete package of back-office services.

Key Takeaways

| Strong Economic Growth: | Average annual growth of 4% since 2000, bouncing back swiftly from the COVID-19 pandemic. Growth continues despite global economic challenges. |

| Abundant Skilled Labor: | Colombia’s extensive university network produces a steady supply of skilled yet affordable talent. |

| Improved Infrastructure: | Significant advancements in infrastructure, including airports, a metro system and upgraded ports. |

| Political Stability and Rule of Law: | A strong democratic tradition, institutional stability and respect for the rule of law provide confidence. |

| Strategic Trade Position: | Access to two oceans, membership in trade alliances, and free trade agreements make Colombia a pivotal hub for global commerce. |

| Diverse Investment Opportunities: | Key sectors for investment include agriculture (livestock, flowers, coffee), renewable energy (hydropower, solar, wind), and tourism. |

What are the 5 top reasons to invest in Colombia?

A growing economy

The Colombian economy has shown impressive growth rates so far this century, averaging around 4% annually since 2000 and with only one year in which it decreased.

After a rocky period in the COVID-19 pandemic of 2020-21, the country bounced back quickly, returning to solid growth in 2022.

Ongoing complications with the global cost of living crisis have affected the country, but the economy continues to grow year on year.

This is perhaps most starkly seen in the fact that Colombia has jumped ten places over the past decade in terms of international GDP (PPP) per capita rankings, now standing in the mid 80s.

Human talent

Colombia has so many universities that the capital Bogota is known as the ‘Athens of the Andes’. These universities produce a regular supply of skilled labor that still manages to be relatively affordable. There are more graduates per year than vacancies in engineering and tech fields, meaning that you can find good workers for most jobs at a lower cost than in richer economies.

The same is true for administrative staff and blue-collar workers in the country. It makes it easy to invest in Colombia when you have reliable access to plenty of workers at reasonable salaries. Furthermore, the local work culture is similar to European and North American ones, meaning that there should be little friction along those lines.

Infrastructure improvements

While more needs to be done, Colombia has taken huge leaps forward in terms of infrastructure in recent years. Ex president Juan Manuel Santos oversaw a major update of the road network and all the major international airports have been fully refurbished to bring them in line with global standards.

Within the capital Bogota, work has finally started on its brand new Metro network, which will make the city much more functional. Complementing that is a rail link to nearby satellite towns, allowing the commercial and financial sectors of the city to grow faster. Deep sea ports in Buenaventura (Pacific) and Barranquilla (Atlantic) have also been upgraded, meaning cruises have returned to the former.

Political stability

The country has a long and strong tradition of democracy, meaning that you can be confident when you invest in Colombia. Although there was a long-running internal conflict, that was brought to an end in 2016 and the future is bright.

Institutions are strong and although bureaucracy can be difficult to deal with at times, this is a result of a commitment to the rule of law and the importance of following the constitution, especially in urbanized central areas such as Bogota, Medellin, Bucaramanga and Ibague.

Trade deals

Given its strategic location, it’s no surprise that Colombia acts as a trading hub, with access to both the Atlantic and Pacific oceans and easy connections both to the rest of South America and to North America. The country has also joined the exclusive OECD club of rich nations.

Colombia is a founder member of the Community of Andean Nations and the Pacific Alliance, as well as being an associate member of MERCOSUR. On top of that, the country negotiated a major free trade agreement with the United States in 2012. This is important, as the US remains Colombia’s most important trading partner.

Where to invest in Colombia: 3 Key industries

While there is plenty of room for growth across the economy, we have picked out five particular areas of interest for those who want to invest in Colombia.

Agriculture

Colombia is a major producer and exporter of livestock, especially cattle. With growing worldwide demand for meat products, this is a market that sees no signs of slowing down. The country has vast resources of arable land, meaning that there is plenty of room for growth and land reform is helping to open this up further.

Flowers and fruit are major sectors as well, with the country providing the vast majority of roses consumed in the United States. Then, of course, there is Colombia’s most famous product: coffee. Travel anywhere in the world and you will see Colombian coffee on the shelves and in mugs.

Energy

Colombia produces oil, but that market is largely closed off to new investors. However, in the field of renewables, there are a lot of opportunities. In fact, Colombia currently stands as the number 4 destination globally for renewable investment.

Much of that is related to hydropower schemes, already well developed and commonplace across the country for domestic power supplies. Expertise in hydro schemes is assured with decades of experience in the sector. Both solar and wind also have great potential, with Colombia being tropical and mountainous with sunshine guaranteed and strong winds in many areas.

Tourism

After decades of internal conflict, Colombia has turned a new leaf with the signing of a peace deal in 2016. This milestone has paved the way for sustained growth in tourism, including medical tourism in Colombia, over the past few years. New areas are opening up to visitors, and confidence in the country is growing. While Colombia currently receives only a fraction of the international tourists it could, this is rapidly changing.

Colombia’s second city, Medellin, is also a key destination for digital nomads and remote workers. This has led to a boom in the local economy, with demand for apartments, fine dining and luxury items skyrocketing in recent years.

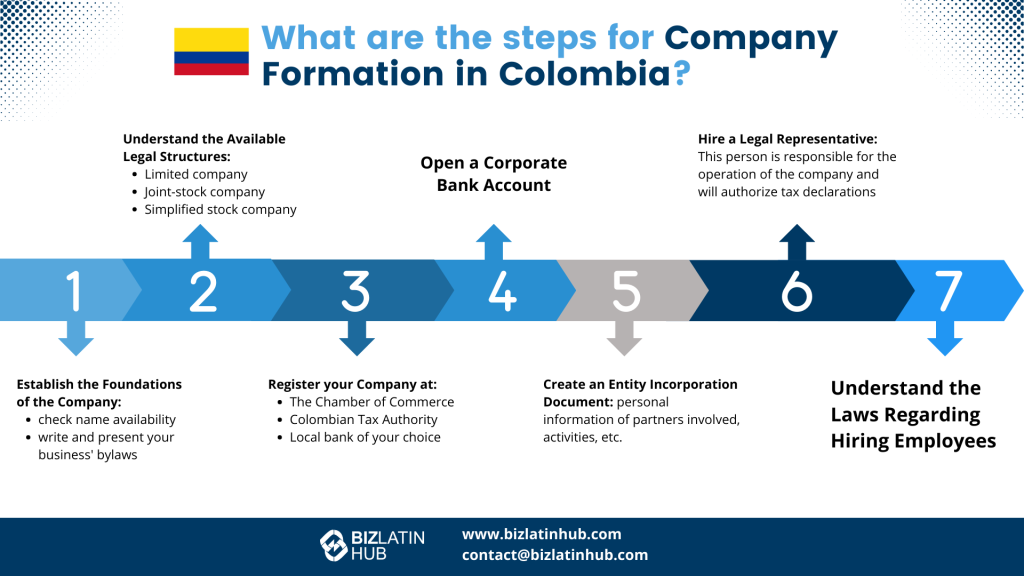

How to set up a company and invest in Colombia?

Colombian law recognizes various forms of business entities, but the most common ones are:

- Sociedad Anónima (S.A.): This type of company is similar to a public limited company (PLC). It requires at least five shareholders and a minimum capital contribution of 100 times the monthly legal minimum wage.

- Sociedad Limitada (Ltda.): This is similar to a limited liability company (LLC) in other countries. It requires at least two partners and a minimum capital contribution of 100 times the monthly legal minimum wage.

- Sociedad por Acciones Simplificada (SAS): This is a simplified stock corporation designed to provide a more straightforward and faster incorporation process compared to the traditional S.A. and Ltda. companies. It requires at least one partner and has no minimum capital requirements. In our experience, this is what we almost always recommmend.

- Empresa Unipersonal: This is a sole proprietorship, where the business is owned by a single individual. There is no minimum capital requirement, and the owner is responsible for all obligations of the business.

FAQs on doing business in Colombia

Answers to some of the most common questions we get asked by our clients.

Can a foreigner own a business in Colombia?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

How long does it take to register a company in Colombia?

In our experience, registering a company in Colombia takes around four weeks.

What does an LTDA company name mean in Colombia?

LTDA in a company name in Colombia refers to a Sociedad de Responsabilidad Limitada, which is similar to a Limited Liability Company. This type of corporate structure is characterized by the partners’ liability being limited to their contributions to the company’s capital.

In an LTDA, partners are not personally responsible for the company’s debts beyond their investment, providing a level of protection for individual assets. Small to medium-sized businesses frequently use it in Colombia because it combines elements of partnership and corporate structures, providing flexibility and legal protections.

What does an S.A.S company name mean in Colombia?

S.A.S means Sociedad por Acciones Simplificada, which is similar to a Joint Stock Company. This is a type of commercial company with legal presence and assets independent from those of its owners. Shareholders are liable only up to the amount of their respective contributions corresponding to the integration of the shares they subscribe to or acquire. Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond its contribution, except if the legal presence of the company is declared unenforceable.

What entity types offer limited liability in Colombia?

Both the Sociedad por Acciones Simplificada (S.A.S) and Sociedad de Responsabilidad Limitada are Limited Liability Companies in Colombia.

Is there any support from government to invest in Colombia?

Yes, the government agency ProColombia is set up to do exactly this. On their website you will find advice and help with the bureaucracy of the country.

Biz Latin Hub can assist you in Colombia

At Biz Latin Hub, our bilingual team of accounting & taxation experts is on hand to help you understand what the new Colombia tax reform means for your business and help you take advantage of every new benefit it introduces.

As well as tax advisory, we offer a comprehensive portfolio of back-office services, that also includes company formation, visa processing, hiring & PEO, due diligence, and legal services, meaning we can provide a tailored package of integrated services to meet your individual needs.

Contact us today to discuss how we can support you doing business in Colombia, or any of the other markets around Latin America and the Caribbean where we have teams in place and offer our services.