Conducting merger and acquisition (M&A) due diligence in Colombia when buying or partnering with a local company is important to assess the real value of your commercial enterprise, and detect potential risks that can have a severe impact on your business operations. By engaging with a trusted due diligence services provider in Colombia, you will be able to verify an organization’s compliance with local corporate regulations and evaluate its financial health before closing a business deal.

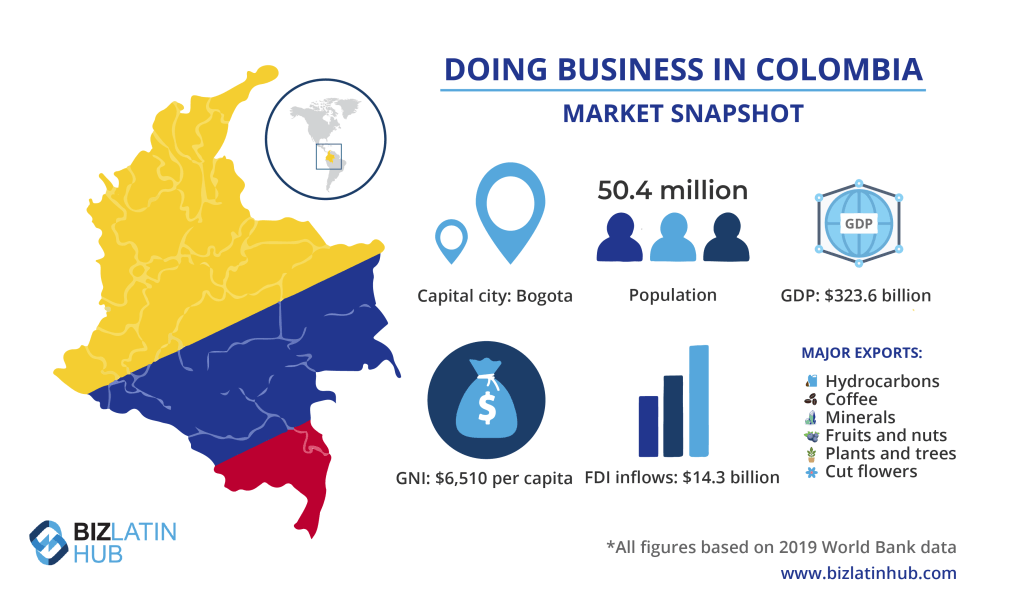

Colombia is Latin America’s fourth-largest economy by gross domestic product (GDP), which reached $323.6 billion (all figures in USD) in 2019. That same year, the South American country registered a gross national income (GNI) of $6,510 per capita — a figure that places it among upper-middle income nations, according to standard established by the World Bank.

Colombia maintains a business-friendly environment, bolstered by long-running political and economic stability that has helped the country maintain consistent economic growth that has never dropped below 2% since 2001.

Bordering Brazil, Peru, and Panama — the latter frontier linking Central and South America — with major ports serving both the Pacific and Atlantic coasts, and with North America just a few hours away by plane, Colombia has a highly strategic geographic location. As one of the closest partners of the United States in Latin America and the Caribbean over more than half a century — and a major recipient of US aid — it also maintains an important strategic political position in the region.

Colombia has built a network of free trade agreements (FTAs), granting companies established in the country with preferential access to more than 60 markets in the Americas, Asia, and Europe. In addition, Colombia is one of the founder members of the Pacific Alliance, a political and economic bloc that also includes Chile, Mexico, and Peru, and has expansive ambitions to recruit countries outside the Western Hemisphere.

The Andean nation is one of the main recipients of foreign direct investment (FDI) in the region, which grew from $11.5 billion in 2018 to $14.3 billion in 2019. Colombia’s main export commodities include petroleum, coffee, precious minerals, plastics, and cut flowers.

If you are looking to incorporate a company in Colombia or are considering buying or partnering with a local organization, read on to learn how to undertake a process of M&A due diligence in Colombia, or go ahead and contact us now to discuss your business options.

Understanding M&A due diligence in Colombia

A process of M&A due diligence in Colombia evaluates the business practices of a company operating in the country, identifying possible risks and inconsistencies that can jeopardize or delay your commercial strategy. By conducting due diligence, you will access important and sometimes confidential information on a specific company to verify its regulatory compliance and financial status, allowing you to make an informed decision on whether to continue with a purchase or an acquisition in the country.

M&A due diligence also involves a detailed investigation of a company’s labor practices and environmental behaviors, as well as customer information, sales figures, ownership of assets, and business records. Likewise, a due diligence process verifies if all corporate information has been legally declared by the company before Colombian authorities. By undertaking a thorough M&A due diligence report, you will know if you are making a good investment at a fair price.

Some of the documents that are carefully reviewed during an M&A due diligence process include:

- Income statements

- Records of invoices receivable and payable

- Balance sheets and tax returns

- Profit and loss reports

- Reports of deposits and cash payments

- Utility bills

- Bank loans obtained

- Minutes of shareholders meetings

Key steps to conduct an M&A due diligence process

The main steps involved during a process of M&A due diligence in Colombia are:

Step 1: Choose the right due diligence services provider

Find a due diligence services provider who has extensive knowledge of local corporate requirements and tax regulations, as well as experience offering M&A due diligence services to past clients. In this way, you can be confident that the process is undertaken in the most robust manner possible.

Step 2: Examine corporate compliance

Your due diligence service provider must confirm that the investigated company complies with the basic tax requirements imposed by local authorities and confirm that its declared tax identification number (NIT) is valid. Likewise, it should be confirmed if the company complies with all corporate and labor regulations, and possible legal disputes that may affect the business should be identified.

Step 3: Verify financial health

In this step, the financial history of the company should be reviewed and its degree of indebtedness and liquidity must also be analyzed in order to determine its growth forecasts. Note that the company’s tax status should also be evaluated.

Step 4: Conduct a market study

Once the financial and tax status of the company has been analyzed, a market study must be carried out. This includes an analysis of the product or service to be offered in Colombia and its current demand, as well as an analysis of the real market share, main competitors, and clients’ perceptions.

Types of due diligence processes

Most foreign investors seek to evaluate a company’s financial and legal records during a process of M&A due diligence in Colombia. However, there are other areas of a business that may require a professional examination. The main types of due diligence processes include:

Legal due diligence analyzing the legal situation of a company to identify possible risks of litigation and legal problems with trademarks and patents. Contracts that have been signed with third parties are also examined.

Labor due diligence to assess whether the company complies with all labor regulations established by law, as well as the reaction with local social security authorities and the working conditions of the employees.

Financial due diligence focuses on analyzing a company’s financial records to determine whether its operations will be economically sustainable in the future.

Environmental due diligence evaluates the environmental risk management of a company and verifies if it complies with all environmental requirements established by local authorities.

Biz Latin Hub can conduct your M&A due diligence in Colombia

At Biz Latin Hub, our multilingual team of due diligence specialists has extensive experience undertaking meticulous examinations of different types of companies in Colombia, identifying potential inconsistencies that can put your commercial operations at risk and helping you to make educated decisions when expanding your commercial operations. With our full suite of legal, company formation, and accounting services, we can be your single point of contact to incorporate a company in Colombia, and any of the other 15 countries in Latin America and the Caribbean where we are present.

Reach out to us now for more information or a free quote.

Learn more about our team and expert authors