Starting a business in Nicaragua offers excitement and presents challenges. Nicaragua is in Central America. It provides many opportunities in different sectors. A good understanding of the local conditions is important for success. Nicaragua’s politics, economy, and culture create a unique business setting. Businesses should identify key industries. These include tourism, agribusiness, and renewable energy. This information helps make good investment decisions. The real estate sector also shows strong growth potential. This is especially true in areas like Tola. This guide compares the three main pathways for establishing a business presence—direct investment, joint ventures, and outsourcing—to help you choose the most effective strategy.

Key Takeaways: Market Entry Strategies in Nicaragua

| What are the three primary strategies for entering the Nicaraguan market? | Company formation, joint ventures and PEO outsourcing. |

| Which offers the most control? | A direct investment via company formation offers the most control. |

| What are the advantages of forming a joint venture with a local partner? | A joint venture with a local partner can provide invaluable market knowledge |

| Why use PEO services? | A PEO allows for market entry without establishing a legal entity. |

| Which strategy is best for quickly testing the market? | PEO is the quickest way into the Nicaraguan market |

Comparing 3 Key Market Entry Strategies

1. Direct Investment: Company Formation

- Description: This involves establishing a 100% foreign-owned subsidiary in Nicaragua. The most common structure is the Sociedad Anónima (S.A.).

- Best For: Companies making a significant, long-term commitment who require full control over their operations and brand.

- Considerations: This strategy offers the most control but also involves the highest upfront cost and the longest timeline for setup.

2. Strategic Alliance: Joint Ventures

- Description: This involves partnering with an established local Nicaraguan company to form a new, jointly-owned entity.

- Best For: Companies that can benefit from a local partner’s expertise, resources, and established market presence.

- Considerations: This can accelerate market entry but requires careful partner selection, due diligence, and a well-drafted joint venture agreement to align goals and mitigate risk.

Expert Tip: The Importance of Due Diligence in a Joint Venture

From our experience, while a joint venture with a local partner can provide invaluable market knowledge, it also carries significant risk if the partner is not properly vetted. Before entering into any joint venture agreement in Nicaragua, we strongly advise conducting comprehensive due diligence on your potential partner.

This should include a legal review to check for any existing litigation, a financial review to assess their stability, and a reputational check within the local business community. A thorough due diligence process is the most critical step in ensuring a successful and secure partnership.

3. Outsourcing: Professional Employer Organization (PEO)

- Description: This strategy involves hiring local staff through a PEO provider, which acts as the legal employer.

- Best For: Companies that want to test the market, hire a small team quickly, or establish a presence without the cost and complexity of setting up a legal entity.

- Considerations: This is the fastest and most flexible entry strategy, with the lowest initial investment and risk.

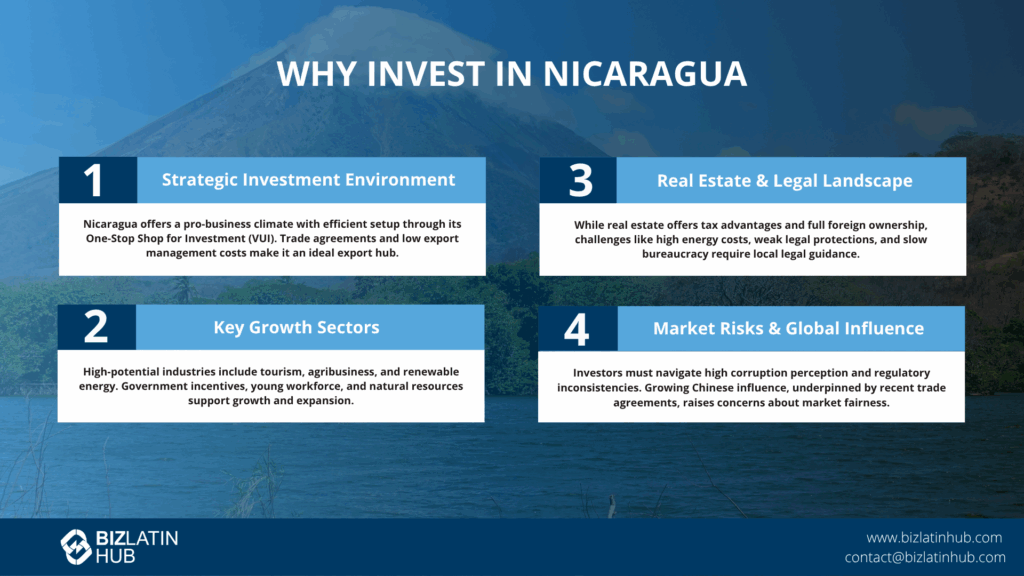

Economic Overview and Market Opportunities

Nicaragua’s economy offers opportunities in sectors such as agriculture, textiles, and tourism. Its strategic location and participation in the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) provide preferential access to the United States market.

Nicaragua has shown strong economic growth. Recent data shows GDP grew 4.57% in 2023. The country has low costs for export management. This makes it good for businesses that export goods. Key industries are agribusiness, light manufacturing, and outsourcing services. These industries support its open economy.

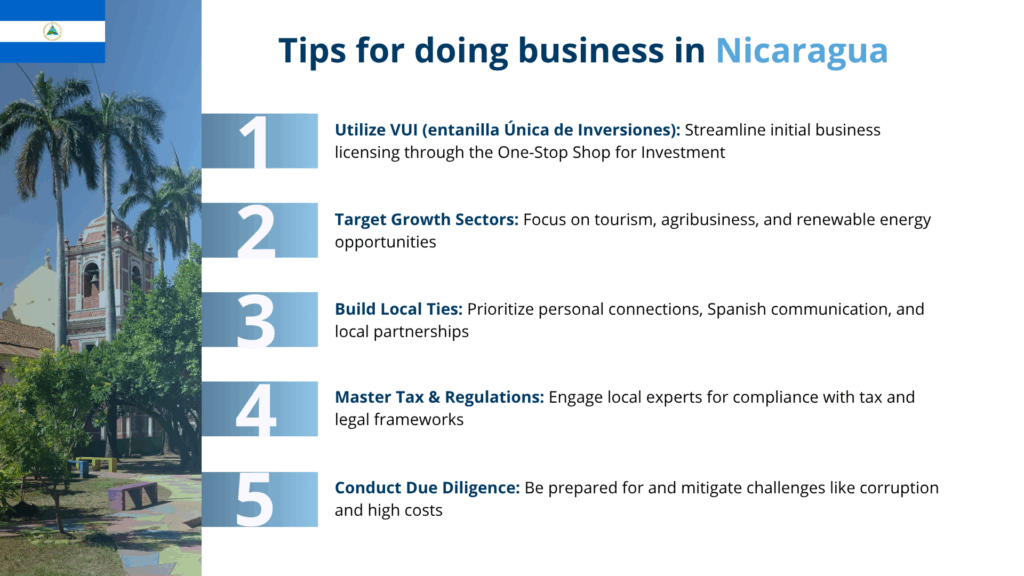

The Nicaraguan government aids businesses with friendly policies. It offers benefits for foreign investments. These benefits apply mainly to renewable energy and tourism. Investors can use the One-Stop Shop for Investment (VUI). The Ministry of Development, Industry, and Trade (MIFIC) manages the VUI. This service helps speed up the first steps of business licensing. It can take about 13 days for some procedures.

Key Advantages of Doing Business in Nicaragua:

- Recent strong economic growth

- Low export management costs

- Supportive government policies for specific sectors

- Faster initial business setup through VUI

| Industry Sectors | Key Opportunities |

|---|---|

| Agribusiness | Sustainable farming methods |

| Manufacturing | Light production facilities |

| Services | Outsourcing and call centers |

Nicaragua’s economy attracts businesses and investors. They look for growth and efficiency. The market gives diverse opportunities. These opportunities match its natural and human resources.

Political and Economic Overview

Nicaragua is an important part of Central America’s economy. Its average GDP growth was about 2.8% historically (1961-2023). Some periods showed faster expansion. Low export management costs helped this growth. However, in 2020, the GDP fell by about 1.8%. The COVID-19 pandemic and other issues caused this. In the third quarter of 2022, year-over-year GDP growth was about 3.4%.

Economic Sectors

- Agribusiness: Main exports are coffee and minerals.

- Light Manufacturing and Outsourcing: These greatly help the economy.

Some difficulties exist. These include perceived corruption and infrastructure limits. Electricity costs can be high. Customs processes can be slow. These problems can affect business operations.

Foreign Investment

In 2013, some reports said Foreign Direct Investment was 12.2% of GDP. Top investment sectors then were:

- Energy

- Mining

- Free Trade Zones

- Industrial

- Telecommunications

Even with difficulties, these investments show economic potential. Legal and economic systems change over time. This creates different opportunities for foreign investors. Nicaragua’s growth attracts businesses. They want opportunities in Central America.

Cultural Nuances Impacting Business

Building personal connections is very important in Nicaraguan business. Networking events and community meetings offer chances for these connections. Patience and politeness are valued. Nicaraguan schedules can be more flexible than in other cultures.

Speaking Spanish helps business connections. Many Nicaraguans in business speak English. However, using Spanish creates better understanding. Think about language use in your interactions.

Nicaragua has nine national paid holidays. Local holidays for patron saints also affect business. Knowing these dates is important for scheduling.

Quick Reference:

- Language: Use Spanish if you can.

- Holidays: Respect national and local holidays.

- Patience: Adjust to flexible schedules.

- Politeness: Always interact respectfully.

Nicaragua’s culture requires a good understanding of local ways. Business relationships improve when you appreciate these cultural points.

Identifying Key Market Opportunities

Nicaragua offers good opportunities for investors. Pro-business changes help this. The government works to make investment easier. The One-Stop Shop for Investment (VUI) is a key part of this. The Ministry of Development, Industry, and Trade runs the VUI. It makes the initial setup more efficient. Nicaragua’s trade agreements with the United States and European Union create chances for global partnerships. Foreign direct investment in energy, mining, and telecommunications helps Nicaragua’s production. Also, Nicaragua has some of Central America’s lowest export management costs. This makes it a good base for export businesses. Nicaragua has a young population. A large part of the people is under 40 years old (about 76% in past estimates). This young workforce offers a labor advantage.

Tourism Sector Potential

Nicaragua’s tourism industry has grown a lot. Some reports show a 65% increase in certain past periods. This makes tourism one of the country’s biggest and most active industries. Political and economic stability helped this growth. Better infrastructure and more flights also contributed. The government’s friendly approach to business includes tax benefits. These attract international tourism investors. There are many business chances in lodging, food, and tourism services. These areas show good growth signs. The Nicaraguan Hotel Association has often noted tourism’s growth. This shows the industry is strong and good for investment. Nicaragua’s beautiful landscapes and growing international appeal make it a good place for tourism businesses.

Agribusiness Opportunities

Nicaragua is known as a Central American economy with high growth potential. This makes it a good place for agribusiness. Its open economy has low export management costs. This helps businesses that export products. Agribusiness is a key part of Nicaragua’s economy. It offers many investment chances. A young, active workforce helps this industry grow. Nicaragua also has many natural resources. Coffee production is a good example. Good economic performance and many resources create favorable conditions for agribusiness investment. This makes Nicaragua an attractive place for agribusiness projects.

Renewable Energy and Infrastructure

Specific current data may change. However, renewable energy is an important sector for developing economies. This is due to the global move to sustainable energy. Nicaragua is working to improve its infrastructure. This can attract investment in renewable energy. Countries like Nicaragua usually see growth in renewable energy. This happens as they improve their general infrastructure. Investors might find chances in sustainable energy projects. These projects can add value to the country’s growing infrastructure.

Real Estate Challenges

Nicaragua attracts foreign real estate investors. Its tax policies are a reason. Income earned outside Nicaragua is not taxed there. However, investors must know about major problems in Nicaragua’s real estate market. These include:

- National infrastructure that is not fully developed in some places.

- High electricity costs. These can increase development expenses.

- Slow official processes and perceived corruption. These can make property management difficult.

- Worries about inconsistent rule enforcement.

- Reports of poor legal protections. These create risks, especially for rental agreements.

Investors can use strategies to lower tax payments. One way is to structure ownership. For example, an investor owns 99% and a lawyer owns 1%. Still, it is important to know about these risks when investing in property.

Key Regions for Investment, Including Tola

Nicaragua has several areas good for investment. Each area offers different chances. The table below shows some main areas:

| Region | Key Characteristics/Opportunities | Target Audience/Sectors |

|---|---|---|

| Tola | World-class surf spots, luxury resorts | Expatriates, tourists, real estate, services |

| Managua | Main business center, strategic location | Retail, IT |

| San Juan del Sur | Popular tourist spot | Hospitality development |

| Granada | Colonial charm, artisan shops, restaurants | Expatriates, tourism |

| León | Academic center, natural beauty | Education, eco-tourism |

Establishing and Managing Real Estate Assets

Nicaragua’s laws let foreign investors own real estate completely. This helps investment. A common ownership method has foreigners owning 99% of a property. A lawyer holds the other 1%. This can reduce some taxes. Income from outside Nicaragua has a 0% tax rate there. Income earned inside Nicaragua is subject to Nicaraguan income tax. For companies, this is usually a 30% rate. Personal income tax for residents uses a scale. The top rate also reaches 30%. An investor visa is needed to manage real estate. Investors should hire a local attorney. The attorney can help with laws and protect their interests. The Ministry of Development’s One-Stop Shop for Investment can make the first steps of starting a business easier. It simplifies some procedures within about 13 days.

Establishing Local Partnerships

Creating local partnerships in Nicaragua means working with local legal experts. These experts help with business setup. They also help understand labor and tax laws. Companies often find partners through networks and professional contacts.

Partnerships might need permits. Qualified local attorneys can help get these. It is important to understand Nicaragua’s changing legal system. In the past, there was a “Law on Agents, Representatives, or Distributors of Foreign Companies.” The details and current use of such laws can change. So, getting current legal advice on agency and distribution agreements is vital. This ensures you follow current laws on contract terms and ending contracts.

Nicaragua does not have a central, complete public list of business partners. So, businesses should connect with business groups and attend networking events. These can help make good connections.

Here are some main steps for creating partnerships:

- Work with local attorneys for permits and current legal advice.

- Use professional networks to find partners.

- Carefully study and understand local laws that affect your business.

- Join business groups for networking chances.

Following these steps helps companies make good partnerships in Nicaragua.

Seeking Legal and Regulatory Advice

Investors in Nicaragua need legal and regulatory help. The business environment is unique. Hiring a local attorney helps manage this environment well. The One-Stop Shop for Investment (VUI) helps local and foreign businesses with initial registration. However, investors often need more legal help for daily operations and specific rules. Starting a business in Nicaragua usually takes about 13 days for the first VUI steps. Legal advice makes this process smooth and efficient. Environmental rules can differ by industry. Talking to legal experts ensures you follow these rules. Decree 20-2017 on environmental reviews is an example. These rules can affect business operations. Company rules, like shareholder rights, also change based on a company’s own documents. Hiring a lawyer is a good idea to handle these differences.

Understanding Trade Relations

Nicaragua offers a low-cost setting for export businesses. It has one of Central America’s lowest export management costs. Professional channels can help create business partnerships in Nicaragua. The Foreign Investment Promotion Law protects foreign investors. This includes intellectual property rights. This law encourages foreign direct investment by offering some protections. Some foreign governments also give trade support. Their embassies often handle this. Nicaragua’s open economy has important sectors. These include agribusiness, light manufacturing, and outsourcing services. These industries are a big part of the country’s economic activity.

Intellectual Property Rights in Nicaragua

Nicaragua protects different kinds of intellectual property. The Intellectual Property Office (Registro de la Propiedad Intelectual – RPI) is part of MIFIC. It manages patent and trademark registrations. Nicaraguan law protects industrial designs, signals carrying programs, and plant types. The Foreign Investment Promotion Law promises foreign investors full protection for intellectual property rights, patents, and trademarks. Nicaragua is part of several World Intellectual Property Organization (WIPO) treaties. These are international agreements that make sure intellectual property rights are respected. Enforcing these rights in Nicaragua gives patent owners the sole power to stop others from using their inventions for business without permission. This strong protection system gives potential investors more confidence.

Navigating Taxation Laws

Businesses in Nicaragua must report to the Nicaraguan Tax Authority (Dirección General de Ingresos – DGI) every month. This is true even if there is no income. Income earned locally is subject to Nicaraguan taxes. For companies, the general income tax rate is 30%. For people living in Nicaragua, personal income tax uses a scale. Rates go up to 30%. Income earned outside Nicaragua by Nicaraguan residents is usually not taxed in Nicaragua. Understanding these tax laws can be difficult. Hiring skilled accountants helps understand financial rules. The Nicaraguan Tax Authority now audits more often. These audits can take several months. Also, getting city licenses involves fees. These fees change based on the company’s social capital. Payments must be made at specific banks. Knowing these tax duties and rules helps businesses operate more smoothly in Nicaragua.

Dealing with Corruption and Security Concerns

Addressing corruption and security issues is important for businesses in Nicaragua. Transparency International’s 2023 Corruption Perceptions Index came out in January 2024. It ranked Nicaragua 172nd out of 180 countries. Nicaragua scored 17 out of 100. This shows a very high level of perceived corruption in the public sector. Investors should understand the local legal system to protect their interests.

The Nicaraguan Criminal Code has penalties for breaking competition laws. These include fines and jail time for actions that harm fair competition. Businesses must follow these rules to prevent legal problems.

Hiring a local attorney can help with legal issues. An attorney ensures you follow local laws. This is very important given recent government actions. For example, in March 2023, the government canceled the legal status of COSEP (Superior Council of Private Enterprise). This shows government enforcement of registration rules and actions against business groups.

High energy costs affect business operations. Reasons include unclear power generation methods and use of fossil fuels. The price system is complicated. This makes electricity a major expense.

Key Points:

- High perceived corruption ranking shows potential risks.

- Legal penalties exist for breaking competition laws.

- Getting help from a local attorney is highly suggested.

- High and complicated energy costs affect businesses.

Understanding and handling these issues can help businesses run more smoothly in Nicaragua.

International Influences: Assessing the Impact of Chinese Investments

Chinese investments in Nicaragua are increasing. The Free Trade Agreement between Nicaragua and China started on January 1, 2024. This agreement might give special benefits to Chinese investors. This has caused worry that it could put local businesses at a disadvantage. Laureano Ortega Murillo, son of President Daniel Ortega, manages relations with China.

Legal experts and local business groups have pointed out potential problems. They say Nicaraguan businesses need fair conditions. The large amount of Chinese money could create unfair competition if not handled openly and fairly.

The Nicaraguan public and some business areas are worried. They fear agreements might help Chinese investors more than local ones. This could change how the local market works. More Chinese influence is clear. This is due to close connections with high-level Nicaraguan officials.

Potential Impacts of Chinese Investments:

- Possible special benefits for Chinese investors under the FTA.

- Risk of unfair competition for Nicaraguan businesses.

- More Chinese economic influence in the market.

- Worries among local people and businesses about openness and fairness.

Understanding these factors is very important. Nicaragua needs to ensure fair business conditions for everyone. This means balancing international partnerships with local needs.

Market Entry Options

Nicaragua provides several ways to enter its market. The first steps of setting up can be quick for some procedures. The Ministry of Development, Industry, and Trade’s One-Stop Shop (VUI) helps new businesses get started in about 13 days for these first steps. Local attorneys are key for foreign investors. They help with rules and legal issues. Foreign companies often choose to use a Nicaraguan Corporation (Sociedad Anónima – SA). This is the most common type of business. Businesses that export products find Nicaragua attractive. This is because of low export management costs. Business owners can choose to create joint stock companies. They can also open branch offices or set up representative offices. These options help them use Nicaragua’s economic growth opportunities.

Utilizing Agents or Distributors

Partnering with agents or distributors is a smart way to enter the Nicaraguan market. Main points and steps include:

- Working with Nicaraguan businesses. Professional networks and business contacts often help make these connections.

- Knowing that finding reliable partners is very important. Nicaragua does not have a central, complete public list to check potential partners.

- Choosing partnership types like general or limited partnerships, joint-stock companies, or joint ventures. These help use local distribution systems well.

- Handling legal incorporation, tax registration, and creating needed company governance systems. Local legal experts should guide this process. They can advise on current agency and distribution laws.

Joint Ventures and Direct Marketing

Joint ventures are a good way to enter Nicaragua’s market. Main procedural steps are:

- Applying for trader registration.

- Completing tax and city registrations.

- Writing a Public Deed of Incorporation.

- Registering company books. These steps are needed to set up any business type, including joint ventures.

For direct marketing, main points are:

- Understanding Nicaragua’s Commercial Code from 1917, and any later changes.

- Talking to local legal experts. This ensures you follow commercial laws and business rules. This approach helps companies follow existing legal rules. It also helps them promote their products and services well.

Compliance with Regulatory Requirements

Starting a business in Nicaragua means following several rules. The Ministry of Development, Industry, and Trade (MIFIC) runs the One-Stop Shop for Investment (VUI). This VUI makes the first steps of business licensing easier for local and foreign companies.

All businesses must follow the Nicaraguan Code of Commerce. This code gives shareholders equal rights, unless the company’s own documents say otherwise. Environmental rules in Decree 20-2017 (“Environmental Assessment System for Permits and Authorizations for the Sustainable Use of Natural Resources”) require businesses to get permits for using natural resources sustainably.

Foreign business owners often set up a Nicaragua Corporation (Sociedad Anónima – SA). This is the most common business type. These businesses must deal with official procedures that can be slow. This includes possible delays and unclear customs values set by the Nicaraguan Customs and Tax Authorities.

Here is a basic checklist for businesses:

- Register with the VUI for initial licensing.

- Follow the Nicaraguan Code of Commerce and related company laws.

- Get environmental permits based on Decree 20-2017, if needed.

- Prepare for customs and tax reviews and keep following all rules.

This table shows main groups and what they do:

| Entity | Function |

|---|---|

| Ministry of Development, Industry, Trade (MIFIC) | Initial Business licensing via VUI, Trade Policy |

| Nicaraguan Code of Commerce | Manages commercial activities, shareholder rights |

| Decree 20-2017 | Environmental permitting |

| Customs and Tax Authorities (DGA and DGI) | Customs values, tax collection and reviews |

Understanding these rules is very important for running a business smoothly in Nicaragua.

Leveraging Free Trade Agreements

Nicaragua uses Free Trade Agreements (FTAs) to get more foreign investment. The Free Trade Agreement with China, which started January 1, 2024, is a big part of this plan. This agreement tries to build international trade. However, it has created worries about possible unfairness.

Key Points of the China-Nicaragua FTA

- Benefits for Foreign Investors: The agreement might give some benefits to foreign investors. This could put local businesses at a disadvantage if not applied fairly.

- Hidden Benefits: Legal experts and business groups worry about hidden benefits or unfair terms. These could help foreign companies more in contracts.

- Attracting Investment: The agreement is part of Nicaragua’s larger plan to get foreign investors through good trade conditions.

| Advantage | Concern |

|---|---|

| Investment | Possible favoring of foreign companies |

| Trade Relations | Risk of unfair benefits for the local economy |

The Nicaraguan government uses FTAs to create international partnerships. But how these agreements are managed and negotiated affects their success and fairness. Balancing benefits between foreign and local companies is still a big topic in Nicaragua’s economic growth.

Conducting Adequate Due Diligence

Doing proper research (due diligence) is very important when doing business in Nicaragua. Investors should hire a local attorney. This helps follow local laws. Local attorneys give information about the legal system. They help with court procedures and property rights.

Approval from the Competition Authority (Procompetencia) is needed for some company mergers and purchases. This is especially true for deals between two foreign companies that affect Nicaragua. These deals might need approval before they can legally happen.

The business sections of embassies might give general information. But specific legal and business advice should come from qualified local experts.

The Ministry of Development, Industry, and Trade has a One-Stop Shop for Investment (VUI). This service makes the first steps of business licensing easier. The E-Regulations Nicaragua platform can also help investors. If it is working and current, it gives details for registering an online business.

Key Points:

- Hire a local attorney for legal help and research.

- Get approval from the Competition Authority for relevant company purchases.

- Get general information from embassy business sections. Add to this with local expert advice.

- Use the VUI for easier initial licensing.

- Use the E-Regulations platform (check if it is current) for business registration information.

Doing proper research reduces risks. It helps set up a business smoothly in Nicaragua.

Strategies for Expansion and Long-term Success

To grow and have long-term success in Nicaragua, businesses should use smart plans.

1. Leverage the VUI: Use the One-Stop Shop for Investment (VUI). It makes initial business licensing easier. This service helps a business start some registration steps in about 13 days.

2. Embrace Export Opportunities: Use Nicaragua’s low export management costs and open economy. This setting helps companies that export.

3. Utilize the Youthful Workforce: Use the young population. A large part is under 40. This active workforce can bring new ideas and be productive. However, they might need skills development and training.

4. Form a Corporation: Set up a Nicaragua Corporation (Sociedad Anónima – SA). Many business owners prefer this type. It offers a good liability structure.

5. Engage a Local Attorney: Hire a local attorney. They can help understand the changing legal system. They also help protect property rights, follow tax rules, and manage regulations.

Summary Table of Key Actions:

| Strategy | Benefit |

|---|---|

| Use the VUI | Quick initial business setup steps |

| Focus on exports | Low costs and open market access |

| Employ young workers | Chance for new ideas and productivity |

| Register a Nicaragua Corporation (SA) | Common and dependable business structure |

| Retain a local attorney | Necessary legal help and ongoing rule following |

Following these plans, along with careful research and being able to adapt, will help businesses operate in the Nicaraguan market. It will also help them work for long-term success.

Frequently Asked Questions: Entering the Nicaraguan Market

A Professional Employer Organization (PEO) is a service that allows you to hire employees in Nicaragua without setting up your own company. The PEO acts as the legal employer, managing all HR and compliance tasks. It is the fastest way to establish an operational presence.

The most common legal entity for foreign investors is the Corporation (Sociedad Anónima – S.A.), due to its flexibility and clear governance structure.

A joint venture allows you to leverage a local partner’s existing distribution channels, customer base, and knowledge of the domestic market, which can significantly reduce your time to market and operational risks.

Yes, Nicaragua’s laws permit 100% foreign ownership of companies and offer various incentives to attract foreign direct investment, particularly in the tourism and free trade zone sectors.

Biz Latin Hub can help you with opportunities in Nicaragua

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.