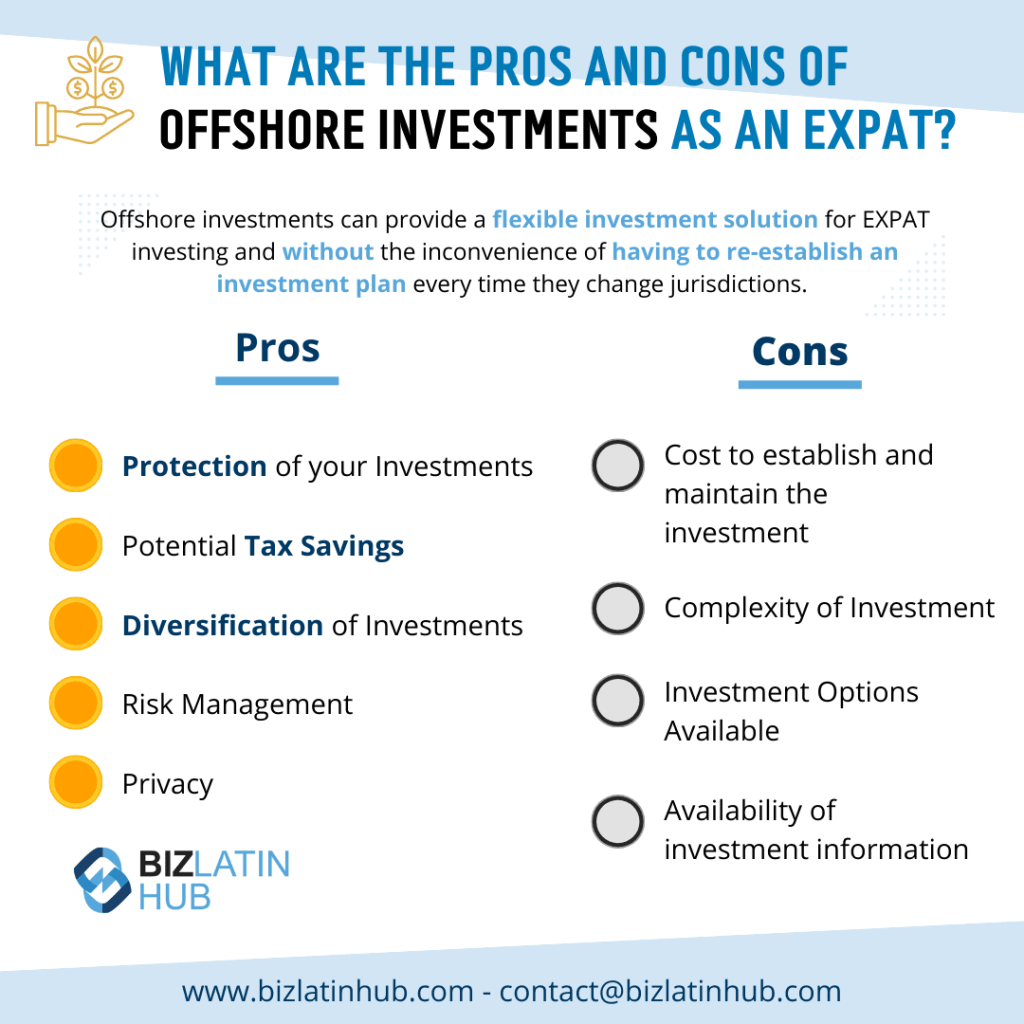

After careful contemplation, you’ve decided that opening an offshore investment account and building a portfolio would be a good idea. But which assets would be best to help you achieve your financial goals? Along with the different types of investments, you also want to determine if specific opportunities are right for you. Read on to find out more about offshore investing and about some considerations to be taken into account so you can decide whether a particular investment or opportunity will likely be a good fit for you.

1. You’re Comfortable With The Location of The Opportunity

There are important reasons to consider where an investment is based. One pertains to the protections local laws afford investors, especially the offshore variety. Knowing that you can hold the asset and fully comply with those laws matters. It also helps you decide if any extenuating factors make you uneasy about keeping that asset.

For example, an asset based in a nation with consistent political and economic stability is good. By contrast, assets based in nations with more erratic histories may not be something you want to consider. This is true even if the asset itself seems to be stable.

SEE ALSO: How to form an offshore company in Panama?

2. The Investment Performs Well in More Than One Economic Situation

It’s always in your best interests to look beyond current performance, and even the projected performance. Take time to look at the historical activity and see how the investment has performed over time during various economic, political, and other events. For example:

- How did the investment do during the last couple of recessions?

- How much of an impact did the worldwide pandemic have on the performance?

- How did the investment perform during the previous major political elections?

Previous events, be they economic, political or of another nature, can be strong indicators of future performance.

3. Acceptable Balance Between Volatility and Return

You are the only person who can determine how much risk you’re comfortable taking on any investment. There are some points to remember as you consider the amount of volatility or risk involved versus the potential returns.

A good rule of thumb is to identify how much you can afford to lose and remain financially stable. If you can acquire an asset and still financially manage if it fails to perform well or even loses money, then risking it may be something to consider. Should losing money on the asset create a significant financial hardship, it might be better to consider investments that are likely to produce lower but steady returns. These typically come with less risk and volatility.

4. Is it an Affordable and Manageable Investment Opportunity?

It’s never wise to spend so much on investments that you cannot cover your other obligations. You should invest with money that isn’t needed for necessities like food, clothing, and shelter. Your goal with investing is to improve your financial condition and provide a more comfortable standard of living. It shouldn’t leave you without a roof over your head or food on the table.

Be practical about how much you can sink into those offshore investments at any given time. You may want to think about setting up an offshore checking account and setting aside funds until there’s enough to purchase investments that you would like to own. Keeping all the activity separate from your domestic holdings will ease the temptation to overspend and potentially create financial hardship.

5. The Investment Will Aid in Achieving Your Financial Goals

No matter how promising an investment may seem, it’s not worth it if ownership will not move you closer to your financial goals. In the long run, you will do better to choose assets that have the potential to help you reach at least one of those goals. If ownership would likely help you achieve multiple goals, that’s all the better.

As you evaluate any asset, identify what you expect to get from that ownership specifically. Which goals will the investment directly or indirectly move you closer to obtaining? If you have trouble relating to anything specific, that investment may not suit you. Turn your attention to other opportunities that are capable of helping move you closer to your endgame.

6. Does the Opportunity Add Diversity to Your Portfolio?

As with your domestic investments, it’s essential to diversify your offshore holdings. Include offshore mutual funds, time deposits, real estate, and stocks in the mix. If you come across a bond issue that you believe would be good for your portfolio, consider adding it too.

A diversity of holdings in an offshore setting provides the same key benefit that applies to your domestic assets. When some of the investments aren’t performing as anticipated, others are likely to be doing quite well. This helps to avoid net losses on the portfolio in general. It also gives you some breathing room to decide if holding on to those underperforming assets that may improve in a few months or if selling now and replacing them with something more promising would be best.

7. A Potential to Keep the Investment for the Long Term

Not all assets are intended to be held for more than a short while. Even so, it’s good to have a strong foundation for your offshore portfolio. You can achieve that by having a core group of assets you intend to maintain for years rather than weeks or months.

Assets with a history of steady returns are a good choice for that foundation. You can consider options like real estate or shares of stock in companies that have been around for a long time and remain profitable. With that type of stability, it will be easier to speculate about assets like stocks with higher volatility, futures, and other options generally held for a limited time.

8. Choose the Best Offshore Investment Options for You

Remember that what constitutes a good opportunity for one investor may not be right for you. Once you have a clear picture of your current financial situation and future goals, you can then consider if an offshore asset or opportunity is a good fit. Never feel that you have to take on an asset just because someone else thinks it’s a good idea. Ultimately, you are the one who assumes the risk and either reaps the rewards or incurs a loss.

When researching and inquiring about the best offshore investment opportunities, take your time, ask plenty of questions, and choose wisely. Doing so helps you build an offshore portfolio that will thrive.

Biz Latin Hub can help you with your Offshore Investment Process

At Biz Latin Hub we have a strong reputation for being market leaders in working with clients to understand and operate within the local market, and likewise we are well positioned to direct you to a reputable financial advisor that will support your investment decisions. Choosing the right investment advisor when doing offshore investment can mean the difference between low or high returns.

Contact us today to find out more about how we can assist you. Or read more about our team and expert authors.