Antigua and Barbuda, a twin-island nation in the Caribbean, offers a number of compelling advantages for businesses and investors. From its attractive tax and regulatory regime to its strategic location, growing infrastructure, and stable political climate, the country is increasingly seen as a viable base for regional and international operations. Below are the main reasons many international businessfolk consider company formation in Antigua and Barbuda for long term investment.

Key takeaways on opportunities in Antigua and Barbuda

| Is foreign ownership allowed in Antigua and Barbuda? | Yes, up to 100% ownership by foreign investors is permitted, although you will need a resident representative. |

| Company types that offer limited liability | |

| What international links does the country have? | |

| What is the business culture in Antigua and Barbuda? | Largely similar to North America and Europe, with limited cultural differences. |

Key opportunities in Antigua and Barbuda

Overall, Antigua and Barbuda presents a strong proposition for businesses seeking a stable, English‑speaking base in the Caribbean, with favorable tax incentives, government support, and an environment open to foreign investment. For industries aligned with tourism & hospitality, financial services, ICT, agriculture/manufacturing (especially export‑oriented), and small / medium enterprises, the opportunities are particularly promising.

1. Strategic Location & Market Access

- Gateway to the Caribbean: Antigua and Barbuda is well positioned to serve regional markets, particularly through CARICOM, and its geographic location facilitates trade with both North and South America as well as Europe.

- Stable Currency: The country uses the East Caribbean Dollar (XCD), which is pegged to the US dollar. This provides stability for imports, contracts, and foreign exchange risk.

2. Business‑Friendly Regulatory Environment

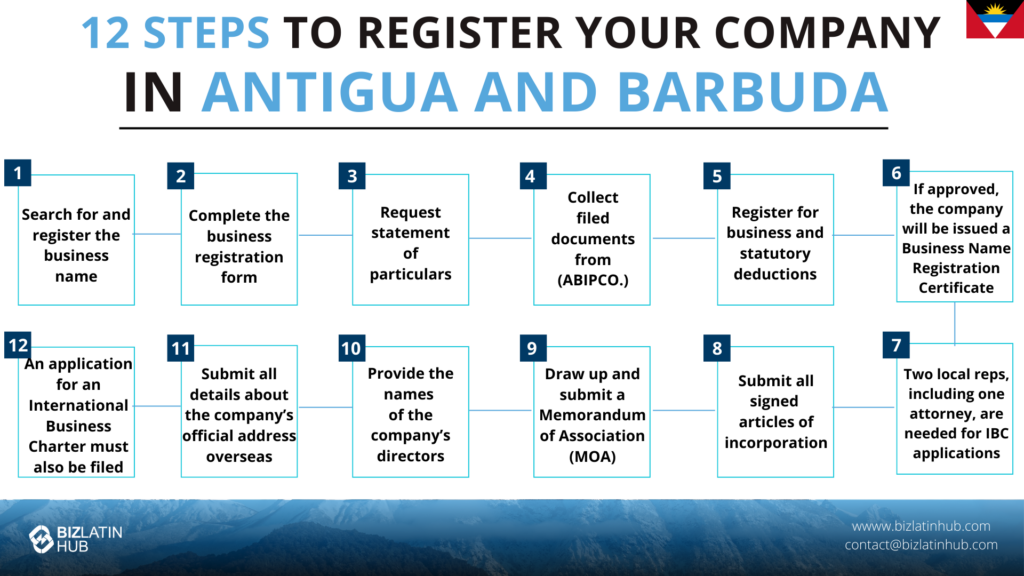

- Transparent company formation: The regulatory framework, company law, and the incorporation process are relatively streamlined. Foreign investors have access to support from the Antigua & Barbuda Investment Authority (ABIA) to facilitate licensing, permits, and regulatory compliance.

- Special Economic Zone (SEZ) incentives: Antigua has established SEZs (Special Economic Zones), which provide tax‐ and duty‐free incentives, and duty concessions for qualifying industries, making them attractive for manufacturing, financial services, trade & logistics.

3. Attractive Tax and Fiscal Incentives

- Corporate tax: Standard corporate tax is 25%, but certain sectors (e.g. telecommunications, insurance, oil, financial services) may benefit from reduced rates or special treatment.

- Value‑Added / Sales Tax (ABST): The general sales tax rate (ABST) is about 15–17%, depending on the good or service. Some sectors, notably tourism or hospitality services, have reduced or specific rates.

- No capital gains, wealth, or inheritance taxes: Antigua and Barbuda does not impose separate taxes on capital gains, inheritance, or (in many cases) on foreign‑sourced income for certain structures.

- Incentives for manufacturing and small businesses: Under the Small Business Development Act, businesses may obtain exemptions or reductions in duties, property tax, and income taxes for up to five years. There are also incentives for manufacturers via import duty waivers on raw materials, machinery, tools etc.

4. Skilled Workforce & Human Capital

- English as official language: This reduces barriers for many international companies in communications, contracts, and operations.

- Availability of trained labor in key sectors: Particularly in tourism, financial services, ICT, and related industries. The government also focuses on matching skills training with business needs.

5. Political Stability, Safety & Governance

- Stable democratic governance: Antigua & Barbuda follows a parliamentary democracy, generally considered stable, with legal protections for contracts, property rights, etc.

- Relative safety and security: Compared to many countries in the region, it is viewed as having lower levels of large‑scale political risk, and a well‑established rule of law.

6. Government Support & Incentive Programs

- Small Business Support & Entrepreneurial Development: For example, the Prime Minister’s Entrepreneurial Development Programme (EDP) has been expanded, with significant funding, low‑interest loans, training and support.

- Duty, tax & concession programs via ABIA: The Antigua & Barbuda Investment Authority offers concessions, duty exemptions or reductions, customs duty relief, etc., for enterprises meeting certain investment, employment, or sectoral criteria.

Potential Challenges & Considerations

To have a balanced view, here are some of the areas a business should consider carefully:

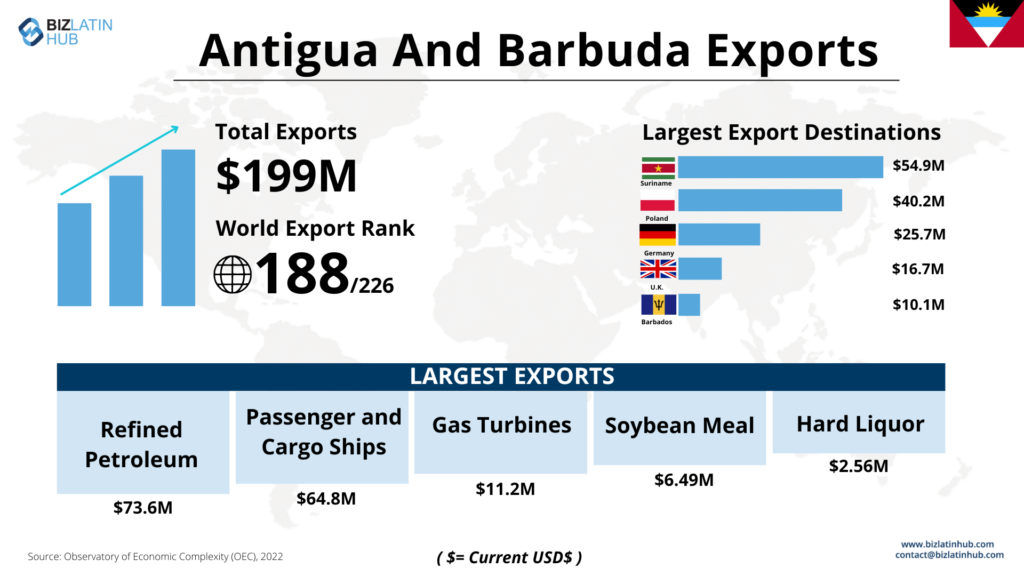

- Small domestic market size: With a relatively small population, local demand is limited; many businesses will depend on exports, tourism, or servicing markets abroad.

- Import dependency: Many inputs, goods and capital equipment must be imported, which can raise costs and import duty exposure (unless exemptions or incentives apply).

- Infrastructure limitations in certain areas: While major infrastructure (ports, airports, telecommunications) tends to be adequate, more remote islands or lesser‑connected areas may have gaps.

- Environmental & climate risks: Hurricanes, tropical storms, sea‑level rise and other climate‑related threats are real; businesses in certain sectors may need to invest in resilience or insurance.

Frequently Asked Questions (FAQs) on Opportunities in Antigua and Barbuda

In Antigua & Barbuda the standard corporate income tax rate is 25% for resident companies on their taxable profits. Some sectors (like telecommunications, insurance, oil, or banking) may be eligible for reduced rates or special concessions depending on government policy and investment conditions.

No, Antigua and Barbuda does not impose a personal income tax on individuals in the way many countries do. That means income earned by individuals (subject to certain residency and source rules) is generally not taxed.

Yes. Antigua and Barbuda has a sales tax / consumption tax system: the ABST (Antigua & Barbuda Sales Tax). The rate is in the region of 15–17% for most goods and services. Some sectors (e.g. tourism, hotels, specific services) may have different rates or special treatment.

Yes. Foreign investors (and domestic ones) in certain sectors can benefit from a range of incentives through the Antigua & Barbuda Investment Authority (ABIA) and legislation such as the Small Business Development Act. These may include exemptions or reductions in customs duty, reductions in withholding tax, exemptions or reductions in import duties on raw materials, equipment, tools, etc.

Generally yes. The country has a stable political system, rooted in parliamentary democracy, and well‑established legal institutions. It is considered relatively safe compared to many jurisdictions in the region, with rule of law, property rights and contract law functioning in ways investors find reliable.

Biz Latin Hub can help you with opportunities in Antigua and Barbuda

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.