New Zealand has the second most honey exports in the world, behind China. Known for its agricultural prowess, the country prides itself on a ‘quality over quantity’ produce economy. However, strains on New Zealand’s suppliers should give cause to consider alternative solutions to the world’s growing demand for honey.

We explore the possibility of connectivity between Latin America and New Zealand to alleviate pressure on the South Pacific nation’s honeybees and promote hidden potential for honey exports. If both sides co operate and co ordinate, this could easily be a win win situation.

If you are considering company formation to explore the potential for honey exports to or from Oceania or Latin America, Biz Latin Hub can help you out. We have offices across both regions, meaning that we have you covered wherever you are in the world. Not only that, but we can make sure that our array of back office services keeps you fully compliant for the long term, allowing you to focus on honey.

New Zealand’s agriculture economy

New Zealand is world famous for its productive agriculture sector. The nation, despite its population of fewer than 4.8 million people, is one of the world’s largest dairy exporters. Its dairy, eggs, honey, and meat products alone rake in US$15.4 billion and make up 40% of total exports. Fruits, nuts, wood and cereal preparations make up a further US$7.1 billion in revenue and 18.5% of total exports.

New Zealand agriculture has experienced many successes in overseas markets. Demand for New Zealand dairy in Asia has skyrocketed in parallel with the region’s rapid growth. Such is its success that Fonterra, New Zealand’s co-operative group for local dairy farmers, has established a hub in Singapore to assist the distribution of its products across the region.

NZ honey in the world market

In recent years, New Zealand’s natural honey has experienced a steep increase in demand worldwide. The South Pacific country produces between 15,000-20,000 tonnes of honey per year. Export revenue reaches over NZ$340 million a year (over US$223 million), a number that continues to grow.

There is a real buzz around Manuka honey in the increasingly wealthy Asian middle classes and the UK. This due in part to its scientifically-proven antibacterial properties. The honey is reported to alleviate sore throats and digestive issues, aid wound healing, and prevent tooth decay.

Challenges for New Zealand’s liquid gold sector

New Zealand faces some challenges in keeping up with the growing demand for its native Manuka and other natural honey. The value of bees in pollinating the country’s agricultural and native flora also causes some distraction for the honey sector. This mounts a hefty workload on the country’s native and introduced bee populations.

As the sector feels the stretch to provide, nervousness around the sector’s sustainability and local price for honey increases. Producers that were once the queen bees of their field are now starting to feel the strain.

Environmental and lifestyle trade-offs

The payoff for Manuka beekeepers has dramatically increased over the last decade. In 2010, Manuka sold for NZ$37.50 (around US$24.60) per kilogram. Today, Manuka sells for up to and over NZ$100 (US$65.60) per kilo. New Zealand honey has developed the reputable label of a ‘luxury’ good, favoring quality over quantity.

However, setbacks for Manuka and other local honey producers include:

- anxiety around threatened native bee species as a result of introducing honeybees to the country

- threats to bees and hives such as varroa mite and colony collapse disorder

- an increase in commercial sabotage activity, and

- increasing urbanization of key pollen-collecting areas for bees.

Locally, Kiwi honey-lovers are finding the revered spread less affordable for their own household consumption. As global demand drives honey prices up, more of the liquid gold gets shipped off New Zealand shores to its trade partners’ kitchen cupboards.

Where Latin American honey exports come in

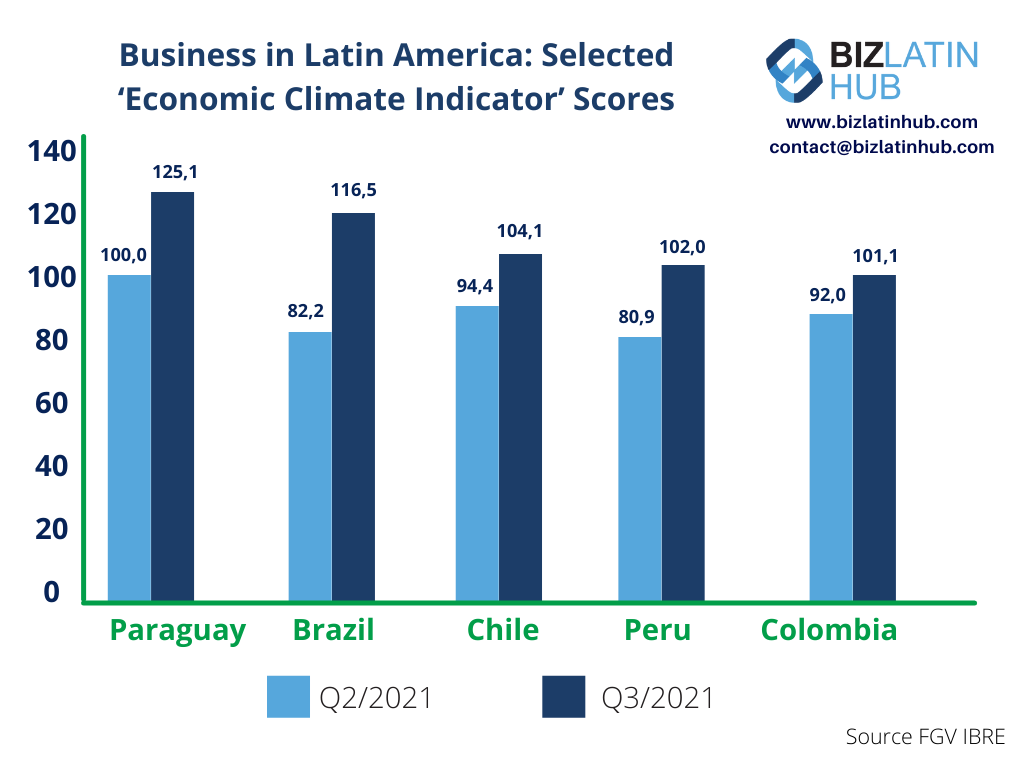

Latin America has some of the world’s largest honey exports by volume. Argentina, Mexico and Brazil all rank within the top ten major global honey exporters:

| Country | Value of honey exports ($US) | Percentage of total exports |

| Argentina | 175 million | 7.8% |

| Mexico | 120.4 million | 5.4% |

| Brazil | 95.4 million | 4.3% |

Chile, the region’s other leading economic powerhouse exports US$29 million in natural honey, which accounts for 1.3% of the country’s total exports.

Latin America’s main honey customers at this point are found in North American markets. US beekeepers are experiencing similar issues to New Zealand, such as colony collapse and commercial espionage.

Little interaction is seen between New Zealand and Latin American honey sectors currently. However, beekeepers and honey production businesses in both regions should consider what one can provide the other.

Good conditions for bees

Despite being underrated and under-reported, Latin America’s honeybees show impressive signs of good health. Research to discover what’s driving the sustainability and positive productivity of the region’s bees can be hard to come by. Available research from biology journalist Apidologie indicates:

- the region’s bees may possess a natural resistance to certain diseases

- an abundance of pollen resources in more concentrated, accessible areas

- low-income agriculture commerce employs fewer industrial-scale pest control techniques (e.g. widespread pesticide and insecticide spraying)

- the region’s geographic diversity offers more sustainable conditions for bees and improves their adaptability.

This suggests that Latin America’s potential to provide to the global market has been largely untapped. Local and multinational agricultural businesses seeking diversification should consider the opportunities the region’s resilient bees and geographic conditions offer.

Success for the two markets in honey exports

In a purely symbiotic context, Latin America’s ability to meet growing demands for honey worldwide could relieve New Zealand of pressure. Emerging global honey suppliers may sting the revenues of Kiwi beekeepers initially. However, this could help the country’s honey sector develop more sustainable practice, and further support their native conservation efforts.

Due to low production costs, Latin American honey exports could be offered to New Zealanders at more affordable prices.On top of boosting exports for the region, Latin America could take another step towards supporting its own food security. Farmers already engaged in agricultural activities can keep bees without requiring more land to do so.

As with New Zealand, bees can aid in the pollination of crops, which would further support local agricultural business success. This gives farmers stability and can stimulate crop production, including for the region’s biggest overseas sellers, such as coffee.

Sharing information and best practice techniques

Finally, different climates call for different sustainability measures. Bees are sensitive to changes in climatic conditions. Further research on Latin America’s varied geography could reveal solutions to climate issues and sustainability best practice. This could offer widespread benefits to local honey economies both in New Zealand and Latin American countries looking to expand their agricultural portfolios.

This is an exciting time for Latin America. As a strong agricultural producer like its Kiwi neighbor, honey has been surprisingly overlooked as a potential key export for the region. Businesses should consider how the honey exports sector could contribute to their success and the continued growth of the region.

Biz Latin Hub can help with honey exports in or out of Latin America or New Zealand

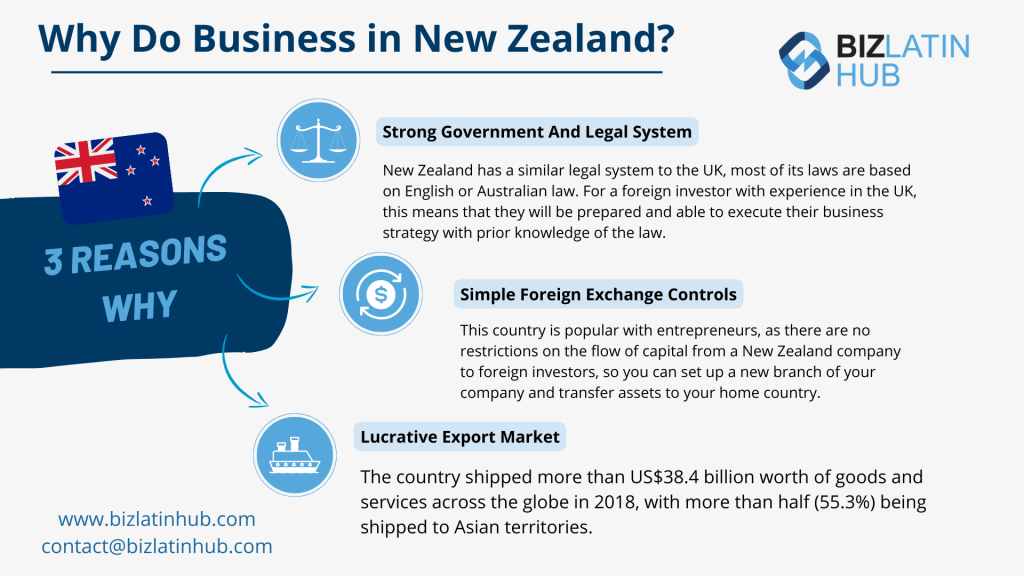

New Zealand’s hive of export and import activity make it one of the most attractive markets in the world for investors. With a multicultural population, opportunities for new businesses are plentiful and incredibly diverse.

At Biz Latin Hub, we can help you navigate the company formation process for doing business with and in New Zealand or Latin America. Our multinational team of experts offers tailored business solutions for firms looking to expand into these regions. This includes visa processing, legal services, company incorporation, due diligence, and accounting.

To find out more, contact the team today here at Biz Latin Hub.