Guatemala is an increasingly attractive location for companies expanding into Central America. However, setting up and managing HR, payroll, and compliance in-country can be complex. With a Professional Employer Organization (PEO) or Employer of Record (EOR) in Guatemala, you can hire employees legally and quickly without incorporating a company. Biz Latin Hub provides flexible, fully compliant PEO and EOR services to simplify your hiring needs in Guatemala or company formation in Guatemala.

Key takeaways on payroll outsourcing in Guatemala

| Hiring | Not part of standard payroll outsourcing in Guatemala, but available with PEO services |

| Compliancy | Your payroll outsourcing in Guatemala will handle everything for you |

| Legal support | Provided |

| Working Hours | Up to 8 hours daily, six days a week, 44 hours max weekly |

| Monthly minimum wage (2024) | Varies according to sector and geography, between GTQ$3,171-$3,634 (approx. USD$410-$470) |

What Is a Professional Employer Organization (PEO) in Guatemala?

However, in the event that you do not have an entity established in the country, or wish to avoid the expense and time commitment associated with company formation, you will likely opt for payroll outsourcing in Guatemala via a professional employer organization (PEO). Such a firm will hire local staff on your behalf, meaning you do not need to establish an entity to have workers overseas.

When you use a PEO, which can also be known as an employer of record (EOR), they act as the official employer in the eyes of local authorities, and their service will also include on-boarding and off-boarding, as well as the drawing up of legal documents related to your overseas staff.

Some of the main tasks a payroll outsourcing company will be in charge of include:

- Making payments and completing tax procedures in accordance with local law

- Carrying out regular payroll and budget calculations

- Managing, registering, and updating information related to contracts and salaries

- Printing and delivery of pay stubs

- Making direct deposits of wages and benefits

- Preparing of management reports

Key Advantages of PEO and EOR Services for Expanding into Guatemala

Payroll outsourcing in Guatemala comes with a number of benefits, such as:

Cost effectiveness

One of the most attractive aspects of payroll outsourcing in Guatemala is the cost saving it generally involves. Because while you will have to pay a fee to the company providing the service, when you outsource payroll it means you can avoid the costs involved not only paying in-house staff, but also recruiting and replacing them.

Guaranteed compliance

Another key benefit of outsourcing your payroll is that you are guaranteed compliance with local norms and legislation. Because a payroll outsourcing firm will have vast experience in the market and will be aware of the latest developments in labor, corporate, and tax law, so you can rest assured that all statutory requirements.

In the event that you are looking to enter multiple markets at the same time, a PEO with an international presence will be your best option, because that way you will be able to manage all staff through the same company, regardless of the legislative differences in each jurisdiction.

Focus on other aspects of your business

As an administrative task that does not generate revenues in itself, payroll is an ideal function to outsource if you want to focus more of your efforts on more profitable aspects of your business. Because when you outsource payroll in Guatemala, that leaves your leadership team with more opportunity to focus on the likes of product development or building up contacts in your industry.

Time saving

Managing payroll is a time consuming activity, and while managing it internally will see the majority of that time commitment fall upon your in-house team, there will undoubtedly be times when managers and senior managers have to dedicate time to the process. When you outsource payroll, you eliminate such necessity, freeing up valuable time for senior people in your organization whose time is at a premium.

Expert advice

While the payroll outsourcing firm you hire will mainly be undertaking an administrative role, they will also be well-placed to provide expert advice on a variety of topics related to your overseas expansion, and not simply related to relevant legislation, but also on candidate profiles and market dynamics. Where that payroll outsourcing firm has an international presence, they will also be able to advise you on future expansion plans, based on their knowledge of the markets where they operate.

Benefits of Using PEO & EOR Services in Guatemala:

Quickly hire Guatemalan employees without forming an entity

Ensure compliance with Guatemalan labor and tax laws

Full-service payroll and social security processing (IGSS)

Legal risk mitigation and reduced admin burden

Support for short-term or project-based hiring

Bilingual local HR and legal support

PEO vs. EOR: Which Is Right for Your Business?

When expanding into Guatemala, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR is legal in Guatemala and allows foreign companies to hire local staff without establishing a legal entity.

Note that in Guatemala, PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Guatemala. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate local regulations, establish entities, and ensure full HR compliance with local labor laws. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

| Feature | PEO Guatemala | EOR Guatemala |

|---|---|---|

| Legal Employer | Client (with entity) | Biz Latin Hub (acts as legal employer) |

| Hiring Speed | Medium | Fast |

| Compliance Responsibility | Shared | Fully managed by Biz Latin Hub |

| Best For | Companies with local presence | Fast entry or temporary operations |

| Contract Ownership | Company-employee | EOR-employee |

Use this table to evaluate the right hiring model based on your operational structure in Guatemala.

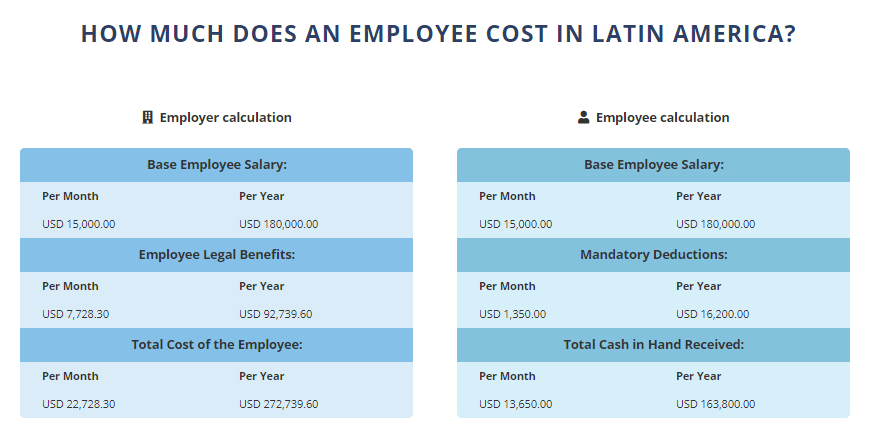

Use a payroll calculator to calculate hiring costs in Guatemala

If you would like to get an idea of the costs of outsourcing your payroll in Guatemala, it is worth seeking out a payroll calculator. Because while such a tool will not be able to give you a totally accurate figure, it will give you a very close estimate, as well as allowing you to compare payroll costs in competing markets.

One such example is the payroll calculator that can be found on the recruitment & PEO services page of the Biz Latin Hub website.

By using our tool, you will develop a good indication of the costs you can expect to incur when payroll outsourcing in Guatemala, or any of the other 15 countries in Latin America and the Caribbean where we operate.

FAQs on payroll outsourcing in Guatemala

No, traditional payroll outsourcing in Guatemala will not handle this, solely focusing on managing payments. A Professional Employer Organization (PEO) will be necessary for managing recruitment.

Payroll outsourcing in Guatemala comes with a number of benefits, such as:

Cost effectiveness

Guaranteed compliance

Focus on other aspects of your business

Time saving

Expert advice

Varies according to sector and geography, between GTQ$3,171-$3,634 (approx. USD$410-$470)

The standard workday is eight hours long, with a maximum of 44 hours per week.

This is a twice-per-year bonus common to many countries in Latin America that corresponds to one average month’s salary, paid in two installments in June and in December.

A PEO in Guatemala helps companies with legal entities manage HR, payroll, and social security processes while sharing employment responsibilities.

An EOR in Guatemala legally hires employees on your behalf, allowing you to operate without forming a local entity.

Yes, Biz Latin Hub can assist with incorporation and transferring employees from EOR to your local company.

Yes. Biz Latin Hub ensures compliance with labor laws, IGSS, and SAT tax requirements.

EOR is ideal for market entry, testing operations, or short-term hiring without the burden of local incorporation.

Biz Latin Hub can undertake your outsourcing payroll in Guatemala

At Biz Latin Hub, our multilingual team of recruitment & PEO experts has the experience and know-how to meet your payroll outsourcing needs in Guatemala, as well as being on hand to activate our established recruitment network to find those staff quickly whenever necessary.

With our full suite of market entry and back-office services, we can be your single point of contact to expand your business in Guatemala, or any of the other 15 countries across Latin America and the Caribbean where we have a presence. We also operate in Southeast Asia and the South Pacific.

Contact us now for further advice or a free quote.

Learn more about our team of expert authors.