You must open a corporate bank account in Guatemala for seamless financial transactions, allowing you to manage operational expenses, pay salaries, and comply with local tax obligations promptly. With business-friendly policies supporting company formation in Guatemala, opening a corporate bank account in Guatemala is a crucial step in this process. Guatemala has a developing banking infrastructure and increasingly serves foreign-owned companies seeking Central American expansion. The process requires clear documentation and tax registration.

Key takeaways on how to open a corporate bank account in Guatemala

| Which banks are best to open a corporate bank account in Guatemala? | Banco Agromercantil. Banco Industrial. Banco Promérica. Banco G&T. BAC. Bantrab. |

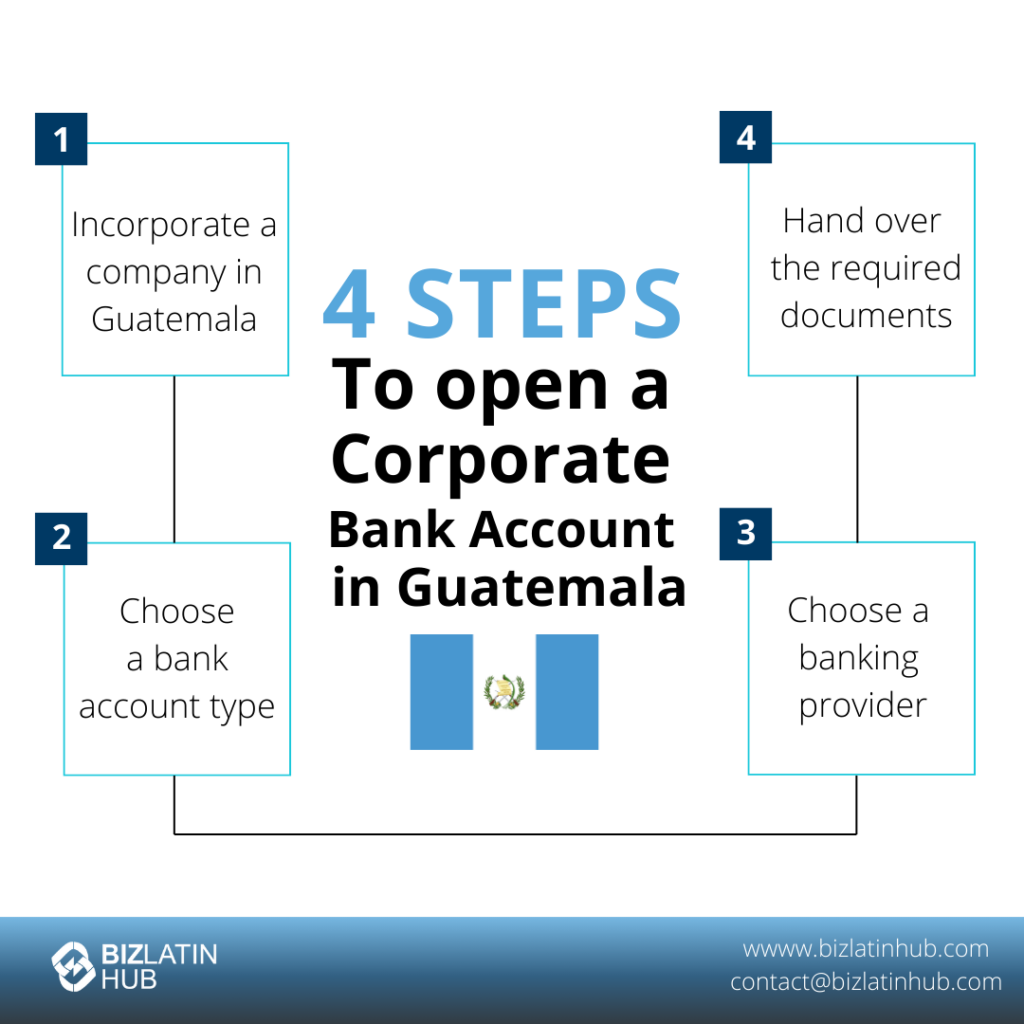

| The four step process to open a corporate bank account in Guatemala: | Step 1 – Incorporate a company in Guatemala: Step 2 –Choose a bank account type. Step 3 – Choose a banking provider. Step 4 – Hand over the required documents. |

| Does every corporate bank account follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

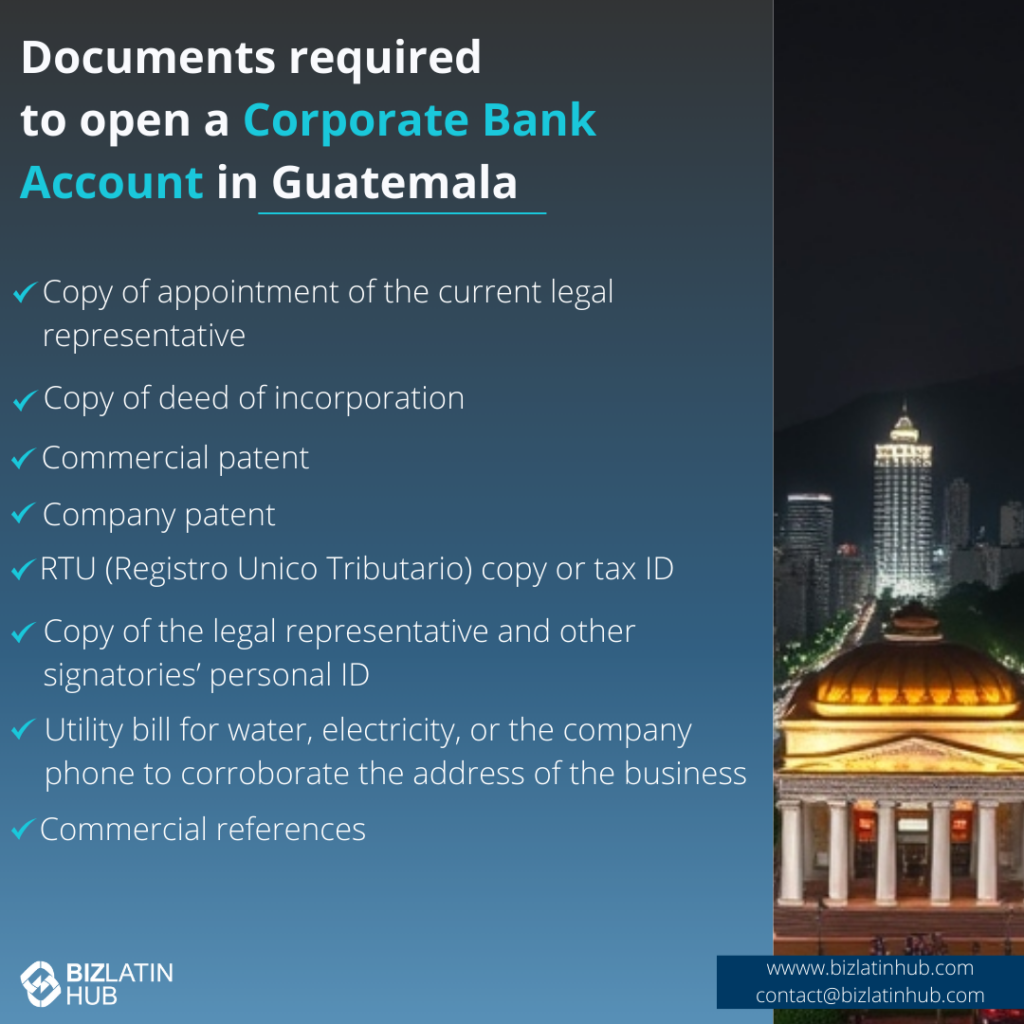

| What are the necessary documents when opening a corporate bank account in Guatemala? | Copy of appointment of the current legal representative. Copy of deed of incorporation. Commercial patent. Company patent. RTU (Registro Unico Tributario) copy or tax ID. Copy of the legal representative and other signatories’ personal ID. Utility bill for water, electricity, or the company phone to corroborate the address of the business. Commercial references. |

Step-by-Step Account Opening Process

The process of opening a bank account in Guatemala can be summarized into four general steps, each of which will be further discussed below:

- Step 1 – Incorporate a company in Guatemala:

- Step 2 –Choose a bank account type.

- Step 3 – Choose a banking provider.

- Step 4 – Hand over the required documents.

1. Incorporate a company in Guatemala

Only a legally registered company can have a bank account. Therefore, before you can open a corporate bank account in Guatemala you will need to carry out the incorporation process by registering your company before the Mercantile Registry (Registro Mercantil).

As you are in the process of registering your company, you will be asked to decide what type of legal entity your company falls under. As a business executive, you should consider all types of available legal entities and choose the one that is most adequate for your business expansion strategy.

If you choose to register your company as an S.A., you will be asked to attach the following documentation during registration:

- Public deed of constitution.

- Certificate of appointment of the legal representative(s).

- Identification of the business owner(s).

- Tax domicile of the company.

- Receipts or other proof of payment of fees.

After submitting the required documents for your company type, the Mercantile Registry will approve the company constitution. At this point, your company will be officially incorporated and you are ready to move on with opening a corporate bank account.

2. Choose a bank account type

Before you approach a possible banking provider, you should know what type of bank account you would like to open. Different account types will differ in the options they offer and the restrictions they have in place. There are three different types of corporate bank accounts in Guatemala:

- Corporate checking account: This will help you manage cash flow, transactions, payments, and international transfers; either through online banking or with associated cards and checkbooks.

- Corporate savings account: Can be used to earn interest on saved profits. For this account, you need to maintain a minimum amount of money to keep earning interest. On some occasions, the banks will require notice before withdrawal of funds.

- Business term deposit: The term deposit bank account is a savings account but is subject to expiry dates and fixed interest rates to guarantee you a set return. You can only withdraw money before the term expires by paying a penalty fee.

You can open a corporate bank account in Guatemala in either Quetzals or US dollars without complications. This must be stated before opening the account.

3. Choose a banking provider

Once you know what type of bank account is best for your business, you may begin to evaluate your options of banking providers. Guatemala has a great variety of banks. As a business executive, you should choose which bank to have an account with by determining which bank’s services are most convenient for your business model.

Some popular banks for foreign businesses in Guatemala are:

- Banco Agromercantil.

- Banco Industrial.

- Banco Promérica.

- Banco G&T.

- BAC.

- Bantrab.

Our recommendation: We recommend that clients, as far as possible, choose a bank if they have a pre-existing relationship with it.

4. Hand over the required documents

Once you have decided where you would like to bank, you can request that they open a corporate account for your business. The bank will then ask you to hand over a number of documents. Each bank has its own specific requirements for opening a business bank account, but most procedures are similar. Due to strict anti-money laundering legislation, every institution that may open a corporate bank account in Guatemala needs to know who the account holders and final beneficiaries are.

This is a list of the requirements most banks in Guatemala will ask for when opening a corporate bank account:

- Copy of appointment of the current legal representative.

- Copy of deed of incorporation.

- Commercial patent.

- Company patent.

- RTU (Registro Unico Tributario) copy or tax ID.

- Copy of the legal representative and other signatories’ personal ID.

- Utility bill for water, electricity, or the company phone to corroborate the address of the business.

- Commercial references.

PRO TIP: To speed up the process of opening a bank account in Guatemala, it is recommended to travel to the country. Business executives can take this opportunity to get acquainted with the Guatemalan business culture and build commercial relationships that will support the expansion of the company.

Recommended Banks in Guatemala

There are a number of banks operating in the country. Recommended institutions include Banco Industrial, Banrural, and BAC Credomatic.

Most banks require face-to-face onboarding and notarized Spanish documentation, meaning you will need to find an official translator and have a local legal representative.

Comparison Table:

| Feature | Guatemala | El Salvador | Honduras |

| Minimum Deposit | $500 | $500–$1,000 | $1,000 |

| Account Opening Time | 2–3 weeks | 2–3 weeks | 2–4 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Limited | Limited |

Required Documents for Opening a Business Account

You will need to provide a range of documents before opening a corporate bank account in Guatemala. This usually include company registration, NIT (tax ID), legal representative ID, company bylaws, proof of address, business activity description, and possibly a bank reference letter.

On top of that you will need to consider compliance. Banks are supervised by the Superintendencia de Bancos, banks enforce AML rules, UBO disclosures, and foreign transaction declarations. This is an important part of tax and accounting requirements in Guatemala.

Additional FAQs About Banking in Guatemala

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Guatemala:

1. Can I open a corporate bank account online?

No. You can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA). However, the original bank application forms will need to be sent to Guatemala.

2. What documents do I need to open a company bank account in Guatemala?

Once the company has already been established, the following documents must be presented to your local bank:

- Company Bylaws.

- Appointment of RL.

- Patents of Commerce (Entity and Company) .

- Invoice or receipt of water or electricity services.

- RTU (Tax ID).

3. Who can have access to a company bank account?

Initially, only the legal representative and subsequently all the people designated by the legal representative.

4. What is the best bank in Guatemala for foreign companies?

There are multiple good options. These include:

- Banco Industrial.

- Banco Promerica.

- BAM.

- BAC.

- Banco G&T.

5. Why do companies open bank accounts in Guatemala?

Commercial companies must have a bank account when they exceed the legal minimum that they can count on in cash for the initial capital in accordance with the Commercial Code. Also, to maintain adequate traceability of all the company’s transactions and have sufficient evidentiary elements for any inspection by partners or state entities.

6. Do you need Guatemalan citizenship to open a bank account?

Anti-money laundering policies have made the process slightly stricter for non-residents. However, if the company is registered in Guatemala, the bank will allow you to open a corporate bank account.

7. Can foreign companies open business accounts in Guatemala?

Yes, foreign-owned businesses must provide full incorporation documentation, a tax ID (NIT), and a local representative.

8. Are USD accounts available in Guatemala?

Yes. USD and local currency accounts are both widely available.

9. How long does onboarding take?

Most accounts are opened within 2 to 3 weeks assuming all compliance documentation is accurate.

Benefits of Business Banking in Guatemala

Guatemala has experienced progressive economic stability over the last 4 years, with economic growth of 3.1% in 2018 and 2019. Moreover, it is considered to be one of the largest economies in Central America. This makes it an exciting place for investors looking to expand their business in Latin America, but they will need a corporate bank account in Guatemala to operate in the region.

Opening a bank account in Guatemala is a key step for investors, offering streamlined access to one of Central America’s rapidly developing economies. It facilitates transactions in Guatemalan quetzales, reduces international transfer costs, and ensures compliance with local financial regulations, enabling investments in sectors like agriculture, textiles, and renewable energy.

A local corporate bank account also enhances credibility with Guatemalan businesses and authorities while providing access to financial products tailored to the country’s growing market. It helps investors navigate the regulatory framework, adapt to local economic conditions, and capitalize on Guatemala’s expanding opportunities, establishing a strong foundation for success.

Biz Latin Hub can Help you With a Corporate Bank Account in Guatemala

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of how to open a corporate bank account in Guatemala, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about opening a corporate bank account in Guatemala was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.