Guatemala’s growing economy requires businesses to maintain strict compliance standards. An entity health check in Guatemala serves as your comprehensive due diligence tool for identifying compliance gaps and preventing regulatory penalties. Companies operating in Guatemala face potential fines ranging from Q5,000 to Q500,000 for various compliance violations, making regular corporate due diligence in Guatemala essential for business continuity.

This guide provides a complete framework for conducting Guatemala compliance checks and entity verification processes. Whether you’re preparing for an acquisition, seeking investment, or ensuring operational compliance, understanding the local requirements will save time and resources.

Key Takeaways on Entity Health Check in Guatemala

| Topic | Key Information |

|---|---|

| Main compliance areas | Corporate structure, tax obligations (ISR, IVA, ISO), labor law, environmental permits, municipal licenses |

| Critical deadlines | March 31 (annual tax filing), monthly SAT submissions by day 15, quarterly ISR payments, annual registry updates |

| Who needs health checks | All Guatemalan entities, especially those with over Q1 million revenue, foreign ownership, or 10+ employees |

| Frequency recommended | Annual reviews for most companies, quarterly for exporters, monthly for maquilas and special economic zones |

| Common violations | Late SAT filings, incorrect employee classifications, missing municipal permits, outdated corporate books |

| Cost-saving tip | Bundle entity verification with annual compliance tasks to reduce professional fees by up to 40% |

What Is an Entity Health Check in Guatemala?

An entity health check in Guatemala evaluates your company’s compliance across all regulatory requirements. This legal due diligence process examines corporate documents, tax filings, labor contracts, and operational permits. The assessment identifies risks before they become costly problems, ensuring your business maintains good standing with authorities.

Guatemala entity verification goes beyond simple document review. It involves validating information against multiple government databases, confirming that registered data matches operational reality, and ensuring all required updates have been filed timely. Companies often discover discrepancies between their internal records and official registrations during this process.

The scope of a comprehensive health check includes:

- Corporate books and shareholder registries at the Registro Mercantil

- SAT (Superintendencia de Administración Tributaria) compliance status

- IGSS (Instituto Guatemalteco de Seguridad Social) registrations and payments

- Ministry of Labor filings and workplace compliance

- Municipal operating licenses and permits

- Environmental authorizations when applicable to your industry

Local Expert Tip: Schedule your entity health checks in January to align with Guatemala’s fiscal year. This timing allows you to identify and correct issues before the March 31 annual tax filing deadline, avoiding last-minute complications.

Core Components of Due Diligence Guatemala

Conducting due diligence in Guatemala requires systematic verification across multiple regulatory areas. Each component serves a specific purpose in identifying compliance gaps and operational risks. Understanding these elements helps companies prioritize their health check efforts and allocate resources effectively.

Corporate Due Diligence Guatemala Requirements

Corporate structure verification forms the foundation of any Guatemala compliance check. The Registro Mercantil maintains official records that must reflect your company’s current status accurately. During corporate due diligence in Guatemala, professionals examine:

- Whether articles of incorporation match current operations

- If board resolutions properly authorize company actions

- That all corporate books remain updated per Commercial Code requirements

Many companies discover their registered address differs from their operational location, creating notification issues with authorities. Others find their legal representative’s powers have expired or don’t cover necessary business activities. These oversights can invalidate contracts and create personal liability for directors.

The verification process also reviews shareholding structures for compliance with foreign investment regulations. Guatemala allows 100% foreign ownership in most sectors, but certain activities require local participation. Mining, telecommunications, and private security services have specific requirements that affect corporate structuring decisions.

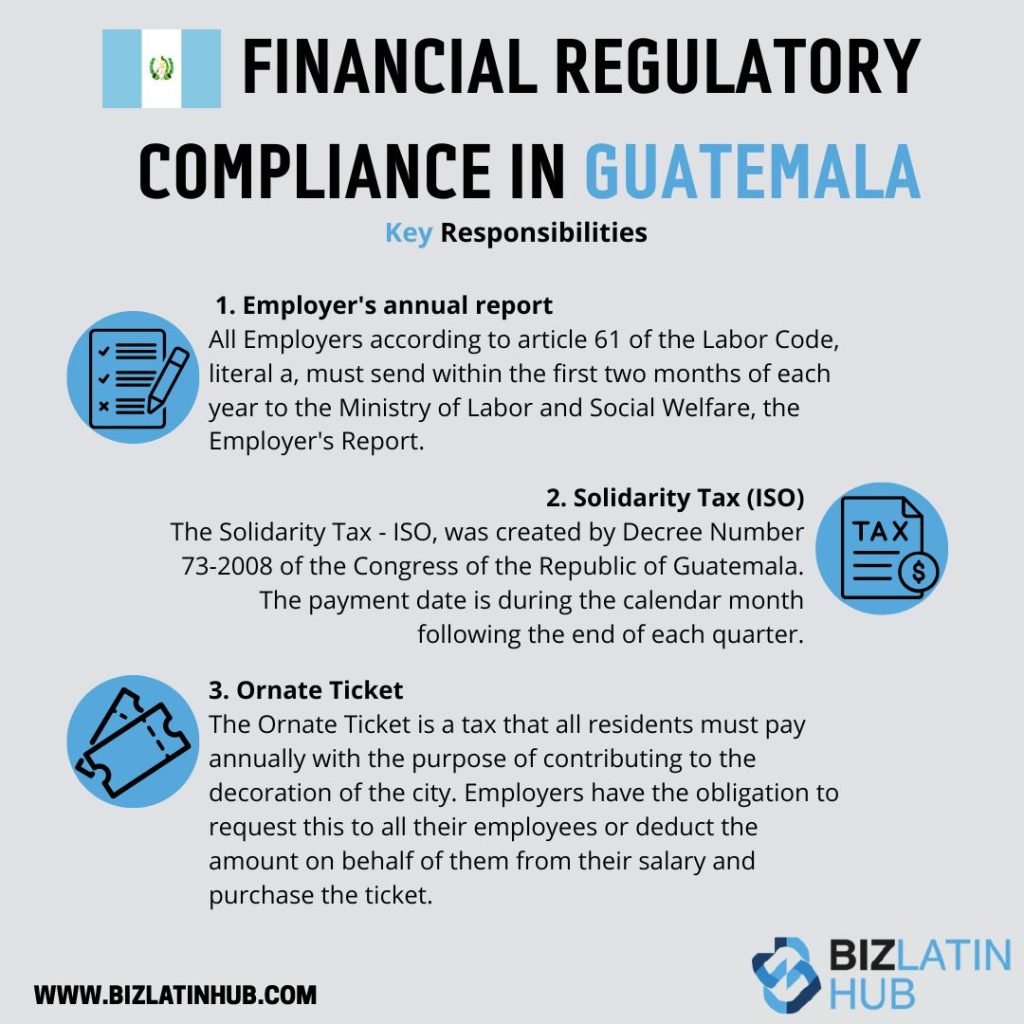

Tax Compliance Verification Standards

Tax obligations form the most complex area of Guatemala compliance checks. Multiple tax types, varying deadlines, and different calculation methods create opportunities for errors that result in significant penalties.

Tax due diligence in Guatemala requires examining multiple obligations across national and municipal levels. The SAT oversees federal taxes including:

- ISR (Impuesto Sobre la Renta): 25% for corporations with specific regimes available for smaller taxpayers

- IVA (Impuesto al Valor Agregado): 12% requiring monthly filings by the 15th of each following month

- ISO (Impuesto de Solidaridad): Calculated at 1% of gross revenue or net assets, whichever is higher

Municipal taxes vary significantly by location. Guatemala City businesses pay between Q50 to Q500 monthly depending on business type and size. Rural municipalities often charge less but may have additional permit requirements. Each municipality maintains its own registry, requiring separate compliance verification.

Practical Recommendation: Access SAT’s “Agencia Virtual” portal before beginning formal due diligence. This free online tool displays your tax account status, outstanding obligations, and filing history. Print these reports as they serve as official compliance evidence during health checks.

Labor Law Compliance Framework

Labor compliance represents a significant risk area for businesses in Guatemala. The country’s protective labor laws create specific obligations that require careful documentation and consistent implementation.

Guatemala’s Labor Code creates specific obligations that legal due diligence must verify. Every employee requires a written contract within 15 days of starting work. These contracts must specify:

- Salary and payment schedule

- Work hours and location

- Job description and responsibilities

- Benefit entitlements

The Ministry of Labor can fine employers Q5,000 per missing contract.

Social security compliance through IGSS covers healthcare, maternity, disability, and workplace injury benefits. Employers contribute 12.67% of wages while employees pay 4.83%. Late payments incur 2% monthly interest plus potential criminal charges for directors. Due diligence reviews payment histories and confirms all employees are properly registered.

Workplace safety regulations require companies with over 10 employees to maintain:

- Internal work regulations approved by the Ministry of Labor

- Visible posting of these regulations in the workplace

- Individual copies provided to each employee

- Annual workplace risk assessments for industrial operations

Cost-Saving Strategy: Combine your annual labor ministry reporting (due each January) with comprehensive health checks. This approach reduces professional service fees while ensuring complete compliance verification.

Operational Permits and Licenses

Beyond corporate and tax compliance, businesses require various operational permits depending on their activities. Missing or expired permits represent one of the most common findings during Guatemala compliance checks.

Guatemala compliance checks must verify industry-specific authorizations beyond basic corporate requirements. Every business needs a municipal operating license (Licencia de Operación) renewed annually. The application requires:

- Updated tax filings

- Lease agreements or property titles

- Environmental impact assessments for certain activities

Health permits from the Ministry of Public Health apply to food service, healthcare, cosmetics, and pharmaceutical businesses. These permits require facility inspections and product registrations. Renewal timelines vary from annually to every five years depending on risk classifications.

Environmental compliance grows increasingly important. The Ministry of Environment and Natural Resources (MARN) requires environmental instruments for construction projects, manufacturing operations, and agricultural activities. These studies must be updated when operations change significantly.

Risk Identification Through Guatemala Entity Verification

Proactive risk identification prevents minor compliance issues from escalating into major business disruptions. Guatemala entity verification systematically examines areas where companies commonly face regulatory challenges.

Effective due diligence identifies risks before they materialize into penalties or operational disruptions. Common risk areas discovered during Guatemala entity verification include:

- Tax contingencies from incorrect withholding calculations

- Labor liabilities from improper terminations

- Corporate governance gaps in documentation

- Regulatory changes affecting specific industries

- Contractual exposures from unauthorized signatories

The risk assessment process prioritizes issues by potential financial impact and correction complexity. Material risks requiring immediate attention typically involve:

- Tax debts accruing daily interest

- Expired permits preventing legal operation

- Labor claims with approaching statutory deadlines

Non-material issues might include formatting errors in corporate books or minor delays in non-critical filings.

Industry-Specific Consideration: Export manufacturers (maquilas) face additional compliance requirements under Decree 29-89. Monthly production reports, temporary import controls, and specific labor regulations require specialized verification procedures. These companies benefit from quarterly rather than annual health checks.

Implementation Timeline for Entity Health Checks

Planning realistic timelines ensures thorough due diligence without rushing critical verification steps. Understanding typical durations helps companies coordinate health checks with business transactions or compliance deadlines.

A comprehensive entity health check in Guatemala typically requires 15 to 30 business days depending on company complexity. The process follows a structured timeline:

- Document collection and initial review (3-5 days)

- Government database verification and agency consultations (5-10 days)

- Risk assessment and findings compilation (3-5 days)

- Remediation planning and report delivery (4-10 days)

Factors extending timelines include:

- Multiple operational locations requiring municipal verification

- Complex corporate structures with various entity types

- Historical compliance issues requiring detailed investigation

- Pending audits or inspections by government agencies

Planning for these variables ensures realistic expectations and adequate resource allocation.

Cost Considerations and ROI Analysis

Understanding entity health check pricing helps companies budget appropriately for compliance verification. Investment levels depend on business complexity, industry regulations, and specific risk factors requiring investigation.

Entity health check costs in Guatemala vary based on company size and complexity:

- Small businesses (single location, <10 employees): Q15,000 to Q25,000

- Medium enterprises (multiple locations or complex operations): Q25,000 to Q50,000

- Large corporations (preparing for transactions or audits): Q50,000 to Q150,000

These investments generate returns through penalty avoidance, operational efficiency, and transaction readiness. A single tax assessment can exceed Q100,000 in penalties and interest. Labor disputes average Q50,000 in settlements plus legal fees. Comparing these potential costs to health check investments demonstrates clear financial benefits.

Budget Optimization Tip: Request fixed-fee proposals covering all verification aspects. Hourly billing often exceeds budgets when issues require extensive investigation. Bundling annual compliance services with periodic health checks reduces overall costs by approximately 40%.

Technology Tools Supporting Compliance

Digital transformation has simplified Guatemala compliance checks significantly. Companies can now verify most compliance requirements online, reducing time and costs associated with physical visits to government offices.

Modern Guatemala compliance checks leverage technology for efficiency and accuracy. Government portals provide real-time verification capabilities:

- SAT’s Agencia Virtual for tax status verification

- Registro Mercantil’s online consultation for corporate records

- IGSS portal for social security verification

- Municipal databases in larger cities for permit status

These tools reduce verification time and provide official documentation.

Private sector solutions offer integrated compliance management. Platforms consolidate deadlines, document requirements, and filing obligations across agencies. Automated alerts prevent missed deadlines while digital document management ensures quick access during audits or health checks.

Frequently Asked Questions (FAQs)

Understanding entity health checks in Guatemala raises common questions among business owners and investors. These answers address the most frequent concerns about due diligence processes and compliance requirements.

How often should companies conduct entity health checks in Guatemala?

Most companies benefit from an annual health check aligned with the fiscal year-end. Businesses in regulated sectors such as banking, insurance, or telecommunications should add quarterly reviews, while firms experiencing rapid growth, ownership changes, or fundraising rounds need additional interim assessments.

What documents are essential for legal due diligence in Guatemala?

Key items are: the corporate constitution and all amendments; current board and shareholder resolutions; tax registrations plus recent filings; employee contracts and IGSS registrations; municipal operating licences; industry-specific permits; and at least the past two years of financial statements. Keeping these organised streamlines the review.

Can foreign companies conduct their own Guatemala entity verification?

Although possible, doing so without local expertise is risky. Multiple agencies impose differing rules, and language, cultural nuances, and informal practices can trip up outsiders. Engaging experienced Guatemalan advisors speeds navigation of bureaucracy and uncovers issues that foreign teams might miss, making professional help cost-effective.

What are the most common compliance failures found during health checks?

The typical red flags are: outdated corporate books lacking required entries; miscalculations in tax withholdings or payments; employees wrongly classified as contractors; expired municipal licences or permits; and missing workplace-safety documentation. These issues are generally fixable but need swift attention.

How does Guatemala compliance check differ for maquilas?

Maquilas—export manufacturers operating under special legislation—must keep detailed temporary-import records, file monthly production reports, comply with specific labour provisions, and pass regular customs audits. Their health checks therefore emphasise operational and customs compliance in addition to standard corporate requirements.

What happens if health checks reveal serious compliance issues?

Early detection lets the company act before authorities do. Most deficiencies can be remedied by filing corrections, arranging payment plans for outstanding obligations, and enrolling in voluntary compliance programmes offered by regulators.

Next Steps: Get your entity health check in Guatemala

Entity health checks in Guatemala provide essential risk management for businesses operating in this growing Central American economy. Regular corporate due diligence in Guatemala identifies compliance gaps before they become costly problems. The investment in professional verification services returns value through penalty avoidance, operational efficiency, and enhanced business credibility.

Successful implementation requires commitment to regular reviews, systematic documentation, and prompt issue resolution. Companies that prioritize compliance find Guatemala offers attractive opportunities with manageable regulatory requirements. The key lies in understanding local requirements and maintaining consistent compliance practices.

At Biz Latin Hub, we simplify the entity health check process by providing comprehensive due diligence services tailored to your business needs. Our Guatemala team combines local expertise with international standards to deliver actionable compliance insights. We handle everything from basic entity verification to complex corporate due diligence projects.

Our integrated approach covers:

- Tax compliance verification and planning

- Labor law assessments and remediation

- Corporate governance reviews

- Regulatory permit verification

- Risk assessment with prioritized recommendations

Through systematic reviews and proactive compliance management, we help businesses operate confidently in Guatemala’s dynamic market.

Partner with Biz Latin Hub to ensure your Guatemala operations meet all regulatory requirements while focusing on business growth. Contact us today to schedule your entity health check consultation.