While company registration in Guatemala continues to attract foreign investors, not all ventures go according to plan. Market fluctuations, regulatory changes, or internal business decisions may lead to the need to formally liquidate a company in Guatemala. When this occurs, it’s essential to follow the correct legal steps to close the company in good standing with Guatemalan authorities.

Key takeaways on how to liquidate a company in Guatemala

| Six Legal Steps: | Inscription of Dissolution Agreement Company Dissolution Deed Liquidator Registration Final Balance Sheet Cancellation of Company Patents Final Registration of Settlement at SAT |

| Timeframe: | 6 to 12 months on average if the company is up to date with obligations. |

| Reasons to Liquidate: | Market exit, strategic changes, partner disputes, inactivity, or insolvency. |

| Types of Liquidation: | Voluntary (by shareholders), Involuntary (due to insolvency or court action). |

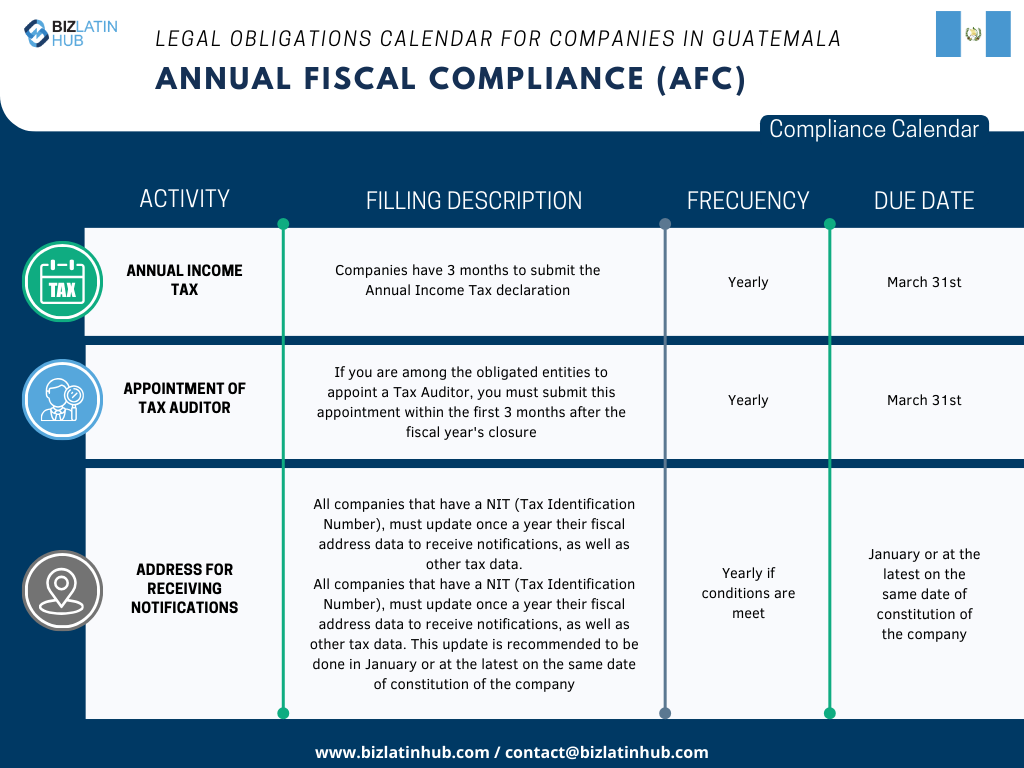

| Regulatory Authorities: | Superintendency of Tax Administration (SAT), Mercantile Registry, and Notaries. |

| Pro Tip: | Hire a bilingual legal and accounting team early to streamline all filings and avoid delays. |

6 Steps to Liquidate a Company in Guatemala

The liquidation process in Guatemala must follow six formal legal steps as defined under the Commercial Code of Guatemala and governed by the Mercantile Registry (Registro Mercantil) and the Superintendency of Tax Administration (SAT). Adhering to these ensures the company is closed correctly and that shareholders, directors, and legal representatives are released from future liability.

Step 1 – Inscription of Dissolution Agreement

The first step involves calling an Extraordinary General Shareholders’ Meeting, during which the shareholders must formally resolve to dissolve the company.

- The meeting minutes (acta) must include:

- A resolution to dissolve and liquidate the company.

- Appointment of a Liquidator (and optionally, a Special Executor).

- These resolutions must be notarized by a Guatemalan public notary and submitted for registration at the Mercantile Registry.

- Legal Reference: Articles 237–240 of the Guatemalan Commercial Code.

Action Tip: Ensure all shareholder votes are properly recorded and that the appointed liquidator is a Guatemalan resident or duly authorized legal representative.

Step 2 – Company Dissolution Deed

Once the dissolution is resolved, the next legal requirement is the public deed of dissolution (escritura pública de disolución).

- A notary public prepares the dissolution deed referencing:

- The shareholder resolution.

- The roles of the liquidator and any special executor.

- The notarized deed must be filed again with the Mercantile Registry for legal effect.

Action Tip: Ensure the notary includes all constitutional clauses of the company in the deed to avoid rejection by the registry.

Step 3 – Liquidator Registration

After the deed is accepted, the liquidator must be formally registered.

- This requires submission of:

- A notarized appointment letter.

- Liquidator’s personal identification or corporate appointment documents.

- Statement of tax compliance issued by SAT.

- Submit these to both the Mercantile Registry and the SAT to give the liquidator legal standing.

Action Tip: Avoid delays by ensuring there are no outstanding tax filings or unpaid tax returns that may cause SAT to reject the registration.

Step 4 – Final Balance Sheet

The liquidator, in coordination with a licensed Guatemalan public accountant (Contador Público y Auditor), must prepare a final financial statement listing:

- All remaining assets and liabilities.

- Tax obligations and credits.

- Any final payments or outstanding claims.

This financial report must be:

- Reviewed and approved by shareholders in a new meeting.

- Published via edict (edicto) in an authorized publication, typically the Diario Oficial.

Action Tip: Shareholders should sign the final balance sheet and attach it to a cancellation memorandum filed at the Mercantile Registry, along with registration fees.

Step 5 – Cancellation of Company Patents

The patente de comercio (business operating license) must be formally cancelled.

- Prepare a memorandum of cancellation with assistance from a notary.

- Submit this with supporting edicts and the final balance sheet to the Registry of Intellectual Property and Commerce.

- Once approved, a certificate of cancellation will be issued.

Action Tip: Don’t overlook any trade name (nombre comercial) registrations that may also need to be cancelled or transferred.

Step 6 – Final Registration of Settlement at the SAT

Once all previous steps are completed:

- Submit a full legal file to the SAT, including:

- The deed of dissolution.

- Accounting books (originals).

- Final tax declarations and shareholder approvals.

- SAT will review and issue the certificate of cessation of operations (certificación de cese de actividades), legally closing the company.

Action Tip: Retain a certified physical copy of this certificate, which is essential if directors/shareholders wish to engage in future business or tax matters in Guatemala.

Other Considerations for Liquidating an Entity in Guatemala

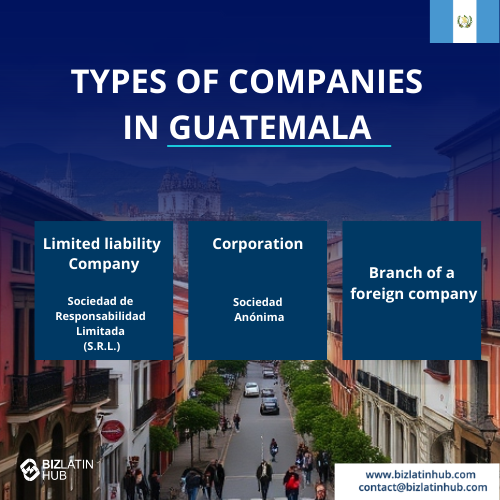

Types of Liquidation

- Voluntary Liquidation: Initiated by company shareholders, typically due to strategic business shifts, reorganization, or exit planning.

- Involuntary Liquidation: Enforced by courts or regulatory authorities (like SAT) when the company is non-compliant, insolvent, or inactive for an extended period.

Reasons to Liquidate a Company in Guatemala

- Withdrawal from the market due to poor performance or low demand.

- Shift in global business focus or restructuring efforts.

- Shareholder or partnership conflicts.

- Regulatory pressures or inability to comply with evolving obligations.

- Avoidance of long-term liabilities or administrative burdens from inactive entities.

Governing Authorities for Liquidation

- Mercantile Registry (Registro Mercantil): Responsible for legal record updates, public deed registration, and dissolution certification.

- Superintendency of Tax Administration (SAT): Reviews final tax compliance and issues the certificate of cessation of economic activity.

- Public Notaries: Draft, certify, and legalize dissolution agreements and company cancellation documentation.

FAQs for liquidating an entity in Guatemala

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Guatemala.

1. What is the process of liquidation in Guatemala?

It involves six mandatory steps:

- Dissolution agreement by shareholders,

- Legal deed of dissolution,

- Liquidator registration,

- CPA-certified final balance sheet,

- Commercial patent cancellation, and

- Final settlement filing with SAT.

2. How long does it take to liquidate a company in Guatemala?

Generally 6–12 months, assuming all corporate and tax filings are current. Delays can result from missing SAT declarations, unresolved legal claims, or missing shareholder approvals.

3. Why do companies liquidate in Guatemala?

Common triggers include poor profitability, market exit strategies, reorganization, or inactivity. Liquidation is also preferred to avoid accumulating liabilities from dormant entities.

4. Can a company be forced into liquidation?

Yes. Guatemalan courts can initiate involuntary liquidation for companies that are insolvent or violate statutory compliance, particularly around tax or labor laws.

5. Which authorities manage liquidation in Guatemala?

The Mercantile Registry handles all legal and structural filings.

The SAT manages tax compliance and final settlement confirmation.

Notaries are essential for certifying shareholder and legal documents.

6. What documents are required to liquidate a company?

Shareholder meeting minutes

Dissolution deed

Liquidator ID and registration

Final balance sheet from a CPA

Cancellation request for company patents

Final approval and closure form filed with SAT

7. Can the company be reopened later?

No. Once liquidation is finalized and SAT confirms cessation, the entity is fully dissolved. A new legal entity would be required for future operations.

Biz Latin Hub provide you with expert advice to liquidate a company in Guatemala

The process of dissolution and liquidation of a company in Guatemala is complex and requires the support of expert legal and accounting professionals. Not having the correct advice can lead to fines or delays in the completion of this process.

Liquidating a company in Guatemala involves multiple legal and financial stages overseen by the Mercantile Registry and SAT. With the right legal and accounting support, the process can be completed cleanly and efficiently—allowing you to exit the market while protecting your legal standing.

Learn more about our team and expert authors.