Discover the step-by-step process for forming a Limited Liability Company (LLC) in Ecuador, where this legal structure is known as a Sociedad de Responsabilidad Limitada or SRL. For foreign companies targeting the burgeoning Ecuadorian market, it’s not hard to set up a company in Ecuador. In particular, forming an LLC in Ecuador offers a simplified process compared to other legal entities, providing greater flexibility and greater protection against potential vulnerabilities.

The country’s stable economy, marked by a decline in corruption and a stronger government framework, coupled with its abundant natural resources and use of the U.S. dollar, position it as a prime hub for business growth. In this context, choosing the right business structure is essential. This may well involve forming an LLC in Ecuador.

Forming an LLC in Ecuador: what is it?

A Limited Liability Company is a business structure whereby the owners of the business are not personally accountable for the company’s liabilities or debts.

The LLC in Ecuador is similar to the characteristics of a regular corporation, but the system of taxation is very different. LLCs do not pay taxes, instead their profits and losses are listed on the personal tax lists of owners. If fraud is recognized or the company is not fully compliant with the legal reporting requirements, the creditors could potentially go after its members. Forming an LLC in Ecuador can be done with 1 director and a minimum of 3 shareholders, of any nationality.

5 Key benefits of forming an LLC in Ecuador:

- Pass-through taxation.

- No restrictions on the number of members allowed.

- Members have flexibility in structuring the company management.

- It does not require as much annual paperwork or have as many formalities as corporations.

- Owners are not personally responsible for business debts and liabilities.

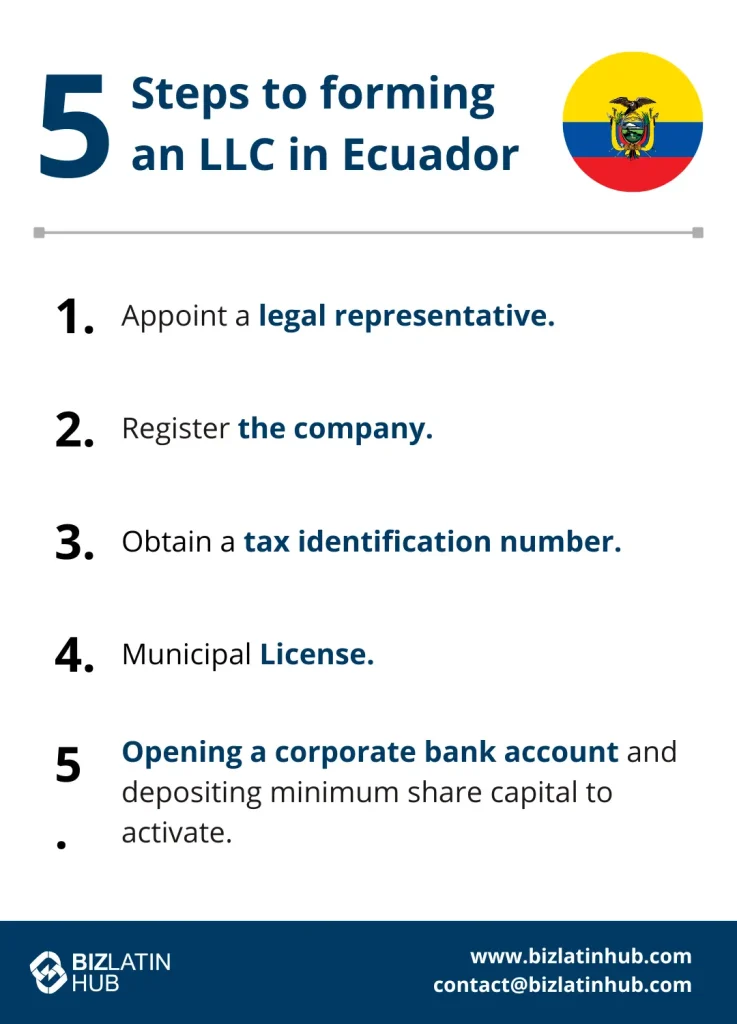

5 Steps to forming an LLC in Ecuador

Forming an LLC in Ecuador consists of 5 steps:

- Step 1 – Appoint a legal representative.

- Step 2 – Register the company.

- Step 3 – Obtain a tax identification number.

- Step 4 – Municipal License.

- Step 5 – Opening a corporate bank account and depositing minimum share capital to activate.

1. Appoint a legal representative

Choose a reliable expert to be your legal representative in Ecuador. Your legal representative will act on behalf of the LLC in all legal aspects, creating and signing your company’s bylaws. This gives your legal representative the power to make legal decisions for your company, and support the company formation process.

If the document is in a language other than Spanish, the legal representative should provide a correct official translation before submitting it. The person appointed as a legal representative must act in the best interests of the company and is mandated by Ecuadorian law to do so. Furthermore, you should define your business’ purpose and economic activities. Before you register your company, make sure to reserve your name as this will ease the process of registration to ensure there is no copyright or trademark. Moreover, the shareholders must deposit a minimum of US$400 before the company’s registration

2. Register the company

It is important to know to register your company with the appropriate authorities. You have to reserve the company name in Ecuador at the Superintendent of Companies. In order to obtain the company’s unique identification number, you will need to go to the Superintendent of Companies to pay the annual registration fee. For this registration you will need the following documents:

- Address of the company.

- The name of the legal representative.

- A certified copy of the public deed of the constitution of the company.

If you want to register these matters could be of importance:

- A public notary is necessary for notarising the documents.

- Make sure you find a lawyer that is able to constitute and sign the documents.

- Prepare the minutes of incorporation, which include the contract, articles of incorporations, company’s bylaws, and the formation of capital.

3. Obtain a tax identification number

Once you have registered your LLC in Ecuador, you’ll need to obtain a tax identification number. Business owners must apply for the Fiscal Code (Registro Único de Contribuyentes – RUC) at the Servicio de Rentas Internas (SRI). This will take approximately 24 hours.

After this, you have to sign up online for Social Security at the Ecuadorian Institute of Social Security, and obtain a passbook to use the online platform for more information.

4. Municipal License

Businesses in Ecuador need an enabling fee, known locally as tasa de habilitacion. To obtain this, you must pay the commercial patent at the Municipio de Quito.

This patent is a tax for companies that conduct in a commercial or industrial activity. Companies must pay this tax every year. The amount will depend on the size of the company and in which sector it operates.

5. Opening a corporate bank account and depositing minimum share capital to activate

In order to correctly form an LLC in Ecuador, the shareholders must deposit a minimum of US$400 before the company’s registration. All the assets of the LLC that are worth US$1000 must be appointed to an auditor and submit annual audited financial statements to the authorities.

FAQs on forming an LLC in Ecuador

1. Can a foreigner own an LLC in Ecuador?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. How long does it take to register an LLC in Ecuador?

Registering a company in Ecuador takes 6 weeks.

3. What is an LLC in Ecuador?

An LLC in Ecuador is a Limited Liability Company, a type of business entity that combines the limited liability protection of a corporation with the flexible management and pass-through taxation of a partnership or sole proprietorship. This means that the owners of an LLC are not personally liable for the debts and obligations of the company beyond their investment in the business.

4. Can an LLC in Ecuador operate internationally?

Yes, an LLC registered in Ecuador can operate in international markets, subject to applicable regulations and restrictions governing cross-border trade.

Contact Biz Latin Hub for help forming an LLC in Ecuador

When forming an LLC in Ecuador, you’ll want to partner with local legal experts who can assist you in this process. It is crucial to find a trusted provider who can act as your legal representation in Ecuador as needed.

At Biz Latin Hub, we have vast experience with helping foreign companies to enter the Ecuadorian market. Our team of experienced corporate lawyers and accountants offer a full suite of bilingual market entry and back-office services for businesses entering Ecuador. This includes commercial and legal representation, company formation, accounting, and employment support. Contact us today for personalized advice on how to get started.

Learn more about our team and expert authors.