Situated close to key markets in North America, The Bahamas presents an inviting environment for global investors. Its business-friendly atmosphere and strong financial services sector create an advantageous landscape for those considering company formation in The Bahamas. Before you start your business, It is crucial to understand the tax and accounting requirements in The Bahamas. Despite its fame for being a tax haven, foreign investors need to be aware of the taxation laws and regulations. This guide explains the tax-neutral framework where government revenue is derived primarily from consumption taxes and license fees rather than income tax.

Key Takeaways Tax and Accounting Requirements in The Bahamas

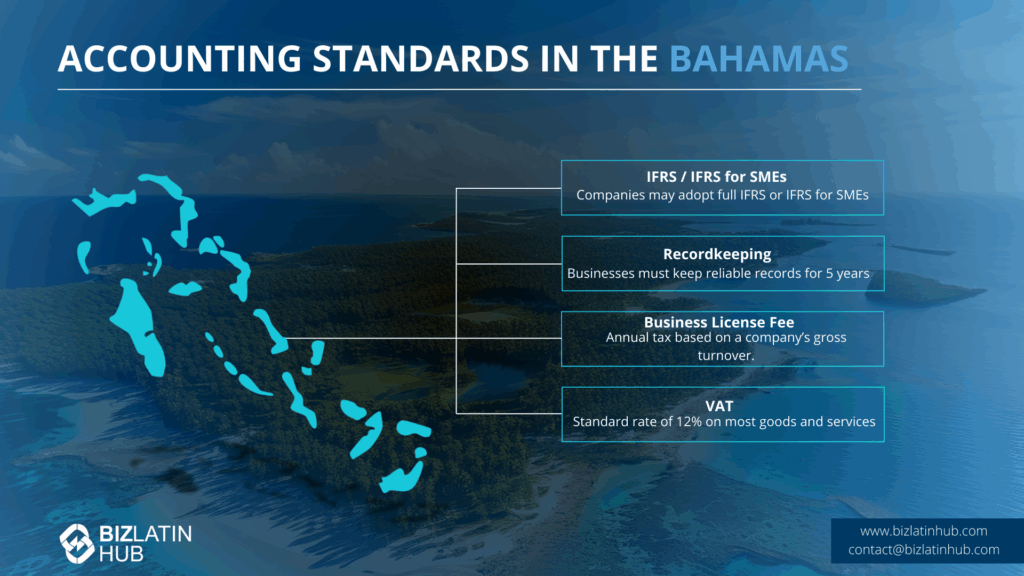

| What Are The Accounting Standards in The Bahamas? | The Bahamas Institute of Chartered Accountants, the regulatory authority overseeing the accounting profession in the Bahamas, allows companies without public accountability in the country to opt for IFRS for SMEs. Alternatively, these companies have the choice to adopt full IFRSs. All companies must maintain reliable accounting records for at least five years. |

| Is there a corporate income tax in the Bahamas? | The Bahamas does not have corporate tax. |

| What is the Business License Fee? | This is an annual tax based on a company’s gross turnover. |

| What Is The Bahamian Value Added Tax Rate? | The standard rate for Value-Added Tax (VAT) is 12%. |

| Dividend Tax Rate in The Bahamas | The Bahamas does not have a withholding tax. |

| What is the difference between a domestic company and an IBC? | An IBC may only do business outside the Bahamas. |

Key Tax Requirements in the Bahamas

The Bahamas has a favorable tax environment with income, dividends, capital gains, wealth, and inheritance being tax-free. While a 12% VAT applies to most products and services, excluding food and certain medical services, real estate transactions over USD$100,000 incur a 10% stamp duty. Additionally, owner-occupied real estate is subject to an annual property tax of approximately 1.5%, and various items carry import taxes ranging from 25% to 40%.

1. Value-Added Tax (VAT)

This is a 12% tax on consumption. VAT-registered businesses are required to file periodic returns and remit the net tax to the Department of Inland Revenue.

2. Business License Fee

This is an annual tax based on a company’s gross turnover. The rate is progressive, meaning the percentage increases as turnover increases. The license renewal and fee payment are due by March 31st.

Expert Tip: Audited Accounts for Turnover > $100k

From our experience, business owners often forget that the Business License Fee renewal requires financial verification. For businesses with turnover exceeding BSD $100,000, the application must be certified by a qualified accountant.

If turnover exceeds BSD $400,000 (thresholds subject to change), certified financial statements are required. We advise clients to schedule their annual accounting work in January/February to ensure financial certifications are ready for the March 31st Business License renewal deadline.

3. Real Property Tax

Companies that own real estate in the Bahamas are subject to an annual real property tax. The rate varies depending on the type and value of the property.

Tax and accounting requirements in The Bahamas: Key local tax rates

Understanding the tax and accounting requirements in The Bahamas is vital when entering this market. Here are the tax rates you need to know.

Income Tax: There is no income tax in The Bahamas.

Capital Gains Tax: There is no capital gains tax.

Withholding Tax: The Bahamas does not have a withholding tax.

Social Security: Both employers and employees contribute to social security on employment remuneration in the Bahamas, with a standard rate of 9.8%.

The employee pays 3.9%, while the employer covers 5.9%. It’s worth noting that these contributions do not apply to earnings surpassing BSD 710 per week.

Accounting and Financial Record-Keeping

BICA, the Bahamas Institute of Chartered Accountants, grants licenses to certified public accountants, registered public accountants, and public accounting firms. Presently, there are more than 200 licensed chartered accountants in The Bahamas, and the criteria for obtaining a CA license encompass education and experience.

The Bahamas Institute of Chartered Accountants allows companies without public accountability in the country to opt for IFRS for SMEs. Alternatively, these companies have the choice to adopt full IFRSs. All companies must maintain reliable accounting records for at least five years.

The Role of the Department of Inland Revenue

The Department of Inland Revenue is the government agency responsible for the administration of the main business taxes in the Bahamas, including VAT and the Business License Fee. All businesses operating locally must register with the department and file their returns accordingly.

International tax treaties

The Bahamas has established 22 Tax Information Exchange Agreements (TIEAs) with various jurisdictions, including Australia, Argentina, Belgium, Great Britain, Greenland, Denmark, Iceland, Spain, Canada, China, Mexico, Monaco, Netherlands, New Zealand, Norway, San Marino, USA, Faroe Islands, Finland, France, Sweden, and Japan.

FAQ regarding tax and accounting requirements in The Bahamas

Using our experience, we’ve pinpointed common questions and worries our clients often have when dealing with accounting and taxes in The Bahamas.

No, the Bahamas does not have a corporate income tax, capital gains tax, or tax on dividends. It is a direct tax-free jurisdiction.

Businesses in the Bahamas are not subject to corporate tax, withholding tax, payroll tax, or transfer tax.

The revenue collection authority in The Bahamas is known as The Department of Inland Revenue.

The Bahamas Institute of Chartered Accountants, the regulatory authority overseeing the accounting profession in the Bahamas, allows companies without public accountability in the country to opt for IFRS for SMEs. Alternatively, these companies have the choice to adopt full IFRSs.

BICA, the Bahamas Institute of Chartered Accountants, grants licenses to certified public accountants, registered public accountants, and public accounting firms. Presently, there are more than 200 licensed chartered accountants in The Bahamas, and the criteria for obtaining a CA license encompass education and experience.

Government approvals are required for a non-Bahamian investor to conduct business in The Bahamas.

The Hotels Encouragement Act provides various incentives, including exemptions from customs duties, stamp duties/excise taxes on the importation of materials for hotel projects, and a five-year waiver on customs duties for construction plants and equipment.

Additionally, it grants a ten-year exemption from real property taxes, extendable, and 20 years free from direct taxation on earnings, dividends, and interest for completed hotel projects. Similar incentives are available under the Industries Encouragement Act, the Family Island Development Encouragement Act, and the City of Nassau Revitalization Act.

Detailed information can be found on the Bahamas Investment Authority website. It’s important to note that there are no grants or incentives exclusively reserved for foreign investors.

The Business License Fee is an annual tax that all businesses operating in the Bahamas must pay. It is calculated on a sliding scale as a percentage of the company’s annual turnover. The license must be renewed by March 31st each year.

VAT is a consumption tax with a standard rate of 12% on most goods and services. Businesses with an annual turnover exceeding BSD $100,000 must register for VAT, collect the tax, and file regular returns.

No. A legally registered IBC that conducts all of its business outside of the Bahamas is exempt from paying both the Business License Fee and VAT.

The National Insurance Board (NIB) manages social security. Employers pay 5.9% and employees pay 3.9% of wages (up to a ceiling).

Biz Latin Hub can organize your tax and accounting requirements in The Bahamas

At Biz Latin Hub, we provide an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

Our team has expertise in tax and accounting requirements in The Bahamas, with legal services, accounting and taxation, hiring, and visa processing available.

Our strong presence in the LATAM region is supported by robust partnerships that stretch across the area. This broad network provides numerous resources to support global projects and venture into new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.