With the largest economy in Central America, taking a look at the largest industries in Guatemala is worthwhile for those who are seeking business opportunities in this country. While it is sometimes overshadowed by its neighbors, there are some exciting possibilities in this economy with room to grow.

The largest industries in Guatemala are in agriculture, which still dominates the economy. However, in recent years, manufacturing has started to rise in importance, often alongside and in partnership with South Korean investment. The country is still developing and has correspondingly competitive labor costs.

In this article, we will look at some of the largest industries in Guatemala if you are thinking about how to incorporate a company in the country or want to do business there. We are experts in Latin America and know the local markets inside out. Our array of back office services is designed to support you anywhere in the region.

The private sector in Guatemala

The private sector is the driving force of the Guatemalan economy. In fact, the private sector is responsible for around 85% of the national GDP. The majority of this sector is active in the following fields: industry, agriculture, and tourism. This sector is steadily growing and is now taking on traditionally public services.

The main input of foreign currency into the country is from private sector capital, through foreign investment, the sale of shares or bonds, short and long term credits, and deposits. These operations increased during 2019 to nearly USD$20 billion, according to data from the Central Bank of Guatemala.

Regarding Foreign Direct Investment (FDI), the Central Bank registered USD$998.2 million during 2019, of which 24% came from the United States.

This increase in the private sector has led to a decrease in government size. Services such as airports, banking institutions, and even public utilities are now managed by private companies. As an example, private investors recently have planned a new highway in Guatemala as a private investment project.

Manufacture and agriculture sectors

The industrial, manufacturing, and agricultural sectors are home to many of the largest industries in Guatemala. These sectors primarily focus on the production of the following products:

- textiles

- furniture

- petroleum

- sugar

- flowers

- fruits and vegetables

- processed foods

- chemicals

The most commonly grown crops in Guatemala are coffee, bananas, nutmeg and cane sugar.

The agricultural sector employs approximately 50% of the country’s workforce and has some of the largest industries in Guatemala. Indeed, the country exports approximately USD$1.02 billion in bananas annually, which is approximately 8.6% of all exports. Additionally, Guatemala exports raw sugar worth USD$999 million (8.5% of exports) and coffee worth USD$753 million (6.4% of exports). These three goods represent the three largest exports leaving Guatemala.

After fresh produce and other foodstuffs, textiles are the third largest export category with a total value of USD$1.68 billion. Knit sweaters and T-shirts are the most frequently manufactured products within this category. Mineral products followed closely with a total value of USD$1.18 billion.

Service sector in Guatemala

The service sector also hosts many of the largest industries in Guatemala. It consists of several specific industries, including tourism, healthcare, customer service, financial services, banking, hospitality, communication and retail. This sector alone makes up over 60% of Guatemala’s economy.

Tourism is one of the most influential industries in the service sector, generating USD$1.8 billion in 2008. Guatemala is a popular stop for cruise ships, and the country receives an average of two million tourists annually. Visitors explore Guatemala’s beaches and pre-Hispanic ruins.

Imported goods

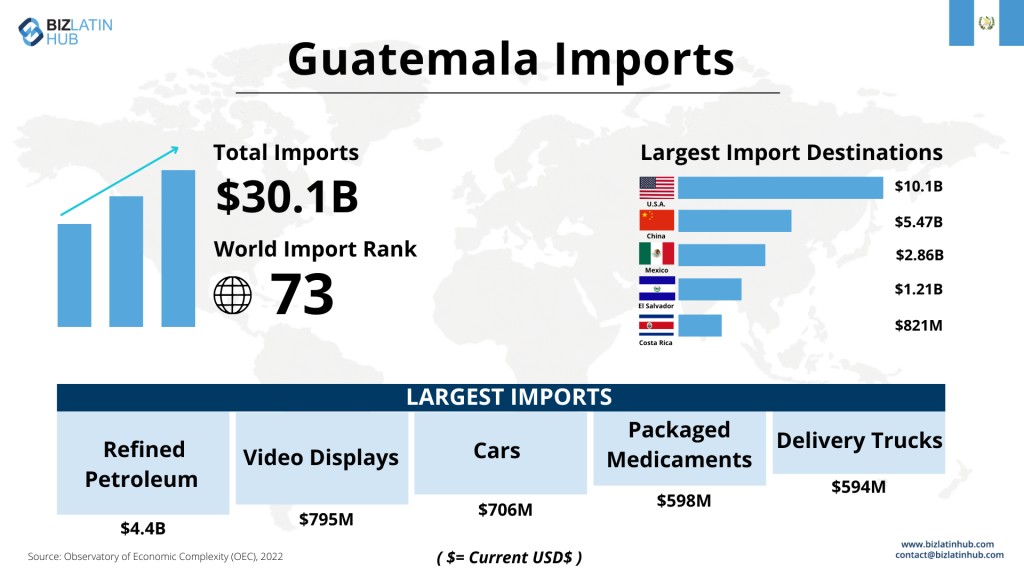

As previously mentioned, some of the largest industries in Guatemala are found within the import industry. The country imports more products than it exports with an annual value of approximately USD$17.4 billion. Although the country imports goods from a number of other nations around the world, its largest import partners are:

- United States (USD$6.42 billion)

- Mexico (USD$2.01 billion)

- China (USD$1.92 billion)

- El Salvador (USD$784 million)

- Panama (USD$591 million)

The largest category of imported products imported to Guatemala is high tech products that cost the country over USD$3 billion annually. The main imported goods within this category are transmission equipment (USD$422 million), computers (USD$212 million) and telephones (USD$130 million).

The second-largest import category consists of chemical products. Within this category, the main imported goods are: packaged drugs (USD$529 million), fragrant mixtures (USD$157 million), and pesticides (USD$138 million).

Mineral products are the third-largest category of imports and include refined petroleum (USD$1.89 billion), petroleum gas (USD$219 million) and coal briquettes (USD$69 million).

FAQs about the largest industries in Guatemala

As previously mentioned, some of the largest industries in Guatemala are found within the import industry. The country imports more products than it exports with an annual value of approximately USD$17.4 billion.

The country exports approximately USD$1.02 billion in bananas annually, which is approximately 8.6% of all exports. Additionally, Guatemala exports raw sugar worth USD$999 million (8.5% of exports) and coffee worth USD$753 million (6.4% of exports). These three goods represent the three largest exports leaving Guatemala.

After fresh produce and other foodstuffs, textiles are the third largest export category with a total value of USD$1.68 billion. Knit sweaters and T-shirts are the most frequently manufactured products within this category. Mineral products followed closely with a total value of USD$1.18 billion.

The largest category of imported products imported to Guatemala is high tech products that cost the country over USD$3 billion annually. The main imported goods within this category are transmission equipment (USD$422 million), computers (USD$212 million) and telephones (USD$130 million).

The second-largest import category consists of chemical products. Within this category, the main imported goods are: packaged drugs (USD$529 million), fragrant mixtures (USD$157 million), and pesticides (USD$138 million).

Mineral products are the third-largest category of imports and include refined petroleum (USD$1.89 billion), petroleum gas (USD$219 million) and coal briquettes (USD$69 million).

Although the country imports goods from a number of other nations around the world, its largest import partners are:

United States (USD$6.42 billion)

Mexico (USD$2.01 billion)

China (USD$1.92 billion)

El Salvador (USD$784 million)

Panama (USD$591 million)

The service sector hosts many of the largest industries in Guatemala. It consists of several specific industries, including tourism, healthcare, customer service, financial services, banking, hospitality, communication and retail. This sector alone makes up over 60% of Guatemala’s economy.

Tourism is one of the most influential industries in the service sector, generating USD$1.8 billion in 2008. Guatemala is a popular stop for cruise ships, and the country receives an average of two million tourists annually. Visitors explore Guatemala’s beaches and pre-Hispanic ruins.

Biz Latin Hub can help with the largest industries of Guatemala

The unreserved market in Guatemala offers plenty of opportunities for doing business. The country’s strategic location, its natural resources, and its distinctive dedication to entrepreneurship encourage companies to consider business operations in this country.

Biz Latin Hub has a dedicated, well-coordinated, and international team, operating in more than 16 countries across Latin America and the South Pacific. Our multilingual expert lawyers and accountants provide tailor-made solutions in market entry and back-office support.

Our vast experience and wide range of backup services ensure quality work when supporting you with legal services, visa procedures, PEO, recruitment and hiring, payroll management, accounting and taxations, and others.

Get in touch with us now and learn more about our team and expert authors.