Incorporating two main islands and a string of smaller outlying islands, New Zealand is the best country in the world to start and run a business, according to The World Bank. The country is of a similar physical size to Japan or Great Britain and benefits from being culturally diverse, with high levels of immigration from countries around the world, specifically from Australia and Asia, who come to do business in New Zealand.

As stated in their latest report, the World Bank considers New Zealand to be more attractive from a business standpoint than Singapore, Denmark, and Hong Kong, thanks to its ease of entry, and relaxed attitudes towards foreign investment and international expansion. As an entrepreneur looking to take your business to new heights, New Zealand could be an option to consider in your strategy.

With a population of 5 million people, all of whom speak English, the country is accessible to investors who want to enter into a new country with fewer cultural, language, and legislative barriers. On top of that, the local ‘can do’ attitude helps to enable growth and innovation in new businesses. Below, we share some of the reasons why you should consider incorporating a business in New Zealand in 2024, and offer guidance on how to maximize your return on investment.

Do business in New Zealand and benefit from a strong government and legal system

New Zealand has been named the least corrupt nation in the world, making it a firm favorite for businesses looking for an Australasian base. The country follows the British Westminster parliamentary democracy and constitutional monarchy set-up, with the government led by a Prime Minister who is elected by citizens. The country also has His Majesty King Charles III as its official head of state, though he has no role in the running of the country.

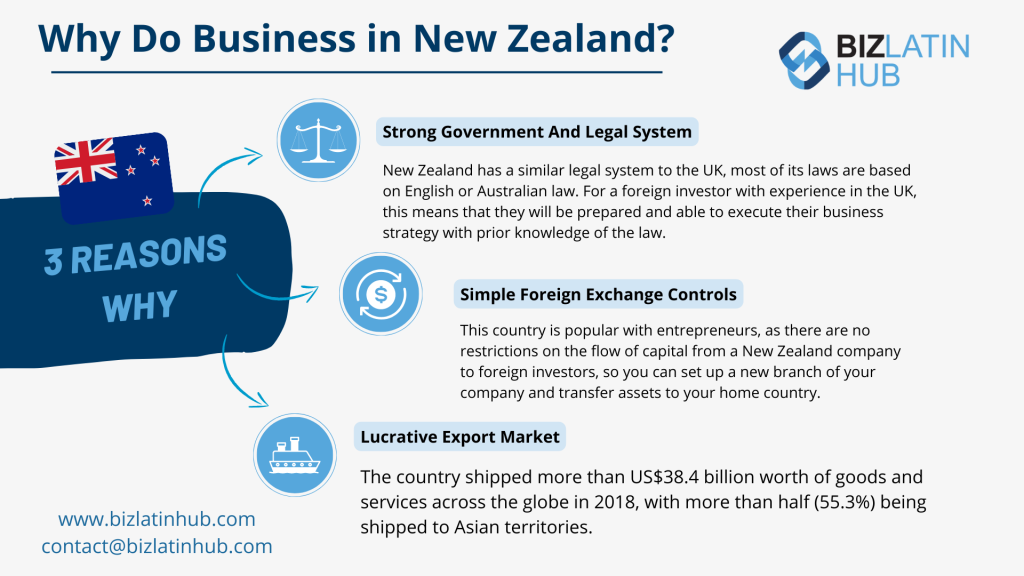

New Zealand’s legal system is similar to the British system, with the majority of the country’s statutes based on English or Australian law. For a foreign investor with a background in the United Kingdom, navigating to a country like New Zealand means you will be forearmed and will be able to execute your business strategy with a prior understanding of the law and your responsibilities as an employer. Of course, there are differences between UK law and NZ law, but the basic principles are the same.

Foreign investment in the country is monitored by the Overseas Investment Office, The Financial Markets Authority, and the Reserve Bank of New Zealand. These institutions regulate the country’s financial markets, investments, and insurance.

Can I move money back to my home country?

When expanding your business into new markets, it is important that you understand your rights as a foreign investor. New Zealand is a popular choice for entrepreneurs as there are no restrictions on the flow of capital from a New Zealand business to overseas investors, so you can effectively set up a new branch of your business and transfer assets to your home country. However, payments may be subject to withholding tax, so calculating your margins makes sense before you make the move and launch a business in New Zealand territory.

Economic strength

Boasting a USD$387.35 billion GDP, New Zealand has long enjoyed positive economic growth. Similar to Australia, the country remained buoyant during the 2008 financial crisis, demonstrating its power and highlighting the differences between NZ and the United States or Europe.

Since 2010, the country has seen an average annual growth of 2.1%. 2022’s growth hit 2.85%. Although economic growth fell to 0.65% in 2023, it is forecasted to increase in subsequent years.

Why do business in New Zealand: lucrative export market

New Zealand is home to a lucrative export market, with exported goods making up around 30% of the country’s GDP. The country shipped more than USD$39.8 billion worth of goods and services across the globe in 2023, with more than half (58%) being shipped to Asian territories. According to World’s Top Exports, current export sales translate to around USD$7,700 per resident in the country, demonstrating just how lucrative the country’s export market is.

The most popular commodities exported in the country are dairy products as well as meat, wood, fruits, nuts, beverages, cereal, fish, machinery, aluminium, and food preparation products. Vehicles, machinery, minerals, electricals, and plastics were the biggest imported product categories, each representing a trade deficit, which unlocks unique opportunities for foreign investors looking to enter into the import and export market.

What growth industries are there in New Zealand?

Because of its geographical position, New Zealand is largely dependent on other countries to prop up its economy, which is why its raw materials sector continues to thrive. Indeed, there are significant opportunities in the agricultural sector, which is the largest in the country, with new technologies and investments required to increase yields and improve the performance of crops and livestock.

Horticulture is another key industry that foreign investors may want to look into – with peaches, plums, nectarines, drupe, cherries, and apricots all grown in huge quantities for export, the ability to add value through food processing could offer significant returns on investment.

The country’s forestry, mining, and fishing sectors are also key areas of growth, although spotting a gap in the market and undertaking due diligence before setting up is critical.

How easy is it to form a company in New Zealand?

Businesses setting up in New Zealand typically form a sole trader business, a partnership, or a limited liability company, with all three offering their own benefits and controls. Offshore entities, on the other hand, conduct business through a local subsidiary company structure or by opening a branch of their company in New Zealand.

In recent times, however, limited partnerships are becoming the most popular choice for international entrepreneurs. When setting up a new business, it makes sense to work with a reputable company that can offer their experience to speed up your application process and ensure your firm is fully compliant.

Why do business in New Zealand: easy visa processing

Finally, it’s important to give a nod to visa processing. As a foreign investor, you can apply for an Entrepreneur Work visa (previously the Long Term Business visa) which will allow you to buy or establish a new business in the country. In order to receive approval for this visa, you will need to make an initial capital investment of NZ$100,000 or more, and score at least 120 on a scale used to determine the likely success of your proposed business venture.

In addition, you will need to present your New Zealand business plan for the visa processing department. The process can take several months and may require some back-and-forth, so it makes sense to begin proceedings as soon as possible to get the ball rolling. You may also want to consider a Work Visa for yourself or your staffers who are not based in New Zealand, offering up to three years in the country for employment purposes. Australian nationals need not apply for an investor or work visa – they’re free to live and work in the country indefinitely.

FAQs on how to do business in New Zealand

Yes, 100% business ownership is permitted.

In recent times, limited partnerships are becoming the most popular choice for international entrepreneurs. When setting up a new business, it makes sense to work with a reputable company that can offer their experience to speed up your application process and ensure your firm is fully compliant.

There are no restrictions on the flow of capital from a New Zealand business to overseas investors, so you can effectively set up a new branch of your business and transfer assets to your home country. However, payments may be subject to withholding tax, so calculating your margins makes sense before you make the move and launch a business in New Zealand territory.

As a foreign investor, you can apply for an Entrepreneur Work visa (previously the Long Term Business visa) which will allow you to buy or establish a new business in the country. In order to receive approval for this visa, you will need to make an initial capital investment of NZ$100,000 or more, and score at least 120 on a scale used to determine the likely success of your proposed business venture.

Biz Latin Hub can help you do business in New Zealand

Entering into a market such as New Zealand will not come without its challenges, so prior planning and preparation are key to ensure your long-term success. Indeed, entering into the country without a clear strategy or an understanding of the market and demand for your products or services will naturally result in failure; don’t make that entrepreneurial mistake.

At Biz Latin Hub, we offer a range of business services designed to help entrepreneurs make their way in new territories. We offer everything from company incorporation to recruitment, due diligence, and accounting. To find out more, contact us and a member of the team will get back to you as soon as they can with a personalized strategy.