Doing business in Argentina in 2025 presents a mix of exciting opportunities and well-known challenges, particularly for foreign investors entering one of South America’s most complex but resource-rich markets. Many of these are aimed at reducing barriers to commercial interests, promising to make it easier to get things done. However, starting a business in Argentina is still best done with local advice to navigate the specific issues that you may face in the country. Businesses looking to do business in Argentina must understand evolving regulations, market entry options, and the key steps to incorporate a company successfully.

Key takeaways on doing business in Argentina

| Is foreign ownership allowed in Argentina? | Yes, 100% foreign ownership is permitted under Argentine law. |

| Strong sectors in Argentina | Manufacturing, energy and tech are all key sectors in Argentina already, with lithium extraction set to join them in coming years. |

| Are there Free Trade Zones in Argentina? | There are ten free trade zones (FTZ) in operation in Argentina that were created to encourage business growth and development. |

| What incentives exist for Foreign Direct Investment in Argentina? | One important benefit for foreign companies is that they receive the same treatment as in the rest of Argentina in the FTZs. International trade is growing in Argentina as a result of decreased restrictions. |

| What international links does the country have? | Argentina is a founder member of Mercosur and has FTAs with countries around the globe. |

Your 2025 guide to doing business in Argentina – learn about the evolving regulatory environment, company formation, and investment opportunities.

Argentina has favorable legislation aimed at attracting entrepreneurs and foreign investment. For foreign companies doing business in Argentina, understanding inflation trends, exchange rate policies, and central bank regulations is essential to building a sustainable local presence.

It is home to several Free Trade Zones (FTZs) and also a few Special Customs Areas (SCAs). The principal FTZs are in La Plata, Tierra de Fuego, and General Pico La Pampa. Businesses looking to Incorporate a company in Latin America should investigate trading opportunities in these areas to take advantage of the tax benefits.

Entrepreneurship is also actively encouraged by the government, with the passing of the recent Entrepreneurs’ Law (Ley de Emprendedores). There are no restrictions on foreign investment in any industrial sectors and there is also no restriction on the percentage of foreign ownership in a local entity.

Argentina operates tax-exempt trading zones to encourage importation and exportation activities. These are the Free Trade Zones (FTZ). There are ten free trade zones (FTZ) in operation in Argentina that were created to encourage business growth and development.

One important benefit for foreign companies is that they receive the same treatment as in the rest of Argentina in these FTZs. International trade is growing in Argentina as a result of decreased restrictions on foreign investment combined with the implementation of free trade zones. Now is a great time to export to Argentina.

Free Trade Zones in Argentina are export processing areas that offer various benefits to the companies that operate businesses in these areas. These benefits include no customs duties and no value-added tax (IVA in Argentina) on goods imported into the FTZ. As a corporation operating in an Argentinian FTZ you will still be liable for corporation tax at the standard rate of 35%.

Strong sectors for doing business in Argentina

Despite Argentina’s macroeconomic problems and omnipresent bureaucracy, there are positive signs in three of its most important sectors:

- Manufacturing – Companies such as Toyota see Argentina as a key part of their regional factory hubs.

- Oil & gas sector – Argentina is a key exporter of oil and gas, with the Vaca Muerta fields boasting large reserves. Furthermore, according to a report published in 2024, the export of crude oil has been rising by around 30% each year.

- Electricity production – The country is adept at generating electricity, but problems persist in distributing power along the national electricity grid. If private companies and the government could work out a deal to invest in updating critical infrastructure, this would not only help to boost power generation, but also jobs as well.

Why Argentina Still Attracts Foreign Business in 2025

Doing business in Argentina continues to appeal to foreign investors despite the country’s long-standing macroeconomic volatility. In 2025, Argentina’s unique combination of natural resource wealth, technical talent, and strategic access to Mercosur markets presents clear opportunities for companies willing to navigate its complexities.

Key opportunity sectors include:

- Technology and IT outsourcing – driven by Argentina’s highly educated, English-speaking developer base and globally competitive wages.

- Agri-export and food processing – with world-leading soy, beef, and wine exports, value-added services and logistics are increasingly in demand.

- Clean energy and lithium – Argentina holds one of the world’s largest lithium reserves, attracting investment in mining and battery production.

- BPO and shared services – global companies are establishing regional finance, HR, and legal hubs due to talent quality and cost advantages.

Local Tip:

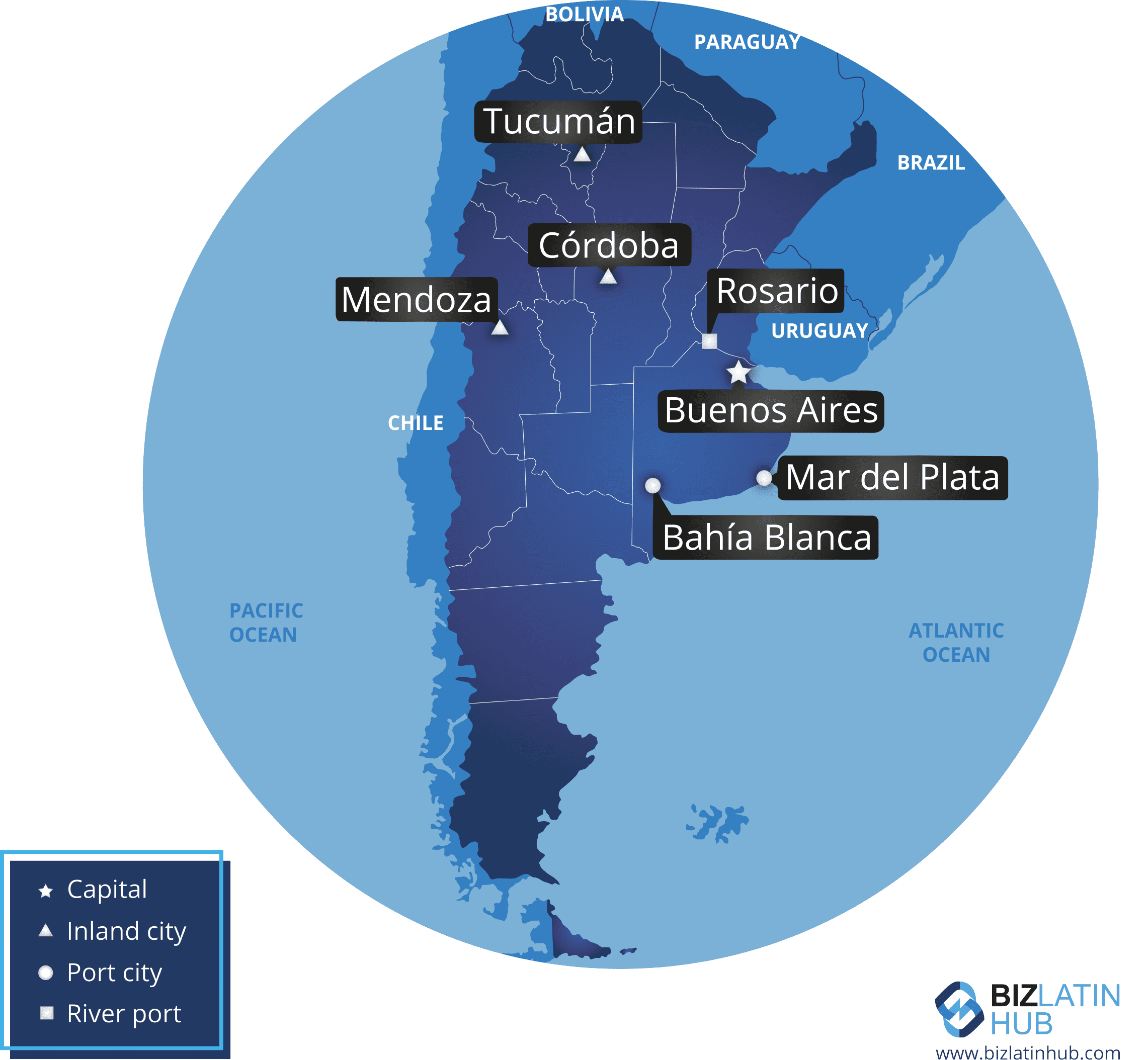

Incorporating in Buenos Aires or Córdoba provides the best access to bilingual professionals, infrastructure, and fast-track business registration.

Legal & Regulatory Considerations

Foreign companies planning to incorporate a company in Argentina must designate a local legal representative, obtain a CUIT tax ID, and register with the Public Registry. While timelines vary across jurisdictions, Buenos Aires typically offers the fastest incorporation process. Partnering with a local expert is strongly recommended to navigate AFIP requirements, bank account setup, and foreign currency considerations.

Doing business in Argentina requires an understanding of local compliance, including company formation procedures, labor laws, and tax obligations as enforced by AFIP. Simply put, the bureaucracy, barriers and burdens that have made doing business in Argentina so painful in the past will continue into the future. Some of the key challenges for companies and investors include:

- Difficulties starting a business

- Importation, currency barriers

- Persistently high inflation

- Convoluted property registry process

- High cost of obtaining credit

- A complicated tax regime

- Complex regulations for cross-border trade

- The ongoing national debt crisis

Local Insight for 2025:

Want to establish your business faster in Argentina? Incorporating in Buenos Aires gives you access to quicker company registration, top financial institutions, and the country’s most established legal and advisory networks.

Key challenges to doing business in Argentina

If you’re wondering if doing business in Argentina will get easier, it could – if you hire the right local legal and accountancy team that will work tireless to obtain all the licenses, certificates, notarization and documentation you will need. What follows are some of the biggest hurdles that companies and investors that plan to do business in Argentina will face:

1. When starting a business, be prepared for red tape

Starting a business in Argentina requires businesspeople to navigate a maze of bureaucracy and comply with seemingly needless requirements like notarizing employee records.

2. Import barriers, difficulty accessing foreign currency

Businesses that rely on imports to Argentina could experience delays or denials of licenses to import goods and services, and face strict limitations on a company’s ability to access foreign currency to pay for those imported goods or services. This is starting to ease, but there is a long road ahead.

3. High inflation

The annual rate of inflation in Argentina is extremely unstable by global standards, meaning that prices can be very volatile. Don’t be surprised to see frequent changes or for products to be valued in US dollars rather than Argentine pesos and offer that option to partners.

4. Registering property

Registering property requires the completion of seven procedures taking an average of 51.5 days. Before the process can begin, three different hard-to-get certificates are required, and the act of obtaining them can be costly and time consuming.

5. Costly access to credit

Bucking the inefficiency trend, getting access to Argentine credit in may be one of the most streamlined processes in the country. This may be the one glimmer of hope that doing business in Argentina will get easier. Still, there are four complex procedures to navigate and the cost of obtaining credit can be quite high.

6. Complex tax system

Paying taxes is a highly complicated process, with around nine payments needed per year, which can take roughly 312 hours of work to prepare. Argentina has very high levels of taxation and a complex system with overlapping taxes, making paying taxes a headache for businesses. The corporate tax rate in Argentina ranges between 25 to 35 percent.

7. Cross-border trade barriers

“Barriers” to Argentine trade might not be the most precise term to use, since those barriers are self-inflicted. But needless to say, cross-border trade remains challenging.

The government recently signed a series of new trade agreements with its neighbors, which sought to optimize the flow of international trade. Among the measures taken was the removal of tariffs on technological products.

Despite these efforts, Argentina remains one of the most complex countries from which to do cross-border trade. On the trade side of things, the future of doing business in Argentina seems to continue to be challenging.

8. Argentina’s sovereign debt crisis

Argentina’s economy has been hit by crises, defaults and rampant inflation for decades. This has been exacerbated by recent fears of a global recession and spiraling inflation, spooking investors over possible defaults and missed loan-repayment targets with the International Monetary Fund (IMF).

FAQs on doing business in Argentina

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Argentina?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Argentina?

| Argentina operates tax-exempt trading zones to encourage importation and exportation activities. These are the Free Trade Zones (FTZ). There are ten free trade zones (FTZ) in operation in Argentina that were created to encourage business growth and development. One important benefit for foreign companies is that they receive the same treatment as in the rest of Argentina in these FTZs. International trade is growing in Argentina as a result of decreased restrictions on foreign investment combined with the implementation of free trade zones. Now is a great time to export to Argentina. Free Trade Zones in Argentina are export processing areas that offer various benefits to the companies that operate businesses in these areas. These benefits include no customs duties and no value-added tax (IVA in Argentina) on goods imported into the FTZ. As a corporation operating in an Argentinian FTZ you will still be liable for corporation tax at the standard rate of 35%. |

3. How long does it take to register a company in Argentina?

It takes between 10 to 14 weeks to form a company in Argentina after all the required information and documentation has been provided.

4. Which sectors are important in Argentina?

Manufacturing, energy and tech are all key sectors in Argentina already, with lithium extraction set to join them in coming years.

5. Does Argentina have trade agreements with other countries?

Argentina is a founder member Mercosur and has FTAs with countries around the globe.

6. What entity types offer Limited Liability in Argentina?

The S.A.S and S.R.L company types both offer limited liability protection for investors.

7. Why do foreign companies choose to do business in Argentina?

Despite historic economic cycles, Argentina offers a large talent pool, cost-efficient operations, and access to growing sectors like tech, agribusiness, and lithium.

8. What’s the biggest challenge when doing business in Argentina?

Currency instability, evolving tax rules, and bureaucratic processes can pose challenges, but local legal support significantly reduces risks.

9. Do I need to form a company to operate in Argentina?

For long-term operations, yes. Forming a company provides full legal control, tax registration, and credibility with local customers and partners.

Biz Latin Hub can help you with doing business in Argentina

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations. If you’re planning on doing business in Argentina in 2025, Biz Latin Hub offers end-to-end support for market entry, legal structuring, and operational compliance.

As well as knowledge about how the business climate in Argentina is likely to pan out, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you finding top talent or otherwise doing business in Latin America and the Caribbean.

If this article on whether doing business in Argentina will get easier was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.