Accounting and tax requirements in Argentina are necessary to keep in mind if you’re looking to register a company in Argentina. With a complex regulatory landscape, it is essential to stay up-to-date with all accounting and tax obligations to ensure compliance with local authorities. This will involve electronic invoices for all transactions, for example and is overseen by tax authority AFIP (Administración Federal de Ingresos Públicos) which manages national tax compliance. ARBA is the Buenos Aires provincial tax authority, responsible for IIBB.

Key Takeaways

| Accounting Standards in Argentina | Accounting and auditing standards encompass technical resolutions, IFRS adoption circulars, interpretations of international accounting standards, and related documents. Rules governing corporate receivership. Regulations for anti-money laundering (AML). Professional conduct standards for certified public accountants, actuaries, and graduates in economics and administration. |

| Corporate Tax Rate in Argentina | 25 – 35% depending on a variety of reasons: business activity, size of the business, net income, etc. |

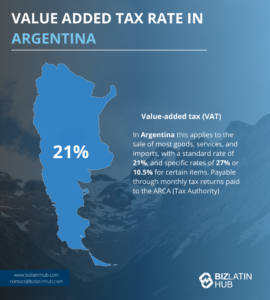

| Argentine Value Added Tax Rate | The current VAT rate (IVA) is set at 21%, with a few variations depending on services and business activity. |

| Dividend Tax Rate in Argentina | A 7% witholding tax applies on dividends paid from an argentine company to resident individuals and non-resident individuals/entities. |

Overview of Argentina’s Tax and Accounting System

In Argentina, taxes are collected at the federal, provincial, and municipal levels. Federal taxes are primarily collected by the Customs Collection and Control Agency (ARCA) (Formerly AFIP). The main federal taxes include:

- Income taxes.

- Minimum presumed income tax.

- Social security.

- Value-added tax (IVA).

- Import and export taxes.

- Tax on financial transactions.

- Net-worth tax.

- System of Withholding Tax Control (SICORE).

Provincial taxes are mainly collected by AGIP (Gubernamental Agency of Public Revenue) and ARBA (Revenue Collection Agency of the Province of Buenos Aires), with the primary provincial tax being the Gross Income Tax.

IFRS-based standards apply for medium and large companies, with small businesses not required to do so as standard. However, there are certain exceptions depending on activity. Required books to keep are Libro Diario, Inventario y Balances. These must all be legalized with the Public Registry.

Corporate Tax, VAT, and Local Taxes in Argentina

Argentina has a sliding scale for corporate income tax, progressively rising by revenue.

The starting number is 25% up to ARS$5M, increasing to 30% between ARS$5M–50M and finally 35% above ARS$50M. Dividends face a 7% withholding tax.

VAT is 21% standard, with the usual exceptions made for essential items at 10.5% and a higher rate of 27% for certain luxury goods.

Finally, IIBB is a provincial tax on gross revenue (3%–5%) and varies by both province and activity carried out by your company.

This means you will have to check with a taxation specialist in order to determine your specific rate for your business.

Both IIBB and VAT are filed monthly, with fines for repeated non-compliance.

Taxation For Residents and Non-Residents

The income tax law in Argentina establishes that individuals or legal entities resident in the country are subject to tax on their worldwide income, whether earned domestically or abroad. They can receive tax credits for similar taxes paid on their foreign activities.

Non-residents are subject to tax only on their Argentine-source income. Generally, non-resident taxes are collected through a final withholding tax, depending on the type of income.

*Income taxes are payable on the net income earned during the fiscal year.

Electronic Invoicing and Reporting to AFIP

Electronic invoices are mandatory for nearly all transactions and must be submitted to AFIP using the CAE system. Digital signatures are required for almost all transactions in real time. This is aimed at promoting transparency and cutting down on malpractice.

VAT and IIBB filings must be made monthly between the 10th–20th of the month, depending on CUIT. Your corporate income tax return must be submitted within 5 months of fiscal year end. Payroll and union reporting must be done monthly.

Employing workers in Argentina means that you will have a number of tax responsibilities on behalf of your employees as well as contributions to make to the social security system. Employer contributions come to 27% of the gross salary paid, with employee contributions of 17% of the same.

Both payment and reporting of these must be filed monthly via the AFIP online portal. The contributions cover ANSES, PAMI and Obras Sociales as well as the ART (occupational risk). Mandatory union dues may also be payable depending on sector and field.

What Countries does Argentina Have Tax Agreements With?

Argentina has signed agreements to avoid double taxation with several countries, including Germany, Australia, Belgium, Bolivia, Brazil, Canada, Denmark, Finland, the United Kingdom, Italy, Sweden, France, Norway, Russia, Spain, Switzerland, the United Arab Emirates, Mexico, the Netherlands, Qatar, and Chile.

These agreements were established to prevent double taxation between residents in different jurisdictions, with the primary aim of reducing the tax burden on residents of various jurisdictions under these agreements.

FAQs About Tax and Accounting in Argentina

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand the accounting and tax requirements in Argentina.

The corporate income tax is progressive: 25% for profits up to ARS 5M, 30% for ARS 5M–50M, and 35% for profits exceeding ARS 50M.

In Argentina, companies must pay taxes on their goods and services when they have been perfected with the delivery of goods and services. The taxes they must pay are at the local, provincial, and national levels.

The equivalent of the IRS in Argentina is the Customs Collection and Control Agency (ARCA) (Formerly AFIP), the Collection Agency of the Province of Buenos Aires (ARBA), the Government Agency of Public Revenue (AGIP), and municipalities.

The accounting standards, regulated and issued by the FACPCE (Argentine Federation of Professional Councils of Economic Sciences), include:

– Accounting and auditing standards, including technical resolutions, IFRS adoption circulars, interpretations of international accounting standards, and other documents.

– Corporate Receivership Rules.

– Anti-Money Laundering Regulations.

– Standards of Professional Conduct for Certified Public Accountants, Actuaries, and Graduates in Economics and Administration.

The professional in Economic Sciences is the National Public Accountant, a professional who publicly attests to their functions and must by law be required to have a qualifying license to practice the profession in the jurisdiction in which they operate in the country.

The IASB’s International Financial Reporting Standards (IFRS) are adopted in the country. These standards have different levels of application:

– Mandatory for entities under the control of the CNV.

– Optional for entities not subject to IFRS obligation.

– Discontinuous if previously applied optionally.

– Comprehensive for entities that present consolidated or individual financial statements, depending on their control over other entities.

The standard VAT rate is 21%, with reduced rates of 10.5% and increased rates of 27% for specific items. Monthly VAT returns are mandatory.

Employers contribute approximately 27% to social security, healthcare (Obras Sociales), and union funds. Employees contribute around 17%.

Yes. Electronic invoicing (Factura Electrónica) is mandatory and must be reported to AFIP in real time.

Gross Income Tax (IIBB) varies by province, typically 3%–5%. It applies to revenue and is filed monthly.

Why do Business in Argentina?

Now is a great time to invest in Argentina due to its abundant natural resources, strategic location, and emerging markets. The country boasts one of the world’s largest reserves of lithium, critical for electric vehicle batteries, and significant agricultural output, particularly in soybeans, corn, and beef. Its renewable energy sector, supported by government incentives, is also expanding rapidly, creating opportunities in wind, solar, and bioenergy projects.

Argentina is currently undergoing economic reforms aimed at stabilizing the market and encouraging foreign investment. Policies to address inflation, promote export growth, and attract international capital are creating a more favorable business environment of late. Additionally, its skilled labor force and competitive costs make it an attractive destination for industries such as technology, manufacturing and agribusiness. Rising bilateral trade with regions such as Asia and Europe further promotes Argentina’s position as a hub for global business, providing a compelling case for entrepreneurs and investors seeking long-term opportunities.

Biz Latin Hub can assist you with accounting and tax requirements in Argentina

Biz Latin Hub provides tailored market entry support and integrated back-office service packages to meet the unique needs of our clients.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, and we are active in markets all around Latin America and the Caribbean,

That makes us the ideal partner for supporting cross-border operations and facilitating multi-jurisdiction market entry.

We are committed to compliance with regulations everywhere we operate, so working with us comes with the guarantee that your company will adhere to every aspect of employment law in Argentina or any other country where we assist you.

Contact us today to find out more about how we can support you in doing business in Argentina.

Or learn more about our team and expert authors.