Find out why and when it is a good idea to get an entity health check in Chile. Manage your business risks and protect yourself from potential non-compliance issues before or after company formation in Chile. The country has well-established and solid legal and compliance frameworks designed to encourage and protect businesses in the country. This guide explains the purpose of a corporate health check and details the primary areas of review necessary to ensure your company is fully compliant with Chilean regulations.

Key Takeaways: Entity Health Check in Chile

| What is a corporate entity health check? | An entity health check helps identify and mitigate potential legal and financial risks. |

| What are the key areas reviewed during a health check in Chile? | It verifies compliance with the Internal Revenue Service (SII) and the Labor Directorate. |

| Why is maintaining good standing important for business operations? | It means that you will be able to operate in the Chilean market without sanctions. |

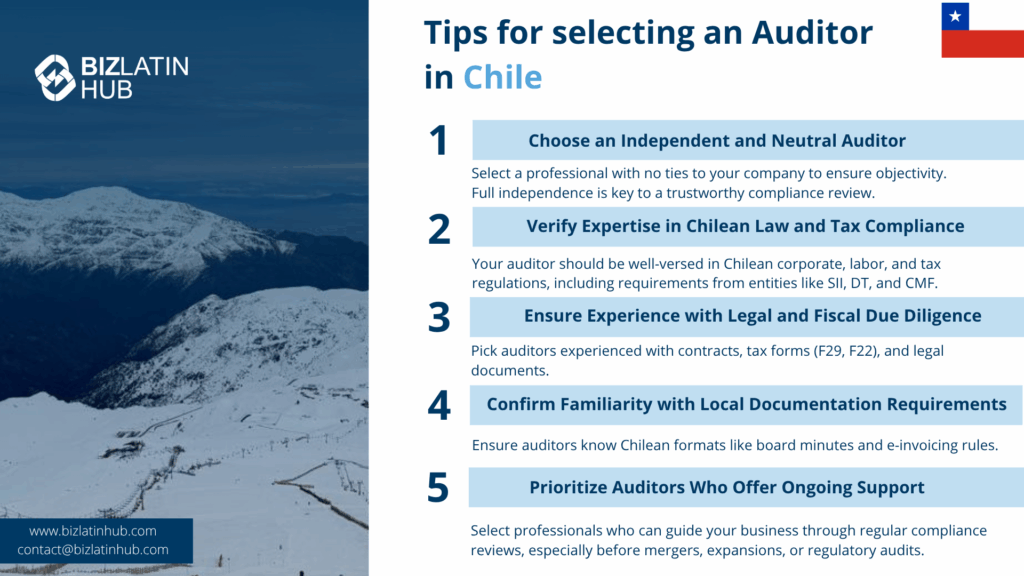

| Who conducts an entity health check in Chile? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Chilean company law. |

| Due Diligence Services | Legal due diligence Chile, Corporate due diligence Chile, Chile compliance check |

| Timeline | Typical entity verification in Chile takes 15-30 business days |

| Cost Range | Basic checks from USD 2,500; Comprehensive audits from USD 8,000 |

| Chilean Regulatory Bodies | SII (tax), DT (labor), CMF (financial markets) |

Why Conduct an Entity Health Check?

An entity health check is a comprehensive review of a company’s corporate records and compliance status. Its purpose is to identify any existing or potential issues that could lead to financial penalties, legal disputes, or reputational damage. It serves as a preventative measure to ensure long-term stability and good standing.

Key Areas Reviewed in a Chilean Entity Health Check

Expert Tip: Verifying the Powers of the Legal Representative

From our experience, a critical issue often uncovered during a health check in Chile is outdated powers of the company’s legal representative (Representante Legal). Corporate actions in Chile, such as signing major contracts or opening bank accounts, require the legal representative to have specific, notarized powers of attorney registered with the Commerce Registry.

These powers can expire or may not have been updated after a change in management. We advise that a key part of any health check is to verify that the current legal representative’s powers are valid and sufficient for all ongoing and future business needs to avoid operational paralysis.

1. Corporate and Legal Records

This involves reviewing the company’s articles of incorporation, bylaws, shareholder meeting minutes, and share register to ensure they are up-to-date and correctly filed with the Commerce Registry.

2. Financial and Accounting Records

This review checks that the company’s accounting books and financial statements are accurately maintained in accordance with local standards and properly reflect the company’s financial position.

3. Tax Compliance Status

This is a verification that all monthly and annual tax declarations have been correctly filed with the SII and that all tax payments are current.

4. Labor and Employment Compliance

This audit ensures that all employment contracts are compliant with the Labor Code, that social security contributions have been paid correctly, and that all other labor obligations are being met.

What is an entity health check in Chile?

As with other countries, an entity health check in Chile – also known as a corporate health or corporate compliance check – is one or more audits or due diligence reviews carried out on a legal entity. These reviews aim to understand if that entity is and has been fully compliant with local corporate regulations.

These reviews cover various aspects of a company’s activities, including the legal, accountancy, tax, human resources, licenses (administrative or others) operations. Entity health checks in Chile can vary quite a lot in terms of the extension, depth and aspects being audited. These are often split into legal or financial checks, but a full entity health check should include legal, accountancy and financial reviews.

We recommend that any thorough entity health check should include and cover the following items:

- Basic company details such as the name, commercial address, industry, capital, and shareholders

- Key facts such as license numbers, operational status of business, legal address and representatives

- Risk analysis and if possible, any sort of credit rating

- Tax compliance

- Parent company/shareholder details

- Directors’ details

- Legal history of the company (changes in ownership, share capital increases, and other activities)

- Litigations or other legal burdens the company has experienced.

Chile-Specific Compliance Tips from Local Experts

1. SII (Servicio de Impuestos Internos) Priority Areas:

- Monthly VAT (IVA) declarations must be filed by the 12th

- Annual tax returns (Renta) due by April 30th

- Electronic invoicing (factura electrónica) is mandatory

2. Labor Law Compliance (Dirección del Trabajo):

- Employment contracts must be written within 15 days

- Mandatory profit sharing (gratificación) calculations

- Foreign worker visa compliance (25% rule)

3. Corporate Registry Updates:

- Powers of attorney must be notarized and registered

- Board meeting minutes require specific Chilean formatting

- Share transfers need immediate registry updates

4. Red Flags Unique to Chile:

- Unpaid provisional pension funds (AFP/ISAPRE)

- Missing “Carpeta Tributaria” documentation

- Incomplete F29/F22 tax forms

- Non-compliance with electronic billing requirements

Comprehensive Due Diligence Services in Chile

Our Chile entity verification process encompasses:

Legal Due Diligence Chile:

- Corporate structure analysis

- Shareholder agreement reviews

- Litigation history searches

- Intellectual property verification

- Contract compliance audits

Corporate Due Diligence Chile:

- Board minutes verification

- Corporate governance assessment

- Subsidiary structure analysis

- Related party transaction reviews

Financial Due Diligence:

- Tax compliance verification (F29, F22, F50)

- Social security payment validation

- Banking relationship assessment

- Financial statement analysis

When should I get an entity health check in Chile?

There are several important situations and reasons that every company should regularly undertake an entity health check in Chile.

1. When investing or acquiring a Chile-based company

Multinationals expanding into Chile, or operating in the country already, may consider acquiring an existing company in the country. An entity health check is an absolute must if you are looking to invest or to purchase a Chile-based company. This check is the best way to fully understand the ‘compliance picture’ of the entity you are acquiring or investing in.

An in-depth audit of a potential acquisition or investment target by a local and independent contractor will eliminate the potential of discovering nasty surprises down the road. Understand before investing your money what, if any, issues the company may have with its compliance and how the government may view its activities. The entity health check in Chile will scrutinize the entity to determine were it stands in its regulatory obligations.

Be empowered to make informed decisions about your prospective investment, and weigh up the costs and benefits of getting involved. An entity health check offers complete information in order to weigh it in in the price offer and thus in the negotiations with the seller for instance.

2. When you already own a legal entity in Chile

An entity health check in Chile will ensure your company complies with all relevant legal, tax, and accountancy obligations and avoid financial or penalties from government institutions. Being consistently compliant will cost you much less to do business in Chile.

This is especially helpful for foreign national business owners and executives. They may find Chile’s corporate compliance requirements difficult to navigate due to unfamiliarity or a language barrier. Entity health checks will ensure you are up to date with payments and avoid any unnecessary complications with the government.

3. Corporate Governance

Being compliant is crucial for a good and healthy corporate governance within your company as structures, protocols and procedures tend to get more and more complex as the company grows. Local compliance is something that inevitably will be less of a priority for management within this growth process and thus, can be easy to neglect.

Corporate governance is usually simpler for small businesses. But if your company is looking to expand, it is wise to complete an entity health check in Chile to properly support and allow for these shifts and increase in company ‘in-house relationships’.

4. Manage Risks

Being compliant is not just about having a good relationship with the government and its various public entities. It is also about managing risk and watching your own back. Avoid slippery slopes of small non-compliance issues growing into larger ones by conducting a regular entity health check in Chile.

Besides accumulating financial penalties from the government as mentioned above, non-compliance presents a reputational risk as well. Companies don’t need to put their credibility at risk, even if compliance measures are challenging for them to understand – hiring a third-party auditor or entity check provider can give you the information you need to make informed decisions and protect the reputation of your company in the public eye.

Industry-Specific Compliance Considerations in Chile

Mining Sector:

- SERNAGEOMIN permits and safety compliance

- Environmental impact assessments

- Royalty payment verification

Financial Services:

- CMF (Comisión para el Mercado Financiero) compliance

- Anti-money laundering protocols

- Consumer protection requirements

Technology Companies:

- Data protection law compliance

- Software licensing verification

- E-commerce regulations

FAQs on an entity health check in Chile

Why should you get an entity health check?

An entity health check helps executives monitor how the business is being managed, reduces the risk of penalties and reputational damage, and minimizes risks during business transactions or audits.

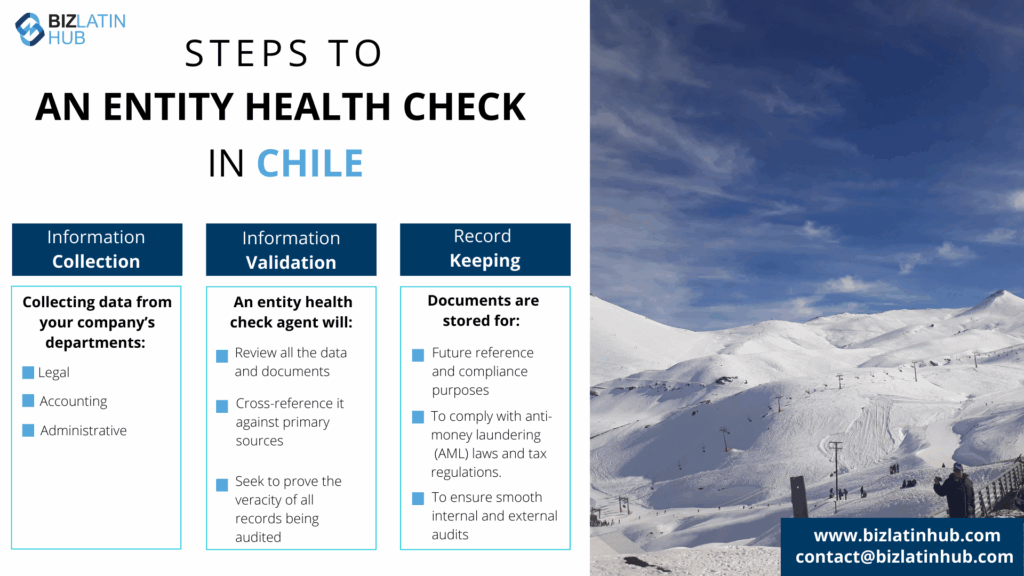

What steps are there to an entity health check?

An entity health check includes three main steps: (1) Information collection from legal, accounting, and administrative departments; (2) Validation of all documents through cross-referencing and audit analysis; and (3) Record keeping for legal compliance and future reviews.

What is an entity health check?

An entity health check is a thorough audit of a company’s corporate, accounting, tax, and labor records to verify that it is in full compliance with all local laws and regulations.

Who are the main regulatory bodies in Chile?

The main regulatory bodies are the Internal Revenue Service (Servicio de Impuestos Internos – SII) for tax matters, the Commerce Registry (Registro de Comercio) for corporate filings, and the Labor Directorate (Dirección del Trabajo) for employment matters.

What happens if a health check finds compliance issues?

If issues are identified, the health check report will provide a list of remediation steps. This allows the company to proactively correct any problems, such as filing late tax returns or updating corporate books, before they are discovered by the authorities.

What are the most common compliance issues in Chile?

Frequent compliance issues in Chile include late SII tax filings, incorrect employee benefit calculations, outdated information in the corporate registry, and failure to comply with electronic invoicing regulations.

How often should a company conduct a health check?

It is good practice to conduct a comprehensive entity health check at least once a year. It should also be performed before any major corporate transaction, such as a sale, merger, or significant financing round.

Biz Latin Hub can help organize an entity health check in Chile

Although Chile is a very favorable business destination, there may arise some complexities when doing business abroad due to legal and cultural hurdles. This includes understanding a company’s corporate compliance requirements.

Avoid unnecessary setbacks and protect yourself and your company by seeking an entity health check in Chile from experienced and trusted experts.

At Biz Latin Hub, our group of local and expatriate professionals offers a full suite of market entry and back-office services that can support your company operations and ensure you operate in full compliance with local regulations. Contact us now, or visit our website at bizlatinhub.com to receive personalized guidance on legal, accounting, tax, payroll, employment, trade, due diligence, and other matters.

Or learn more about our team and expert authors.