Corporate Compliance in Chile aims to promote economic growth, safeguard workers, and maintain a competitive business environment. Understanding these regulations is vital for registering a business in Chile and avoiding penalties. The Servicio de Impuestos Internos (SII) oversees tax declarations, while company incorporation and annual renewals are registered through the local commercial registry. Biz Latin Hub can simplify compliance with its full suite of back-office services, covering all your needs under a single service agreement.

Key Takeaways On Corporate Compliance in Chile

| Is a Fiscal Address Necessary for Corporate Compliance in Chile? | In Chile it is necessary to have a registered fiscal address to receive legal correspondence and governmental visits. |

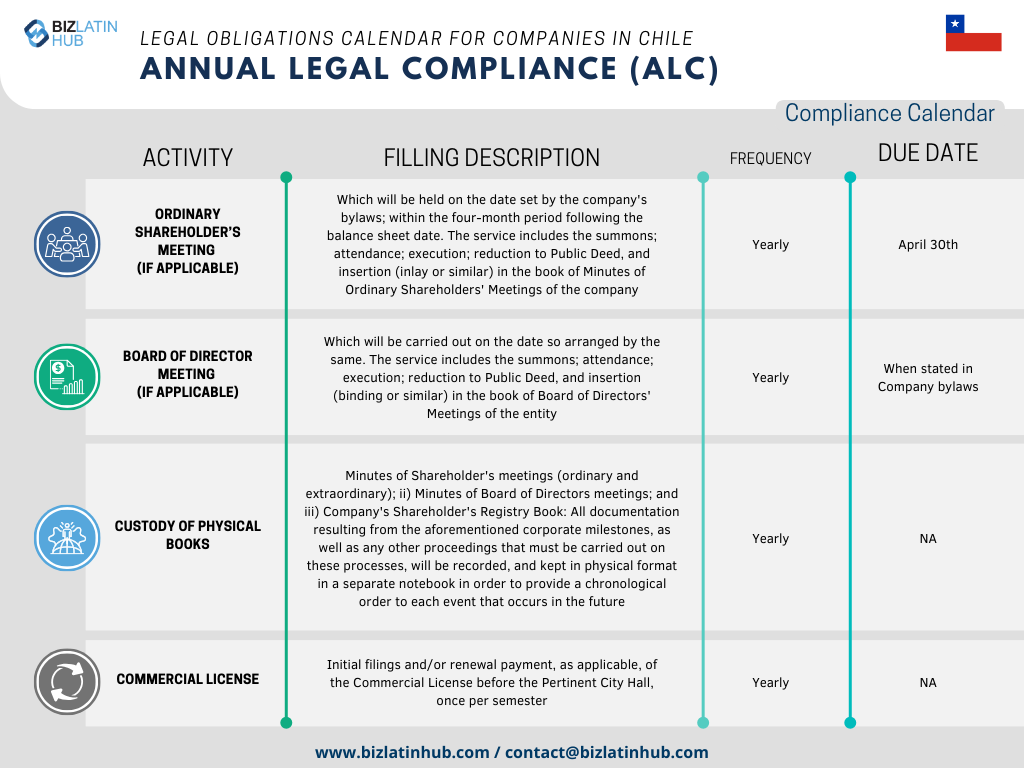

| What Are The Steps For Annual Legal Compliance in Chile? | Oridnary Shareholders Meeting (if applicable) Board of Directors Meeting (if applicable) Custody of Physical Books Commercial License |

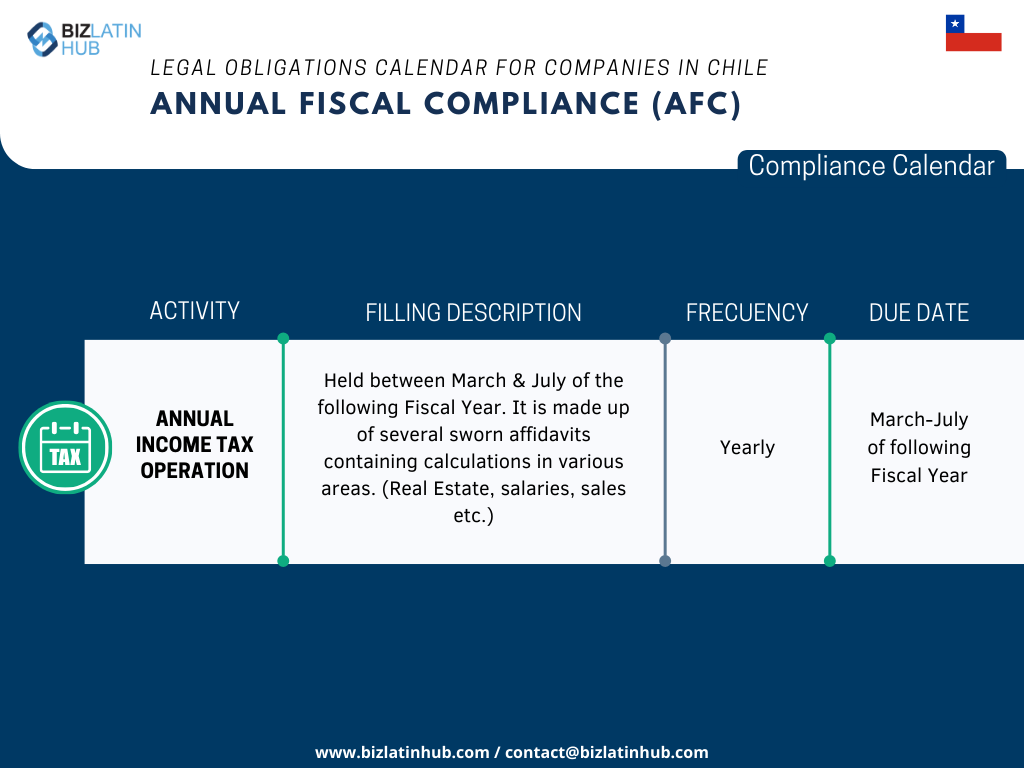

| What Does Annual Fiscal Compliance in Chile Mean? | Annual Income Tax Operation |

| Why Invest in Chile? | Resilient markets make it an attractive destination for foreign companies seeking additional revenue streams abroad. However, corporate compliance in Chile requires some understanding. |

Overview of Corporate Compliance in Chile

The Chilean market requires an understanding of the different kinds of legal entity that Chile has available. With all Chilean legal structures, there are some statutory requirements that must be adhered too. When setting up a company in Chile, certain procedures must be followed, to ensure your company complies with the local and national authorities. Personalized support and counsel from a local law firm makes it easier to ensure your company remains 100% compliant.

Chile has developed several legal structures for companies, from non-profit organizations to stock corporations. A foreign company may incorporate a legal entity with one of the following structures:

- Corporation (Sociedad Anónima– ‘S.A‘)

- Simplified Corporation/Company by Shares (Sociedad por Acciones– ‘S.p.A‘)

- Limited Liability Company (Sociedad de Responsabilidad Limitada– ‘S.R.L‘)

- Branch Office of a Foreign Company (‘Sucursal‘)

Corporate Statutory Requirements in Chile

A popular type of corporation is the simplified corporation, also known as the company by shares. This type of legal entity allows for 100% foreign ownership and can be incorporated with a single shareholder; either a natural or legal person (an individual or a company). This structure is very popular because it allows for the smooth flow of capital in and out of the company. As a result, foreign investors tend to prefer this type of structure.

Once duly incorporated, all legal entities in Chile, must meet some minimum statutory requirements to ensure corporate compliance. They are not very complex nor difficult to adhere to, granted you have a comprehensive understanding of the requirements. It is important that all companies meet the following requirements while engaging in commercial activities in Chile.

What is the Role of a Legal Representative in Chile?

All companies in Chile must appoint a legal representative; this appointment must be completed during the company incorporation process. The legal representative is usually a local lawyer who has an in-depth understanding of corporate compliance and can be the legal face of the company before governmental authorities. Some examples of the roles and responsibilities of the legal representative include:

- Opening and managing the corporate bank accounts in Chile

- Managing rent contract negotiations and signings

- Signing commercial contracts on behalf of the company

- Meeting with governmental authorities

Professional Note: In Chile, the Company Legal Representative must be a Chilean citizen, or a foreigner with the legal right to reside/work in Chile.

Fiscal address

In order to successfully incorporate a local legal entity in Chile, a fiscal address must be registered. This is the official registered address for the company and is used for all official communication and correspondence. This is required by the tax authorities and necessary to ensure compliance with taxation laws. During the company incorporation process, the fiscal address must be stated in the company bylaws so the company can be legally registered.

Tax for corporate compliance in Chile

All companies in Chile, and in most of Latin America, must prepare and lodge regular tax declarations with the national and/or local tax authorities. The latter is known as the municipal license. Other specific tax requirements Chilean companies need to meet include:

- Income tax payments: These payments are due monthly and are mandatory for all companies.

- Value-Added Tax (VAT): VAT is a consumption tax incorporated into the value of goods and services whenever value is added at any step of the supply chain. In Chile, this VAT is taxed at 19% on top of the price of a good or service.

- The municipal license: a yearly obligation. The amount varies based on declared capital, with a minimum and maximum cap.

Commerce Custodian

Every Chilean company must register with the Commerce custodian. The government has made this necessary as part of their commitment to provide more information to potential interested third parties and society at large. By registering with the Commerce custodian, any person can review and analyze the public records on your company – driving transparency.

The Commerce custodian is where third parties can request corporate information on any company formed within Chile. In case of any major corporate changes (Hecho Eventos Essentials), the Commerce custodian needs to be notified. These changes can include:

- Change of company owners

- Mergers or acquisitions

- Change of company share capital

- Change of company legal representative

- Change in registered fiscal address

In case a company does not correctly register before the commerce custodian, the company will face legal problems, which can result in the company being de-registered and closed down.

Annual Shareholders Meeting

In accordance with Chilean corporate governance norms, specific entities are mandated to hold annual shareholder meetings, a practice that is particularly significant for corporations (Sociedades Anónimas – S.A.). Stipulated under the Chilean Corporations Act (Ley de Sociedades Anónimas), these sessions serve as a platform for key corporate deliberations, such as the ratification of financial statements, decisions on profit allocations, and the election of board members (Article 67 of Law No. 18,046 on Corporations).

Although Simplified Corporations (Sociedad por Acciones – SpA) and Limited Liability Companies (Sociedades de Responsabilidad Limitada – S.R.L.) may not be under the same statutory mandate for annual general meetings, they are often required to convene periodic assemblies, as outlined in their internal bylaws, or when summoned by partners or shareholders to address major strategic or financial directives. It’s imperative for companies to adhere to these governance requirements to maintain corporate compliance and uphold transparency (Article 58, Law No. 18,046 on Corporations).

Ultimate Beneficial Owner registration

In light of international standards and regulatory expectations, Chile has been advancing its legislative framework to enhance transparency in the financial and corporate sectors. This includes talk about implementing a registry for Ultimate Beneficial Owners (UBOs), to fortify its stance against money laundering and the financing of terrorism.

Such measures align with the recommendations of the Financial Action Task Force (FATF), which advocates for clear identification of UBOs, to prevent misuse of corporate structures for illicit purposes. Companies must register their UBO with the Internal Revenue Service (SII) if applicable, in accordance with AML regulations.

This is particularly relevant for due diligence processes under Law No. 19,913, which establishes the Anti-Money Laundering and Terrorist Financing Prevention System, and Law No. 20,393, which sets forth corporate criminal liability for money laundering, terrorist financing, and bribery. This will require companies to declare their beneficial ownership information, making it easier to tackle financial crimes and increasing corporate transparency.

Filing dates in Chile

Monthly VAT and payroll returns via the Previred platform are due by the 12th of each month. Annual corporate income tax declarations are submitted in April via Form 22. The municipal license is paid annually per local government schedule, which varies between regions.

Penalties for Non-Compliance in Chile

Failure to comply with statutory corporate obligations in Chile can lead to a range of penalties, including:

- Late Filing Fines: SII may impose monetary penalties for overdue tax declarations or inaccuracies.

- Suspension of RUT (Tax ID): Companies may lose their ability to issue invoices or operate legally if the RUT is suspended due to repeated non-compliance.

- Municipal Sanctions: Operating without a valid patente municipal can result in fines, closure notices, or temporary suspensions by local authorities.

- Personal Liability of Legal Rep: The legal representative may be personally liable for any infractions, unpaid taxes, or contractual breaches.

- Ineligibility for Government Contracts: Companies not in good standing cannot participate in public tenders or benefit from tax exemptions.

FAQs on Entity Legal Compliance in Chile

Based on our extensive experience these are the common questions and doubts of our clients on corporate entity compliance in Chile:

The following are the most common statutory appointments for Chilean legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered local fiscal address is required for all entities in Chile to receive legal correspondence and governmental visits.

The annual income tax operation is made up of several sworn affidavits containing calculations in various areas (real estate, salaries, sales, etc). This is held between March and July of the following fiscal year in Chile.

The ordinary shareholders meeting includes the summons; attendance; execution; reduction to public deed, and insertion (inlay or similar) in the book of minutes of ordinary shareholders meetings of the company. This is held on the date set by the company’s bylaws which will be within the four-month period following the balance sheet date and before the deadline of April 30th in Chile.

The 4 main taxes in Chile are as follows:

VAT (19%)

Income Tax (Corporate u0026 Personal)

PPM Provision on Income Tax

Customs Duties

Companies in Chile must appoint a legal representative, maintain a registered fiscal address, submit annual income tax returns, pay municipal licenses (patente municipal), hold annual shareholder meetings, and maintain physical or digital company books, depending on the jurisdiction.

Annual income tax returns must be submitted to the Chilean Tax Authority (SII), along with financial statements and supporting documentation. Companies must also comply with monthly VAT filings and payroll reports if applicable.

A legal representative must be a resident of Chile (citizen or foreigner with residency), and they are legally responsible for company actions, contracts, and compliance with all statutory requirements. This person acts as the official signatory.

Yes. All operating businesses must pay the patente municipal, a commercial license fee assessed annually based on declared capital. Operating without it may result in municipal fines or business suspension.

Why Choose to Invest in Chile?

As one of the most robust economies in Latin America, Chile has become a sought-after hub for pioneering business ventures and corporate expansion, drawing the interest of well-established foreign enterprises. Its resilient markets make it an attractive destination for foreign companies seeking additional revenue streams abroad. However, corporate compliance in Chile requires some understanding.

The country is a regional economic heavyweight, with solid growth over a number of years combined with outstanding political stability. It is perhaps best known for exports of fertilizer and copper, but the country is rapidly pivoting towards a knowledge economy. Corporate compliance in Chile is likewise taking big strides to stay up-to-date with international standards such as UBO requirements.

Biz Latin Hub can help with corporate compliance in Chile

Before expanding your operations to Chile, it is vital to have a sound understanding of corporate obligations in the region. While the opportunities are great, so are the risks for those who do not comply with Chilean law. To ensure compliance, you have to fulfill certain tasks, which include the following:

- Appointing a legal representative for the company

- Registering a fiscal address for the company

- Complying with local tax regulations

- Registering with the Commerce Custodian

Working with a trusted legal and accounting firm ensures you will reach full corporate compliance as you do business in Chile. Biz Latin Hub was established in 2014 to assist foreign companies in successfully setting up operations abroad.

To learn more about the Chilean economy, opportunities for forming a company in Chile, and how to take advantage of political shifts, please contact us today.